MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED APRIL 4, 2025

Yields plummet as focus shifts from inflation to tariffs and economy…

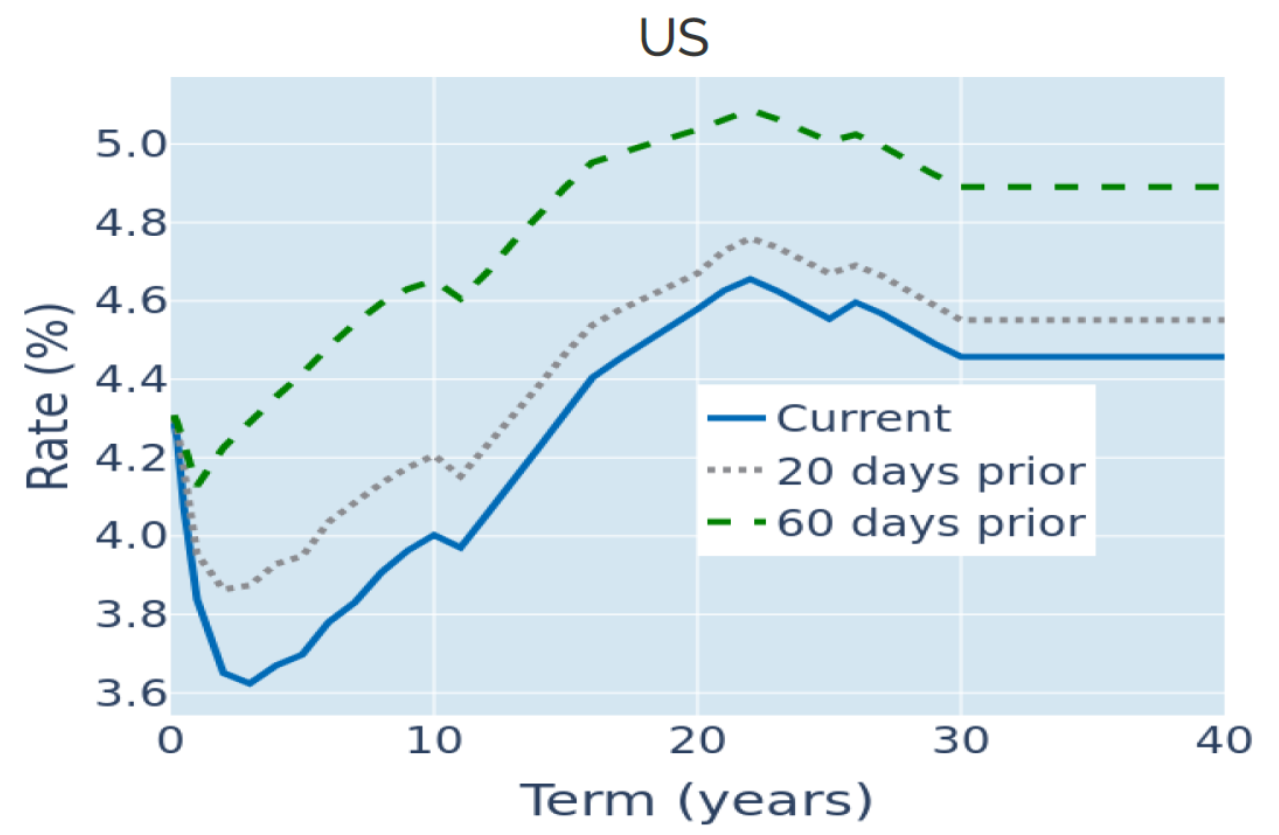

US Treasury yields plummeted to their lowest levels since early October in the week ending April 4, 2025, as traders upped their bets how fast and by how much the Federal Reserve will ease monetary conditions in response to the latest tariff announcement and accompanying stock-market turbulences. The monetary policy-sensitive 2-year rate declined 24 basis points over the expectation that the FOMC will lower its policy target by a full percentage point over the remainder of the year—instead of the 0.75% expected at the start of last week. The next cut is firmly priced in for June, but the chance of an even earlier move at the next meeting in early May also more than doubled from 14% on Monday to one in three on Friday.

