MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED MARCH 14, 2025

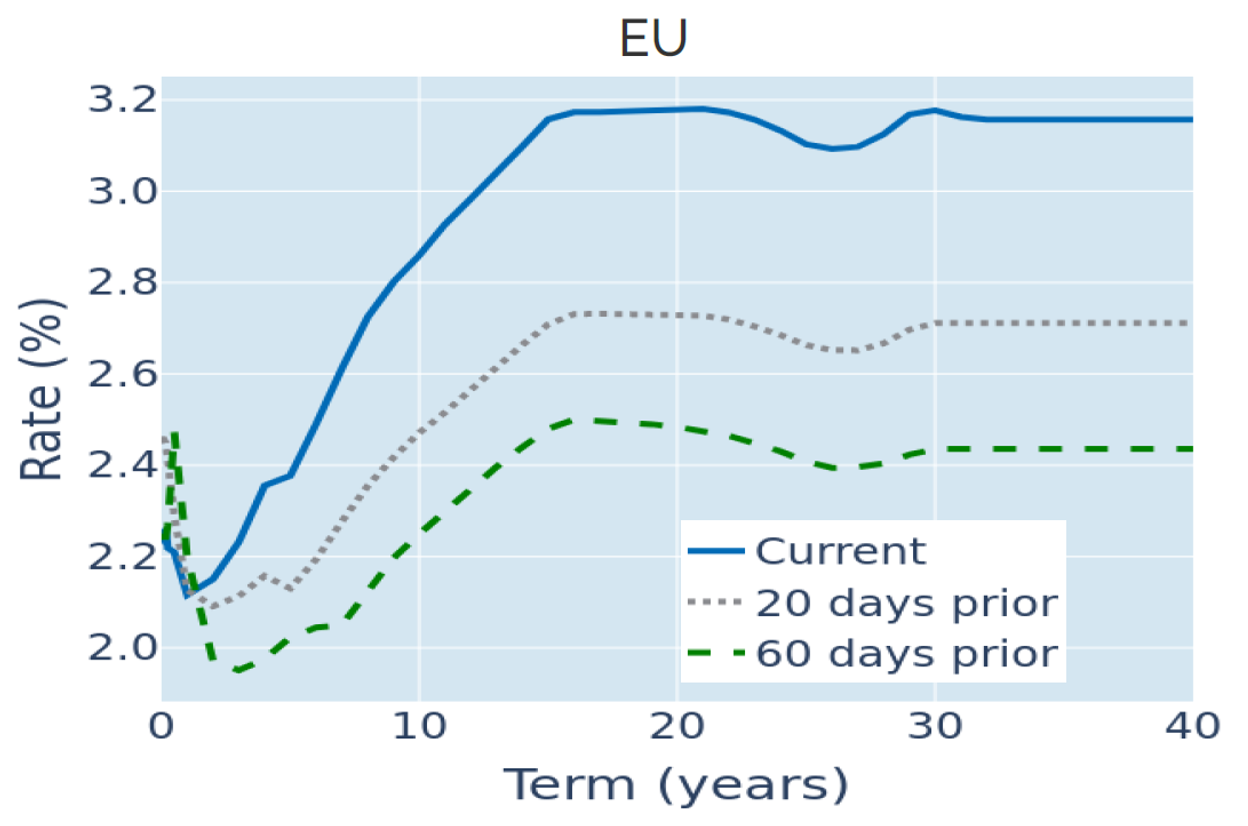

Bund curve steepens as traders evaluate policy implications

The term premium of long versus short-dated German government bonds soared to a 32-month high in the week ending March 14, 2025, as traders weighed up the prolonged effects of recent policy decisions against immediate implications. The 10-year benchmark yield climbed 8 basis points on Tuesday amid growing concerns over the inflationary impact of the recent announcements on increased defense and infrastructure spending as well as the retaliatory tariffs on American imports into the European Union.

The sentiment was echoed in a speech by European Central Bank President Christine Lagarde the following day, in which she noted that trade fragmentation and higher defense spending could “push up inflation” and “lead to larger, more disruptive relative price changes.” Nevertheless, short-term interest rate expectations declined 5 basis points on Thursday, pulling the monetary policy sensitive 2-year Bund yield lower by the same amount.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated March 14, 2025) for further details.

