MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED APRIL 11, 2025

Dollar and Treasuries plummet as investors shift funds to Europe

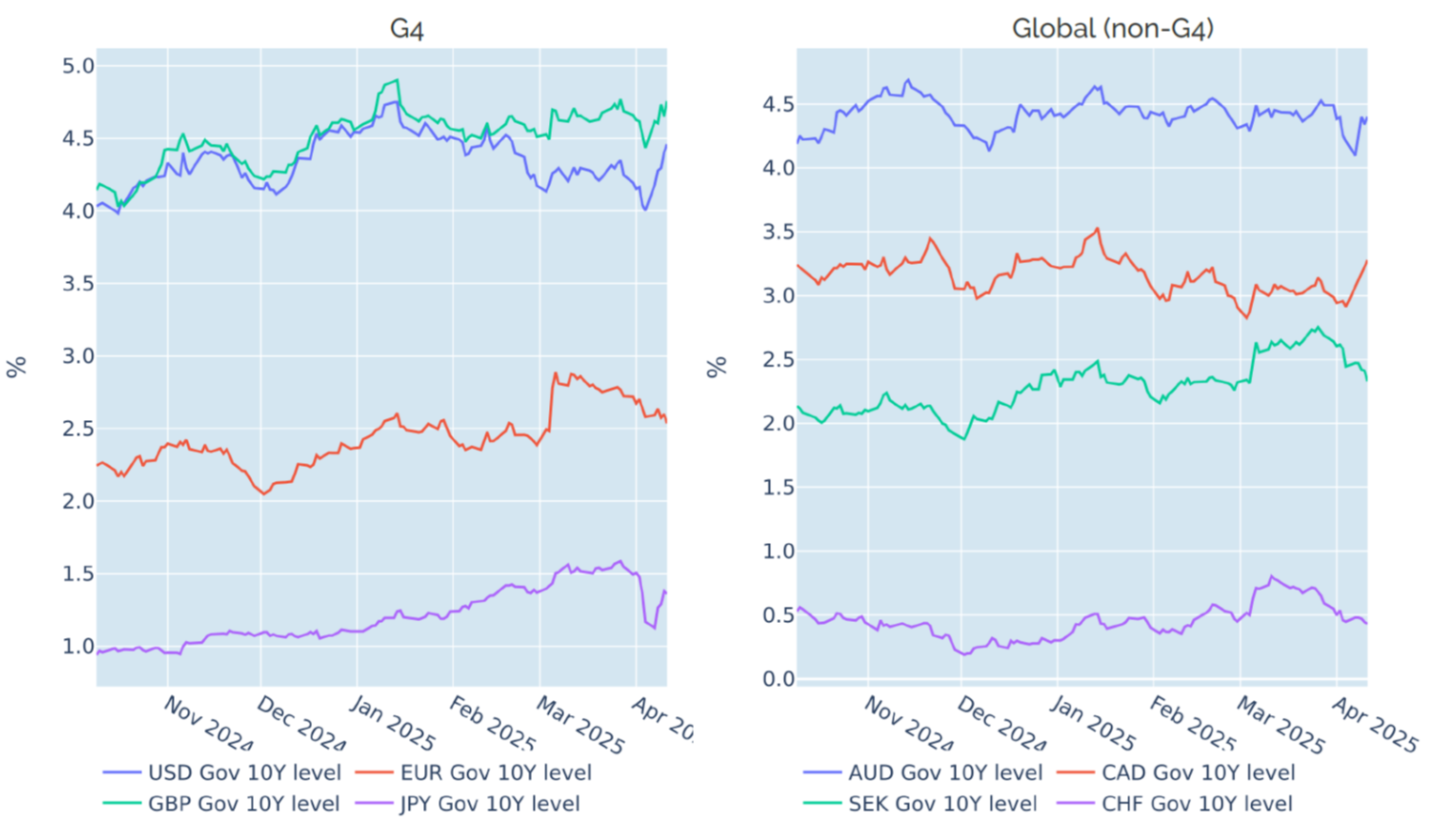

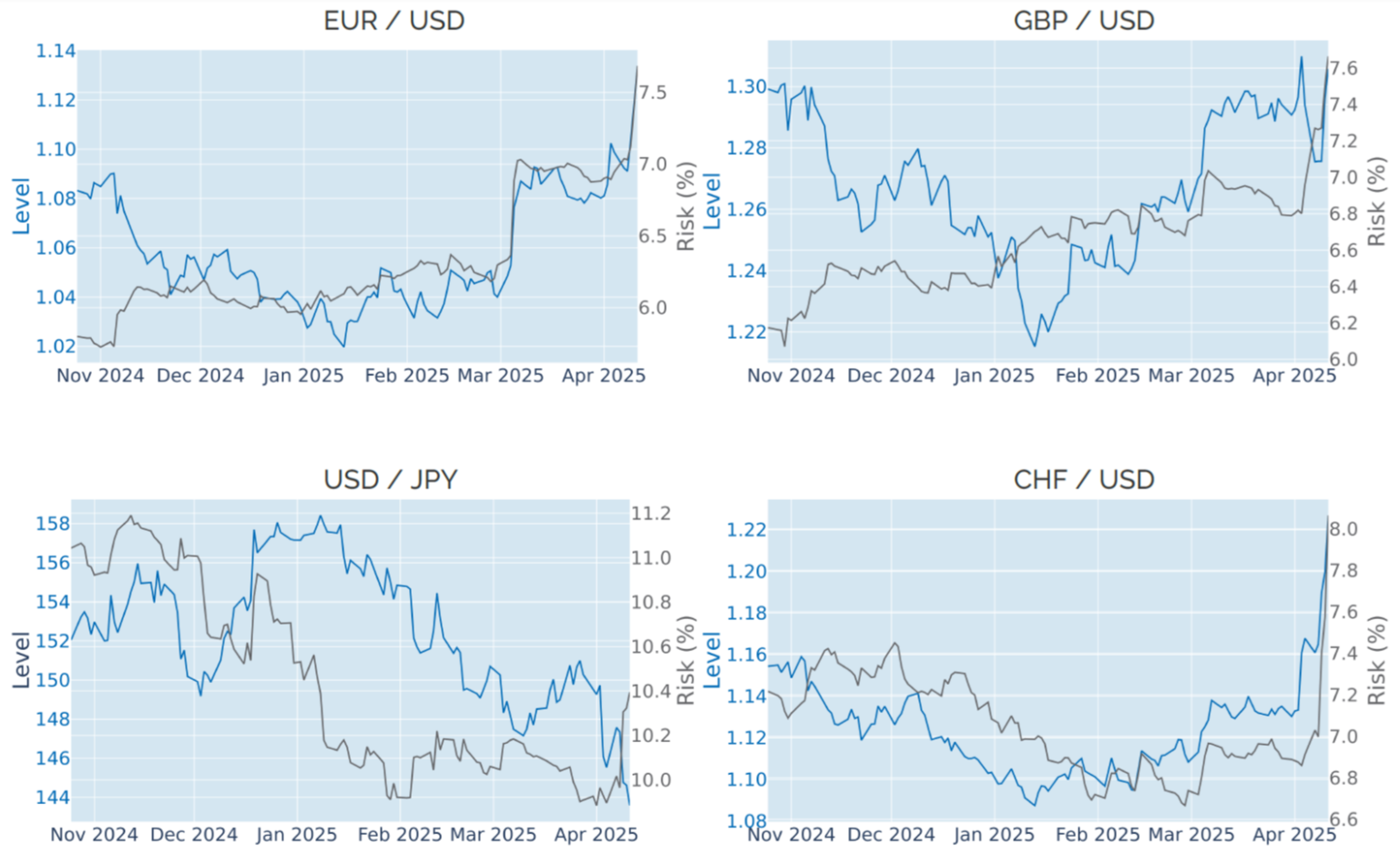

US Treasury yields recorded their biggest weekly increase since 2001 while the dollar fell to a three-year low against the euro in the week ending April 11, 2025, as investors shifted their funds from American into European government bonds.

The 10-year USD benchmark rate climbed 47 basis points, while the corresponding breakeven inflation rate was only marginally higher, indicating that the selloff was not driven by the expectation of accelerating consumer prices. There was some speculation that hedge funds may have been behind the selling who unwound their so-called “basis trades”—a leveraged strategy that tries to benefit from the price convergence of a short futures position and its underlying bond—similar to what happened at the onset of the COVID pandemic in March 2020. However, there is no indication that open interest in Treasury futures has significantly declined last week. Yield fluctuations where also much greater five years ago, when the Federal Reserve slashed rates by a total of 150 basis points within two weeks.

