Delivering Unified Managed Account optimization at scale

- 1 million portfolios rebalanced in 24 minutes

- 100m tax lots processed every day

- 200 basis points in tax alpha across their tax-aware offering powered by Axioma Portfolio Optimizer

The Need

With over 5,000 advisors our client needed a tax-aware optimization engine that could quickly rebalance millions of accounts with specific asset allocations tied to client risk tolerance or goals. As a baseline, they required a solution that could generate tax alpha based on tax lot level data, while maintaining very close alignment to model portfolios suitable to the client profiles at the single account level.

The Challenge

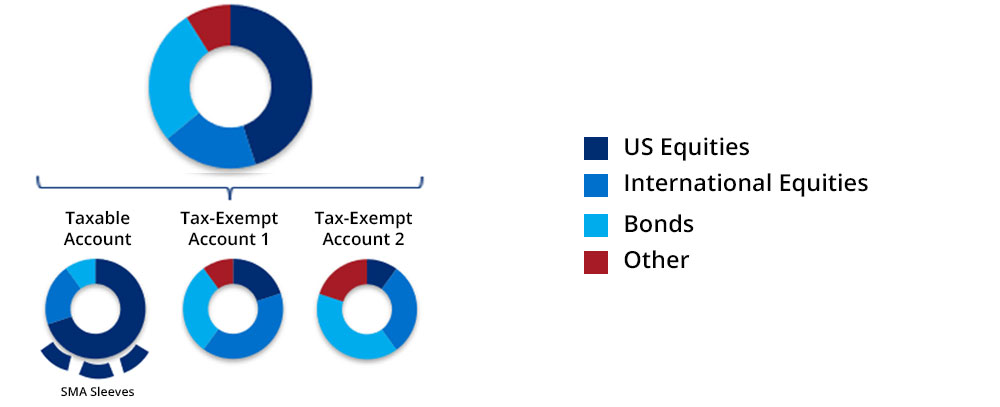

A more critical client requirement was the ability to provide tax-aware optimization across accounts (both taxable and tax sheltered) in a given household (Unified Managed Accounts “UMA”). In managing UMAs, the scalable optimization engine must be able to handle the highly complex task of simultaneously keeping clients aligned with their overall UMA asset allocation targets while closely tracking model portfolios of investment sleeves within given accounts, all on a tax aware basis.

Target allocations

The Solution

Off-the shelf tax optimization

Axioma Portfolio Optimizer has an in-built module that can handle even the most complex tax optimization problems, including the Axioma Multi-Portfolio Optimizer to handle UMA platforms.

Automation and scale

Axioma Portfolio Optimizer is highly scalable with proven ability to facilitate tax-aware rebalancing of millions of accounts on a daily basis.

API integration

API-first technology allows holistic integration into the larger IMS, OMS, PMS and tax accounting systems resulting in overall efficiencies.

Related articles