EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED MAY 10, 2024

Axioma Risk Monitor: US small cap stocks’ risk plunges, led by drop in correlations; Europe outpaces US in terms of returns and diversification; Japanese yen weakens as its volatility jumps

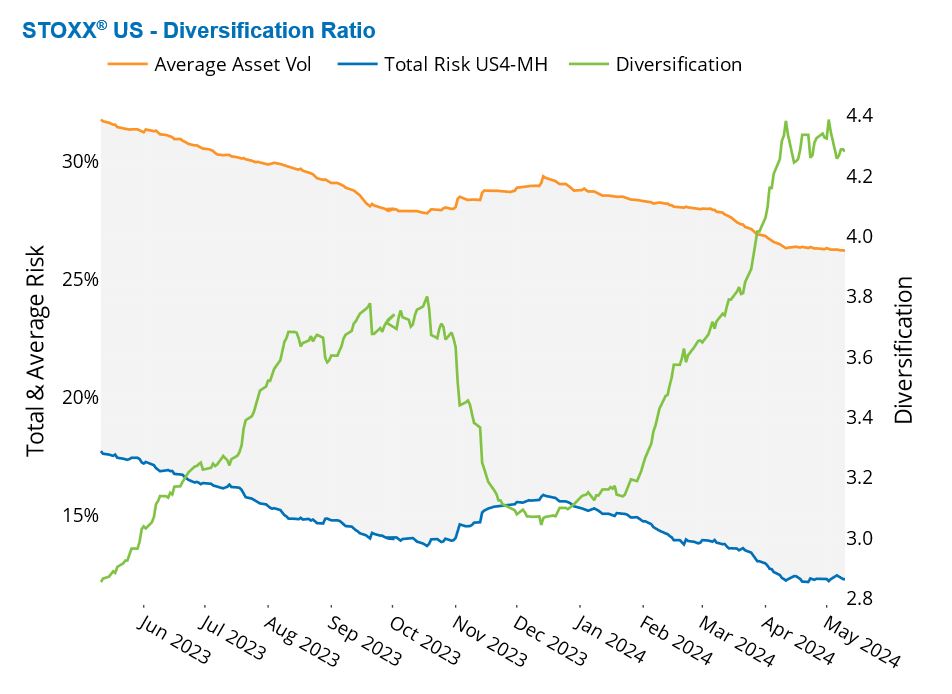

Risk of US small cap stocks plunges, led by drop in correlations

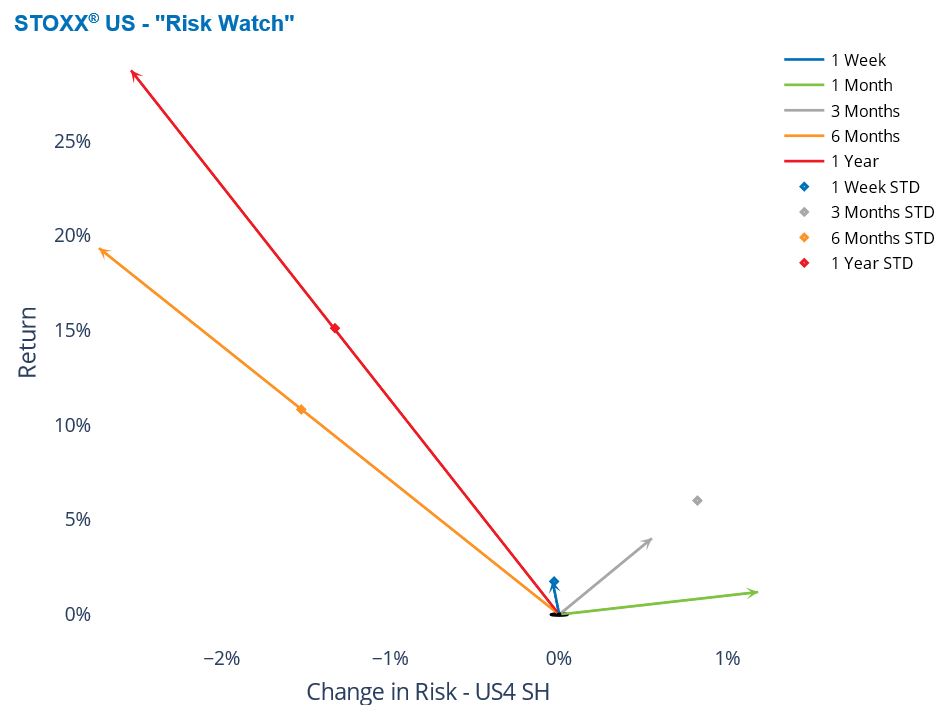

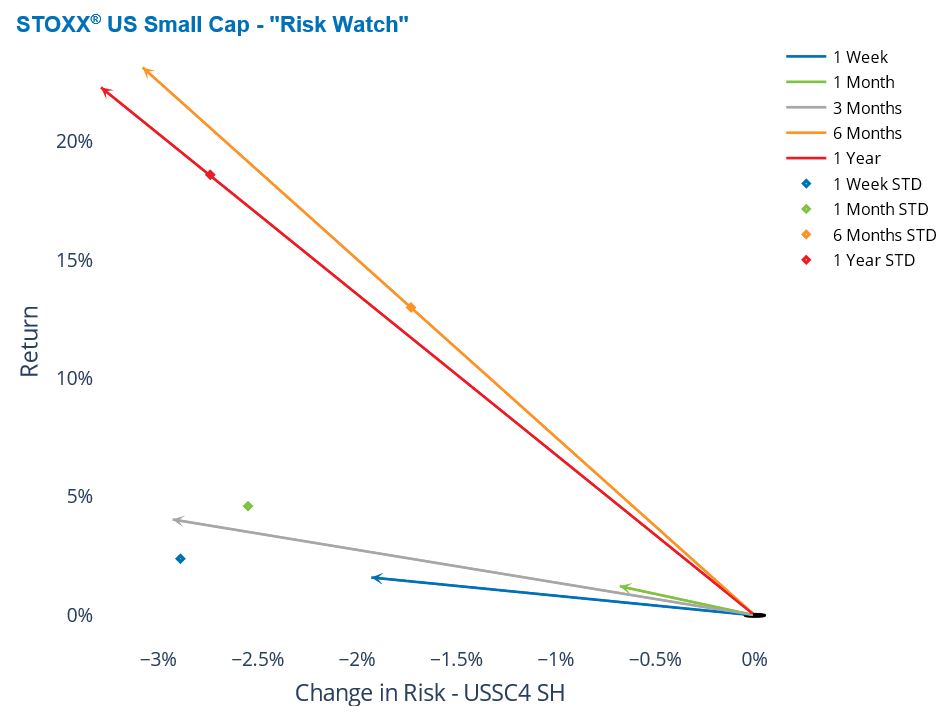

While both small- and large-capitalization US stocks rose last week, the risk of small caps plunged and that of large caps remained relatively flat. The US market was lifted by renewed hopes for an easing of monetary policy. The STOXX US and STOXX US Small Cap indices each recorded a 2% weekly gain, which remained within one standard deviation of the expectations at the beginning of the week, as measured by Axioma fundamental short-horizon All Cap and Small Cap US models, respectively.

