MULTI-ASSET CLASS MONITOR HIGHLIGHTS

Treasury yields fall as markets focus on downside risk from tariffs

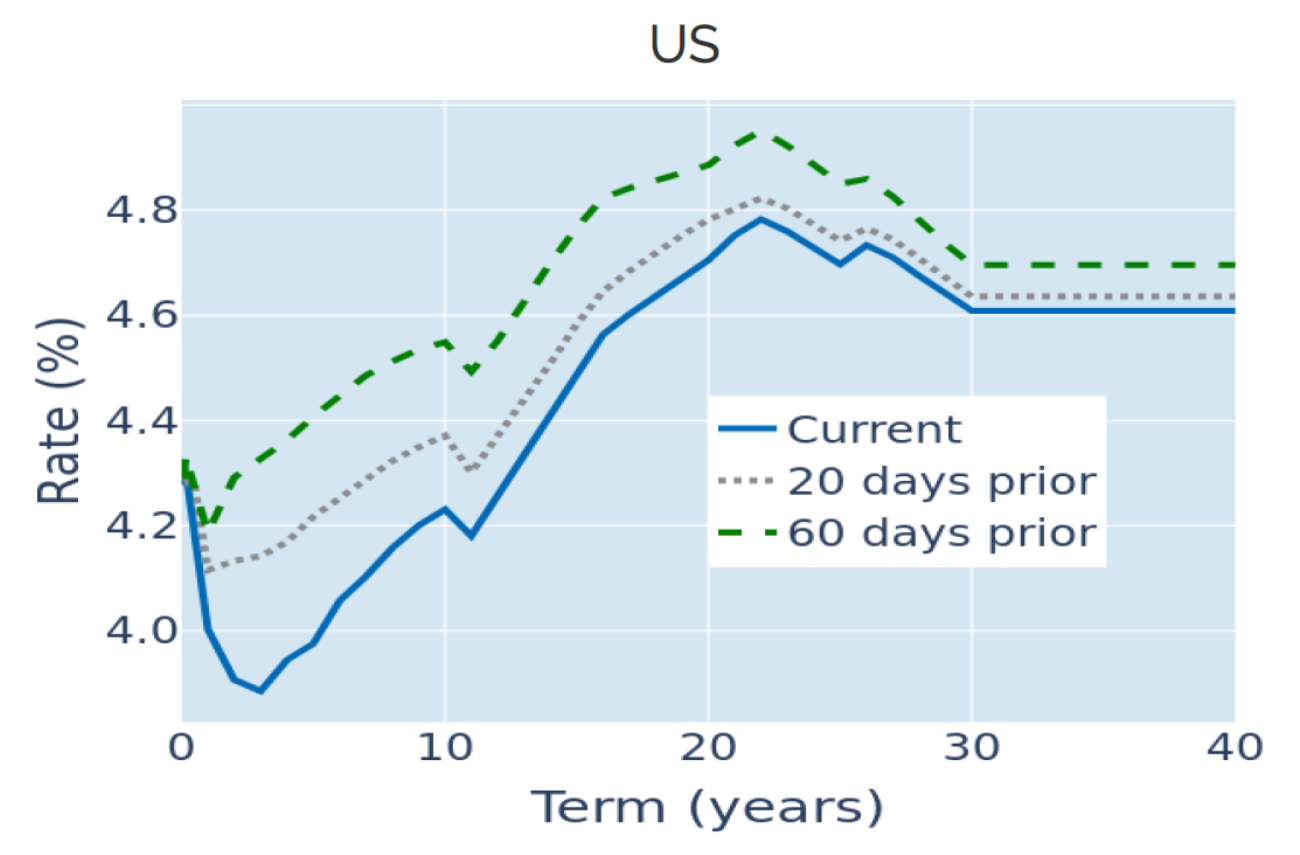

US Treasury yields fell across all maturities in the week ending March 21, 2025, despite the Federal Reserve keeping its policy rate target unchanged in line with market expectations. In the press conference following the two-day FOMC meeting on Wednesday, Chair Powell noted the adverse impact of tariffs on economic growth and their potential to raise inflation, which was also reflected in the committee’s latest economic projections. Rate setters lowered their GDP growth prediction for 2025 from 2.1% to 1.7%, while upping their PCE inflation expectations for the whole year from 2.5% to 2.7% for the headline rate and 2.8% for core prices. The median year-end forecast for the federal funds rate remained unchanged at 3.9%, which was 25 basis points above the level implied by futures markets.

