EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED MAY 24, 2024

Axioma Risk Monitor: Tech stocks keep US market from falling; US Info Tech’s risk dominance rises; Growth style factor plunges in Europe and Emerging Markets

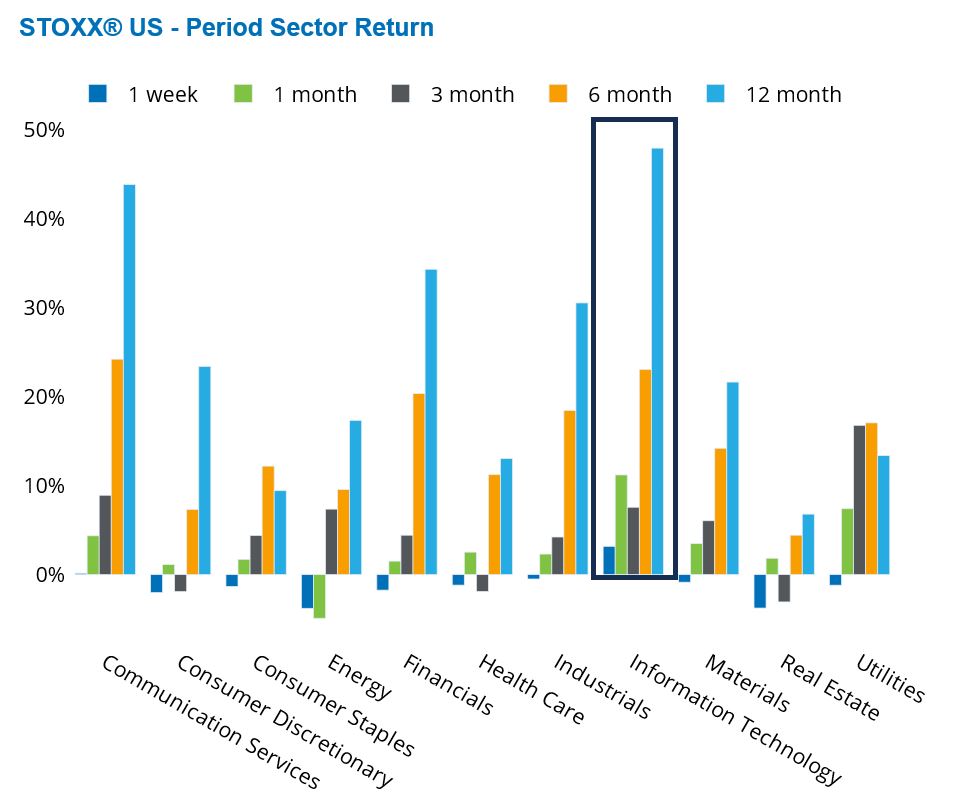

Tech stocks keep US market from falling

The US market reached new highs last Monday yet concluded the week with no significant change, after turbulence around the release of the Federal Reserve's minutes which cast doubt on the likelihood of imminent interest rate cuts. Despite this, the risk forecast of the STOXX US index remained flat, as measured by Axioma fundamental short-horizon model.

Technology stocks prevented the US market from recording a loss last week. Most stocks in the Information Technology (Info Tech) sector were up, with Nvidia—which is now the third largest company in the US index—being responsible for 80% of the Info Tech weekly gains of 0.97%. Nvidia made the headlines again, reporting spectacular quarterly sales and earnings last week, and gaining 15% in five business days alone.

While the Communication Services sector remained steady, all other nine sectors in the US index fell last week, effectively wiping out the gains made by the Info Tech sector. Real Estate and Energy saw the most significant weekly declines, but Financials and Consumer Discretionary had the largest negative impact on the US market, given their larger representation.