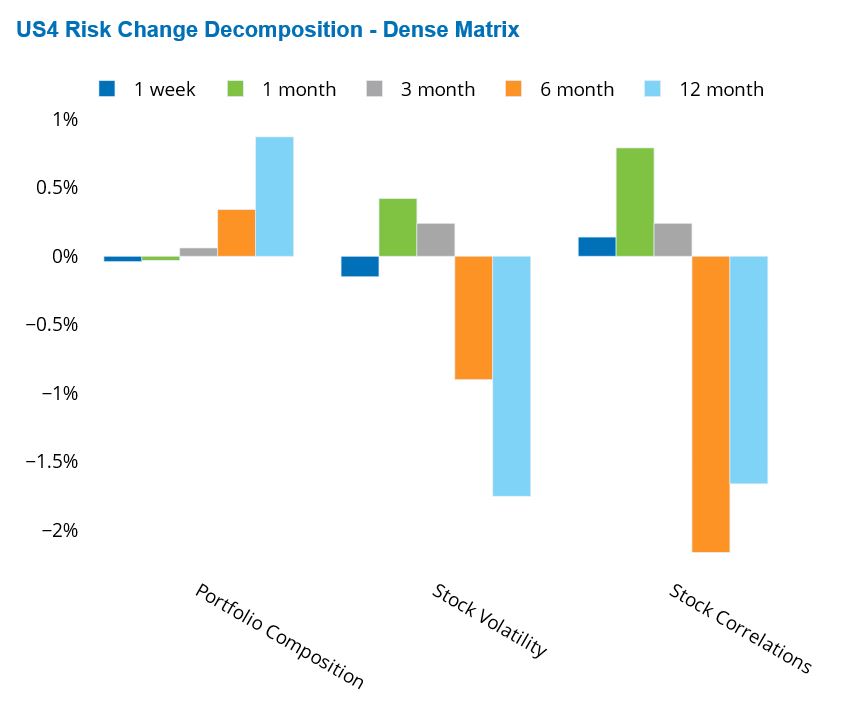

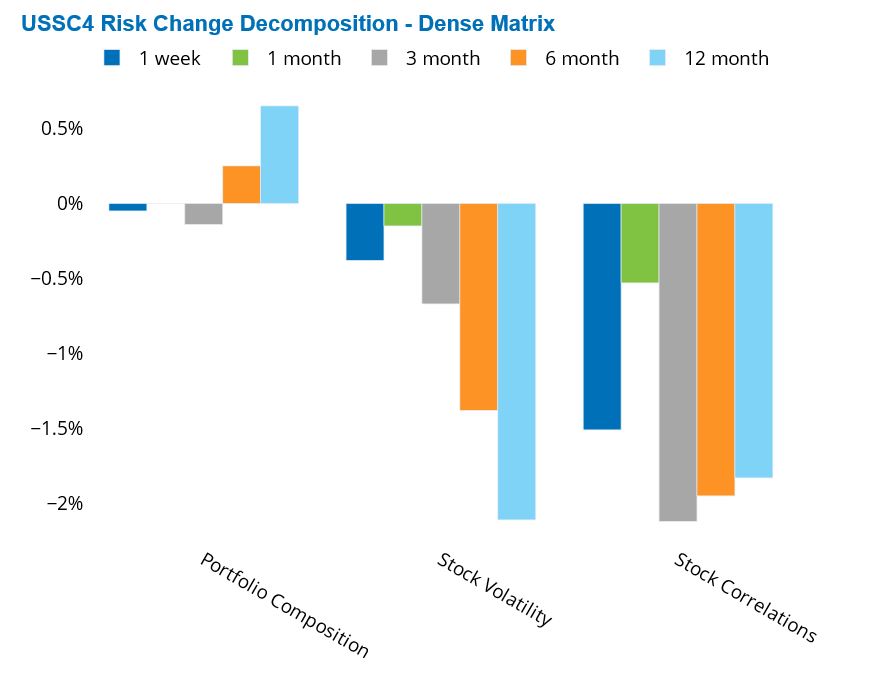

Stock volatility declined for the shares in both STOXX US and STOXX US Small Cap indices last week. However, correlations went up in STOXX US, cancelling out the decline in volatility, while STOXX US Small Cap saw a large decline in correlations which resulted in a total decline in risk for small caps of about 11%.

Despite STOXX US Small Cap seeing the largest drop in risk among all regions covered by the Equity Risk Monitors, the small cap index remained riskier than its US larger cap counterpart.

See graphs from the STOXX US Equity Risk Monitor of May 10, 2024:

See graphs from the STOXX US Small Cap Equity Risk Monitor of May 10, 2024:

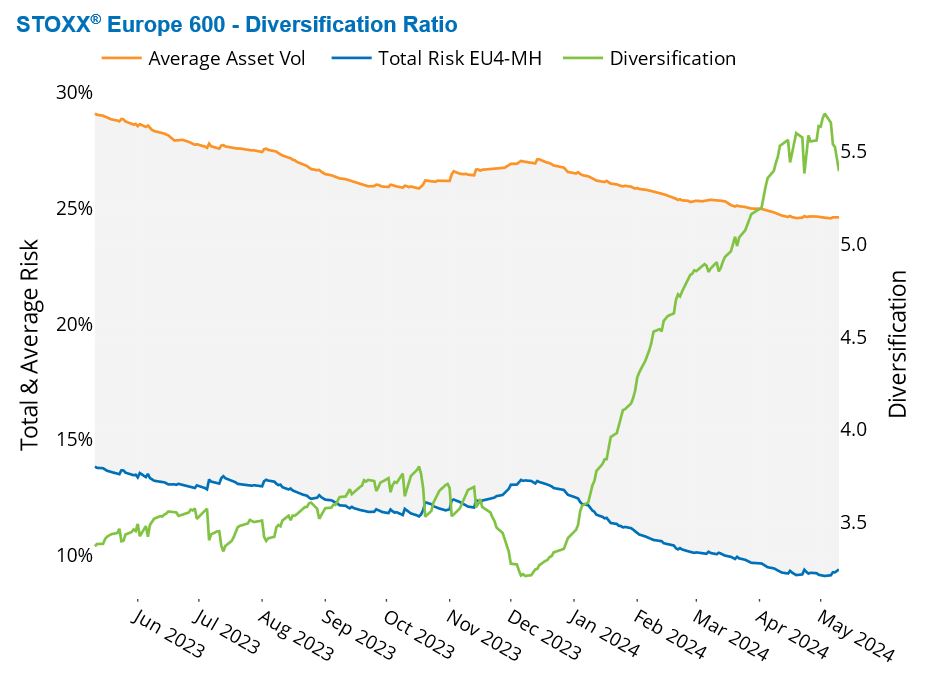

Europe outpaces US in terms of returns and diversification

As Europe moved faster to lower interest rates, the European market has outpaced the US market in terms of returns and diversification this year. Positive economic growth reports have bolstered European shares, along with interest rate cuts by the Swiss Central Bank in March and the Swedish Central Bank last week. Additionally, there is anticipation that the European Central Bank and the Bank of England will decrease rates later this year.

Throughout much of 2024, the European market trailed behind the US market. However, the STOXX Europe 600 index has surpassed the STOXX US index since mid-April. The European index is boasting a year-to-date return of 11.5%—nearly two percentage points higher than that of the US index as of last Friday.

The European market also offers greater diversification than the US market, which is dominated by the Information Technology sector. Despite a sharp rise in risk last week, the STOXX Europe 600’s diversification ratio is higher than that of the STOXX US index. In fact, Europe’s diversification ratio is the second-highest (after STOXX Emerging Markets) among all regions covered by the Equity Risk Monitors.

The asset-diversification ratio is calculated as the weighted sum of asset variances for each stock in the index divided by the total forecasted index variance. The higher the ratio, the lower the implied average correlation amongst index members.

See graph from the STOXX Europe 600 Equity Risk Monitor of May 10, 2024:

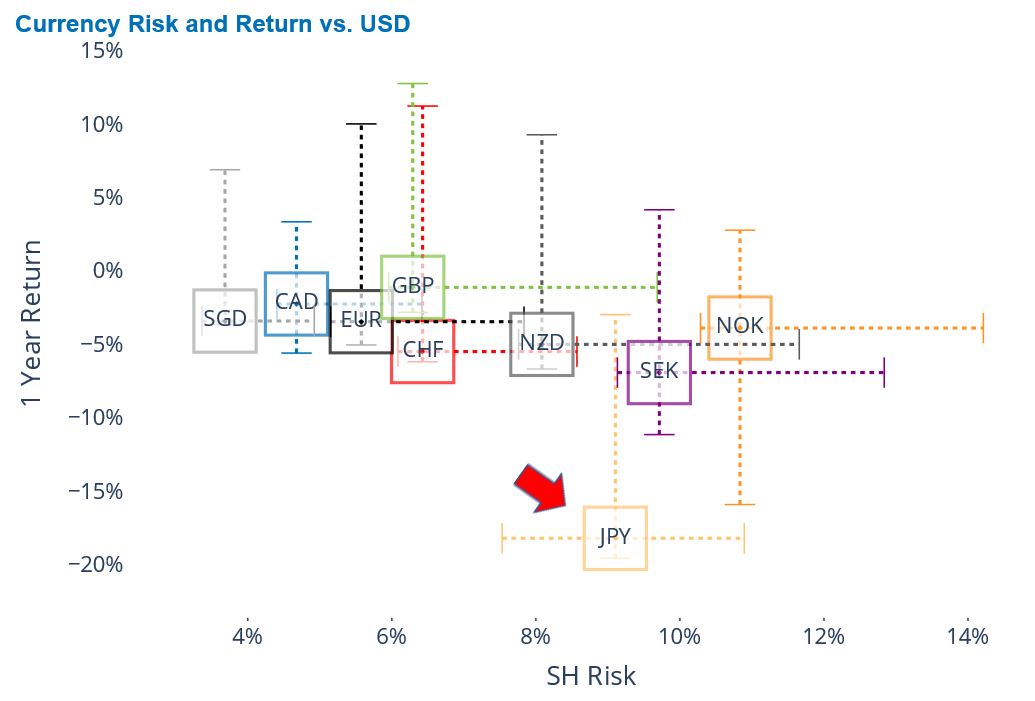

Japanese yen weakens as its volatility jumps

The Japanese yen weakened 10% against the US dollar this year while its volatility continued to rise, following multiple interventions by the Bank of Japan. The Japanese yen’s risk rose 17% in May alone, making it the largest spike in risk among major developed currencies. This recent rise pushed the Japanese currency to the middle of its one-year volatility range against the greenback.

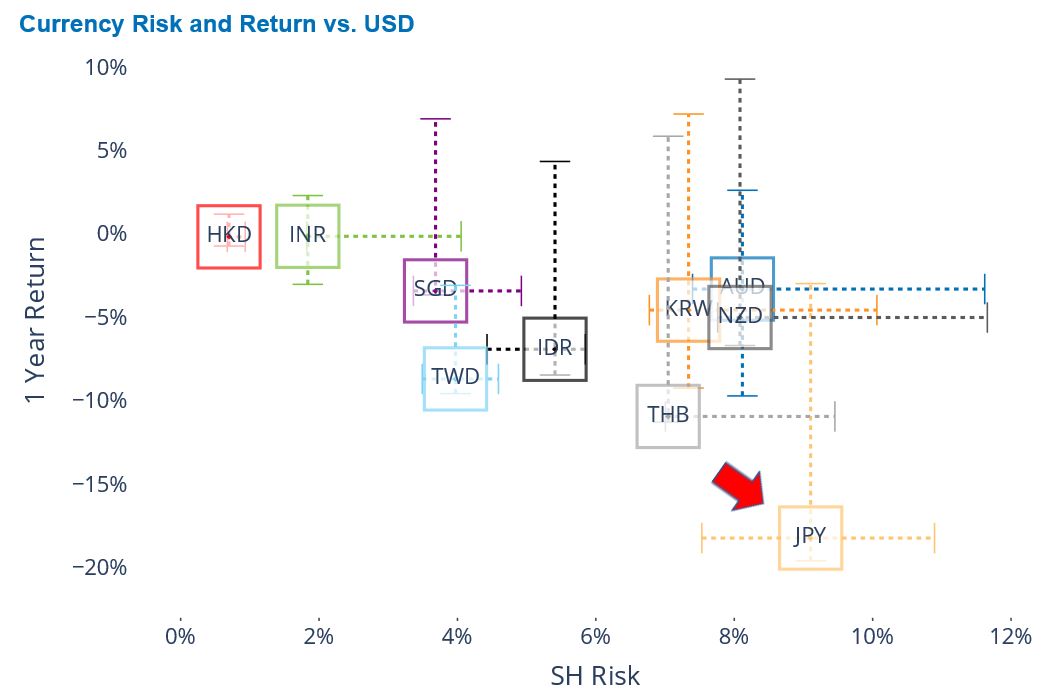

At 9% volatility, the yen is now the third-riskiest developed currency after Norwegian krone and Swedish krona. The Japanese yen is also the riskiest among Asian currencies, its volatility being ahead of even some emerging currencies such as Thai baht or Korean won, as measured by Axioma Worldwide fundamental short-horizon model.

The Japanese currency is the biggest loser against the US dollar, recording a loss of nearly 20% over the past 12 months. In contrast, most major developed currencies suffered one-year losses smaller than 5%.

See graph from the STOXX Developed World Equity Risk Monitor of May 10, 2024:

See graph from the STOXX Asia Pacific ex-Japan Equity Risk Monitor of May 10, 2024: