EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED APRIL 25, 2025

Axioma Risk Monitor: Volatile week ends with strong gains for US market; Magnificent Seven lead US market rally despite year-to-date struggles; US dollar’s downward spiral drives surge in currency volatility

Volatile week ends with strong gains for US market

The US market ended the week with strong gains after seesawing again. US stocks saw a sharp selloff on Monday, falling more than 2%, following President Trump’s remarks about the Fed Chair, which amplified existing anxieties about fiscal stability and trade policy.

President Trump escalated his public criticism of Fed Chair Jerome Powell demanding immediate rate cuts and reiterating threats to remove him. Investors feared political interference in monetary policy, eroding confidence in the Fed’s autonomy and triggering a flight from US assets.

The lack of progress in trade negotiations also heightened fears of prolonged economic disruption and a global economic slowdown. This was reflected in the International Monetary Fund’s decision to scale back its forecast for global economic growth for 2025 and 2026 compared to three months ago.

The market began to recover as President Trump softened his tone on Tuesday on two major issues: he indicated he would not fire Federal Reserve Chair Jerome Powell and signaled a willingness to substantially roll back the 145% tariffs on Chinese imports. Strong earnings reports—particularly from Big Tech—further supported the recovery.

The STOXX US index ended the week with nearly 5% gains, recouping most losses incurred after the April 2nd tariff announcement. However, it remains down 2% since “Liberation Day” and nearly 6% year-to-date.