See graphs from the STOXX US Equity Risk Monitor as of May 24, 2024:

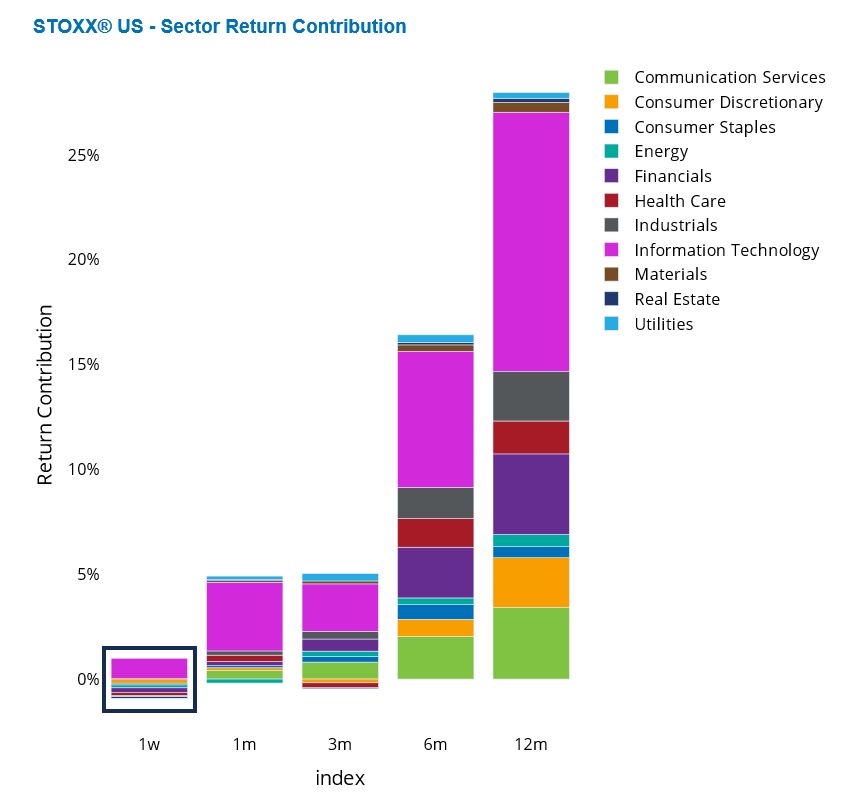

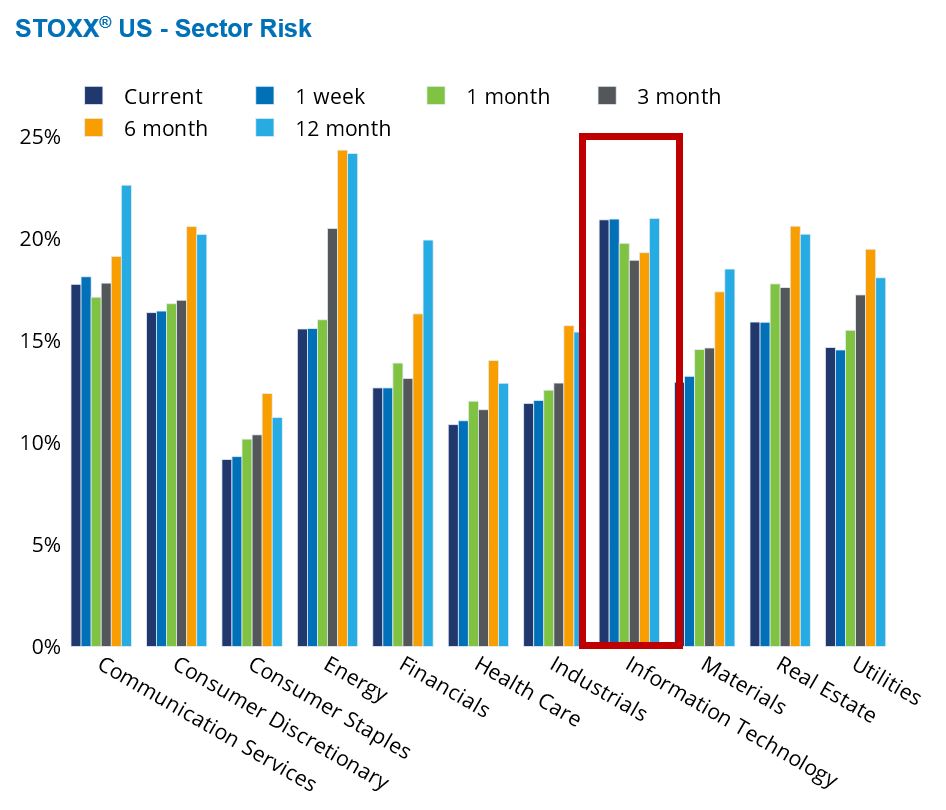

US Info Tech’s risk dominance rises

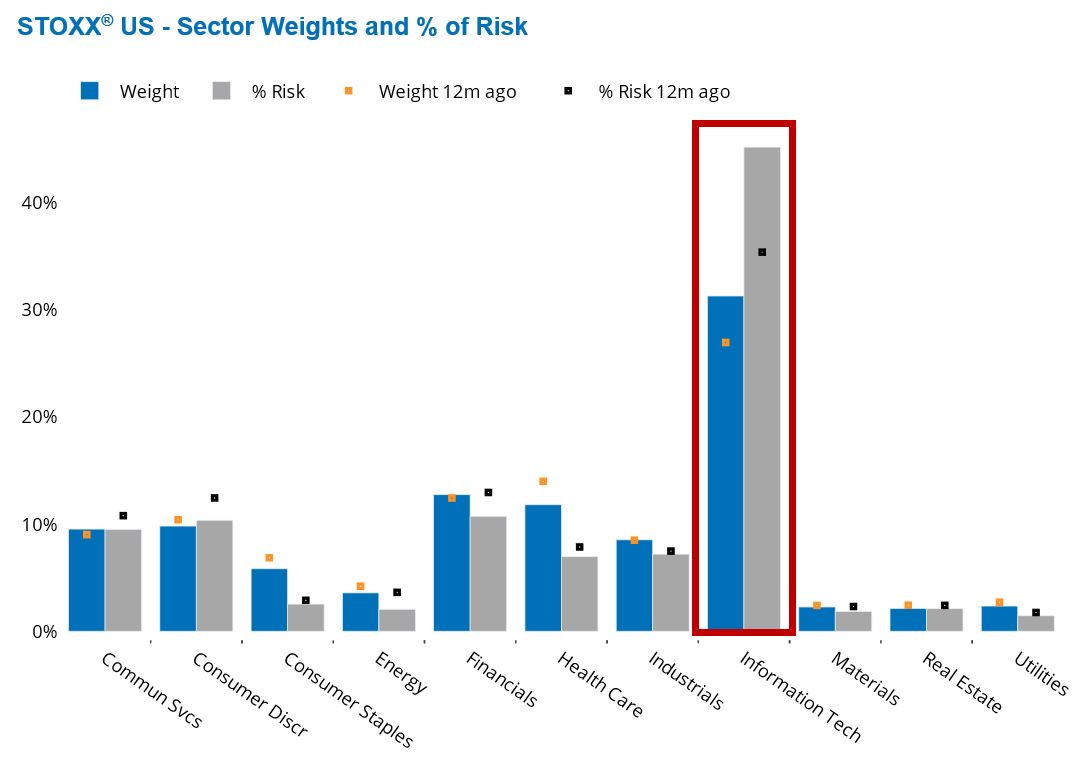

The success of the Info Tech sector this year, combined with its status as the largest sector in the US market, has driven almost half of the US market's year-to-date return of 12%. At the same time, Info Tech is responsible for nearly half of the US market risk, according to the Axioma US fundamental short-horizon model.

Information Technology is the second-best performing sector in the STOXX US index so far in 2024, following Communication Services. The rise in tech shares has resulted in Info Tech representing 31% of the US market as of last Friday, up more than four percentage points since one year ago.

With annualized volatility at more than 20%, Info Tech is now the riskiest sector in the STOXX US index. Even though its risk level is comparable to what it was a year ago, its contribution to US market risk has surged since last year, now accounting for 45% of the US market risk.