The fact that yields fell despite an upward revision in inflation projections shows that bond markets are focused on the downside risk to the economy and that they expect the Fed to ease monetary conditions by more than what is currently anticipated by the rate setters themselves.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated March 21, 2025) for further details.

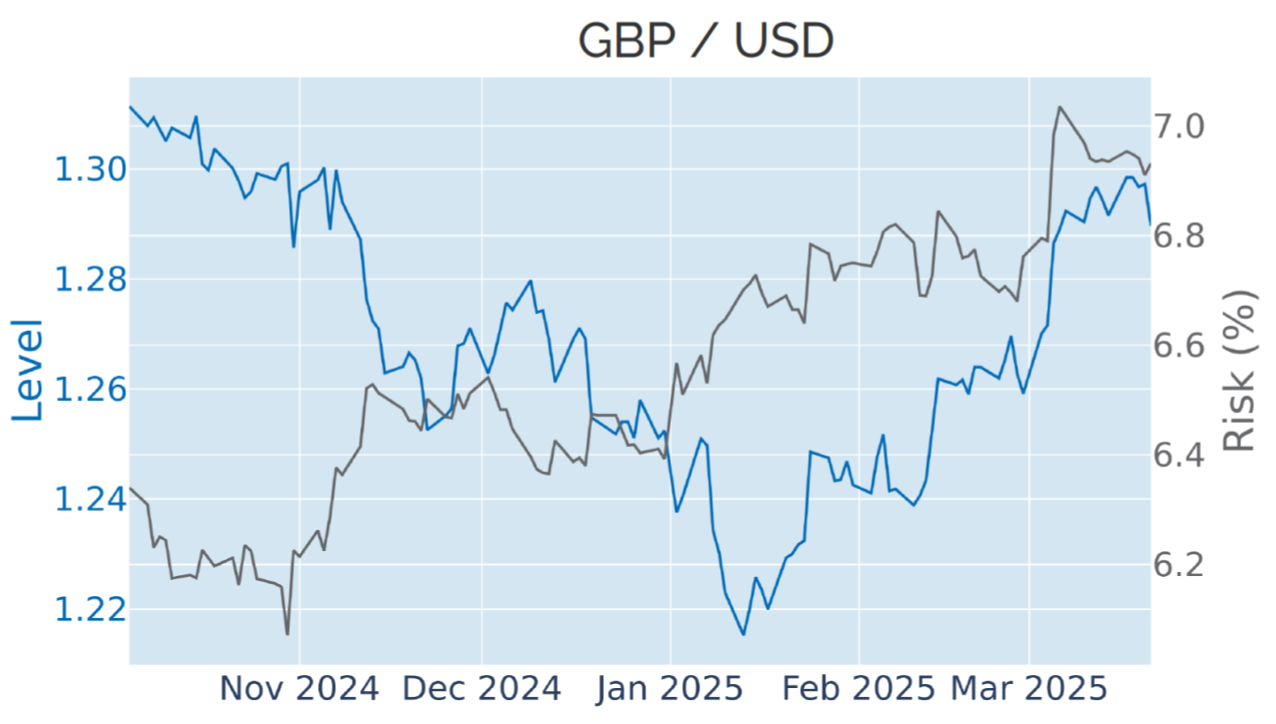

But the dollar rebounds alongside recovering share prices

The US dollar rebounded against its major competitors in the week ending March 21, 2025, as US equities snapped out of their four-week losing streak. Over the course of February and March, the Dollar Index has been moving in lockstep with share prices five out of seven weeks. The increasing correlation of the greenback’s value with the American stock market and the concurrent decoupling from monetary policy expectations underpins the notion that investor focus is shifting away from the Fed’s fight against inflation toward concerns about the health of the US economy.

Large simultaneous selloffs in the dollar and US stocks like the one we just observed are rare. Usually, funds move from shares into USD cash in times of uncertainty. The last time we saw a similar co-movement was in August last year, when a weaker-than-expected labor market report triggered the first serious fears that the economy might be cooling off faster than anticipated. Before that, we would have to go all the way back to the onset of the COVID pandemic in February 2020 to observe similar behavior (before the real panic triggered the universal grab for cash in March).

