EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED AUGUST 16, 2024

- Markets may be in a better place, but volatility and correlation has continued to rise across the world

- Lower weights in biggest stocks vs. a month ago has slightly offset the increase in factor volatility

- Was the reversal in return to Size short-lived?

Markets may be in a better place, but volatility and correlation has continued to rise across the world

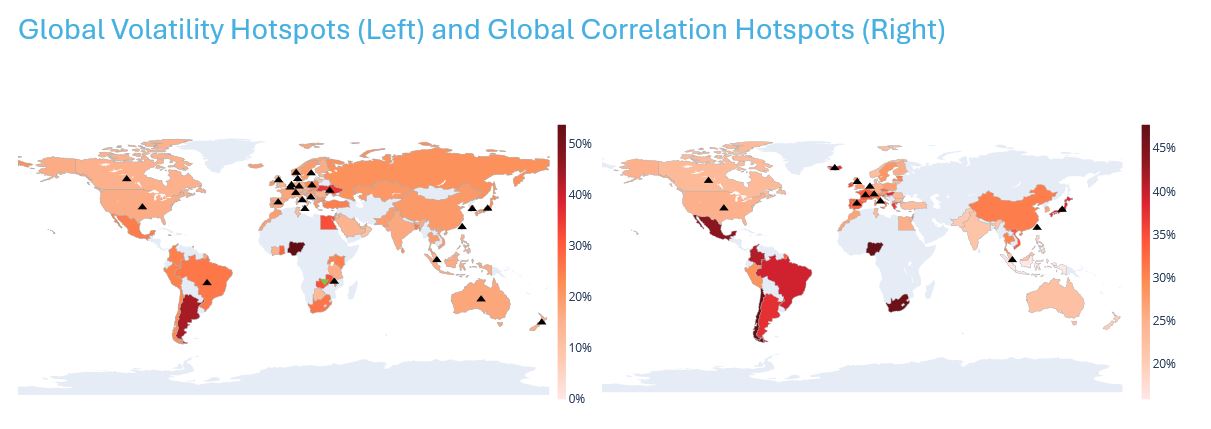

Although markets seem to have calmed down in the past week after the downturn driven by the renewed AI debate, disappointing jobs report and Bank of Japan move to increase rates, the Axioma risk models continue to see elevated volatility. One way to visualize the increase broadly is in the Global Volatility and Correlation Hot Spots charts that appear in each risk monitor. For each country we use the associated Axioma Market Portfolio as an index. For the Global Volatility chart, the up-facing arrows on a country indicate that predicted volatility according to the Worldwide short-horizon fundamental model has risen by more than one percentage point there. For the Global Correlation chart the up arrows show those countries in which the median asset-asset correlation as predicted by the Worldwide model rose more than 2%. For the week ending August 16 it is clear that risk, especially country volatility, continued to rise in most developed countries. Assuming no more big surprises, we would expect volatility to reverse course, or at least stop increasing, but note that even though the news seemed fairly localized it led to a global reaction.

See charts that appear in each of the Equity Risk Monitors as of August 16, 2024:

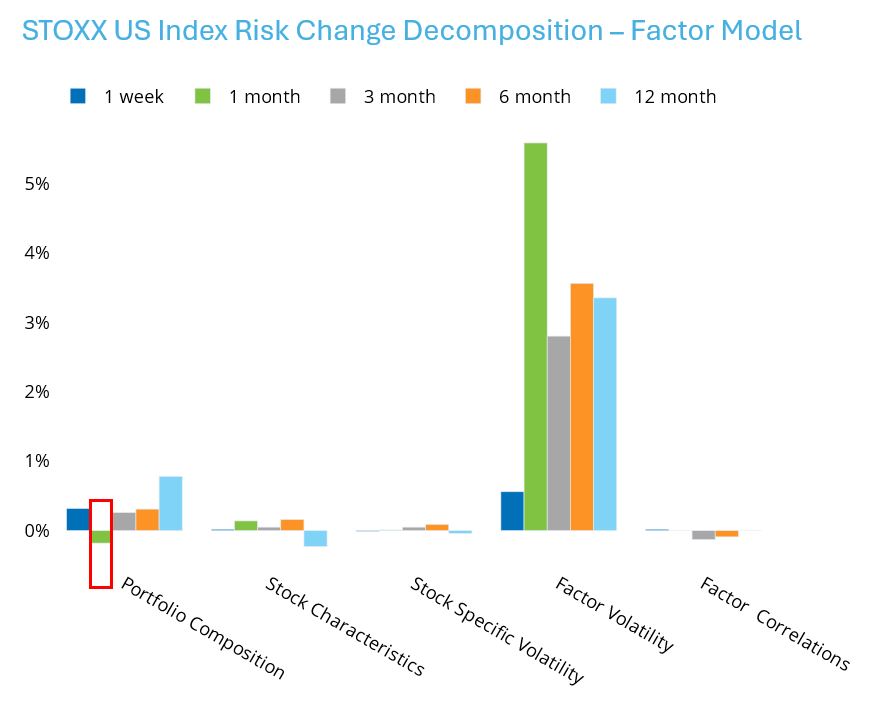

Lower weights in biggest stocks vs. a month ago has slightly offset the increase in factor volatility

In our weekly notes at the beginning of July we noted that the decomposition of the change in risk showed that although factor volatility was declining, the composition of the STOXX© US index (and other major indices that included large cap stocks) was adding to risk, as the biggest stocks were among the riskiest of all stocks in the index and were increasing in weight. More recently we are seeing the opposite, with declining weight in some of the biggest names offsetting some of the increase in risk driven by higher factor volatility, especially over the last month. Total risk in these names increased over the period (as it did for most stocks in the index). Notably, total risk forecasts for NVDA and AMZN increased by 10 and 6.5 percentage points, respectively, while the increase in risk for some of the other big names in the index was lower than the unweighted index average increase of 3.8 percentage points.

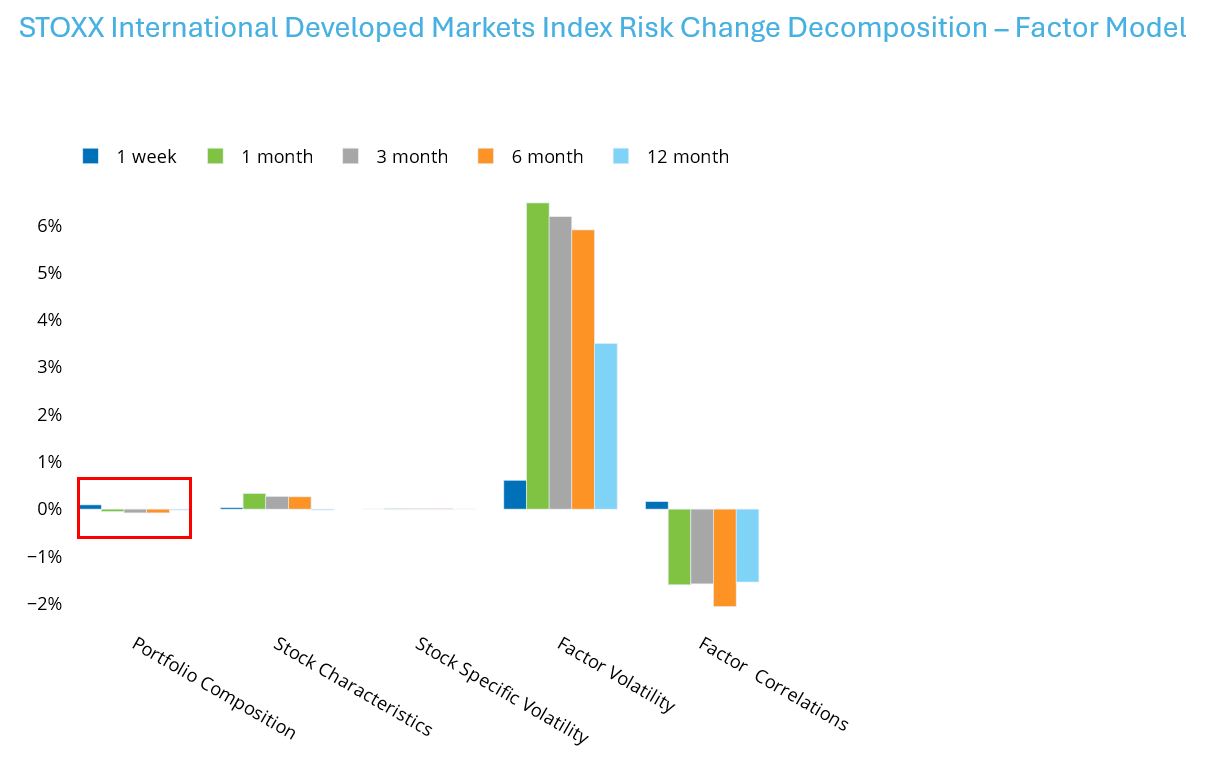

Note that we do not see that the changing composition of the index had the same impact on risk of the STOXX© International Developed Markets Index (which is developed markets excluding the US).