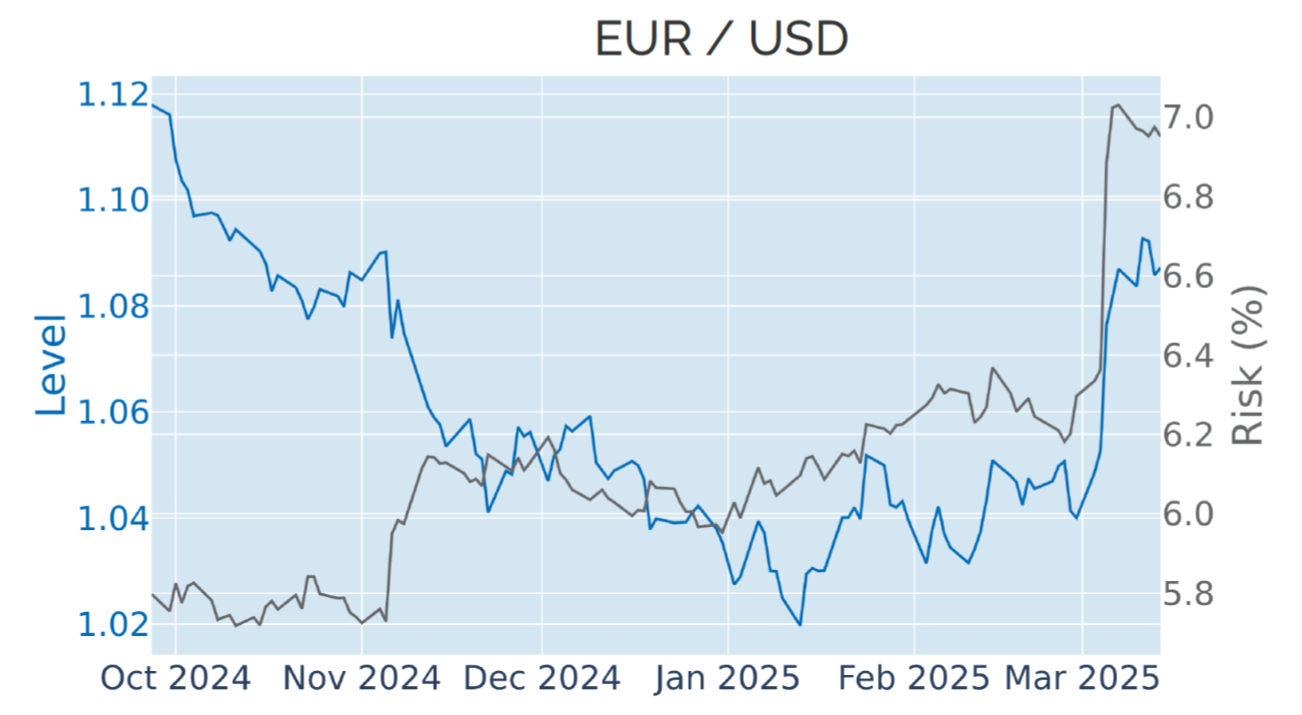

Tariff threats continues to weigh on dollar

Ongoing concerns over the impact of trade Donald Trump’s tariffs on the already shaky American economy pushed the dollar to its lowest level against its major trading partners since before the presidential election in early November on Tuesday. The bigger-than-anticipated deceleration of annual headline inflation to 2.8% in February—down from 3% the month before and lower than the consensus forecast of 2.9%—on Wednesday seemed to confirm the notion of a further slowdown in economic activity.

But month-over-month price growth was still almost three times of what would be required to bring the annual rate down to 2%, which did little to ease the Federal Reserve’s quandary of what to do next. The market consensus seemed to shift slightly toward central banks’ remit to control inflation, as short-term interest-rate futures traders lowered the implied probability of another rate cut in June from 90% at the beginning of last week to just over 70% on Friday. The chance of at least 75 basis points worth of monetary easing over remainder of this year also dropped from three in four last Monday to even odds right now.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated March 14, 2025) for further details.

