Stress testing known unknowns in 2024/2025

Get ready – it could be a bumpy ride.

Stress tests are designed to estimate the impact of adverse market movements on a portfolio to mitigate that risk. Under a risk management framework, they are an indispensable complement to statistical models, like Value at Risk (VaR), especially during crisis or periods of abnormality.

There are many ways to conduct stress tests including historical scenarios (based on actual events like the below), transitive scenarios (simultaneous large shift in multiple factors) and portfolio-driven (reverse stress tests) – all with different outputs. What’s important is that you define from the outset what exactly you are looking to measure.

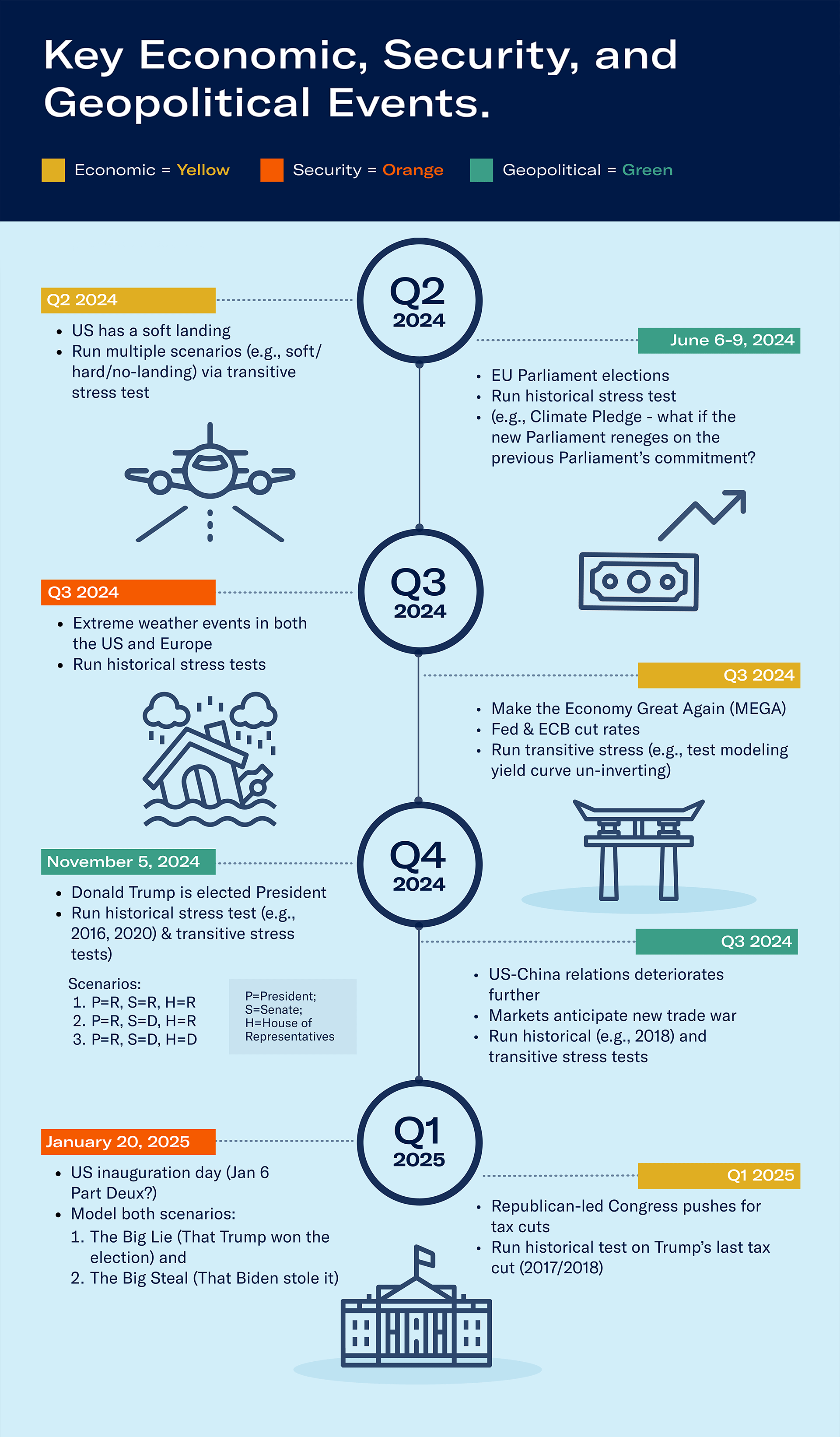

Below, we highlight some of the most potentially disruptive upcoming Economic, Security and Geopolitical events, alongside some examples of comparable events you can use to help construct the most meaningful stress tests.

The enterprise risk management system, Axioma Risk, offers the flexibility to shock single or multiple factors simultaneously and to walk through a historical period or multiple periods a day at a time.

Related articles