EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED JUNE 14, 2024

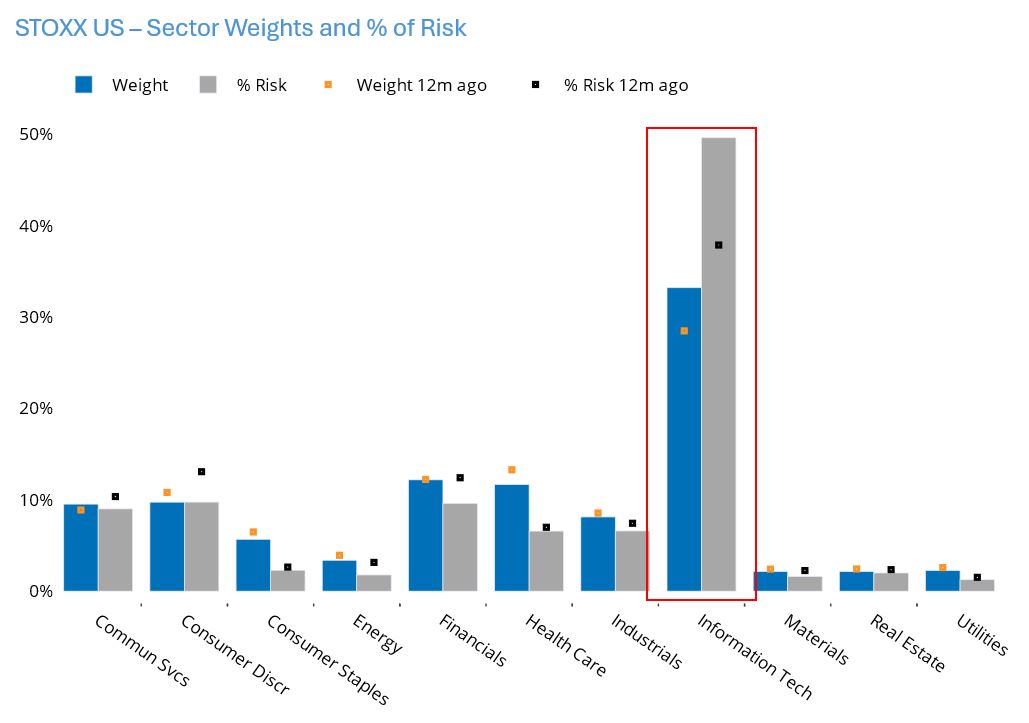

- Technology accounts for almost half the risk of the STOXX US

- High risk contribution is a result of Technology’s increasing risk in contrast to all other US sectors

- France’s country risk shot up on announcement of snap election while UK’s fell

As of last Friday, the Information Technology sector accounted for almost half the overall risk of the STOXX US index, while its weight was a “mere” 33% of the index. As recently as the end of April, Info Tech’s risk contribution was only 42.6% versus its weight of 29.9%. A year ago, the risk contribution was less than 40% (although it was still higher than the capitalization weight).

The size of the gap between the sector’s weight and risk, and its expansion, is troublesome, as it crowds out other investment opportunities, especially for portfolio managers with a tracking error target. Underweighting these stocks would incur substantial tracking error, and with their high weight overweighting them would leave much less room for other overweights. The high weight and risk contribution leads to a positive feedback loop, in that managers need to hold these stocks, keeping weights high or driving them higher. That is, until something happens to change views on Technology, and the high index and portfolio weights lead to a turbulent downturn in prices and possibly active returns as well.

