MULTI-ASSET CLASS MONITOR HIGHLIGHTS

Treasury curve steepens as traders assess the effect of further tariffs

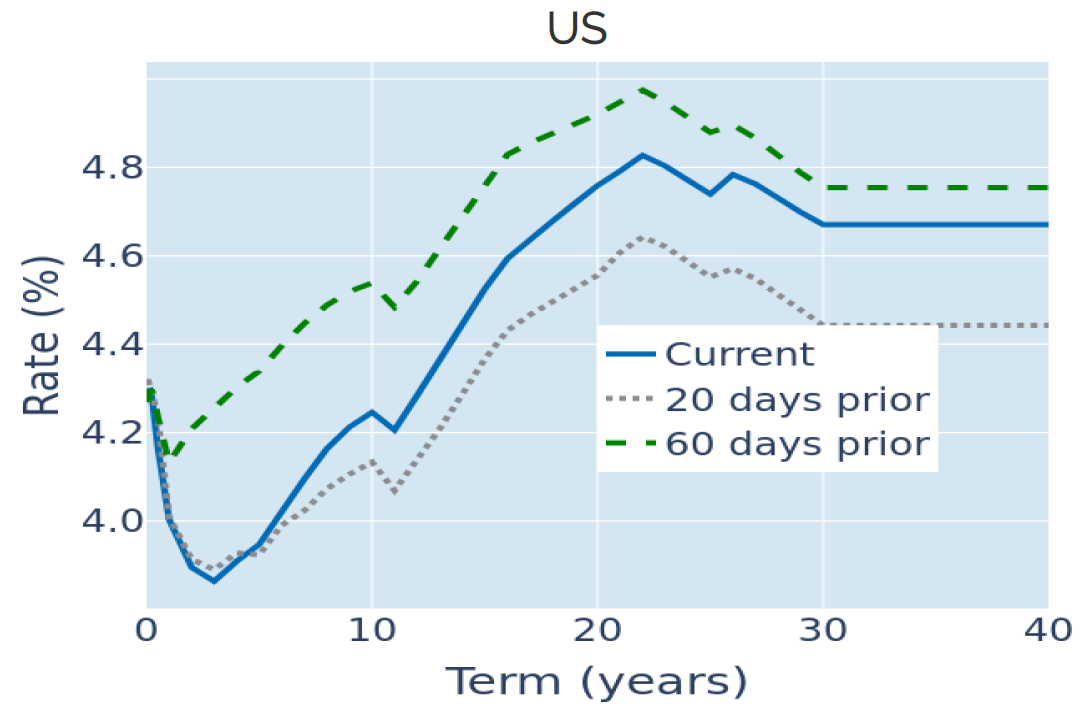

The term premium of long over short US Treasury bonds widened to a 10-week high in the week ending March 28, 2025, as traders tried to balance the opposing forces of persistent inflationary pressures with growing concerns over the adverse economic impact of Donald Trump’s wide-ranging import levies. Tariffs are due to be paid by the importing company, who may try to pass them on to the end consumer if possible, which means that they are likely to raise inflation.

The 10-year breakeven inflation rate—implied by the price difference between inflation-protected and nominal Treasury bonds—climbed to its highest level since late February on Thursday, also lifting the same maturity nominal yield to a 4-week high. The notion of underlying price pressures was underpinned on Friday, when core personal consumption expenditures—the Federal Reserve’s preferred inflation gauge—accelerated from 2.6% per annum in January to 2.8% in February, beating the consensus forecast of a more moderate increase to 2.7%.

At the other end of the curve, the monetary policy-sensitive 2-year rate fell to its lowest level in almost three weeks, with now one in three market participants expecting the Fed to lower its policy target by more than 75 basis points before the end of the year.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated March 28, 2025) for further details.

Ongoing trade war concerns continue to weigh on dollar

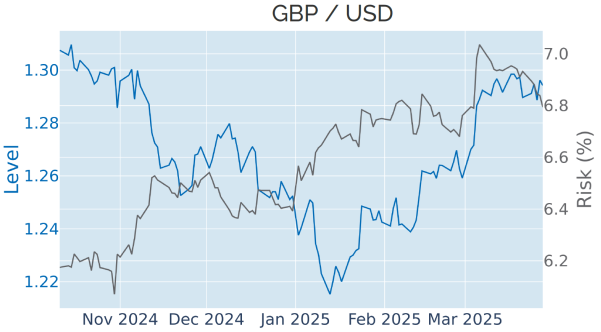

The ongoing concerns over the impact of the latest round of incoming tariffs on the US economy continued to weigh on the dollar last week. The pound sterling was one of the major beneficiaries, ending the week 0.4% stronger against its American rival, despite a bigger-than-expected drop in UK inflation.

The deceleration of headline consumer price growth from 3% to 2.8% was greater than the annual rate of 2.9% predicted by analysts. The GBP/USD exchange rate dipped by half a percentage point in response, as traders lowered their monetary policy predictions following the news, but more than recouped its losses amid the general dollar weakness on Thursday and ended the week firmly in the black.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated March 28, 2025) for further details.

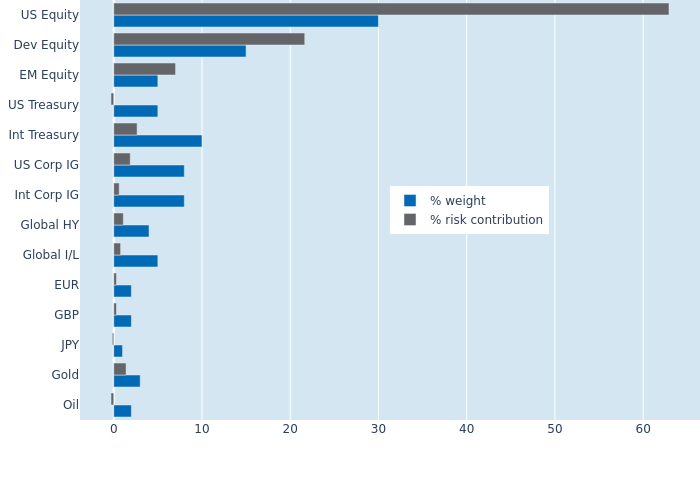

Lower FX and equity volatilities reduce portfolio risk

Lower fluctuations in share prices and exchange rates reduced the predicted short-term risk of the Axioma global multi-asset class model portfolio by almost a percentage point to 6.4% as of Friday, March 28, 2025. The effect was most notable to for non-US equities—developed and emerging—which saw their combined share of total portfolio risk shrink from 29.7% to 28.5%. The added benefit of a slight inverse relationship of FX and stock market returns also meant that they appeared much less risky relative to their market-value weight than their American counterparts, when viewed from the perspective of a USD-based investor. But it was the Japanese yen that offered the biggest risk reduction per monetary unit, followed by oil and US Treasury bonds. Even though crude prices once more moved with equity markets, their ongoing inverse relationship with exchange rates against the dollar meant that the holding the commodity still reduced portfolio risk overall.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated March 28, 2025) for further details.

You may also like