Long yields fell by almost a quarter point, too, driven by a similar drop in the 10-year breakeven inflation rate. Even though import levies can be expected to put significant upward pressure on consumer prices in the short term, market participants seemed to have reached the conclusion that this will be more than offset by the long-term damage that the current trade policy will do to economic growth. The bumper increase of 228,000 new jobs reported for March on Friday did little to alleviate those concerns, despite comfortably beating the consensus prediction of 135,000, as the numbers referred to a period before the imposition of the latest policy measures.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated April 4, 2025) for further details.

…further depressing the dollar…

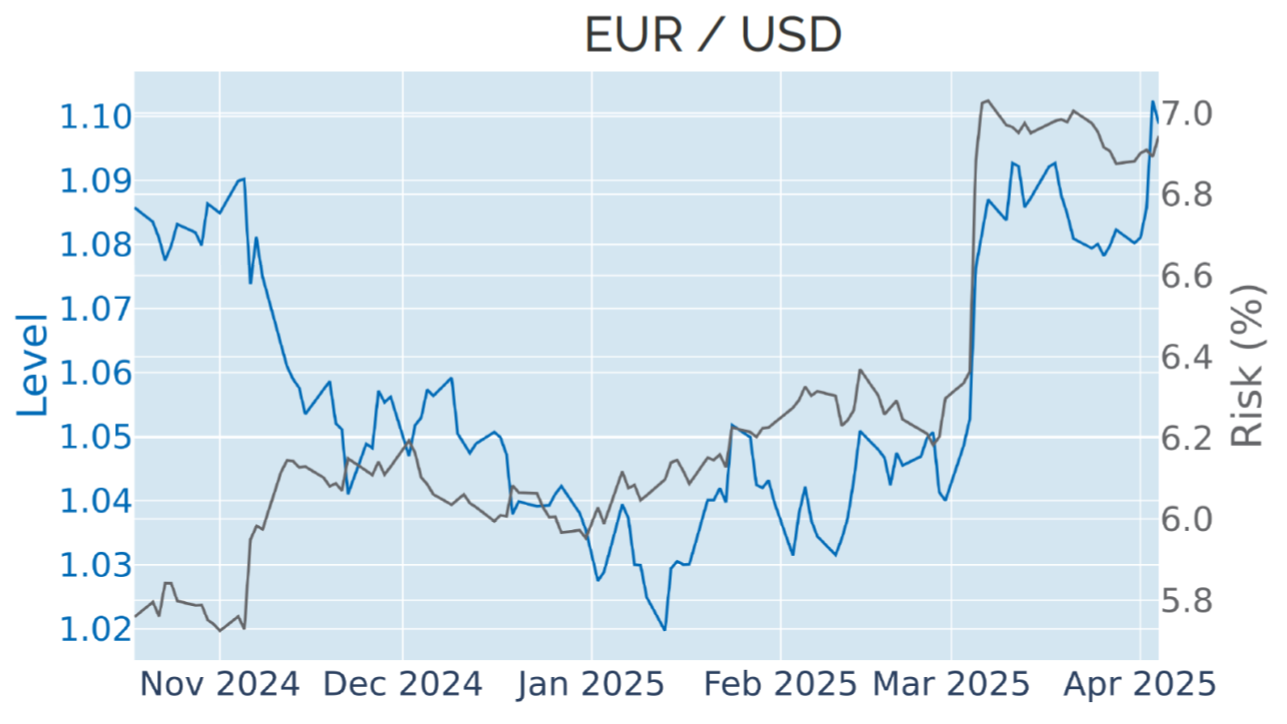

Last week’s simultaneous drop in US share prices and interest rates continued to weigh on the dollar, which fell another 1% against a basket of major trading partners. Traditional safe havens like the Japanese yen and the Swiss franc were the major beneficiaries, each gaining around 3% against their American rival, while the euro strengthened by 1.5%, pushing all three currencies to 3-month highs. But not all currencies profited from the greenback’s ongoing weakness. Commodity currencies, such as the Australian dollar, the New Zealand dollar, and the Norwegian krone, were hit particularly hard, as prices for oil and other raw materials plummeted amid rising fears of a potential recession.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated April 4, 2025) for further details.