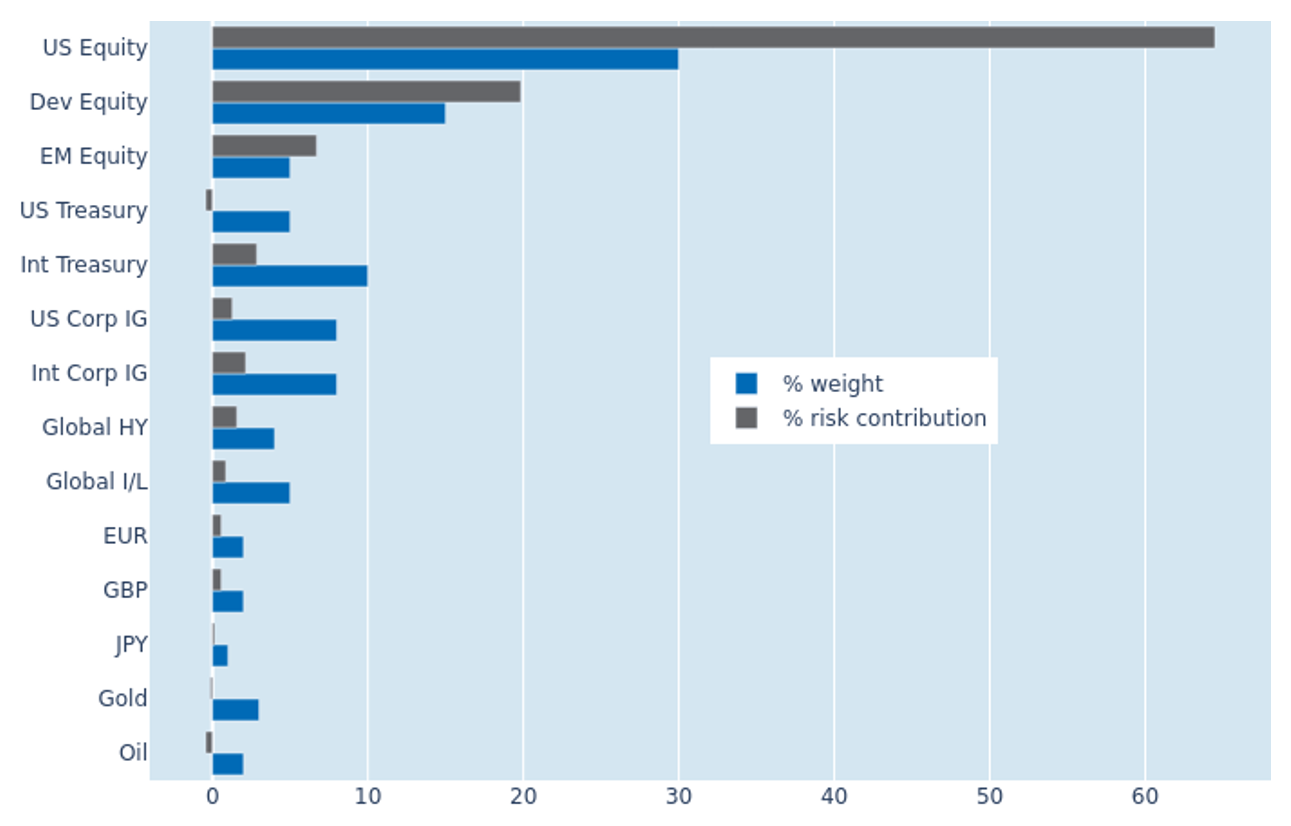

Portfolio risk rebounds as US stocks descend into correction territory

The predicted short-term risk of the Axioma global multi-asset class model portfolio rebounded by almost a percentage point to 7% as of Friday, March 14, 2025, as the adverse effects of higher stock-market volatility were only partially offset by weaker exchange-rate fluctuations. The effect was most notable for US equities, which saw their share of total portfolio risk mushroom from 50.7% to 64.5%, as the American stock market continued its steep descent into correction territory. This was in stark contrast to their counterparts from other developed markets, where the benefit of lower FX volatility shrunk the percentage risk contribution from 22.1% to 19.9%. Gold now joined its fellow commodity oil in actively reducing overall risk, as safe-haven buying pushed the precious metal to yet another all-time high.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated March 14, 2025) for further details.

You may also like