BOLSTERING THEIR FRONT OFFICE AND REDUCING THEIR SYSTEM LANDSCAPE

Client story

Storebrand share their story on why they adopted a new strategy that saw them consolidating their technical landscape and taking on more and more of SimCorp’s front office solution.

Having the right vision

Arne Martin Moen, Chief Operating Officer, is responsible for maintaining and supporting the SimCorp Dimension installation as well as the back office and fund pricing functions. “We play an important role in gathering data from all our vendors, settling and reconciling the trades, pricing the funds and making sure our operations are running smoothly 24/5,” he explains.

A few years ago, Storebrand made the strategic decision to consolidate systems and get more out of SimCorp Dimension. On this, Arne says “We haven’t added a lot of new functionality for quite some time. However, after we made a strategic decision to consolidate systems onto the SimCorp Dimension platform, we had a look at all areas and tried to map out gaps. We have been working closely with the business side and have prioritized the implementation projects in the right order to maximize value to the overall business. The SimCorp Dimension product has always been very strong in the back-office space, but in the past 5-6 years it has really taken off in terms of middle and front office functionality.” So much so that Storebrand is now playing a game of catchup, having maintained a status quo for quite some time, they are now on a journey of consolidation, and expanding into SimCorp’s front office solution.

Taking stock, and moving forward

Over the years, Storebrand has accumulated many systems. Arne explains that, “we made a count of our systems and found that there are more than one hundred systems if you include custom built executions, Excel models and external integrations. While we don’t have a fixed reduction number in mind, our goal is to consolidate as much as possible”

Arne went on to tell of a case they had recently with a manual pricing routine, “we used to copy and paste the data manually between Excel and SimCorp Dimension. We have since automated it in Dimension and now run the calculations in a batch job. We ran the Excel and batch job in parallel for a month and discovered an error one day. The error occurred in the manual process and the automated batch job was correct. It’s clear we need to continue shifting over to SimCorp Dimension and automating the calculations.”

Arne Martin Moen, Chief Operating Officer, is responsible for maintaining and supporting the SimCorp Dimension installation at Storebrand Asset Management.

IBOR: A better data foundation for front office

As with all SimCorp Dimension installations, an investment book of record (IBOR) supports firms with their data overview. “Our front office teams require up-to-date position data and it’s important that everyone is working on the same dataset. Having multiple systems and data integrations makes it difficult to manage both data consistency and data integrity among them. It’s great that we get a single view of data out of SimCorp Dimension.” Storebrand still has multiple data sources, so they are looking to continue consolidation efforts to have a more complete overview of their data.

“The great thing about SimCorp Dimension is that there is such a large relational database, so you’re able to connect a lot of these data points,” says Arne. “You can basically query everything, create your own dashboards and get the complete picture when needed. We are heading in the right direction, but still need to do more.” Storebrand really see the value and is on a journey to get the most out of it as they use Order Manager and Asset Manager more and more in the front office space. It is important to them to see everything in the same environment. As Arne puts it, “The beauty of the IBOR is that it supports other aspects of the organization (in particular our front office) and not only the operational side.”

Excelling in the front office

Storebrand makes heavy use of Compliance Manager, managing over 6000 compliance rules every day. According to Arne, “it’s much easier now to follow up on the investment mandates and make sure we have one consistent data source for all our reporting which includes internal, external and regulatory reporting. Just to know that there is no problem with the data consistency is really important.” Compliance staff also indicated they have saved approximately ½ hour per day in the time it takes to do their compliance reporting. Flexibility in customizing the real-time dashboard alerts for portfolio managers, simple drag and drop rule creation and one click drill-through were some of the other operational benefits mentioned.

"It’s much easier now to follow up on the investment mandates and make sure we have one consistent data source for all our reporting…"

Storebrand recently started moving all their portfolio managers over to the SimCorp Dimension front office solution. After a head start in 2017, the fixed income portfolio managers quickly came to the conclusion that all portfolio managers with best of breed systems could integrate fully with SimCorp Dimensions front office tools. “It was important for us to bridge the gap internally between operations and our front office, while ensuring we still had all the functionality we did in our best of breed system. We have succeeded in doing that with SimCorp’s front office solution.”

Storebrand put forward the ambitious goal of moving over all portfolio managers within a year. As Arne explains, “within three to four months one of our fixed income teams migrated from their old system and is now fully utilizing the front office tools in SimCorp Dimension. As of now, they are using SimCorp Dimension’s Asset Manager and Order Manager, which are fully integrated to execution management systems for daily order execution.” Thanks to the setup of SimCorp Dimension’s Compliance Manager, pre-trade checks are now smoothly executed. Going from excel spreadsheets and old manual solutions, the everyday life of portfolio managers is now simplified, time is saved, and operational risk is reduced. They, in particular, appreciate the ability to easily change views (i.e. from credit view to more issuer based, rating focused), see how close they are to their min/max limits on their dashboard, and create a deal off of a simulation “without any hassle”.

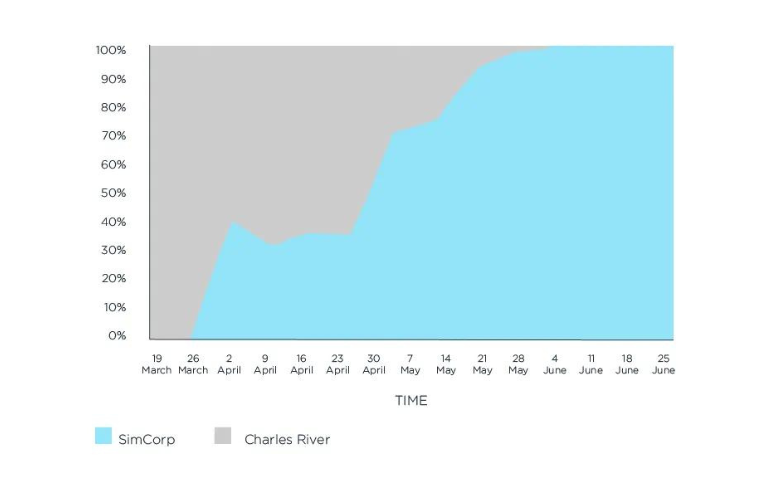

Øyvind Enger, Project Manager in Storebrand Asset Management has worked on most of their front office projects over the past few years. Reflecting back, he says, “we went from 0 to 100% of trades from these teams in SimCorp Dimension within 10 weeks – which was a huge success for us!" The migration from the former system, to SimCorp Dimension can be seen in the graph below. For the equity project the main goal was to decommission an external order / execution management system within a tight deadline.

The allocation and currency trading teams are also moving over to Order Manager and Asset Manager from their previous spreadsheet models. By June 2018 they will finalize the process of migrating the equity teams. This move really shows the benefit of having an integrated system, even with the vast majority of custom configurations that have been built up over a decade. With SimCorp Dimension, it is easy to connect our solutions together, yielding a massive benefit in consolidating data, mitigating operational risk and reducing cost. We used to do pre-trade compliance in Excel for front office, while utilizing Limit Monitor for post-trade compliance. Now our front and middle offices have the same data and the same calculations, which saves a lot of time post-trade and reduces our overall number of breaches.

Want to learn more about how Storebrand use SimCorp Dimension on a daily basis? Listen to this webinar recording in which they share some valuable insights.

About Storebrand Asset Management

Storebrand Asset Management is the largest private asset manager in Norway with EUR 73 billion under management. Through the Storebrand and Delphi Funds in Norway and SPP Funds in Sweden they have established a strong position in the Nordic fund market. We provide a wide selection of strategies. Within alternative investments Storebrand Asset Management focuses predominately on real estate and private equity solutions.