See graphs from US and Developed Markets ex-US Equity Risk Monitors as of August 16, 2024

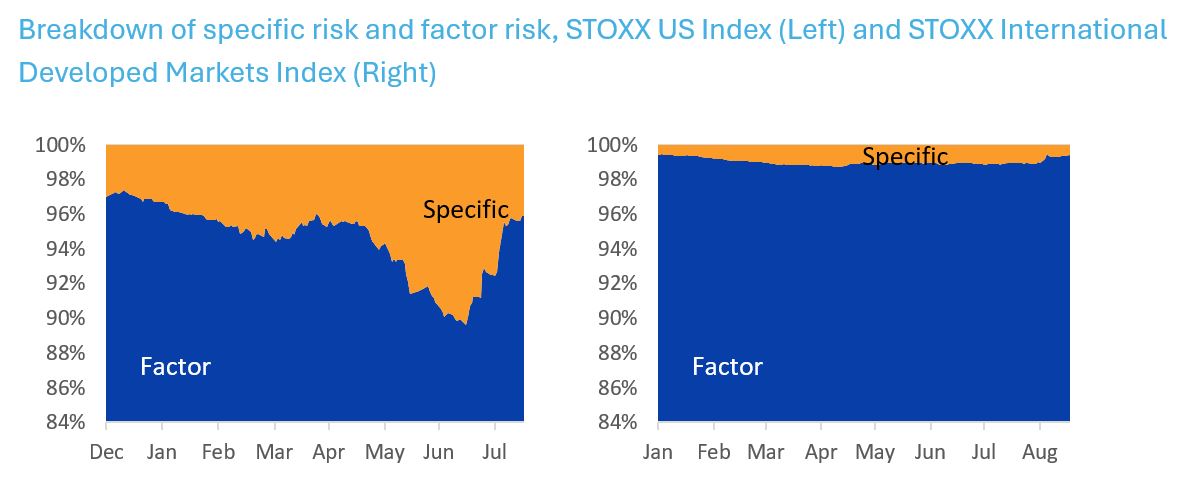

At the same time, the concentration of the US index in a few names resulted in an increasing proportion of specific risk relative to factor risk for the index. At the point of the market peak in mid-July specific risk was almost 10% of the total risk of the US index. That high proportion started to reverse at that point, but specific risk remains around 4% of the total. In contrast, so far this year specific risk was less than 1.2% of the overall risk for this whole year.

The following charts do not appear in the equity risk monitors but are available on request.

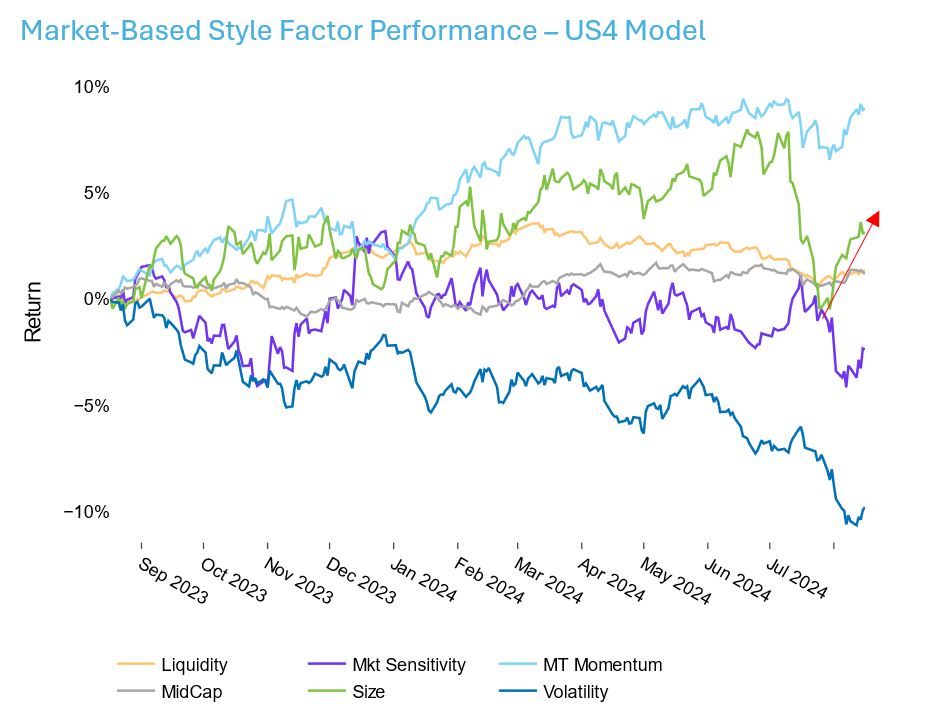

Was the reversal in return to Size short-lived?

In our highlights from July 26 we discussed the reversal in return to the Size factor in Axioma’s US model: where it had been positive all year so far it had turned highly negative. At the same time its volatility was higher than any of the other US factors and at the high end of its 12-month range.

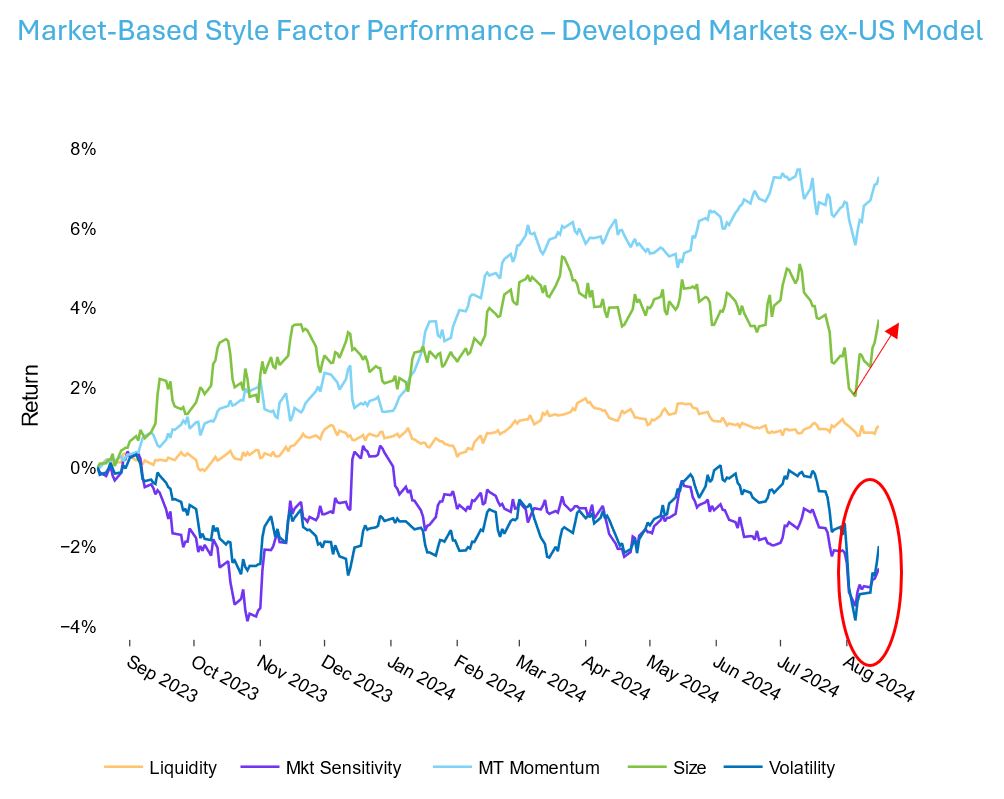

That trend has already reverted in the US, where the Size return has retraced about half the downturn. We saw a similar behavior from the Size factor in the Axioma Developed Markets ex-US model, although not quite as steep; nor was the return prior to the reversal quite as positive as the US. We also note that outside the US the return to Market Sensitivity and Volatility have also been positive of late, reversing the flight-to-quality negative returns from earlier in the quarter. While also there in the US, the recent uptick in the returns to those factors has been much smaller.

For now, as the Technology train continues to chug uphill we expect the Size return to remain positive.

See graphs from US and Developed Markets ex-US Equity Risk Monitors as of August 16, 2024