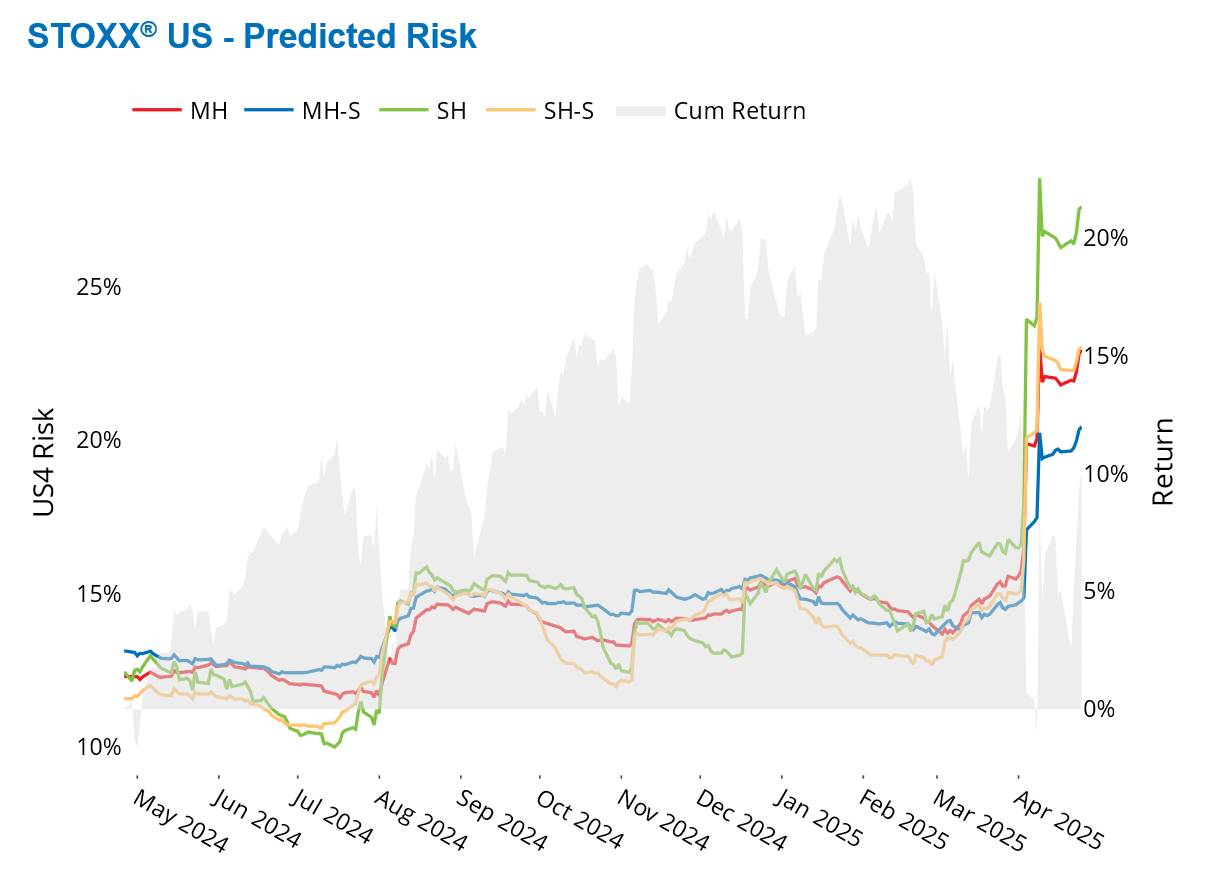

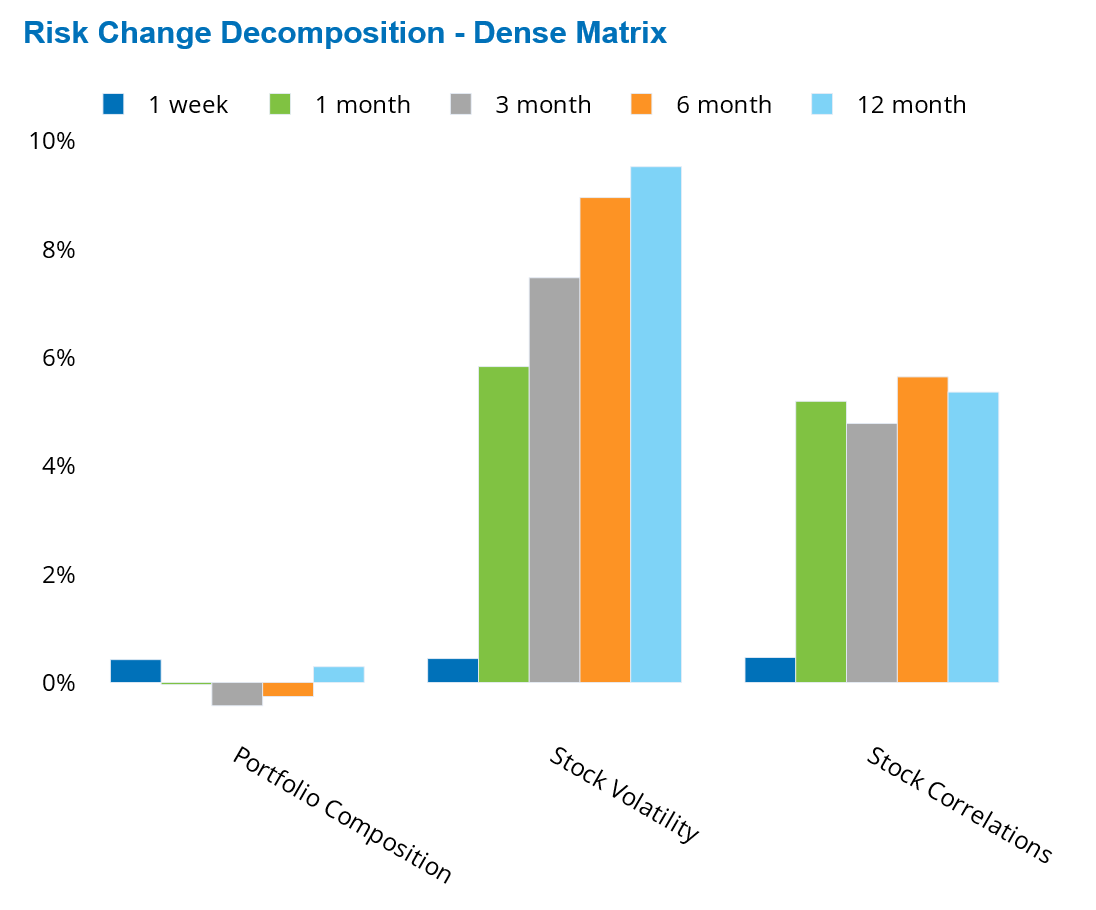

At the same time, the STOXX US index’s risk forecast continued to inch up, nearing 28%—double the long-term median risk for the US market, as measured by Axioma US4 fundamental short-horizon model. This increase in risk has been fueled by rising stock volatility and correlations over the past week, month, and three-, six- and twelve-month periods.

