EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED AUGUST 30, 2024

Diversification Ratios Plummet

One of the index-level analytics we track in the equity risk monitors is the diversification ratio, which compares the weighted-average asset level risk forecast of the index’s constituents to the forecast the model produces for the index as a portfolio of assets. The premise is that the asset specific risk will get diversified away in the index, and that offsetting factor exposures will also serve to lower risk. The higher the “diversification ratio”, the lower the index risk forecast is in comparison to the sum of its constituent parts- because the asset correlations are less than 1. The lower they are in aggregate, the higher the diversification ratio goes.

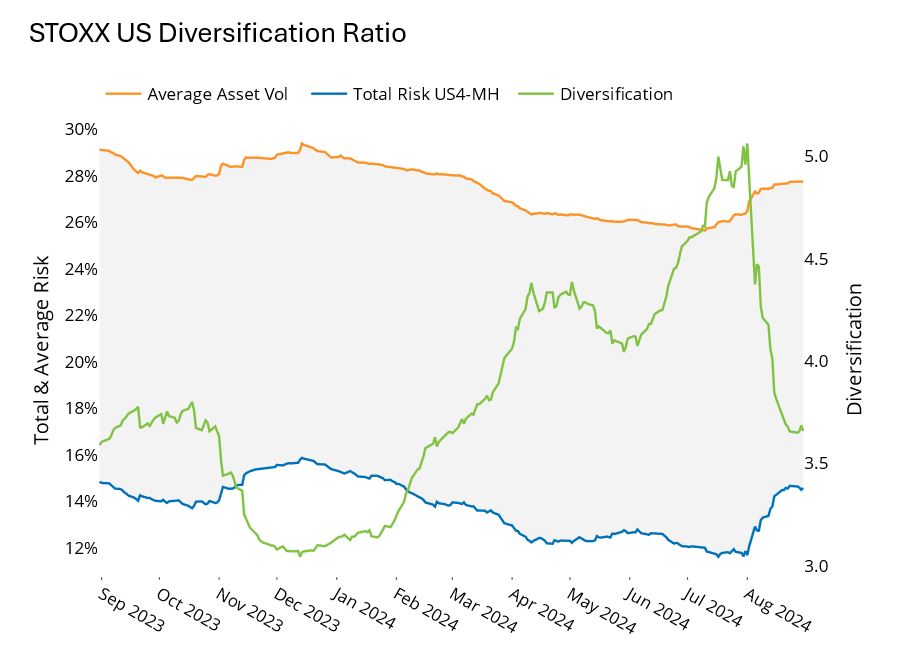

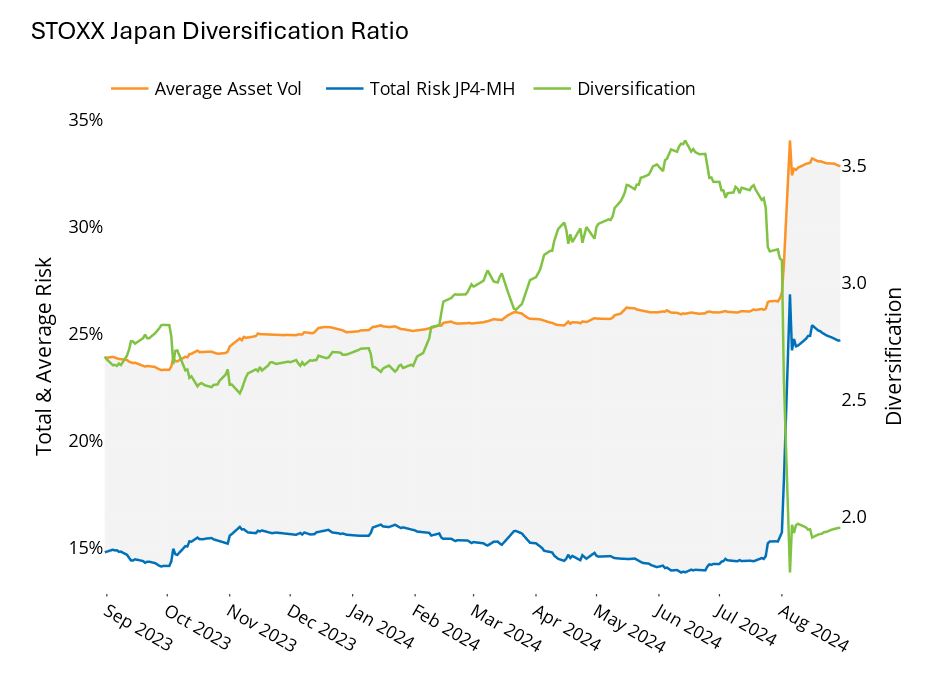

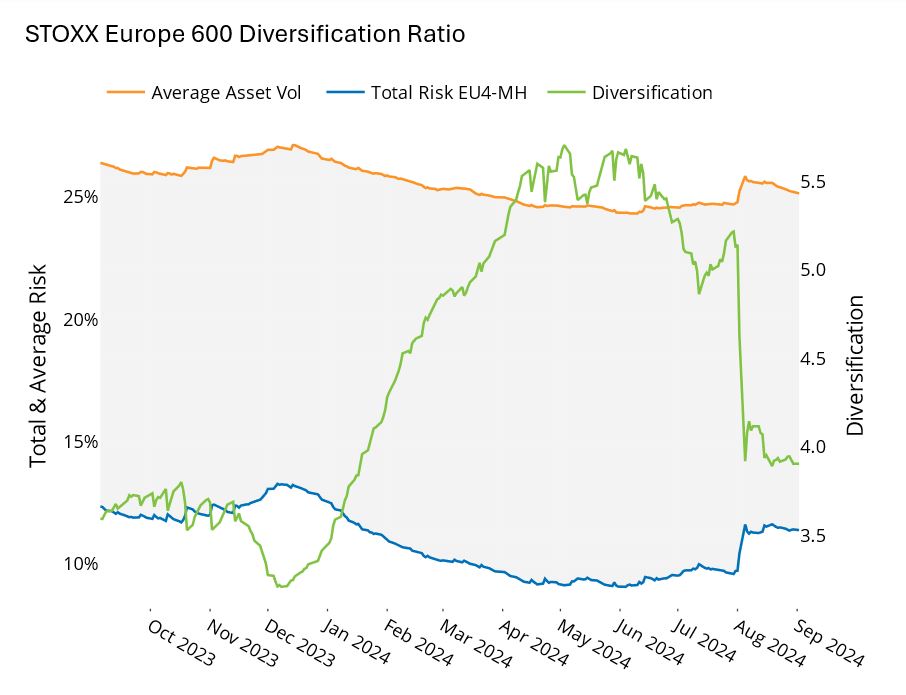

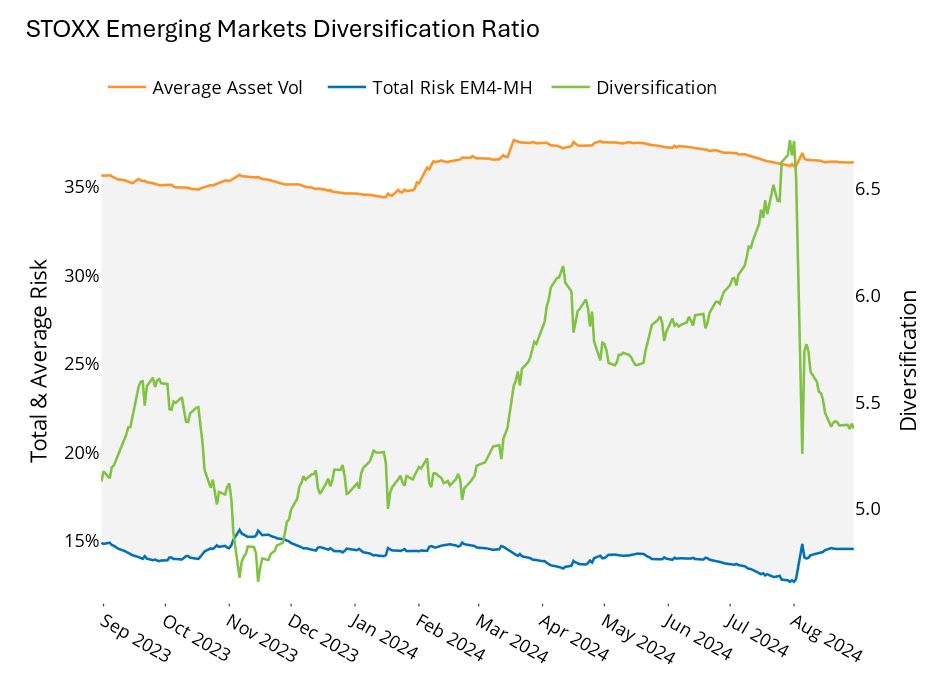

We had been witnessing a rapid rise in diversification ratios in most indices we track throughout 2024 through August. Then the August volatility we have documented here sharply reversed that trend. Below are a few of the charts from this week’s monitors to illustrate the dramatic drop:

Please see Chart 22 in the Equity Risk Monitors for August 30, 2024:

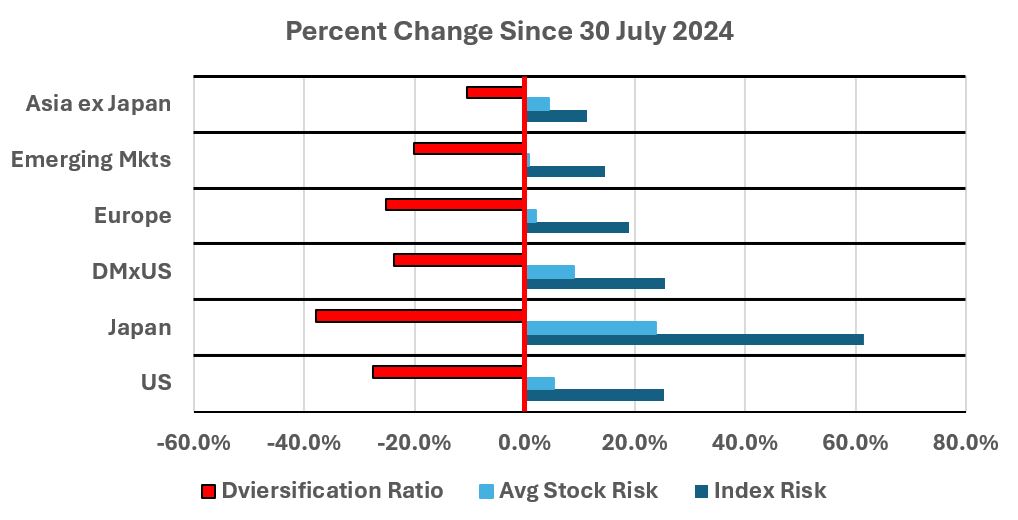

It is difficult to compare the magnitude of the drop in the different markets, so we aggregate the change from July 30th to August 30th here:

The following chart is not published in the Equity Risk Monitors but is available upon request:

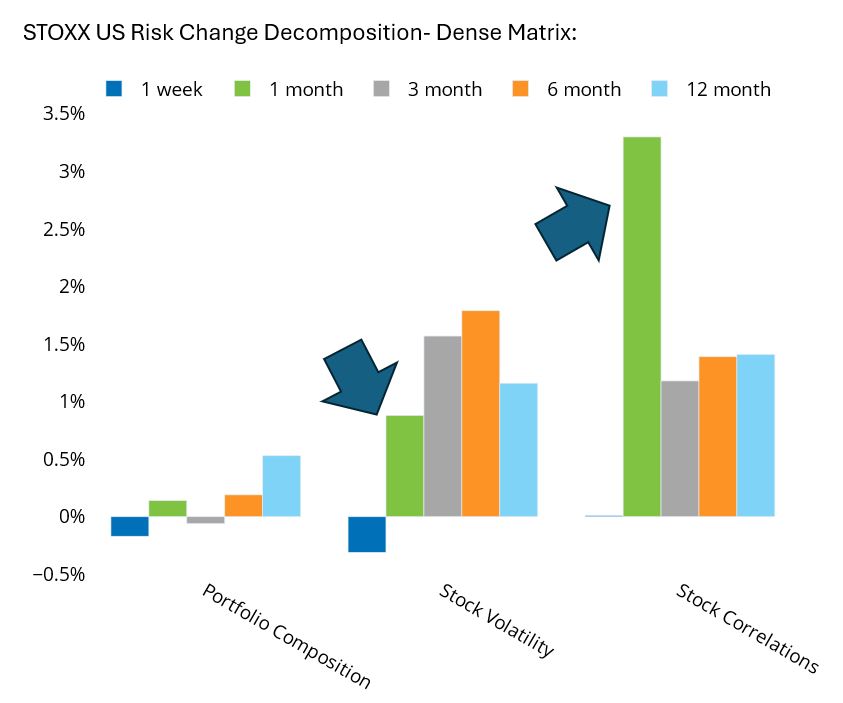

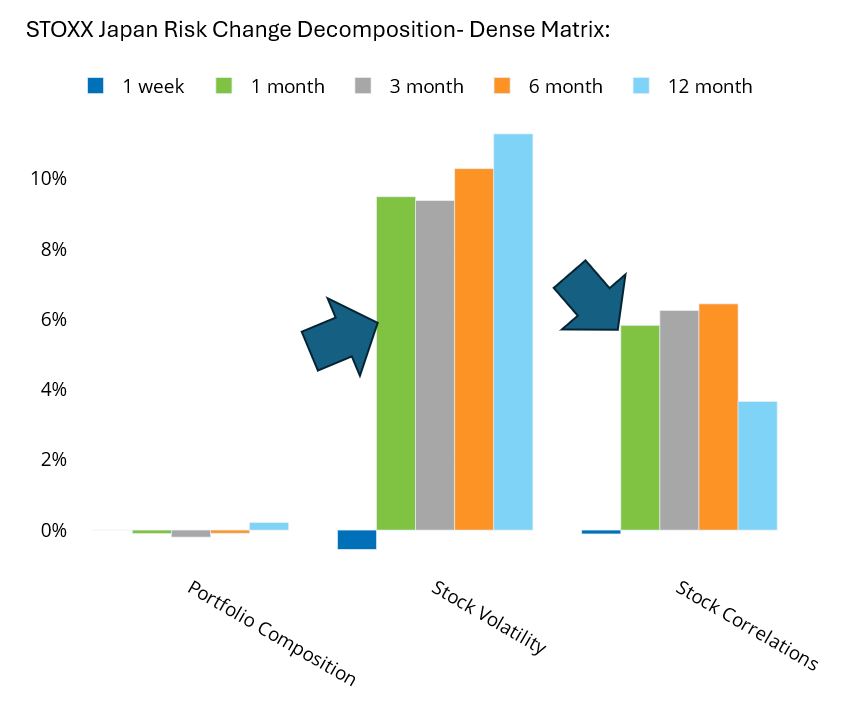

Japan’s index risk surged more than 60% over the month of August, which is orders of magnitude higher than any other major market we track. While the other markets saw similar, albeit smaller declines in the diversification ratio, none of them saw a jump in stock volatility like Japan has. The weighted average stock risk in Japan was up nearly 24% in August. By contrast, the United States saw average stock volatility increase just 5%, and in Emerging Markets it was less than 1%. This would imply that the enormous jumps we witnessed in markets outside Japan is largely driven by increasing asset correlations. We can confirm that by looking at chart 10 for the US and Japan, respectively:

Both volatility and correlations increased in both markets, but the stock level volatility in Japan was markedly higher than the US, jumping by almost 10 percentage points.