EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED NOVEMBER 22, 2024

US 5.1- Crowding Short Interest Reversal

In the week ended November 22, we saw a possible warning sign of a market reversal even as the US index closed higher on the week. The Hedge Fund Crowding factor, which measures the fraction of float and average daily volume held by private funds directly from their SEC form 13F filings was down 0.39%, while its mirror image factor, Short Interest, was up 0.55% for the week. Short Interest measures the degree to which a company’s shares are sold short- as a fraction of float, market cap, and shares available to borrow.

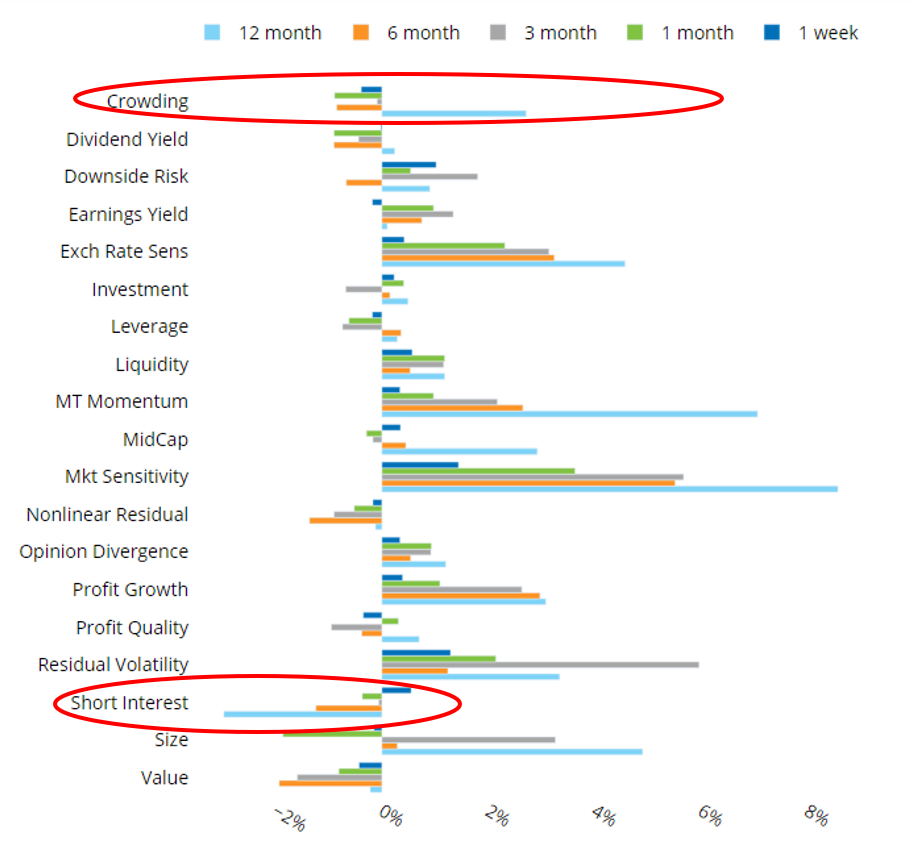

Crowding, which generally has a low volatility, positive factor return has actually been trending downwards in the last six months, but the negative return was much sharper over November:

See Chart 17, Axioma United States Model Style Factor Returns by Period, US 5.1 Equity Risk Monitor November 22, 2024

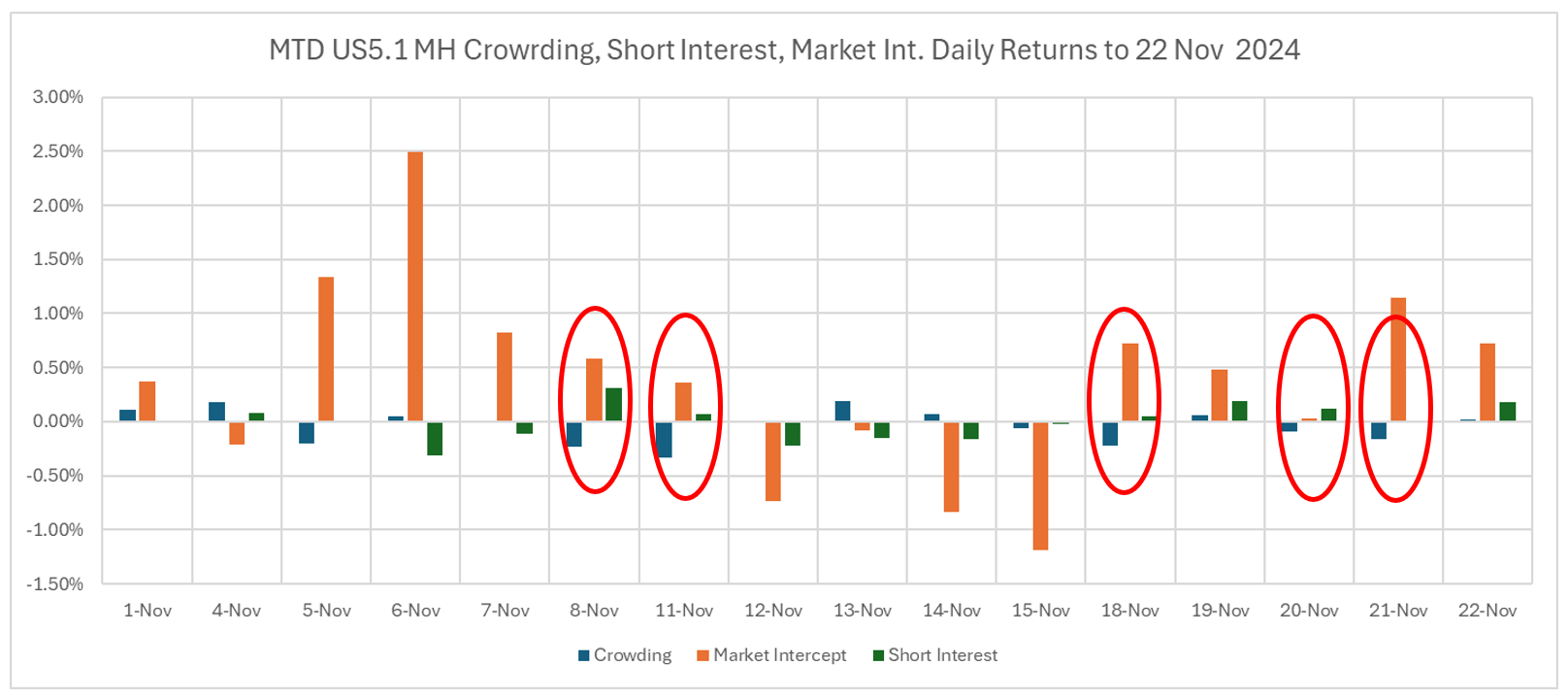

Observing factor returns MTD in November reveals a few days post-election where the typical Crowding/Short Interest relationship was reversed:

While the effect is particularly strong on the 8th and 11th, in the last week there were 3 days out of five where Crowding was down and Short Interest was up. On the other two days last week, Tuesday the 19th and Friday the 22nd, both factors were up but the Short Interest returns were particularly strong at +0.19% and +0.18% respectively.

It would appear that the initial reaction to the US election outcome was to reinforce existing positions, as the Crowding/SI relationship held on the 6th and the 7th. Subsequent to this, it is possible profits are being taken as Crowded longs are sold down and successful shorts are bought back to close.