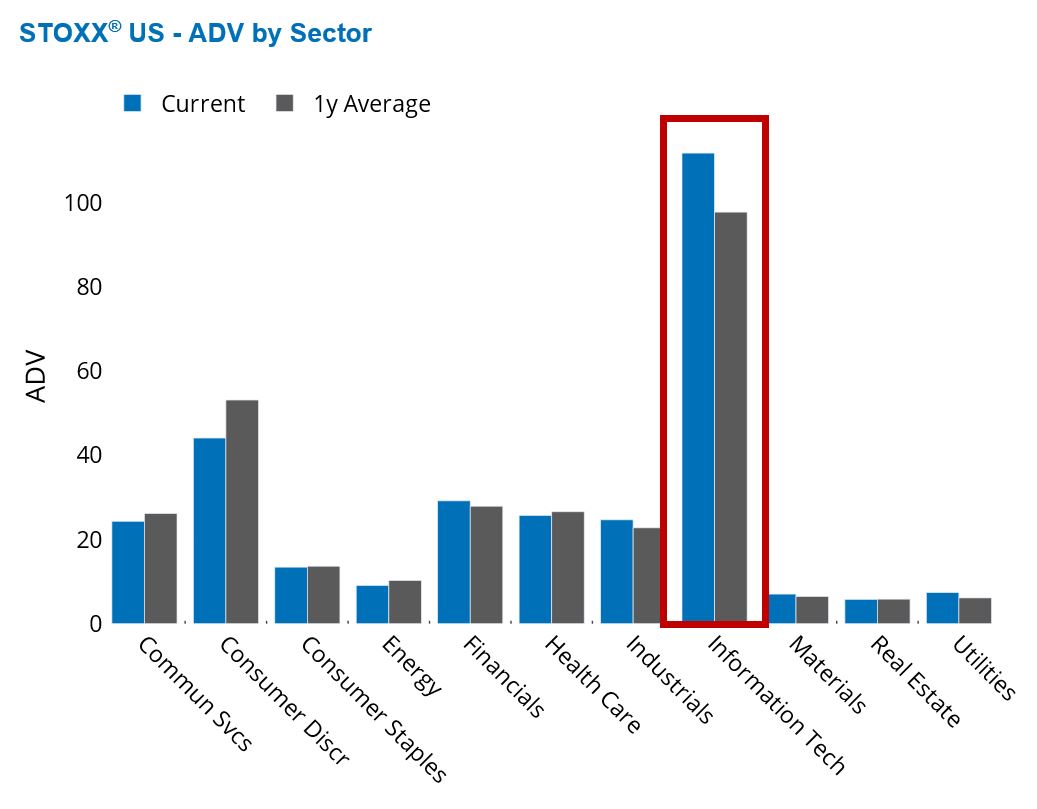

Tech stocks are also the most actively traded in the US, with the current trading levels for the tech sector significantly surpassing the one-year average daily trading volume. This contrasts with other US sectors, which have similar or lower trading volumes compared to their one-year average volumes.

See graphs from the STOXX US Equity Risk Monitor as of May 24, 2024:

