EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED JUNE 6, 2025

Axioma Risk Monitor: Stocks recoup April losses as risk declines; US sentiment improvement reflected in sector and style factor moves; 2025’s tariff turmoil isn’t a replay of 2018—even with similar returns

Stocks recoup April losses as risk declines

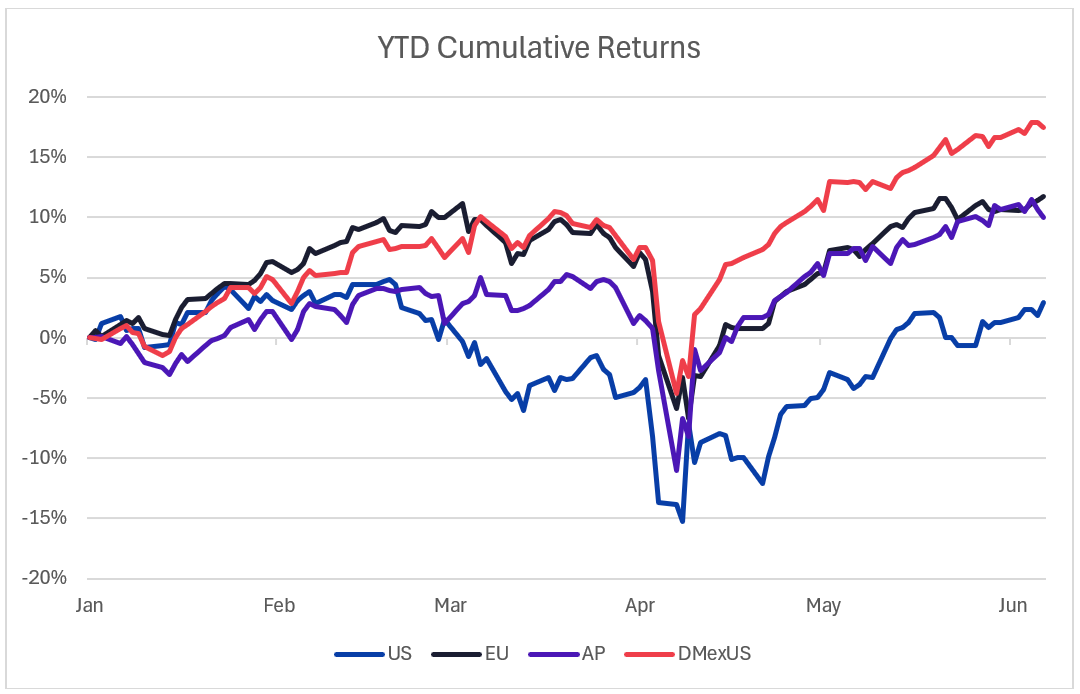

Most major markets recovered their steep April losses following “Liberation Day,” navigating a flurry of tariff announcements, pauses, and legal challenges. After a strong May, equities in all regions tracked by the Equity Risk Monitors—except Japan—continued to climb last week.

Global stocks have been steadily climbing since April 8th, despite mixed signals on tariffs from the Trump administration, ongoing legal battles, and escalating trade tensions. Although the tariffs introduced on Liberation Day faced legal challenges at the end of May, the US Court of Appeals issued an administrative stay the following day, reinstating most of them while litigation continues. As a result, these tariffs technically remain in effect through early June 2025, pending further court decisions.

However, the Trump administration has paused most of these tariffs until July or August to allow time for trade negotiations. So far, only a deal with the UK has been finalized, with other agreements still pending.

In a new development, President Trump doubled tariffs on steel and aluminum imports (excluding those from the UK) last week. This move, made under the Trade Expansion Act, was justified on national security grounds.

At the same time, tensions between the US and China escalated, with both sides accusing each other of violating the mid-May trade truce. Still, President Trump hinted at progress after a call with Chinese President Xi Jinping on Thursday.

On the economic front, the May jobs report exceeded expectations, boosting investor sentiment. However, markets continue to anticipate that the Federal Reserve will hold off on rate cuts until September, with no changes expected in June or July.

US indices reached three-month highs, with the STOXX US Index rising 1.6% last week and 3% year-to-date. However, the US market is underperforming compared to Europe, Asia, and Developed Markets ex-US. STOXX Europe 600 gained 1% last week and is up 12% year-to-date, outperforming the US by 9 percentage points. STOXX Asia Pacific fell 0.6% over the past five business days due to weakness in Japanese shares but still leads the US by 7 percentage points year-to-date. STOXX International Developed Index (Developed Markets ex-US) has outpaced the US by 15 percentage points, with currency effects amplifying gains when measured in US dollars.