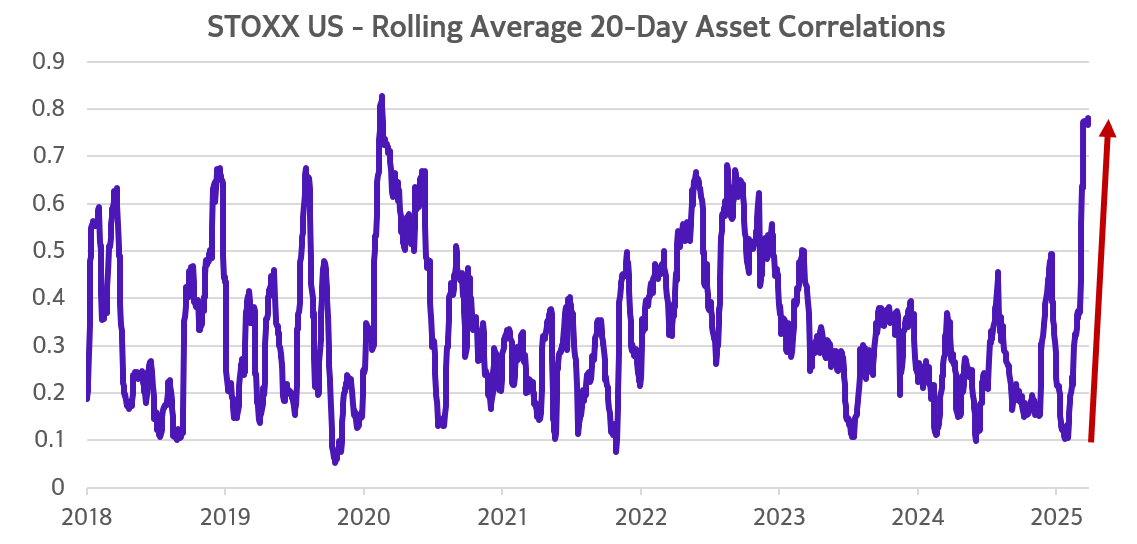

The unabated increase in stock correlations pushed the 20-day average pairwise correlation among stocks in the STOXX US index near 0.8, a level not seen since the height of the COVID-19 crisis in March 2020. High correlations suggest that macroeconomic and geopolitical events are driving stock prices rather than individual characteristics.

See graphs from the STOXX US Equity Risk Monitor as of April 25, 2025:

The following chart is not in the Equity Risk Monitors but is available on request:

Magnificent Seven lead US market rally despite year-to-date struggles

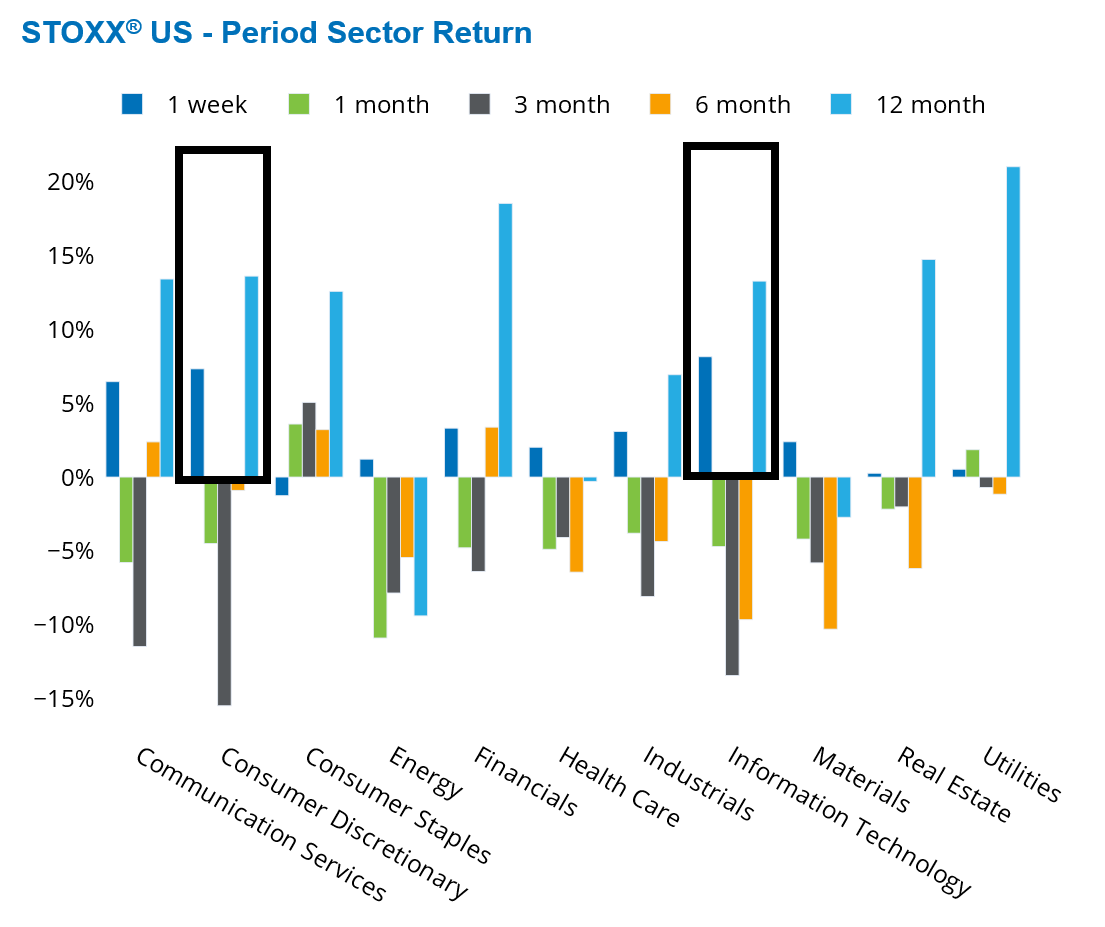

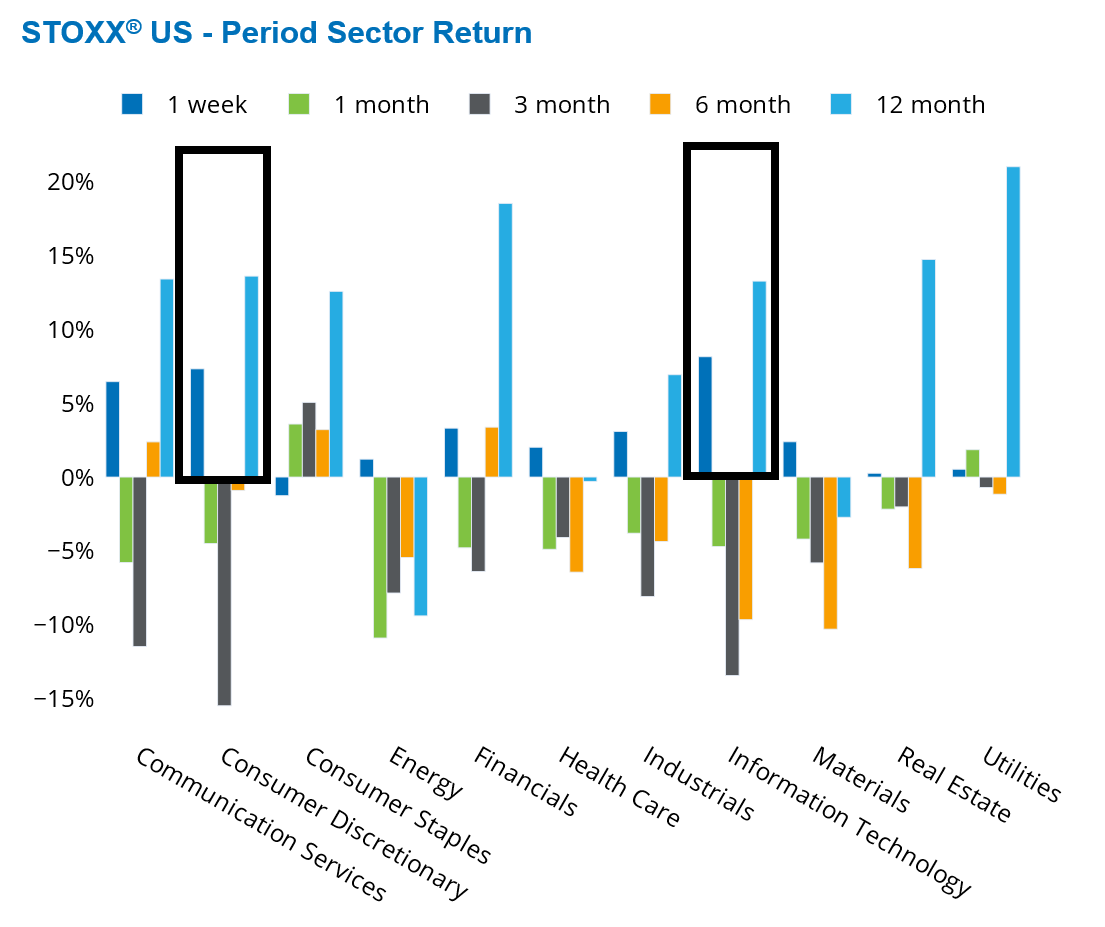

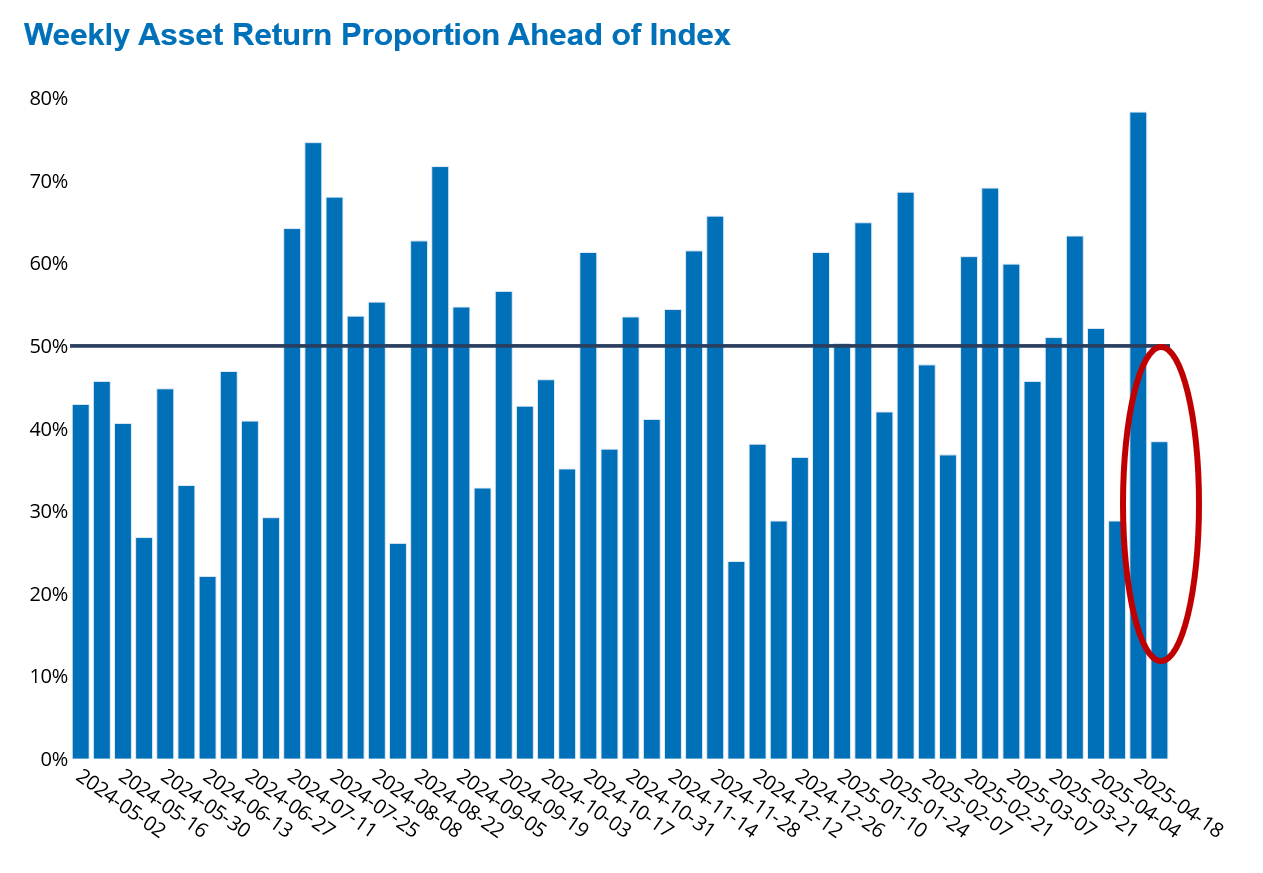

Most US sectors participated in last week’s rally, but less than 40% of stocks in the STOXX US index outperformed the market, indicating that large companies were the primary drivers of the US market's gain. Information Technology and Consumer Discretionary sectors—home to the Magnificent Seven: Alphabet, Amazon, Apple, Microsoft, Nvidia and Tesla—saw the largest gains. Amazon and Tesla belong to Consumer Discretionary (up 7% last week) and the other five stocks are in Information Technology (up 8% last week). Together the Magnificent Seven were responsible for nearly half of last week’s US market gain.

Tesla shares soared 18% last week, marking the best performance among the seven mega tech companies. Although Tesla’s earnings missed expectations, strategic updates on future products and cost management drove a positive market reaction. Elon Musk's announcement of scaling back his involvement with the Department of Government Efficiency (DOGE) starting in May also bolstered Tesla's stock. Amazon, Nvidia and Meta were the next best performers each posting around 9% weekly gains.

Alphabet (Google’s parent) rose about 7% last week as it delivered better-than-expected revenues and earnings, driven by robust advertising revenue, cloud growth, and AI innovation. Alphabet also announced a major stock buyback and a dividend increase, signaling management’s confidence and further fueling investor enthusiasm.

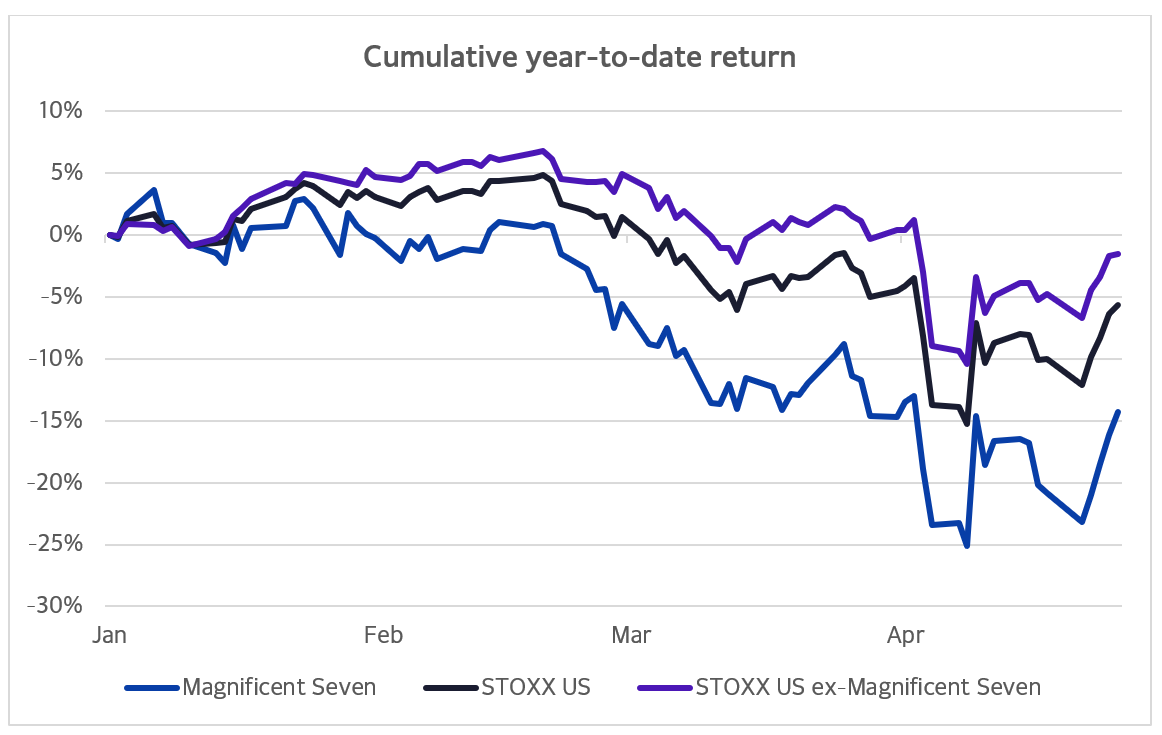

Despite last week’s rebound, the Magnificent Seven have been a drag on the US market for most of 2025, collectively falling 14% year to date. Meta saw the smallest year-to-dare loss (6.45%) and Tesla the largest (29%). Without the Magnificent Seven—which represent nearly 30% of the US market—the STOXX US index would have been down only 2%, about a third of its current year-to-date loss.

See graphs from the STOXX US Equity Risk Monitor as of April 25, 2025:

The following chart is not in the Equity Risk Monitors but is available on request:

US dollar’s downward spiral drives surge in currency volatility

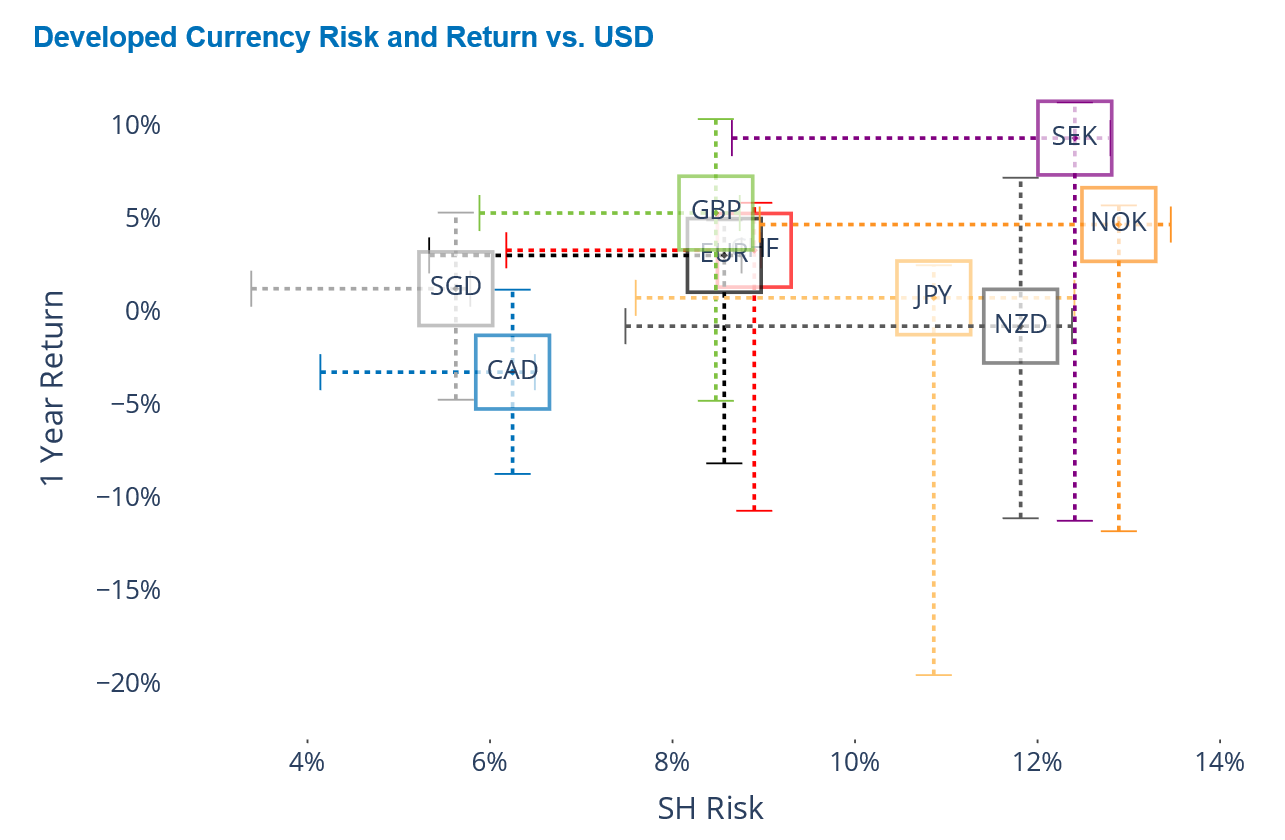

The US dollar has faced significant downward pressure throughout 2025, due to uncertainty surrounding trade policy and tariffs which have eroded investor confidence. The introduction of tariffs in April further destabilized markets, weakening the dollar’s safe-haven status. Investors shifted to the euro, Swiss franc, and Japanese yen, which are now posting 12-month positive returns, and are positioned at or near the high-end of their one-year return ranges.

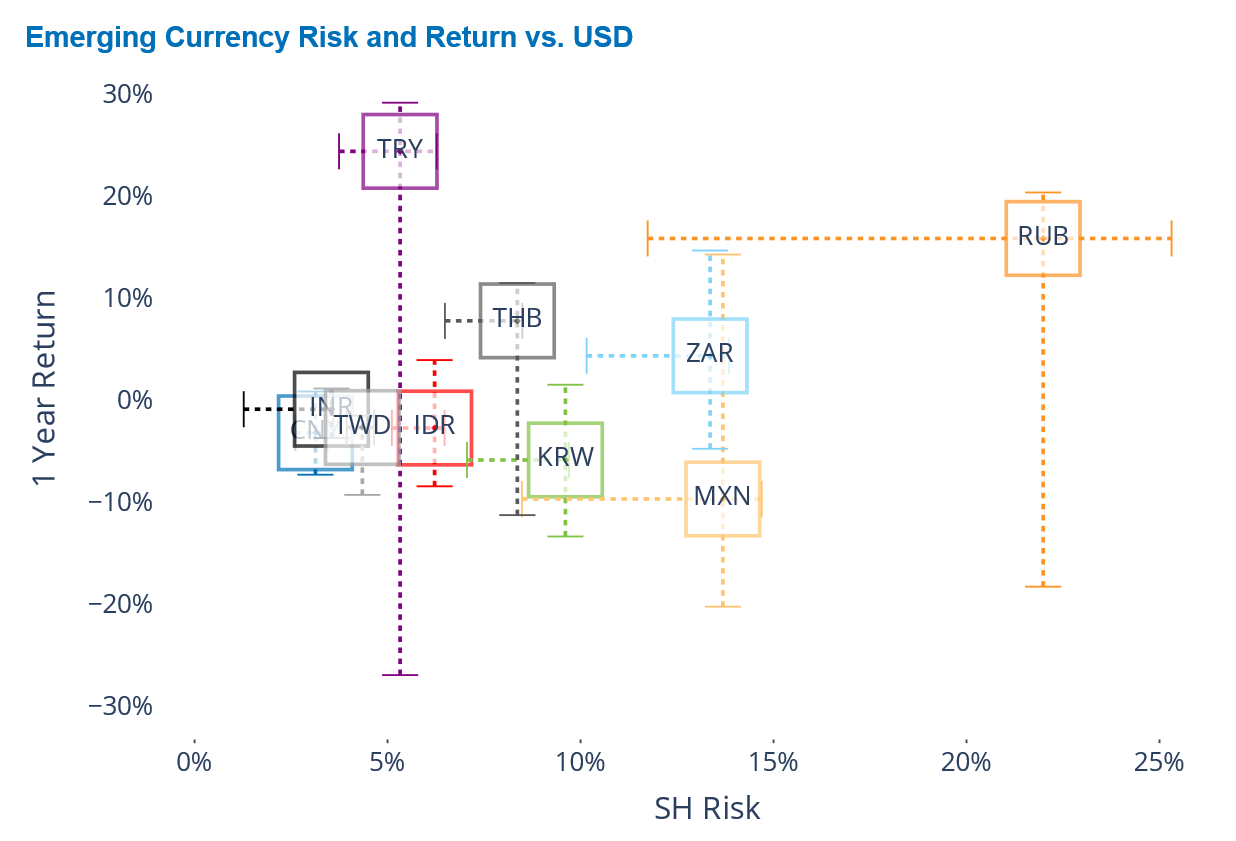

However, the Swedish krona, British pound and Norwegian krone emerged as the biggest winners against the greenback, while the Canadian dollar was the biggest loser among developed currencies over the past 12 months. Among emerging market currencies, the Turkish lira, Russian ruble and Thai baht saw the largest gains, while the Mexican peso experienced the largest loss (nearly 10%) over the past 12 months.

Most major developed and emerging country currencies are now positioned at the high end of their one-year volatility ranges. Among developed currencies, the Norwegian krone stands out as the most volatile, while the Russian ruble holds this distinction among emerging currencies.

See chart from the STOXX Developed World Equity Risk Monitor as of April 25, 2025:

See chart from the STOXX Emerging Markets Equity Risk Monitor as of April 25, 2025:

You may also like