MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED APRIL 25, 2025

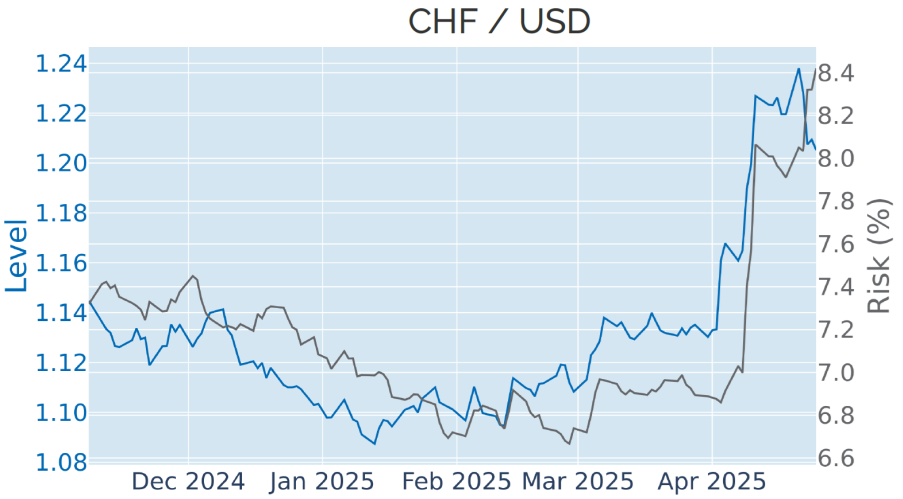

Ongoing capital flight boosts CHF to 13-year high…

Ongoing flight-to-safety flows boosted the Swiss franc to its highest level against the US dollar since September 2011 early in the week ending April 25, 2025. But the CHF/USD exchange rate still ended the week in the red, amid concerns that the Swiss National Bank (SNB) might have to lower interest rates below zero once more to contain the currencies steep rise. The speculation pushed the monetary policy-sensitive 2-year Confederate yield into negative territory for the first time since July 2022, when the SNB lifted its policy rate above zero after keeping it at -0.75% for nearly seven years.

Swiss inflation has been below 2% for almost two years now, after having risen to only 3.5% in the aftermath of the Russian invasion of Ukraine in 2022. This gives the SNB much more leeway to ease monetary conditions than its peers, with around four in five market participants expecting another cut from 0.25% to 0% at the central bank’s next meeting in June and a small chance of rates going negative by the end of the year.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated April 25, 2025) for further details.

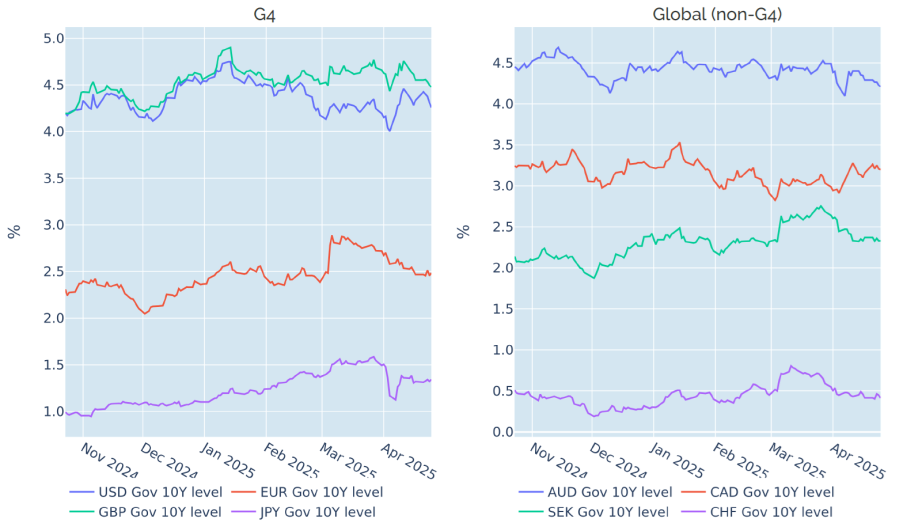

…and depresses European sovereign yields

Increased demand for Swiss government debt was also likely behind the decline in borrowing rates, as investors were looking to reinvest the funds they withdrew from American capital markets. Since their most recent peak in early March, yields on Confederate bonds have come down by around 40 basis points, while US Treasury rates remained unchanged. The only other bond market that saw similar reductions in financing costs was the Eurozone, with yields falling for all governments irrespective of relative creditworthiness. The amount outstanding of Swiss federal debt is only a tiny fraction—less than 1%—of its American counterpart, which means that some of the cash being withdrawn from the United States is likely to find a new home in the much bigger euro bond market.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated April 25, 2025) for further details.

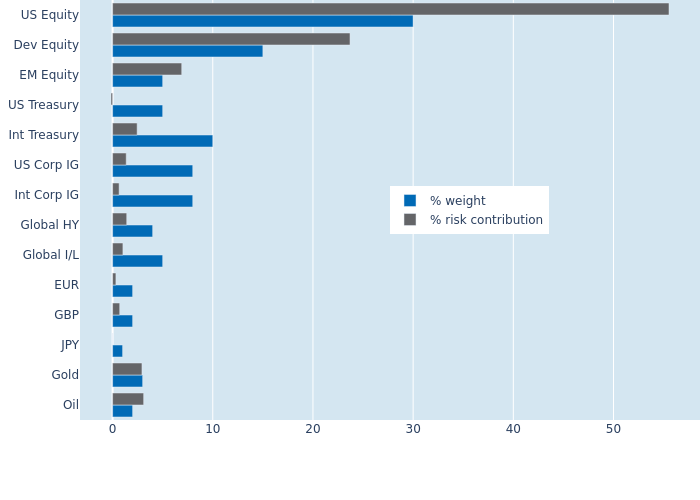

Global stock-market recovery further reduces portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio eased by another 2.2% to 18.4% as of Friday, April 25, 2025, as the American stock market recovered alongside its peers in other parts of the world. But with exchange rates against the dollar also becoming less volatile and decoupling further from local share prices, it was non-US developed equities that recorded the biggest decline in their percentage risk contribution from 25.4% to 23.7%. Gold and oil also saw their shares of total portfolio risk shrink by 0.7% and 0.5%, respectively, as their prices were less positively correlated with equity markets.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated April 25, 2025) for further details.

You may also like