…while credit risk premia soar

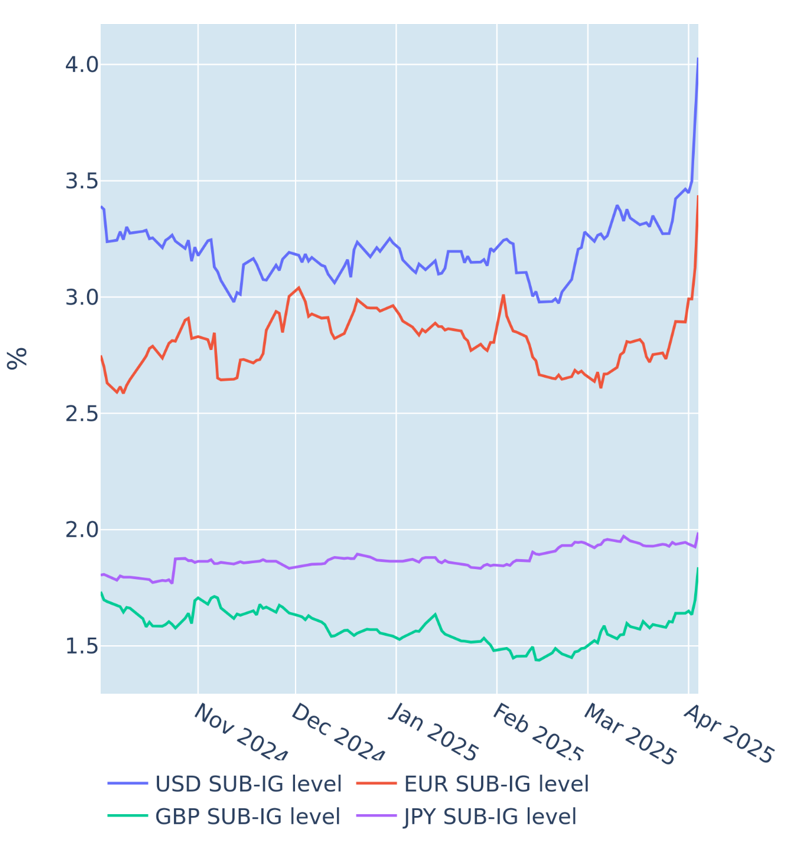

Mounting recession fears were also reflected in widening credit spreads. The risk premia on USD-denominated sub-investment grade debt soared to their highest levels in 17 months, recording their biggest weekly surge since the default of Silicon Valley Bank in March 2023. Thursday’s and Friday’s move also constituted the fastest two-day increase since the onset of the COVID pandemic in early 2020. Spreads on higher-rated issues expanded as well, but to a much lesser extent, which meant that the overall yields on investment grade corporate bonds still fell due to the offsetting effect of lower risk-free rates.

Please refer to Figure 5 of the current Multi-Asset Class Risk Monitor (dated April 4, 2025) for further details.

