EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED FEBURARY 28, 2025

Europe continued its exceptional run last week as the only geographic region we cover with a positive return. Overall, Developed Markets were down 0.97%, led by Japan (-2.04%), followed by the US Core which was down just over 1%. Europe’s market is led by the large European banks, which make up about 22% of the index. However, Defense/Industrial stocks have been surging, particularly on Friday the 28th as it became apparent that Europeans will have to step up with greater contributions if they wish to influence the outcome in the Ukraine-Russia war. Stocks such as Rheinmetall in Germany are up as much as 85% year to date, and 25% last Friday alone.

It’s worth noting that US Small Cap- a bellwether for risk appetite, fell 1.6% for the week and 5.6% for the month of February. Similarly, Emerging Markets fell a whopping 4.25% last week, including a 2.37% drop last Friday alone. For the full month of February, Emerging Markets were flat. The Emerging Market countries with the biggest contributions to the rout were Hong Kong (-0.96%), India (-0.91%), Taiwan (-0.69%), and Korea (-0.67%).

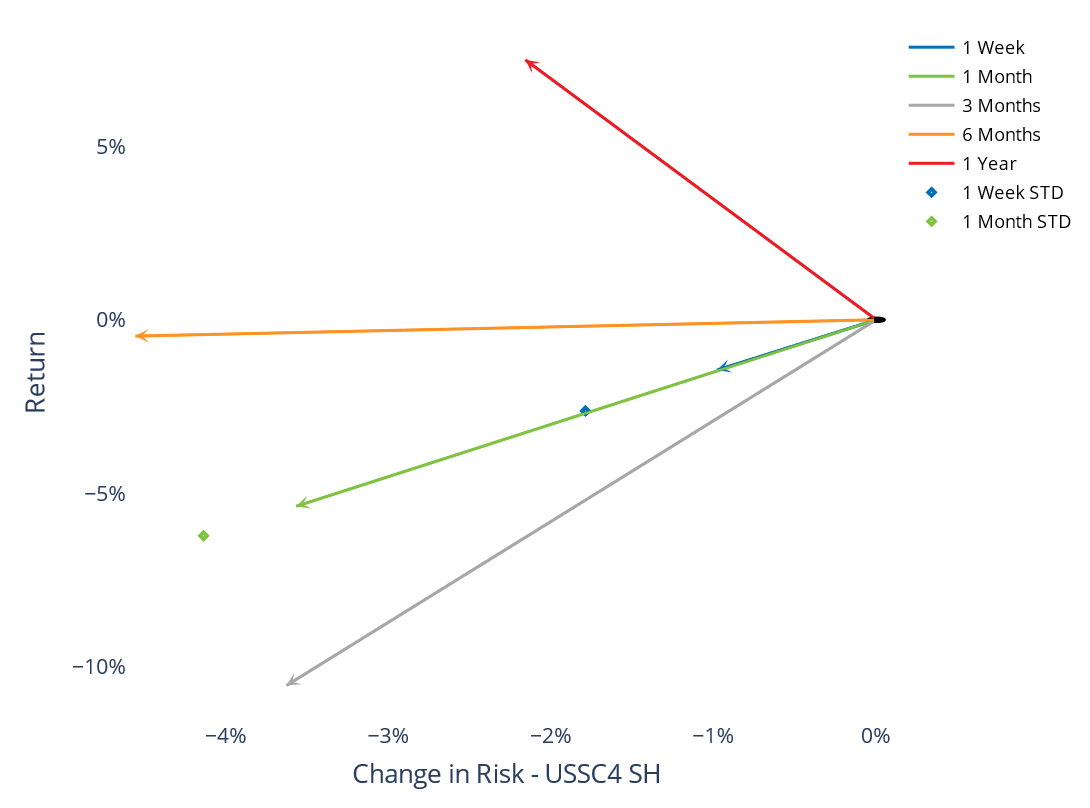

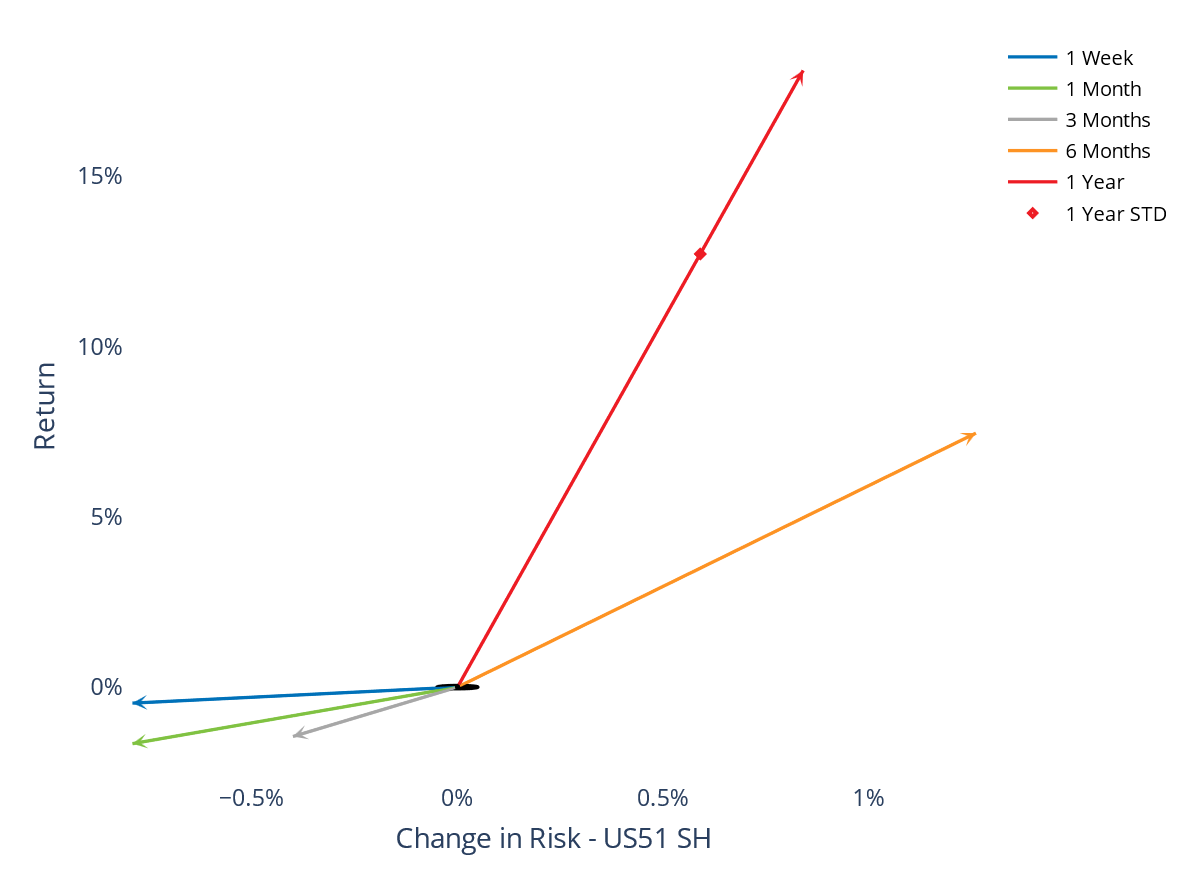

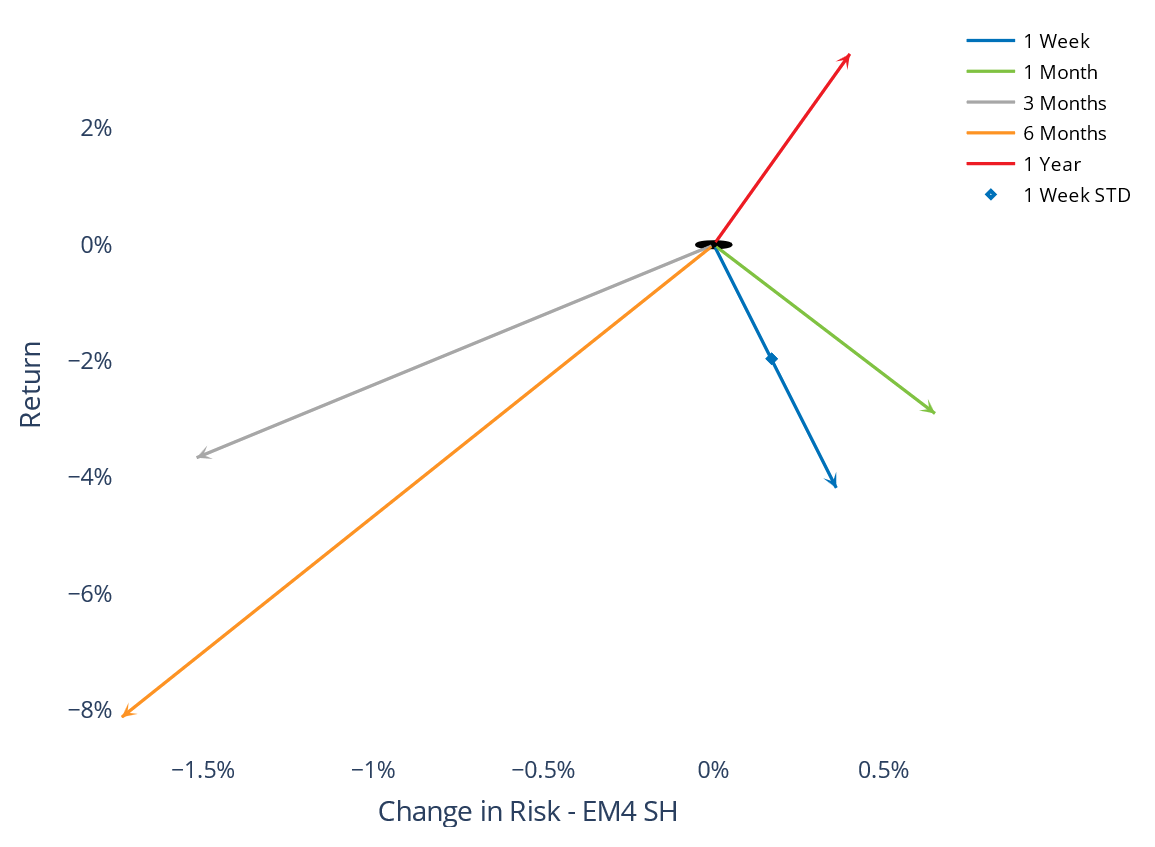

Despite the negative market returns, risk forecasts for the US continued to drop, while the Emerging Markets’ risk forecast increased by about 50 basis points as measured by Axioma US and Emerging Markets risk models, respectively:

Chart 11 - Russell 2000 “Risk Watch”

Chart 11 - Russell 1000- “Risk Watch”

Chart 11 - STOXX Emerging Markets “Risk Watch”

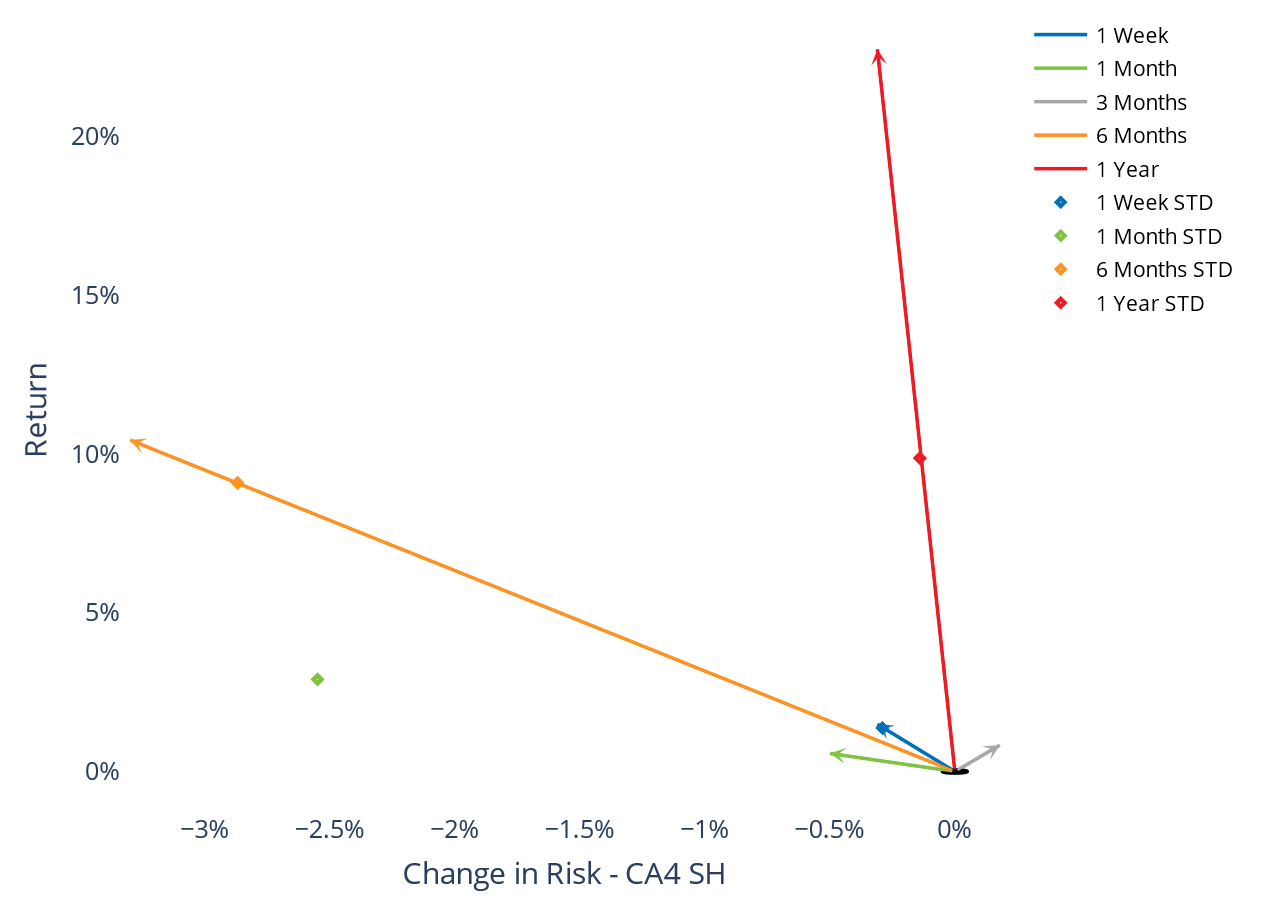

With the threat of tariffs on Canada and Mexico approaching with no apparent off-ramp, one would expect to see a reaction in the equity markets of those countries - as it appears to be the case with Chinese stocks listed on the mainland and in Hong Kong. We do see this with Mexico, which appears to have been down about 2.2% in local terms last week, but Canada was up 1.5% on the week and Axioma regional models continue to show declining risk there as well:

Chart 11- STOXX Canada “Risk Watch”

You may also like