See graph from the STOXX US Equity Risk Monitor of June 14, 2024

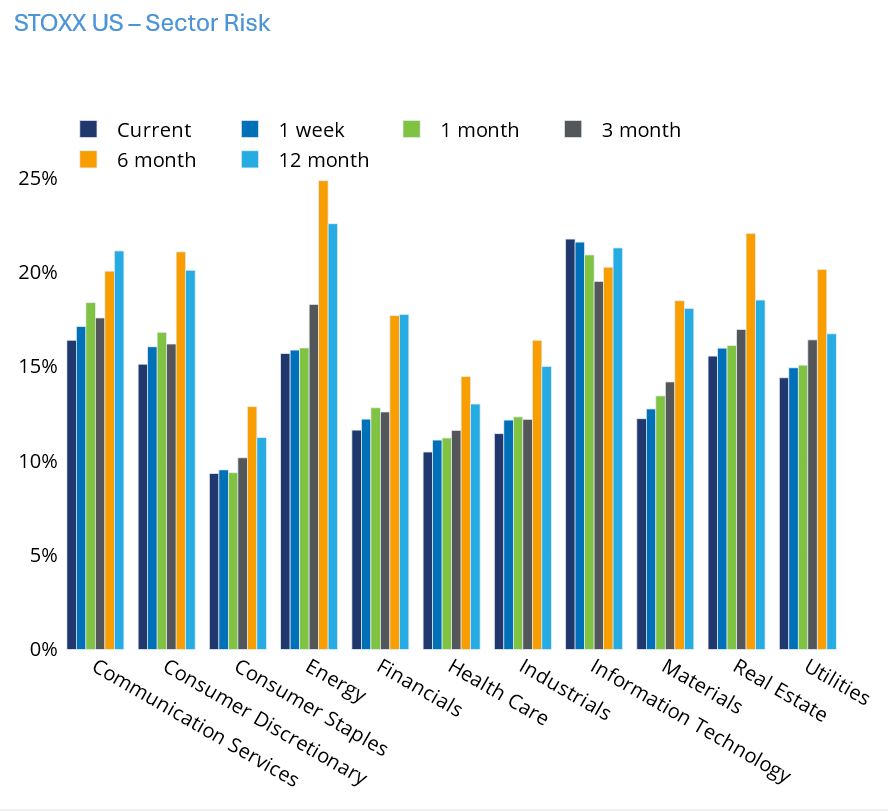

High risk contribution is a result of Technology’s increasing risk in contrast to all other US sectors

The substantial increase in risk contribution noted above is the result of increasing risk in the Info Tech sector over the past week, month, three months, six months and year, while every other sector has seen risk fall in those same periods. A month ago, Info Tech’s short-horizon fundamental risk forecast was 20.9%, about 14% higher than that of the next-highest sector, Communications Services, as measured by Axioma’s US4 short-horizon fundamental model. As of June 14, 2024 Tech’s risk level of 31.3% was almost 33% higher than still-second-place Communications Services’. Tech has not only turned in the best performance of all the US sectors over the discrete periods we look at (with Communications Services close behind), but its high weight means it is also by far the biggest return contributor. But once again, should fortunes turn, Info Tech’s high risk and high weight could signal trouble for managers who are now forced to hold these names.

See graph from the STOXX US Equity Risk Monitor of June 14, 2024

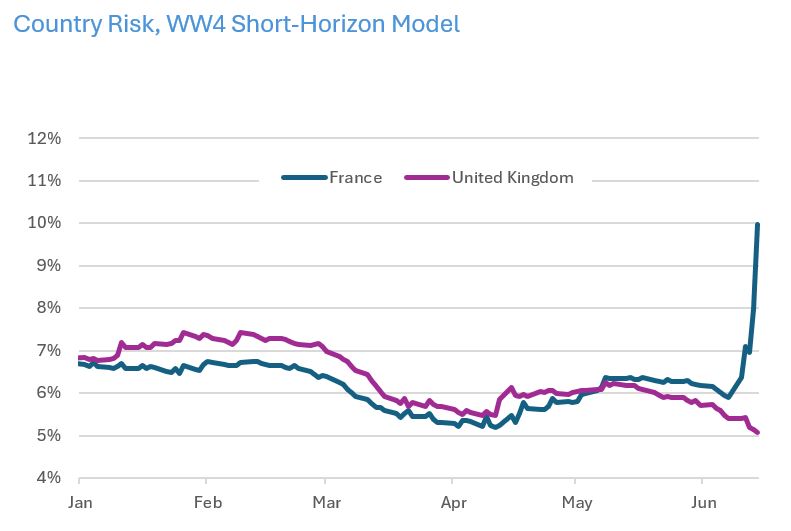

France’s country risk shot up on announcement of snap election while UK’s fell

Country risk is the risk of a country over and above that of all the other model factors (market, industry, style, etc.). It can be thought of as the specific risk for a country. After the far right made substantial gains in the European Union elections, France’s Macron announced snap elections within the country. Even before the EU elections and the call for French elections, the UK’s Sunak called for a general election in that country.

The impact on country risk for each was vastly different. UK country risk has trended down since the announcement, whereas country risk for France shot up from just over 6% to almost 10% over the course of just a few days. Investors clearly view the election in France as much riskier to the economy and stock market than they expect in the UK. Although country risk for France ballooned, it has been higher in the past. Still, while multi-country portfolio managers may not need to rebalance any UK active positions to account for the risk impact, those with overweight positions in France may want to make sure the size of the current bet is commensurate with the increased risk.

Note: The following chart does not appear in the equity risk monitors, but is available on request.