MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED APRIL 17, 2025

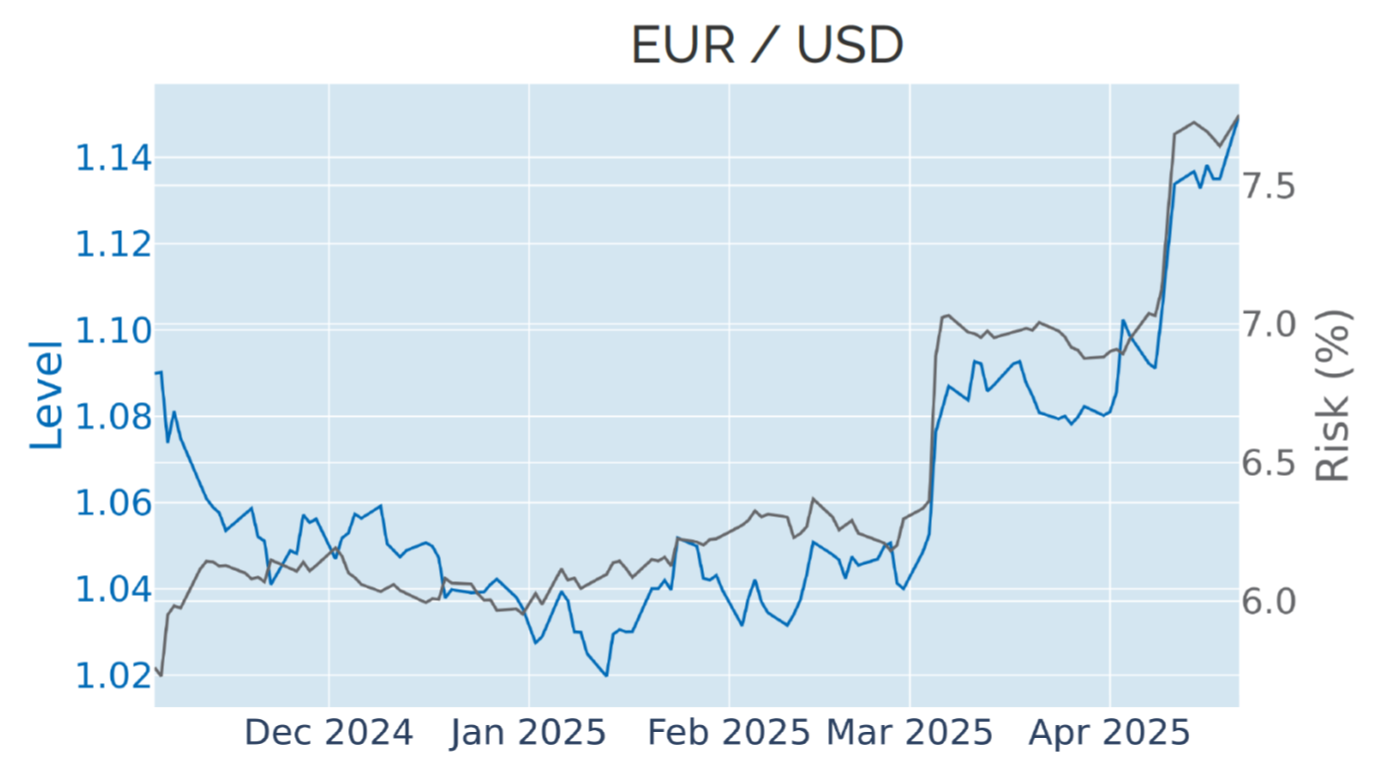

Euro and German bonds continue to rise…

The euro climbed to its highest level against the US dollar since November 2021 in the short trading week ending April 17, 2025, while German Bund yields continued to decline for a fifth consecutive week. So far this month, the 10-year Eurozone benchmark rate has fallen by a quarter of a percent, compared with a similar-sized increase in the same-maturity US Treasury yield. At the same time, the European Central Bank lowered its key rates by 25 basis points on Thursday, while the Federal Reserve is not expected to make any policy changes before its June meeting. Yet, the widening interest rate differential did little to strengthen the greenback, with the euro now up 5% against its American rival since the start of the month.

Please refer to Figures 4 & 6 of the current Multi-Asset Class Risk Monitor (dated April 17, 2025) for further details.

…as capital flight from the US enters fifth week

The capital flight from the United States to Europe seemed set to continue this week, as Donald Trump intensified his attacks on Federal Reserve Chair Jerome Powell on Monday, urging him to lower interest rates immediately. The spat followed warnings from Powell last week about the economic effects of the latest trade policy announcements, which are likely to “include higher inflation and slower growth.” Powell then noted that the central bank could end up “in the challenging scenario in which our dual-mandate goals are in tension.”

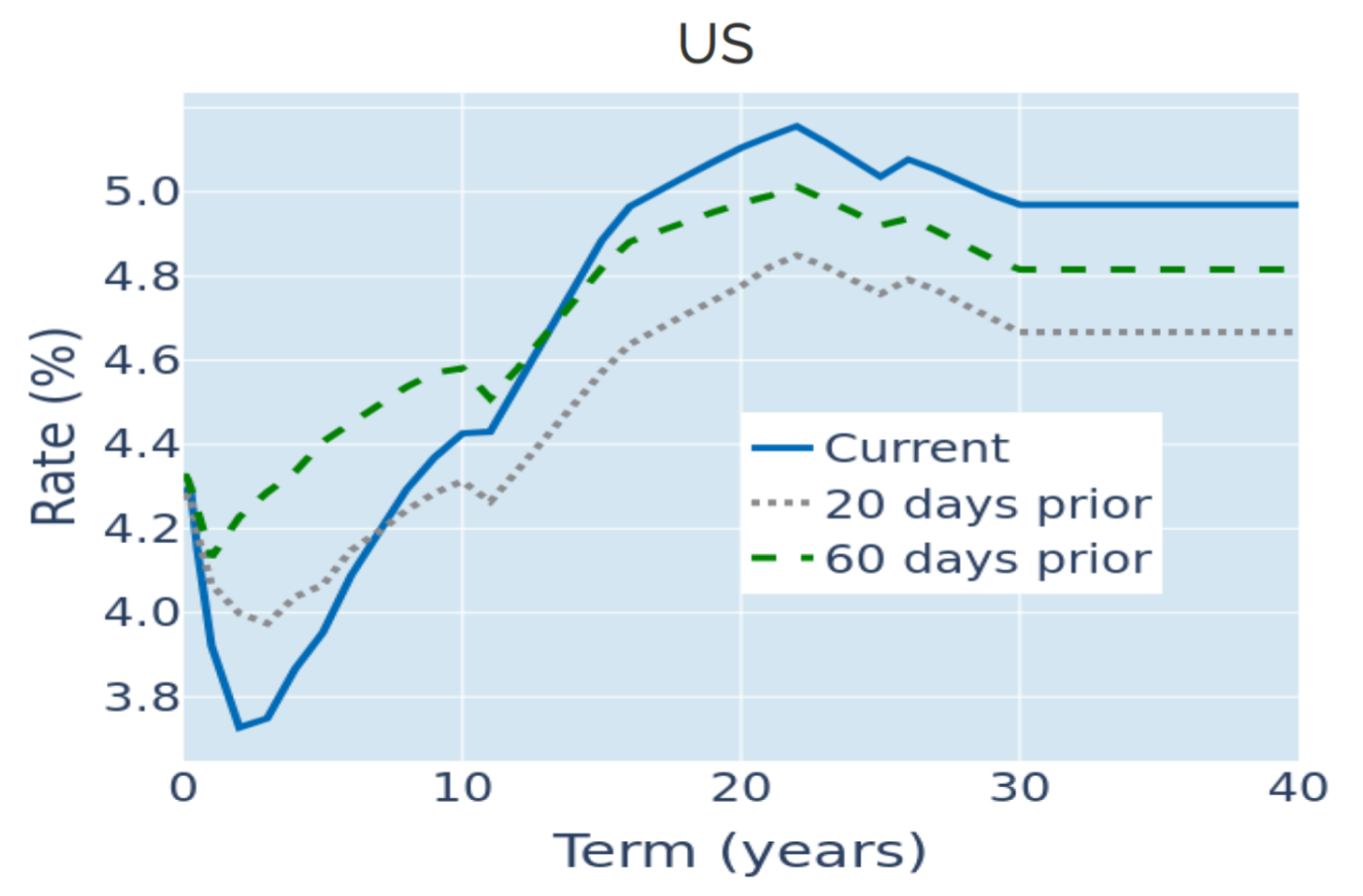

Even though markets do not expect Fed officials to bow to political pressure and already ease monetary conditions at the upcoming FOMC meeting in May, the market-implied probability that the bank will have cut rates by at least 100 basis points by the end of the year increased from 37% to more than 50%. This also impacted the monetary policy-sensitive 2-year Treasury yield, which eased by 20 basis points, lifting the term premium between long and short borrowing rates to its widest level since January 2022.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated April 17, 2025) for further details.

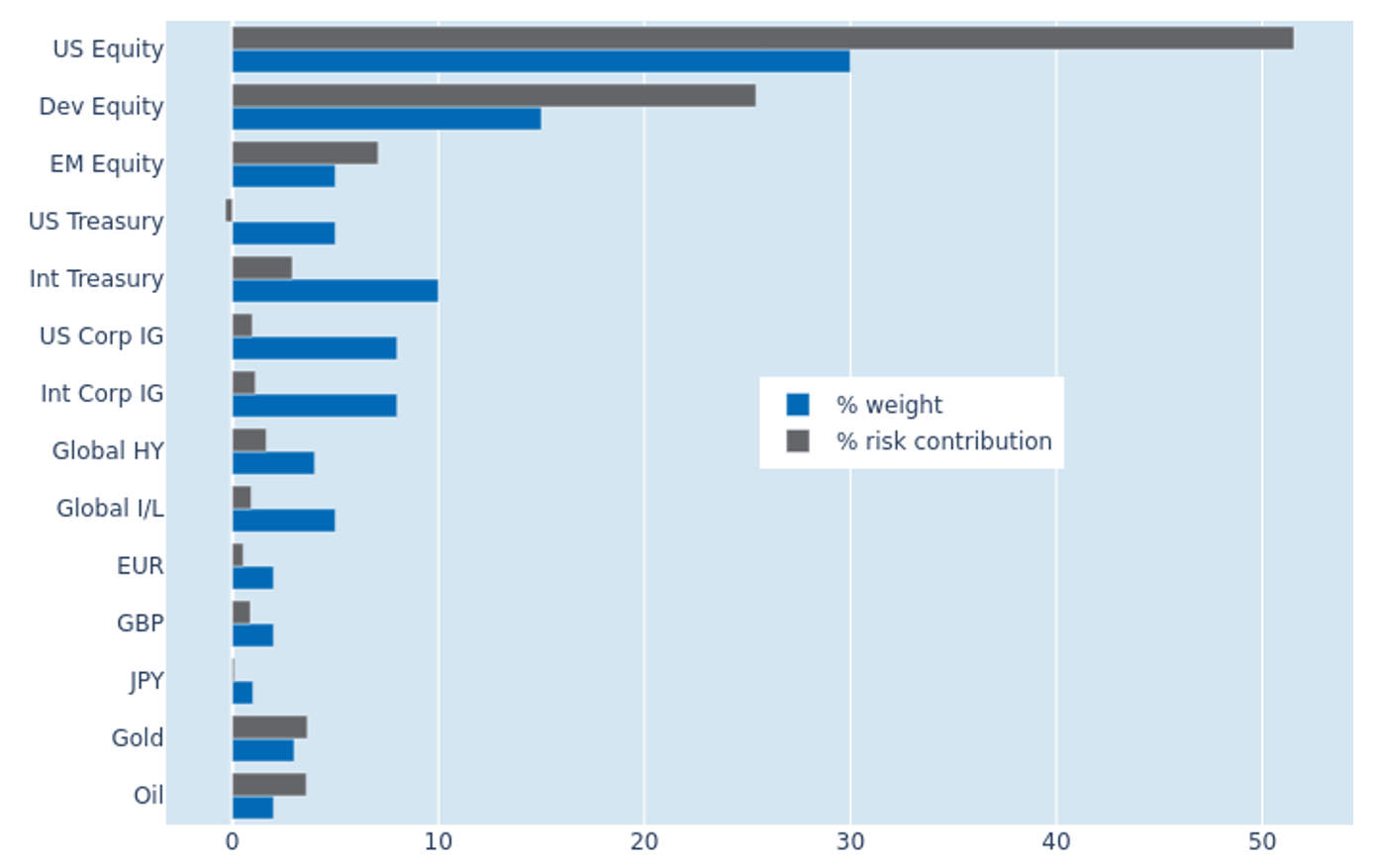

European market recovery eases portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio eased from 21.5% to 20.6% as of Friday, April 17, 2025, as European stock markets pared back some of their recent losses. However, part of the benefits were offset by the concurrent strengthening of the corresponding currencies, which made local equity returns appear more volatile when measured in US dollars. As a result, non-US developed and emerging market stocks saw their combined share of overall portfolio expand by 2.5 percentage points to 32.5%. International government bonds suffered a similar fate, as their returns became more correlated with their respective currencies and local stock markets, more than doubling their percentage risk contribution from 1.2% to 1.9%.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated April 17, 2025) for further details.

You may also like