Japan Sector Rotation 2024

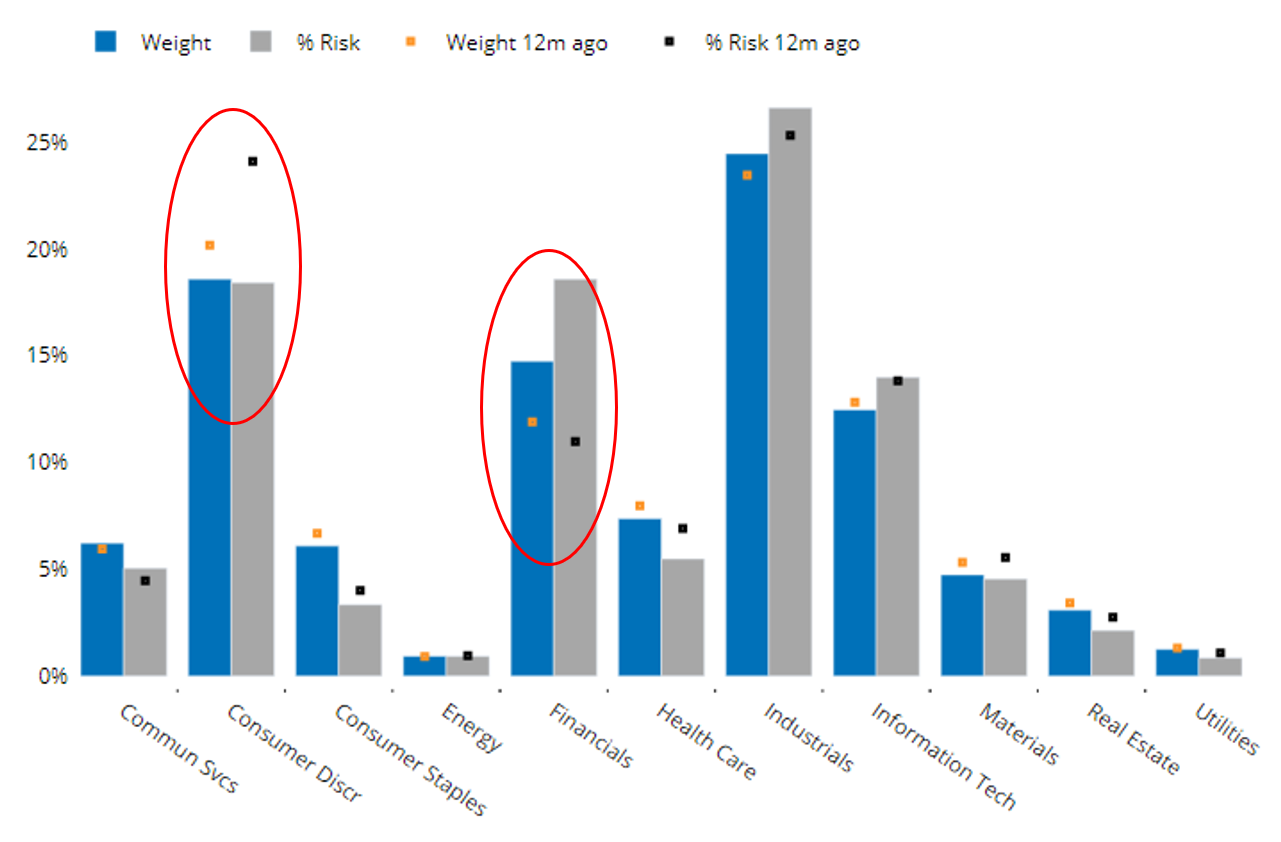

On the 19th of March 2024, the BoJ raised its benchmark interest rate for the first time in 17 years. The before and after performance of the Japanese index since then is starkly different, with most key sectors flat or down. This has caused a large rotation in both the sector allocation, and sector risk contribution in the index relative to 1 year ago:

See Chart 20, STOXX Japan – Sector Weights and % of Risk, Japan Equity Risk Monitor, November 22, 2024

To be sure, weight and contribution are down in several sectors, but none more prominent than Consumer Discretionary. It appears that all the risk (and allocation) rotated out of Discretionary and into Financials.