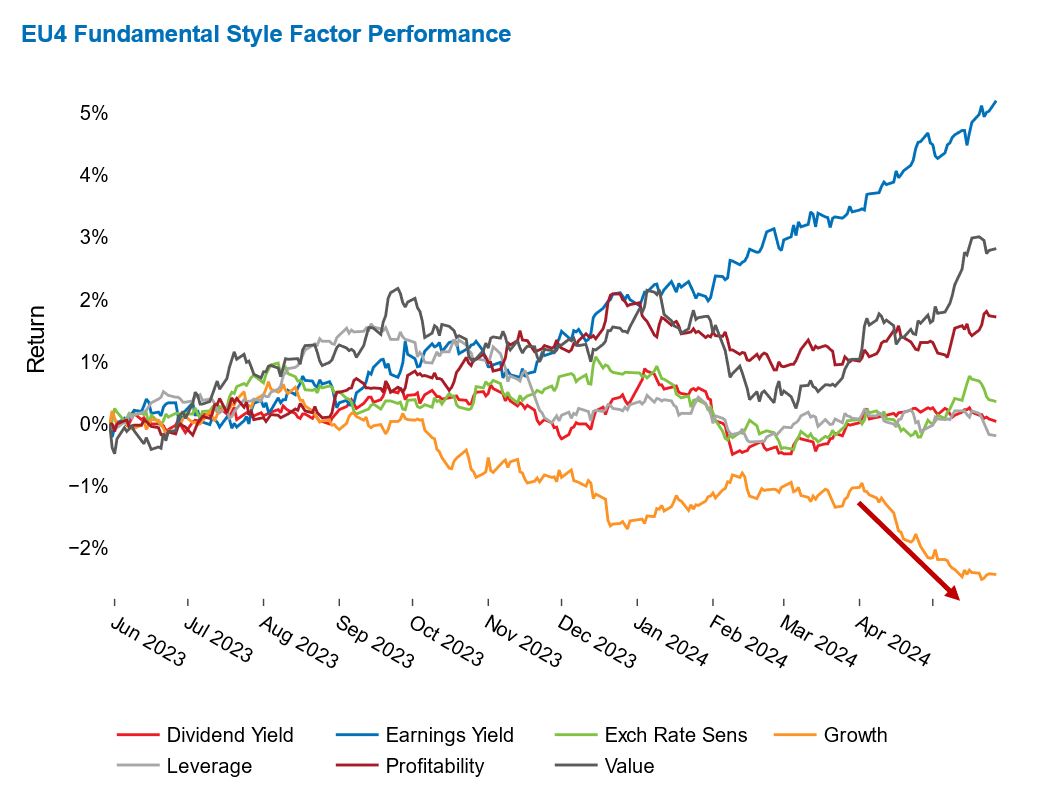

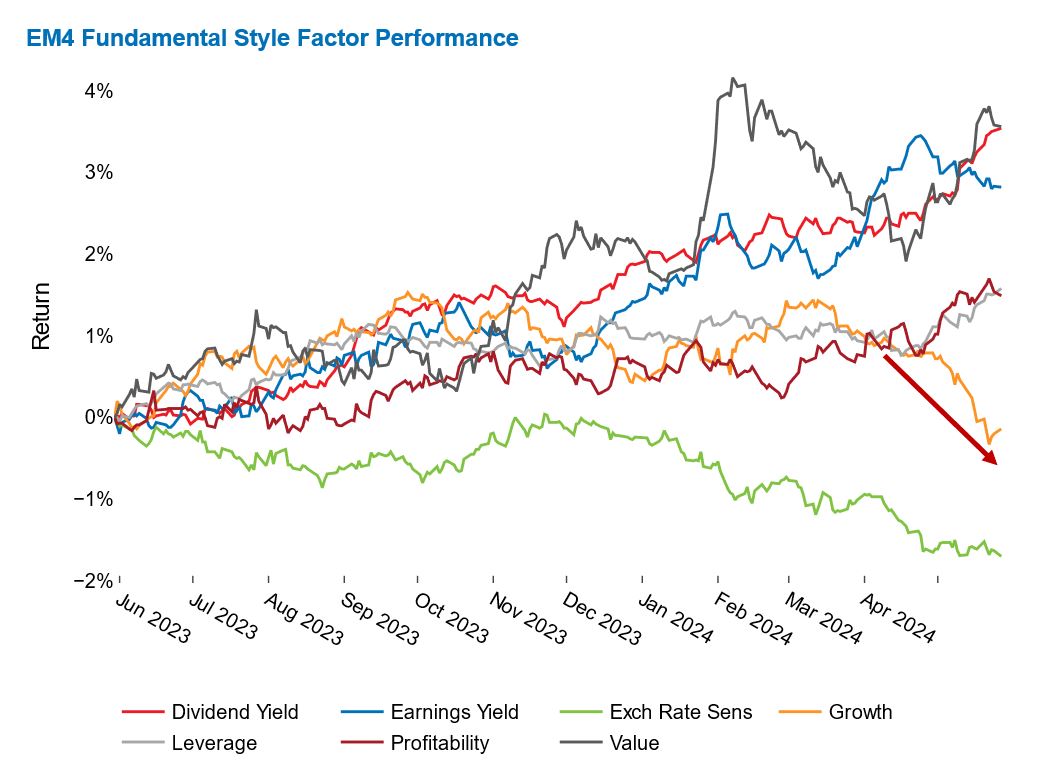

Growth style factor plunges in Europe and Emerging Markets

While the Growth style factor has seen modest positive returns in the US, it plunged in Europe and Emerging Markets over the past three months. Growth fell about 1% in each region, and the declines were more than two standard deviations away from the expectations at the beginning of the period, as measured by Axioma’s Europe and Emerging Markets fundamental medium-horizon models.

In Europe, Growth is also the worst performer over the past year among all style factors in the European model, its 12-month return of 2% falling below two standard deviations below the expectations at the beginning of the year.

See graphs from the STOXX Europe 600 Equity Risk Monitor as of May 24, 2024: