EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED MARCH 14, 2025

Axioma Risk Monitor: Tariffs, sentiment, and recession fears shake-up US market; US risk surges yet stays well below historical peaks; Low-beta and low-volatility US stocks outperform amid declining risk appetite

Tariffs, sentiment, and recession fears shake-up US market

The US market seesawed last week, driven by a combination of heightened trade tensions, growing concerns about a potential recession, release of inflation data, a drop in consumer sentiment, and government shutdown aversion. The week started with a sharp sell-off on Monday, when the STOXX US index fell 2.8%.

Midweek, the market found some relief when February's inflation data showed inflation easing more than expected. This positive news led to a rebound in stocks, with the US index closing slightly higher on Wednesday. However, the cooling of inflation might be temporary, as higher tariffs on US imports could drive prices higher.

The relief was short-lived, and by Thursday, the STOXX US index entered correction territory, having fallen more than 10% from its February 19 peak.

News of averting a government shutdown led to a significant market rally on Friday, but this was dampened by the release of consumer sentiment data showing it had plunged to a two-year low.

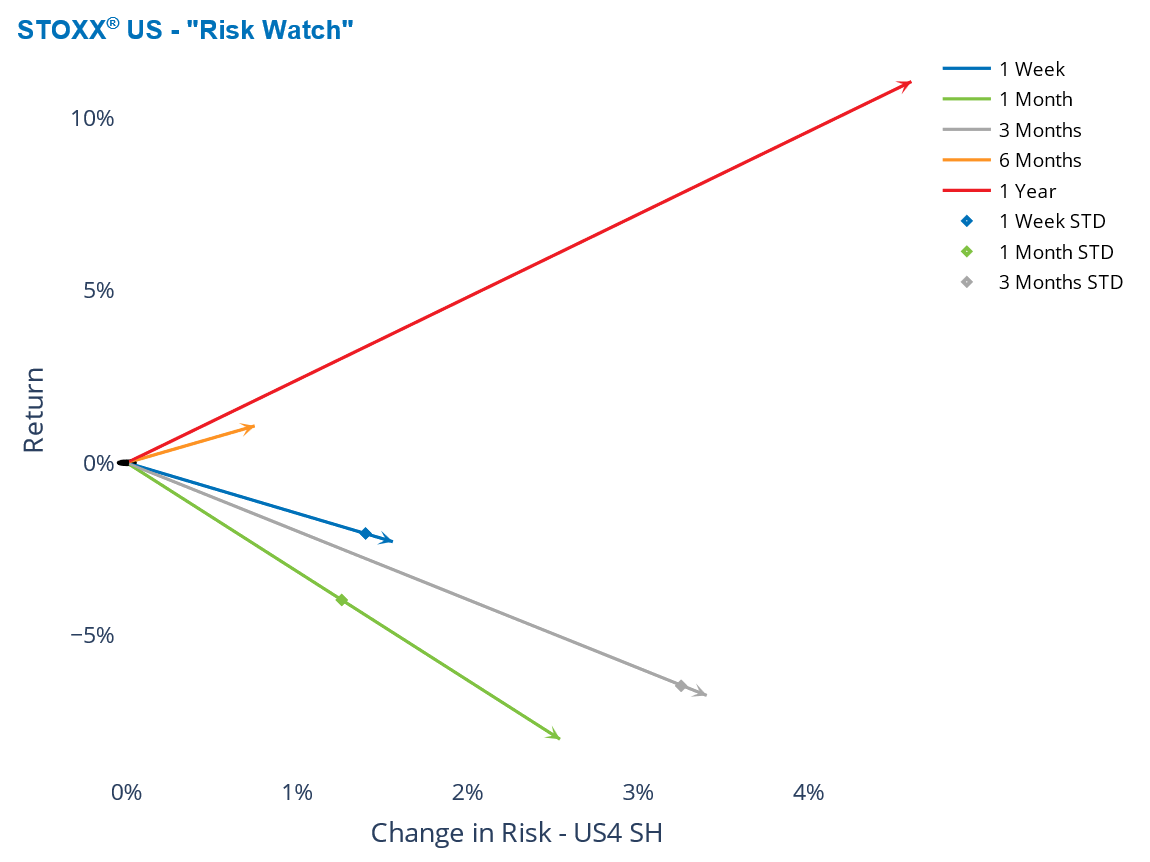

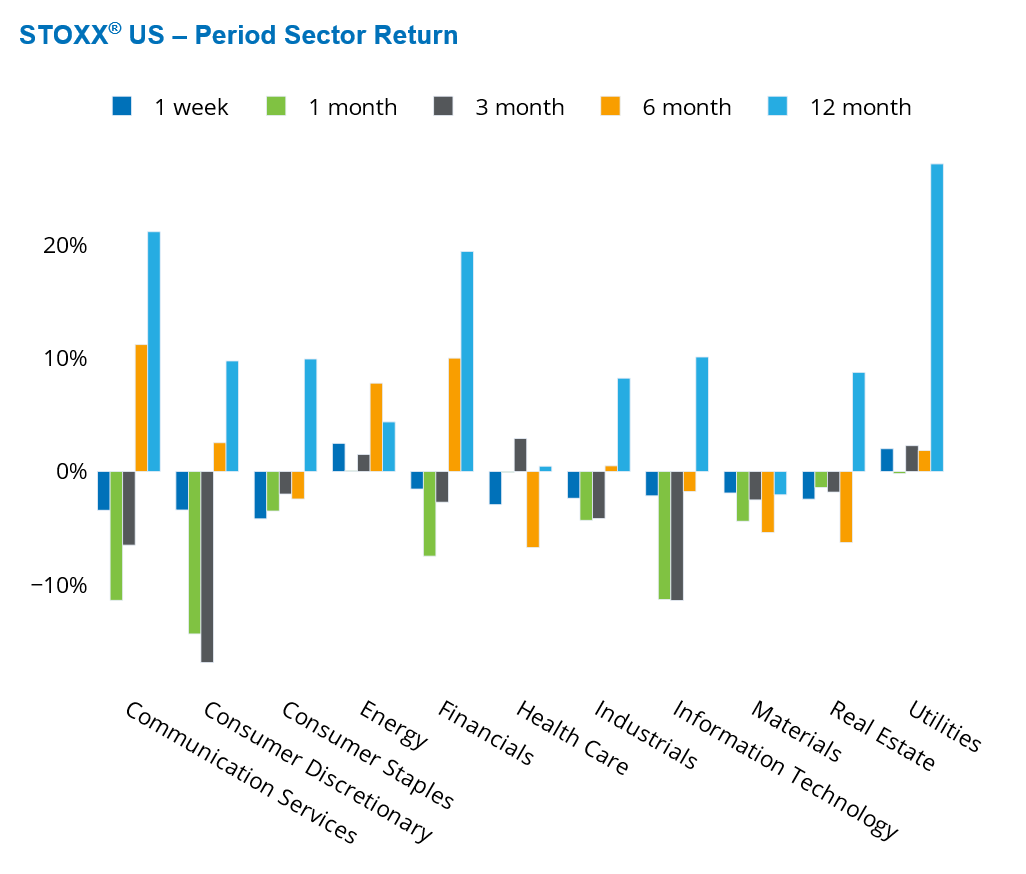

Despite the Friday rebound, STOXX US still ended the week with a 2% loss, which exceeded one standard deviation of the expectation at the beginning of the week. All sectors except Energy and Utility—two of the smallest US sectors—participated in last week’s downturn. Even more notable is the monthly loss of 8% which was about two standard deviations below the expectations four weeks ago, as measured by the Axioma US4 fundamental short-horizon model.

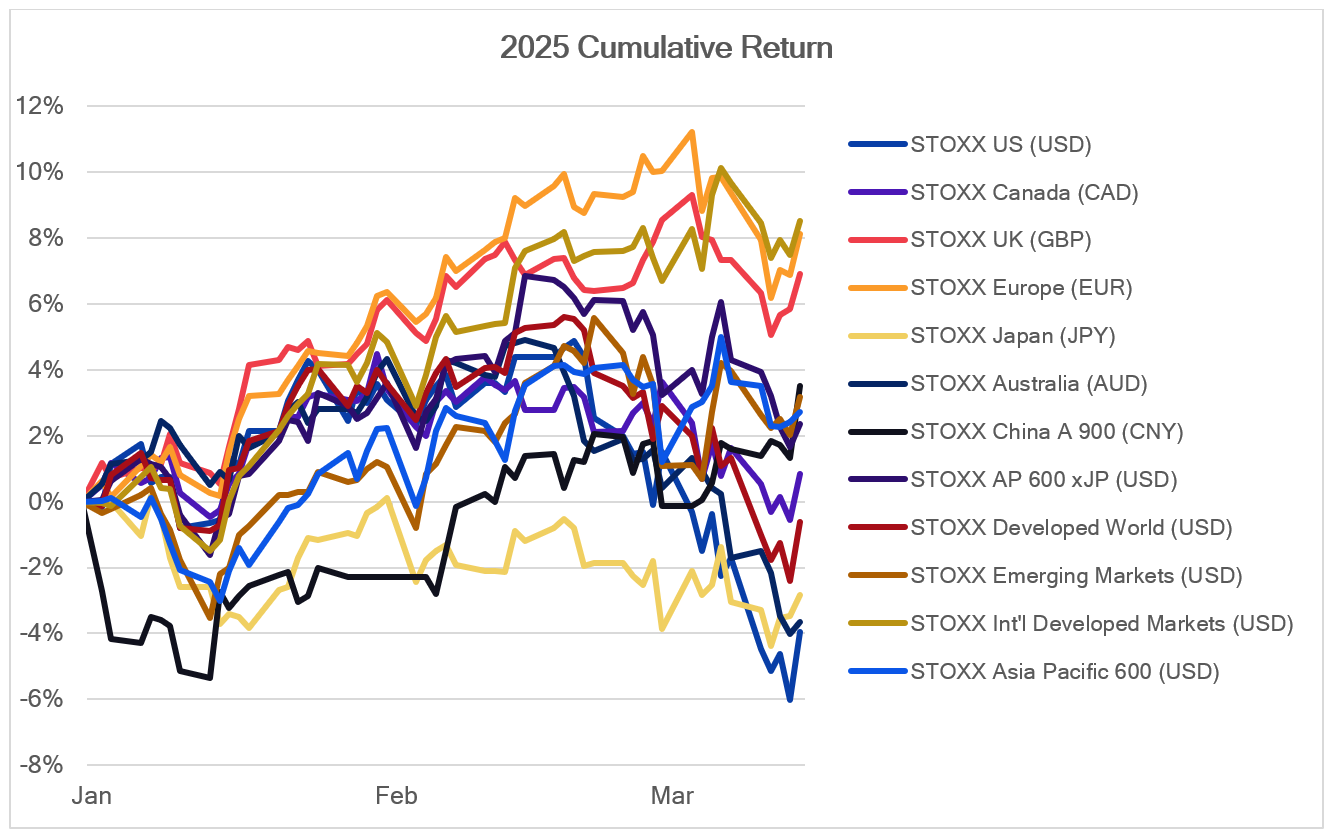

With a 4% year-to-date loss, the US became the worst performer among major regions tracked by the Equity Risk Monitors. Only STOXX Developed Markets, STOXX Japan, and STOXX Australia are also seeing losses this year, along with the US. STOXX International Developed Markets, STOXX Europe 600 and STOXX UK are now the leaders.

The following chart is not in the Equity Risk Monitors but is available on request:

See graphs from the STOXX US Equity Risk Monitor as of March 14, 2025:

US risk surges yet stays well below historical peaks

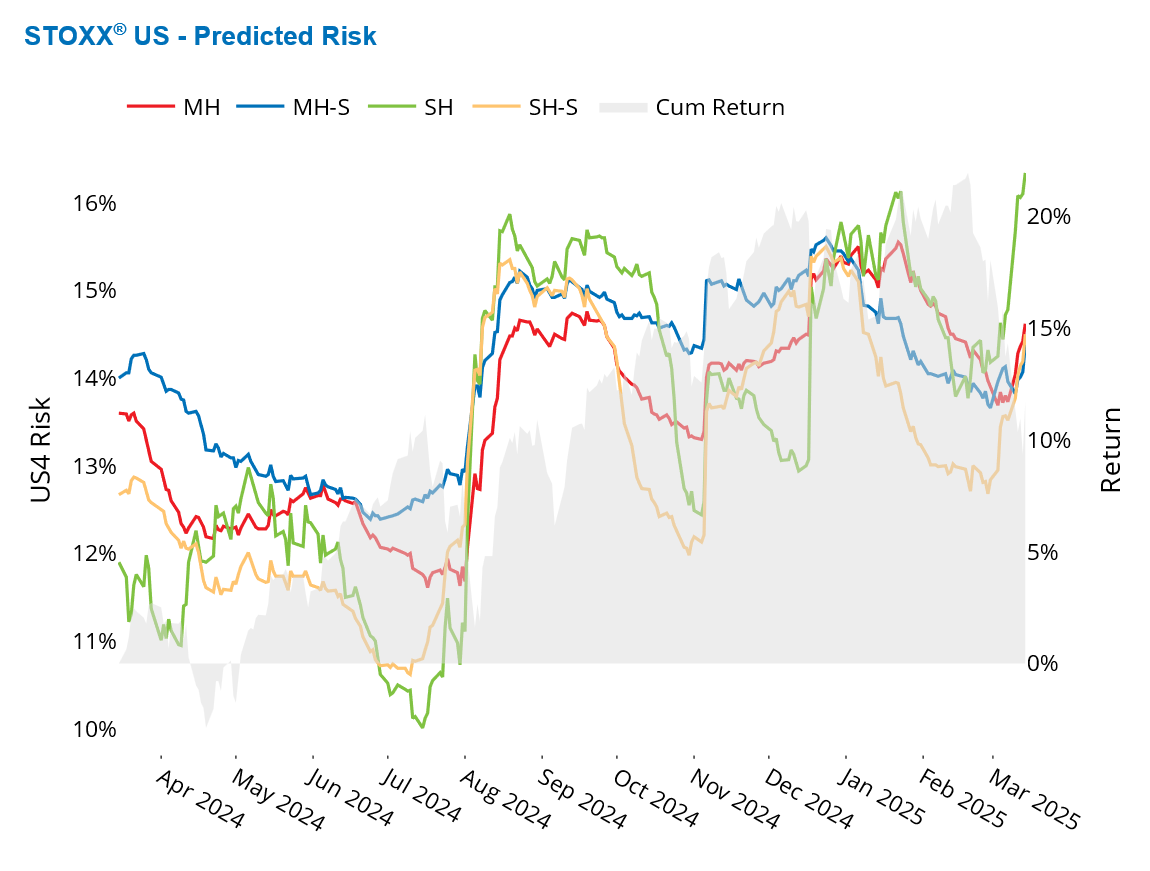

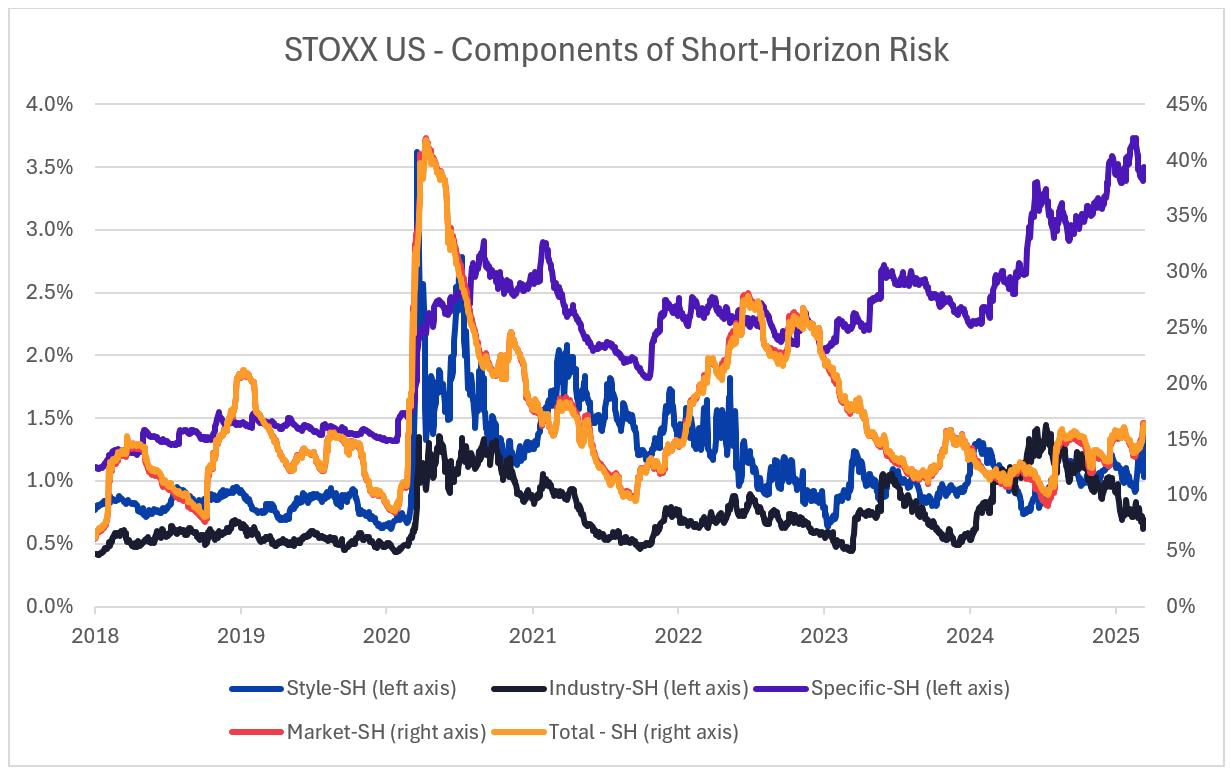

The tumultuous last week led to a sharp increase in risk for the US. Despite the whirlwind news cycles, the current risk level is nowhere near the previous peaks of 2020 or 2022.

All four variants of the Axioma US4 model—fundamental and statistical, at short and median horizons—showed an increase last week. The short-horizon predicted risk saw the largest jump over the past five business days, rising by over 150 basis points to exceed 16% on Friday. This level of risk hasn't been seen since April 2023 and it is only slightly above the seven-year median of 15%.

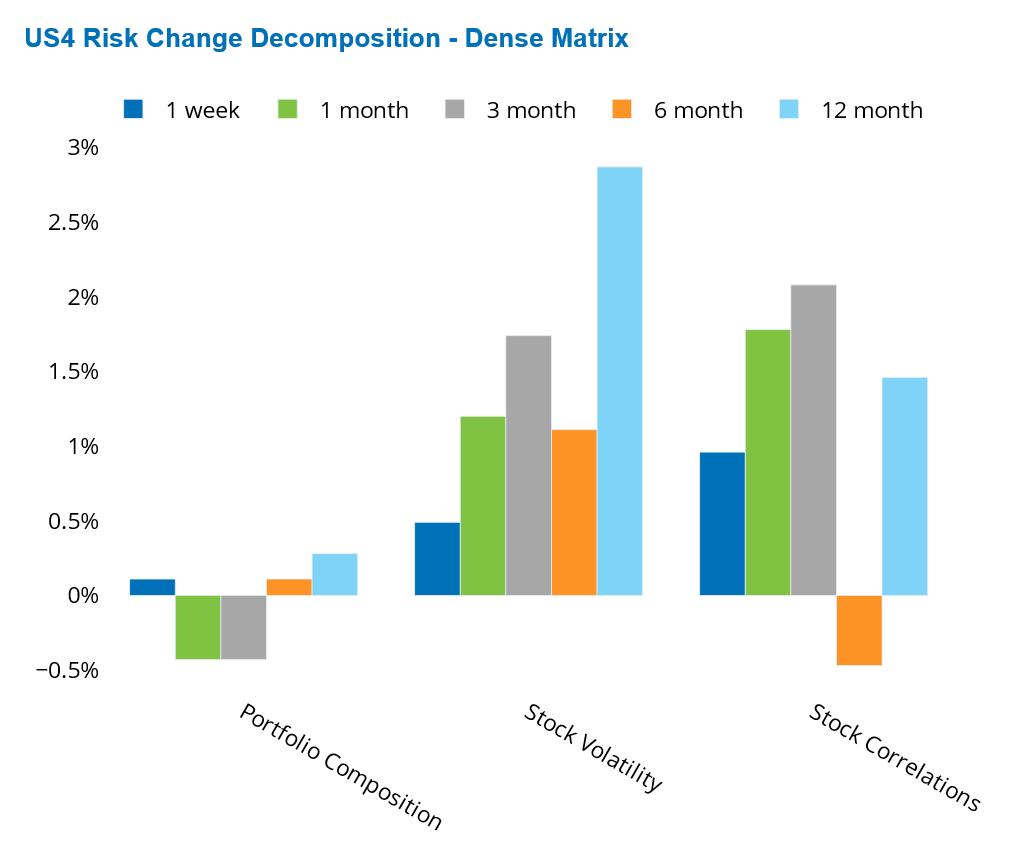

The decomposition of the change in risk from a dense matrix perspective reveals that the rise in both stock volatility and stock correlations drove last week’s risk increase, with correlations contributing more significantly. Changes in the STOXX US composition also added to the surge in risk.

A closer look at the major components of short-horizon risk shows that market risk drove the weekly increase in STOXX US risk while style and industry risks fell slightly. Stock-specific risk, which is only a small part of total benchmark risk, rose a bit last week and remained close to the February seven-year peak.

See graphs from the STOXX US Equity Risk Monitor as of March 14, 2025:

The following chart is not in the Equity Risk Monitors but is available on request:

Low-beta and low-volatility US stocks outperform amid declining risk appetite

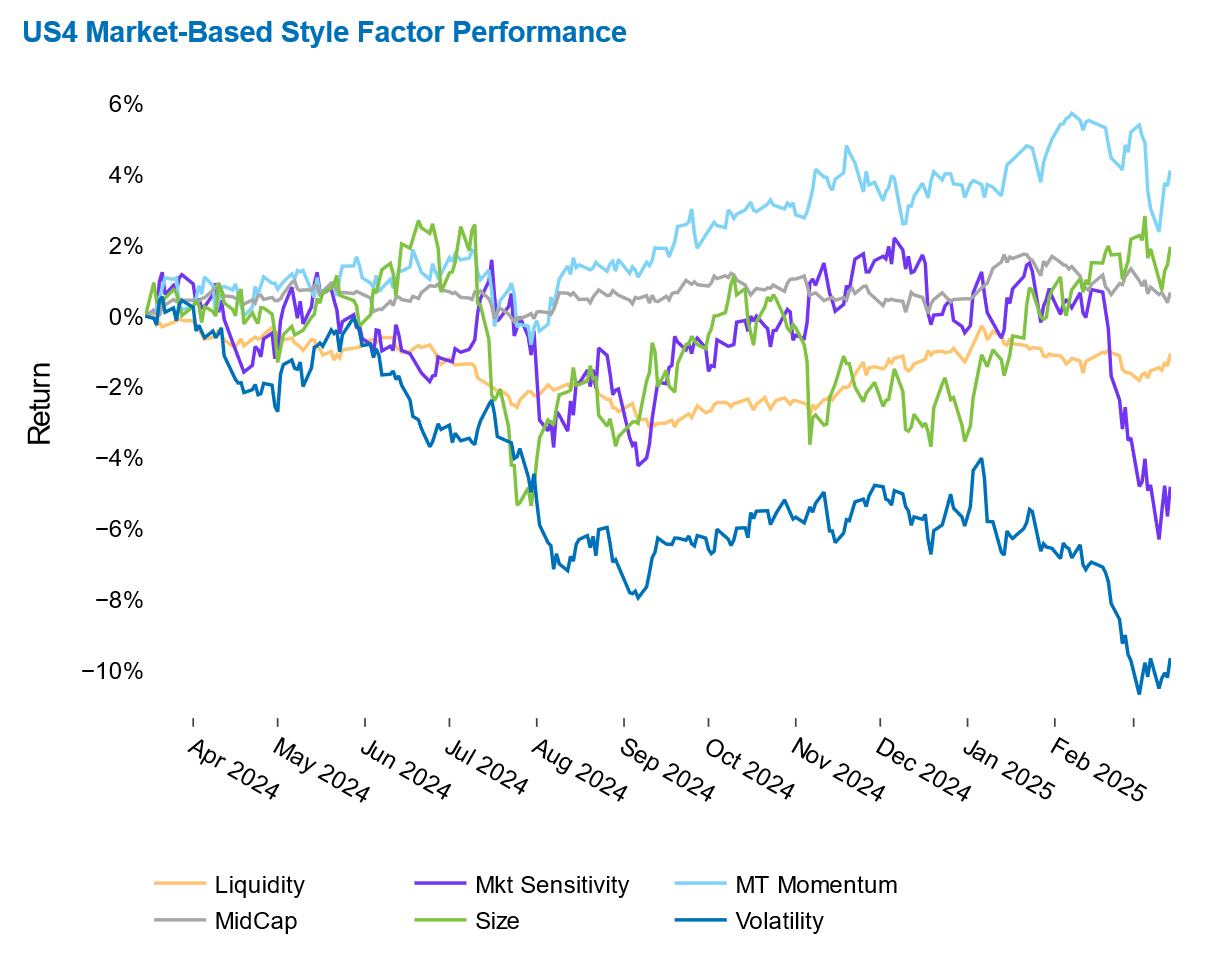

As US market sentiment eroded, risk appetites dropped, leading investors to favor low-beta and low-volatility stocks while avoiding high-beta and high-volatility alternatives. This shift is reflected in the sharp decline in the returns of the US Market Sensitivity and Volatility style factors over the past month.

Markets were optimistic immediately following the November elections, triggering a rise in stocks, but the so-called “Trump bump” has now disappeared. Investors who expected a repeat of the first year of Trump’s first term, when indices marched higher and the US economy grew, were in for a disappointment.

Markets are now starting to anticipate an economic slowdown in the first quarter of 2025. Furthermore, the Treasury Secretary’s comments last week that “corrections are healthy” reinforced the perception that the Trump 2.0 administration is less concerned about market downturns than Trump 1.0, at least in the short term. The uncertainty introduced by rollbacks and delays of tariff policies further weakened investor sentiment.

Since mid-February, US Market Sensitivity has plunged 6% and Volatility has dropped 3%. Market Sensitivity’s monthly decline was nearly three standard deviations below expectations at the beginning of the four-week period, marking it the largest decline across all Axioma fundamental medium-horizon models.

See graph from the STOXX US Equity Risk Monitor as of March 14, 2025:

You may also like