Portfolio risk rises, but flight to safety offsets higher equity volatility

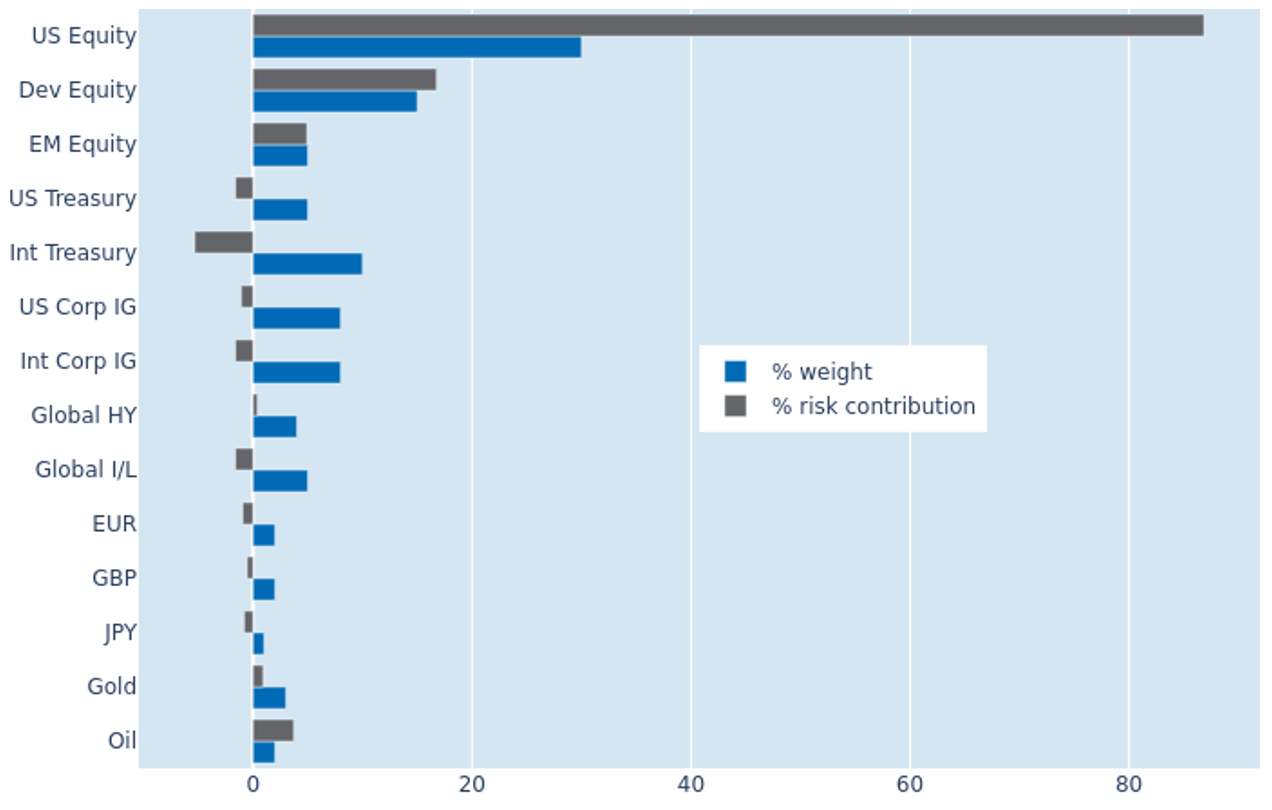

The predicted short-term risk of the Axioma global multi-asset class model portfolio rebounded to 7.5% as of Friday, April 4, 2025, from 6.4% the week before. One may have expected a much larger increase in overall volatility, given the current stock-market turbulences, but much of the losses there was offset by opposing gains in bond prices and exchange rates against the dollar. This was also reflected in the portfolio’s risk profile, with US equities now accounting for 86.8% of total portfolio risk, compared with 63% only a week earlier. Investing in high-quality fixed income instruments and markets outside the United States helped mitigate much of the increased risk, with non-USD government bonds providing the best diversification benefits, followed by investment grade corporates and US Treasury securities. Holding high yield debt, on the other hand, still added to overall volatility, as the higher risk premia outweighed the benefits of lower sovereign yields. Oil also turned from diversifier to additional risk source, as its price fell alongside stock markets.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated April 4, 2025) for further details.

You may also like