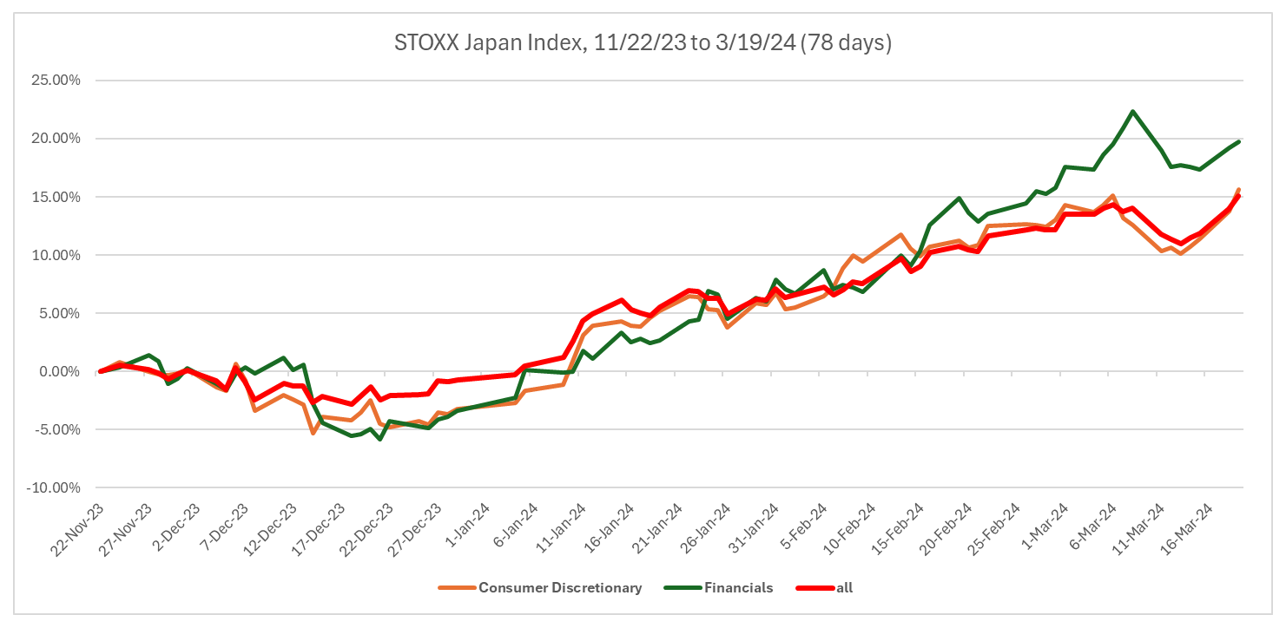

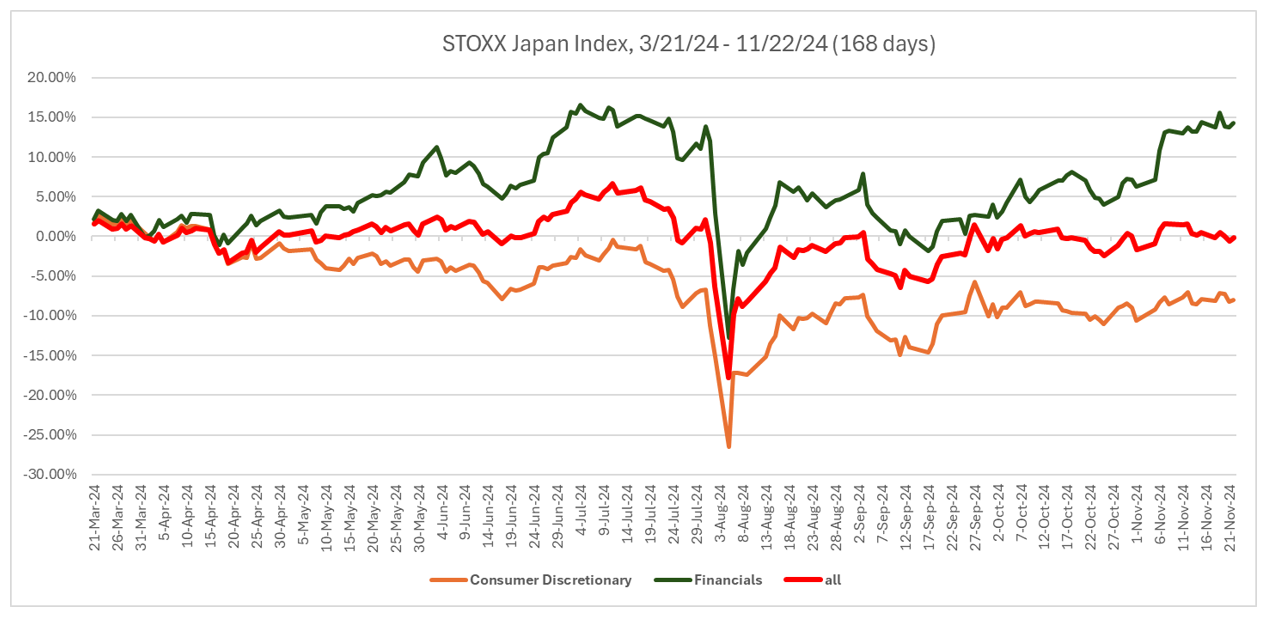

While Financials had been leading the index up to the March 19 rate cut, other important sectors such as Discretionary had been keeping pace. Since March 19th, that is no longer the case- Financials continue to outperform, but Discretionary is down 8% while the index as a whole is flat:

Particularly after the 2nd rate increase at the end of July 31st and the subsequent reversal of the global carry trade (sharp drop beginning of August), the Discretionary sector has yet to recover. It would appear that investors in Japan believe financial institutions have the upper hand vs. consumers in a higher rate environment, particularly as the yen strengthens relative to other trading partners that are lowering their rates.

You may also like