EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED MARCH 7, 2025

- Predicted US volatility has started to rise once again

- With the increase in risk comes outsized factor returns and higher factor volatility

- Sector performance shifted in early February: US fell while Developed ex-US was flat or up

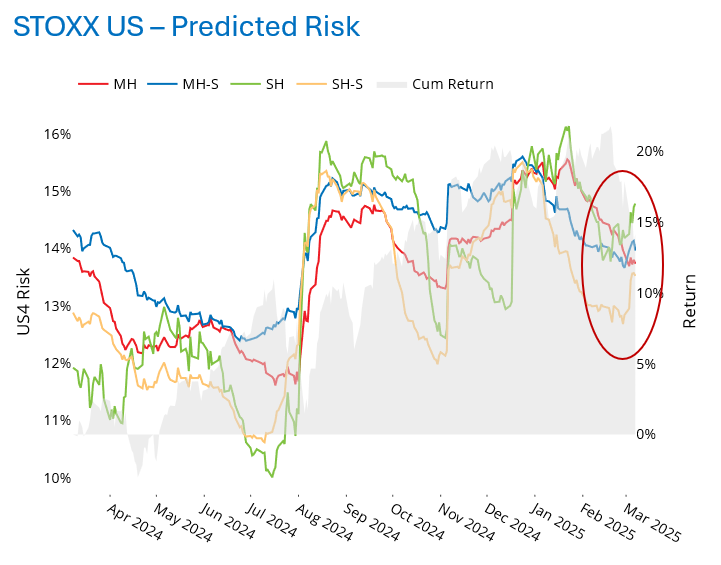

Predicted US volatility has started to rise once again

In recent weeks we have written about falling risk in equity markets, most notably in the US, despite increasing uncertainty about tariffs, renewed inflation and geopolitical events. That decline reversed last week for the STOXX® US index, according to the Axioma US4 short-horizon models. To be sure, predicted risk has not reached the levels we observed last summer, but the recent decline seems to have reversed.

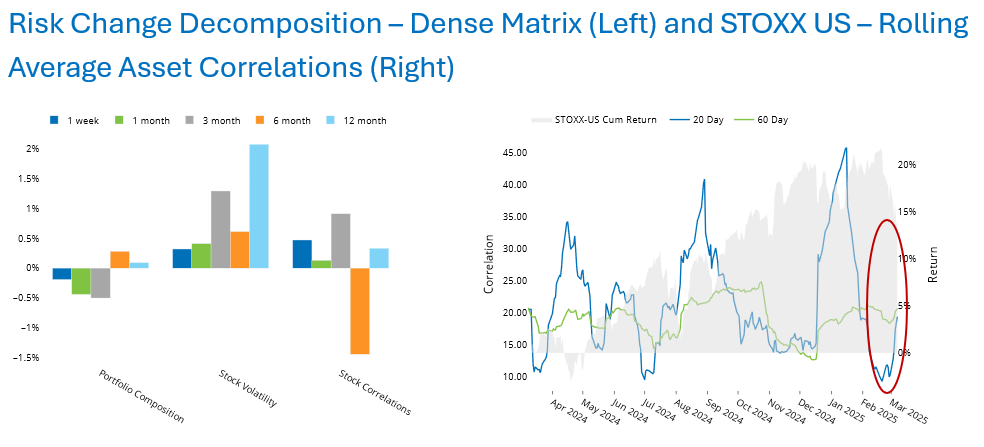

According to our Dense Matrix Risk Change Decomposition the increase in risk last week was driven both by higher asset-asset correlations and by higher stock volatility. Prior to this recent period, asset correlations had been falling and those lower correlations were offsetting higher individual asset volatility, and thereby keeping risk from going up.

See charts from the March 7, 2025 US Equity Risk Monitor

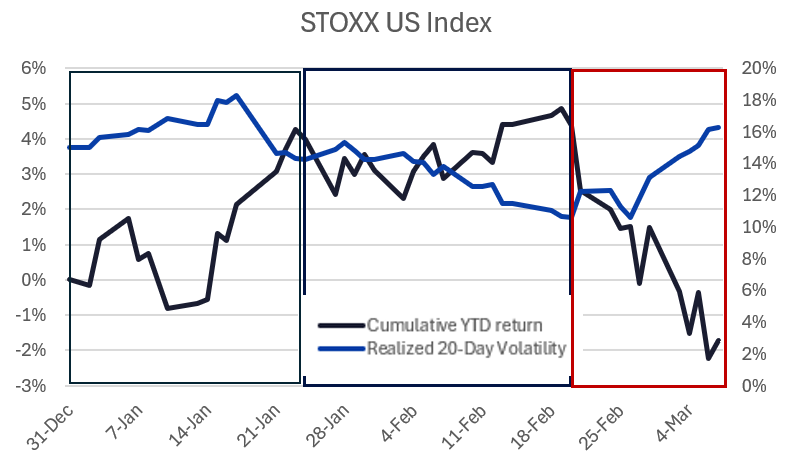

Interestingly, prior to last week, it just felt like volatility was increasing. Our chart of realized 20-day rolling volatility shows that it fell in mid-January when US stocks had an exceptionally good week. It declined slowly through mid-February and, like our model prediction noted above, only started to rise in the past couple weeks. Of course, as of this writing, after Monday’s market move we fully expect to see higher realized and predicted volatility.

The following chart does not appear in the risk monitors but is available on request:

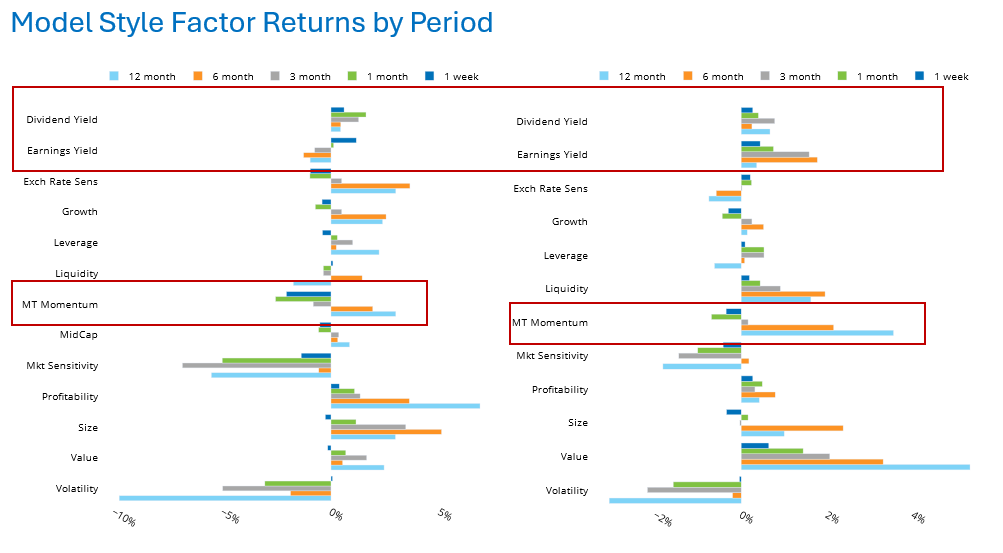

With the increase in risk comes outsized factor returns and higher factor volatility

A number of style factors in the US4 model saw factor returns last week that were higher in magnitude than would be expected given the factor risk forecast at the beginning of the period. Investors are seeking safety in higher-yielding names, and Dividend Yield has been experiencing highly positive returns over the last week, month, three, six and 12 months. The weekly and monthly returns are 2.6 and 3.5 standard deviations above average, respectively (based on beginning of period forecasts). This comes on the heels of a quite-negative return for the factor in 2024.

Earnings Yield saw nine straight months of negative returns through February 2025, culminating in one of the most negative monthly returns in the model’s history. Over the last week, in contrast, the return was unusually positive, well over two standard deviations above expectations.

Medium-Term Momentum had an extremely strong 2024, a very good January 2025 and a slightly positive February 2025. The last week saw a sharp reversal of fortune for the factor, with a return of more than three standard deviations below expectations.

From the perspective of the US5.1 model, our most recent version, we note that Crowding, a factor with a traditionally high positive return, also had a bad week, with a return of -1.05%, a four-standard-deviation move to the downside. At the same time, Short Interest, which has a highly negative average return over the model history, turned in a return of more than +1% last week, almost four standard deviations higher than expected. The outsized returns in the opposite direction of expectations for Momentum, Crowding and Short Interest suggest that investors have changed their minds about which companies and industries are most likely to benefit from shifting US policies, while they are also seeking relative safety and cheapness in high Dividend and Earnings Yield.

It's not just the US that is expected to see changing fortunes. Factors in the Axioma non-US models similarly had some higher-magnitude-than-expected returns. Dividend Yield saw unusually positive returns in Canada, UK and Europe, which drove higher-than-expected returns for the Worldwide (WW4) and Developed Markets ex-US (DMxUS4) models.

Earnings Yield had an unusually good week in Asia ex-Japan and Emerging Markets, as well as in DMxUS4 and WW4, but that was less of a surprise as the factor had been doing well prior to last week, in contrast to what we saw in the US. Medium-Term Momentum’s return was quite negative in Canada, as trade war rhetoric likely drove investors there to expect a change in market leadership. In fact, as noted, new leadership is expected in many of the markets on which we run risk models, although the degree of negative return was not quite as high outside the US and Canada.

See charts from the US4 (Left) and Developed Markets ex-US (Right) Equity Risk Monitors of March 7, 2025:

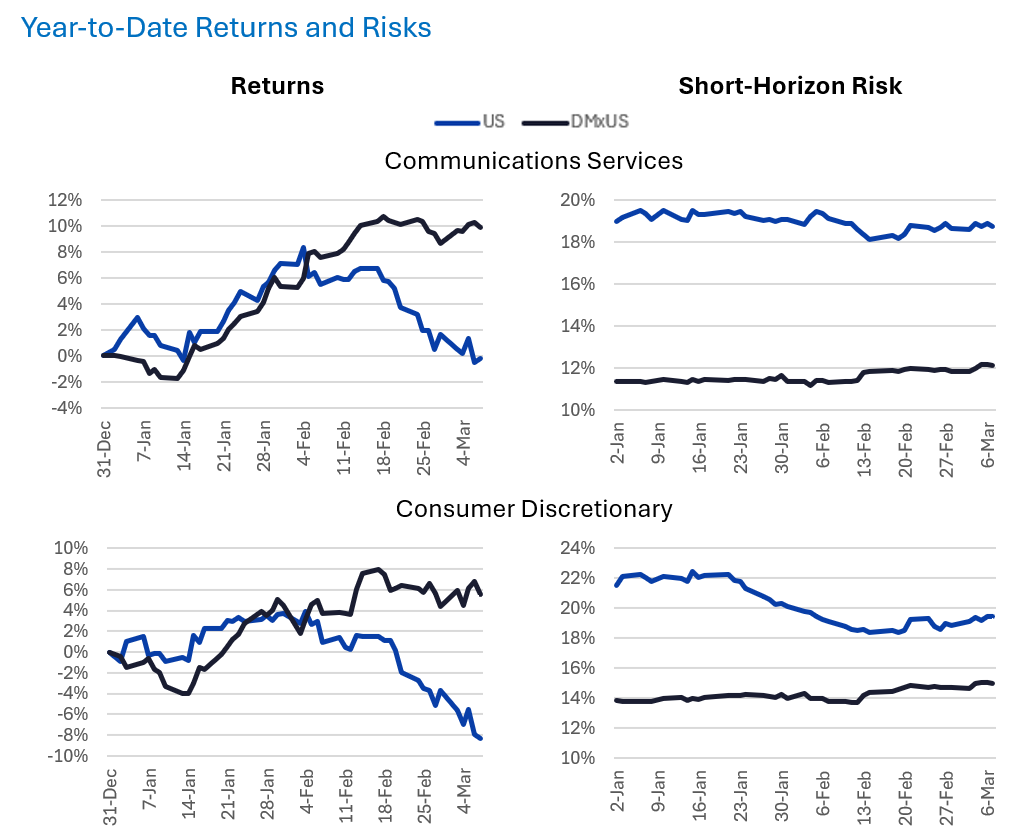

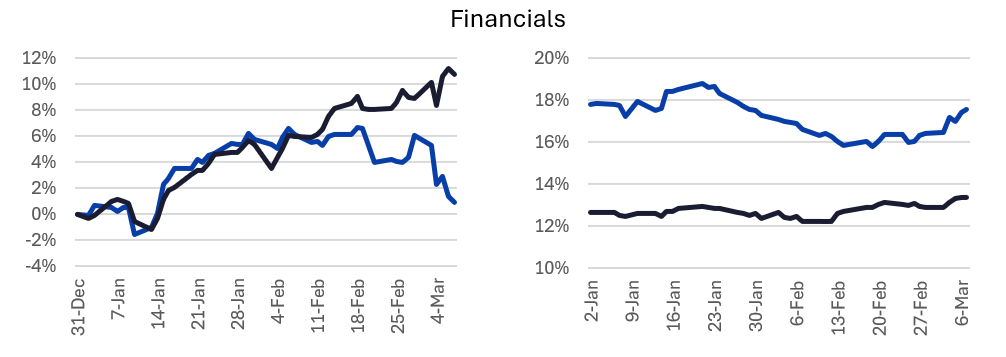

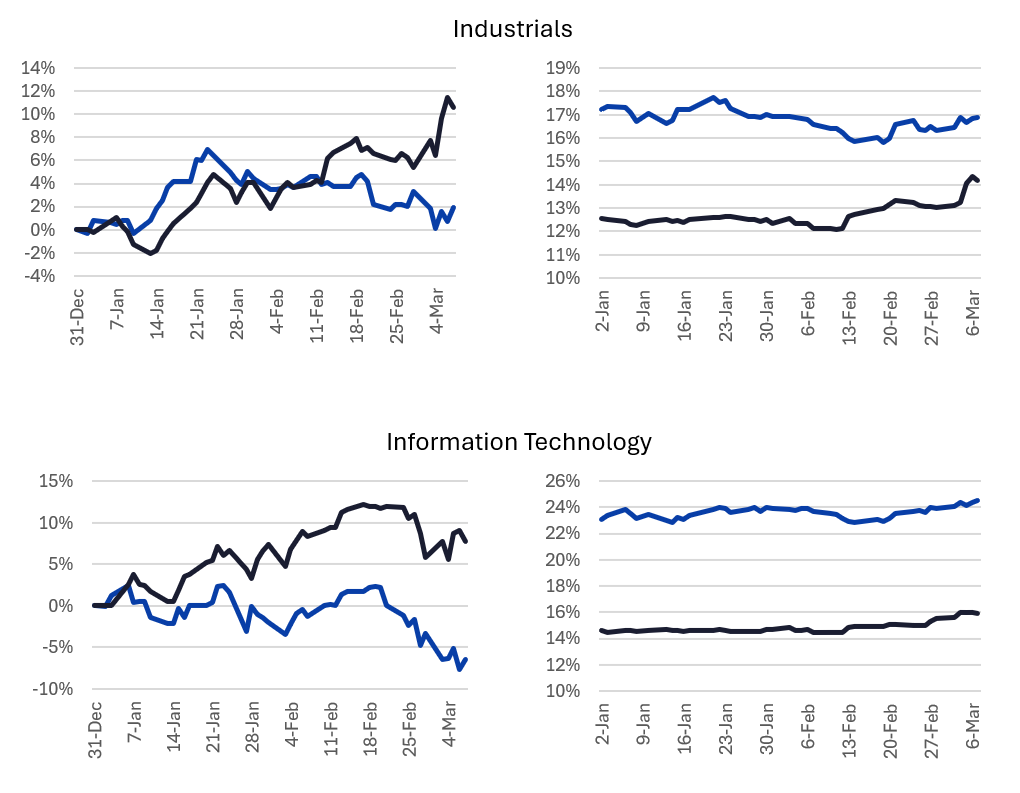

Sector performance shifted in early February: US fell while Developed ex-US was flat or up

US market returns turned negative over the past few weeks, whereas Developed Markets ex-US, as measured by the STOXX® International Index and led by Europe, have seen continued strength over that period (we wrote about this differential last week). Year-to-date the US market is now down, and every sector in the US has lagged its Developed Markets ex-US counterpart, with the exception of Real Estate. For some sectors the return differences are small (e.g. Consumer Staples and Health Care, with strong returns both in and outside of the US, and Real Estate and Energy, where returns were slightly positive.)

Some sectors’ returns, however, have diverged sharply, with US stocks tanking while the same sector outside the US has fared well. Five sectors stand out along this dimension: Communications Services, Consumer Discretionary, Financials, Industrials and Information Technology.

In all cases US sector risk is higher than non-US. That is to be expected, as the non-US sectors benefit from country and currency diversification. Still, the paths taken by the risk estimates are interesting. Risk rose in DMxUS Communications Services and Consumer Discretionary from the point where the returns start to diverge from that of their US counterparts through Friday, March 7, while it fell in the US, as return ticked steadily down.

Risk also jumped for non-US Industrials but remained flat for their US counterparts. Risk rose both within and outside the US for Financial and Technology stocks, although it rose more in DMxUS.

So, the far better performance outside the US in these sectors was accompanied by risk that rose by a larger proportion – digging into the data reveals that the difference was likely the result of a bigger increase in individual stock volatility outside the US as compared with what we see in the US.

The following charts do not appear in the risk monitors but are available on request:

Note: Sector returns are based on sectors within the STOXX US and STOXX International Developed Indices, whereas risks are based on Axioma Market Portfolios.

You may also like