Another major difference to March 2020 is that back then the Dollar Index soared by more than 8% in a broad-based scramble from almost all other asset classes and regions into USD cash. In the current environment, the greenback has lost nearly 9% since its most recent high right before Donald Trump’s inauguration in January. The euro has been one of the biggest beneficiaries, having strengthened by 10% against its American rival over the past 12 weeks. Gains were even bigger for the Swiss franc (+12%) and the Swedish krona (+12.5%). The corresponding government benchmarks were also the only ones which saw their yields decrease last week, indicating that they were among the major destinations of the current capital exodus from the United States.

Please refer to Figures 4 & 6 of the current Multi-Asset Class Risk Monitor (dated April 11, 2025) for further details.

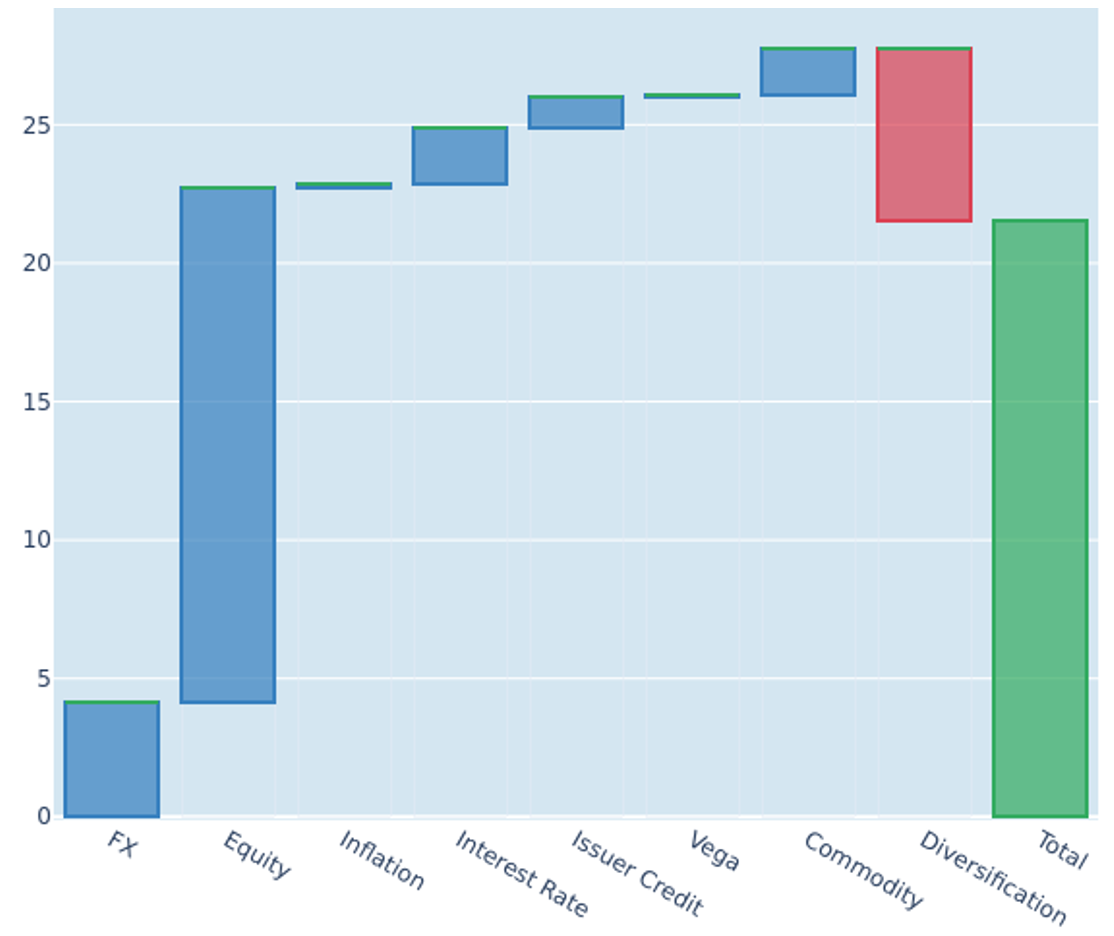

Portfolio risk triples amid stock-market turmoil

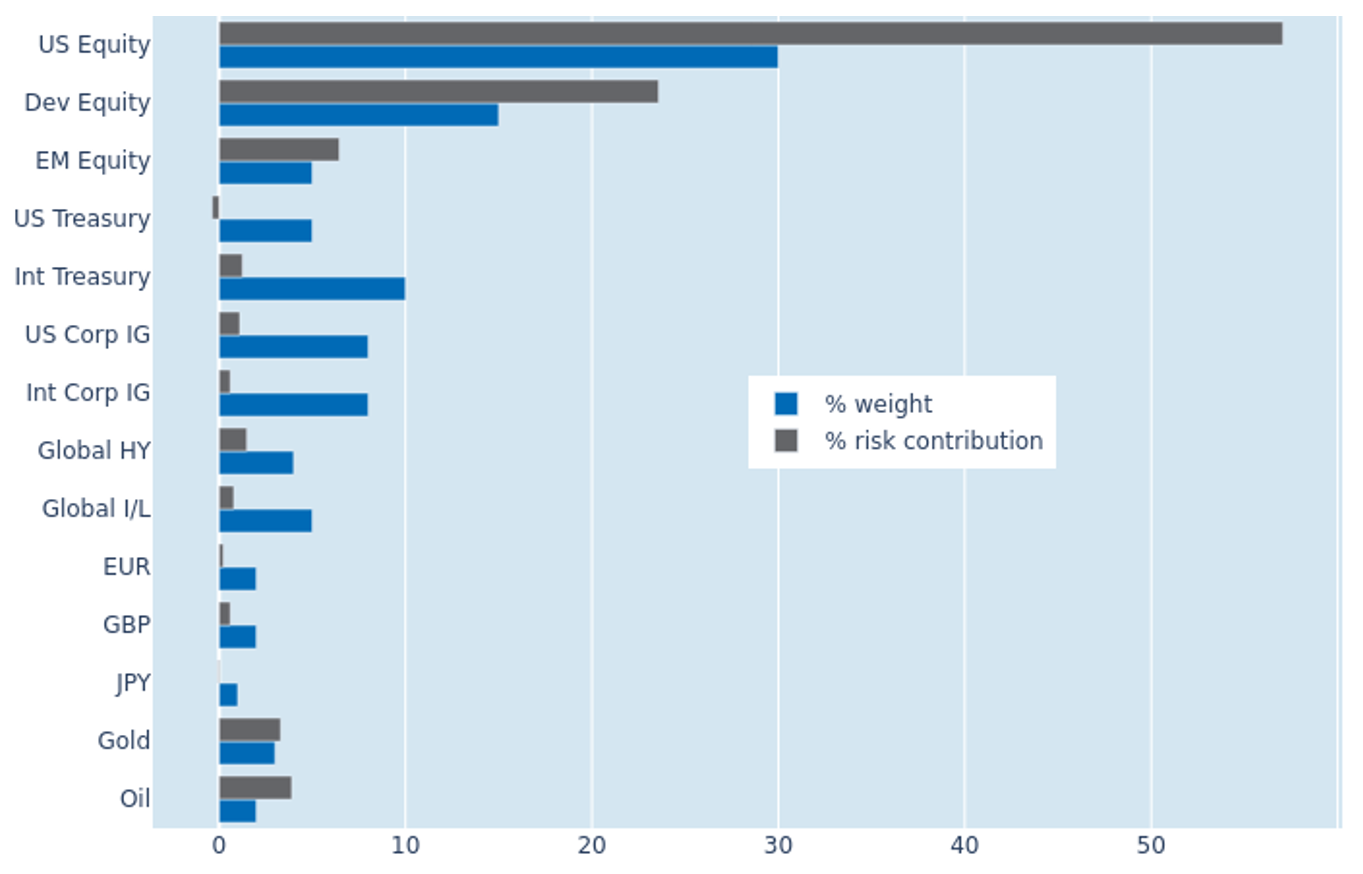

The predicted short-term risk of the Axioma global multi-asset class model portfolio almost tripled from 7.5% to 21.5% as of Friday, April 11, 2025, as equity volatility more than doubled from 18% to 37% amid last week’s stock-market turmoil. It is the highest level of total portfolio risk since June 2022, when central banks began to act more forcefully against persistent inflationary pressures, with the Fed raising its policy target by 75 basis points each at three consecutive meetings. At the time, share price fluctuations were not as strong as they are now, but the concurrent losses in almost all asset classes in the portfolio meant that there was little opportunity for diversification.

The recent flight-to-safety flows kept the interaction between stocks and bonds negative for the time being, so that US Treasury securities still provided some reduction in overall volatility. But the strong co-movement of European bond prices and their corresponding exchange rates against the dollar meant that the percentage risk contribution from non-USD government bonds flipped from -5.4% to +1.2%. Non-US equities also saw their share of total portfolio risk expand from 16.8% to 23.6%, due to a combination of greater standalone volatility and a stronger correlation with their American counterparts.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated April 11, 2025) for further details.

You may also like