The euro took the brunt of the losses against the dollar last week, while the pound held up comparatively well, as Gilt yields defied the general downward trend in borrowing costs and climbed across the board after the Bank of England’s decision to hold its base rate steady on Thursday.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated March 21, 2025) for further details.

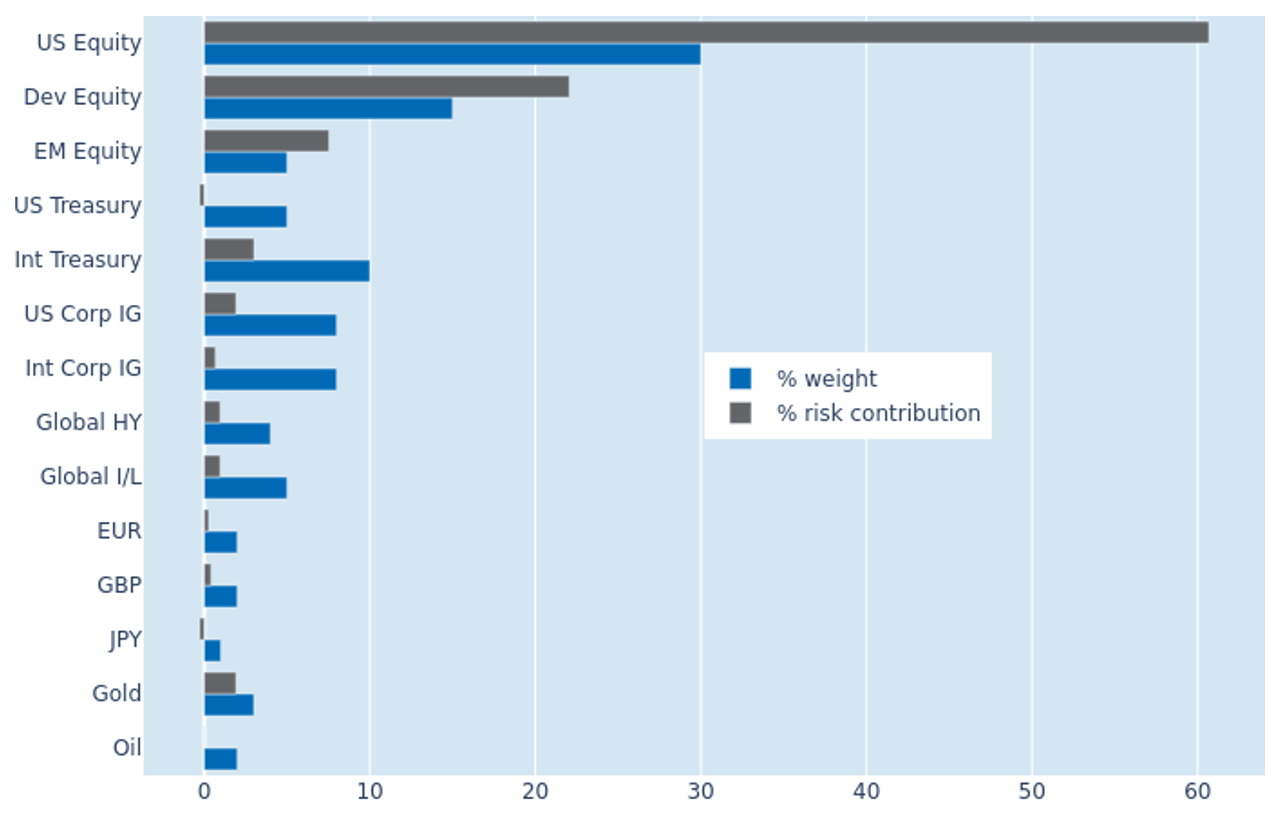

Increased global stock market correlation raises portfolio risk

A greater correlation of global equity returns raised the predicted short-term risk of the Axioma global multi-asset class model portfolio by 0.3% to 7.3% as of Friday, March 21, 2025. The effect was most notable for non-US equities—developed and emerging—which saw their combined share of overall portfolio risk expand by more than three percentage points. American shares, on the other hand, benefitted from lower standalone volatility, which shrunk their percentage risk contribution from 64.5% to 60.7%. Gold once more added to overall volatility, as its value continued to grow alongside recovering share prices, while the contributions from US Treasury bonds and the Japanese yen just about remained negative.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated March 21, 2025) for further details.

You may also like