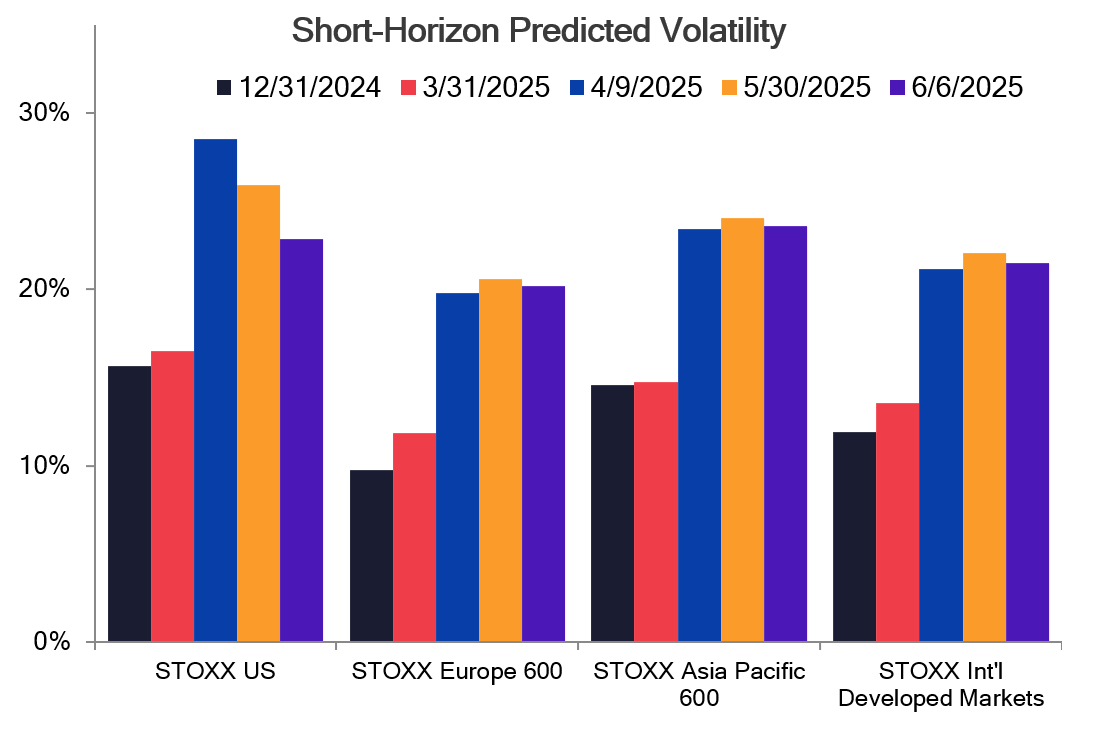

Forecasted risk declined across all regions last week, driven by lower stock volatility and correlations. While risk has eased from the April-May peaks, it remains elevated compared to the start of the year. Among the four indices, STOXX Asia Pacific 600 is currently the riskiest, followed by STOXX US, while STOXX Europe 600 is now the least risky, based on Axioma’s fundamental short-horizon regional risk models.

The following charts are not in the Equity Risk Monitors but are available on request:

US sentiment improvement reflected in sector and style factor moves

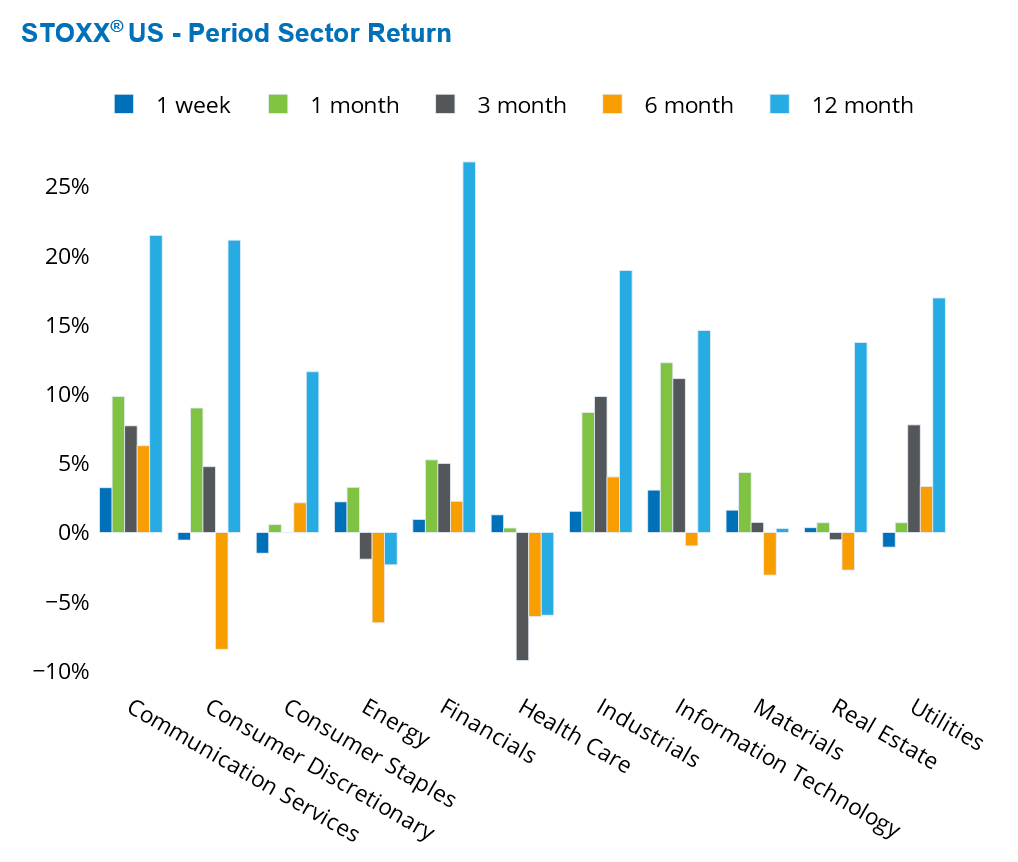

As investor sentiment in the US turned more positive, traditionally defensive sectors like Consumer Staples and Utilities posted the largest losses last week among the 11 GICS sectors in the STOXX US Index. Consumer Discretionary would have recorded modest gains as well, if not for Tesla’s sharp decline. The company suffered its worst one-day market cap drop on Thursday, falling nearly 15% over the week, largely due to escalating tensions between President Trump and Elon Musk.

Leading the market were Communication Services and Information Technology, followed by Energy, which benefited from rising crude oil prices. Despite OPEC’s announcement of increased production for July and the OECD’s downward revision of global growth forecasts for 2025 and 2026, oil prices climbed amid intensifying tensions between Russia and Ukraine.

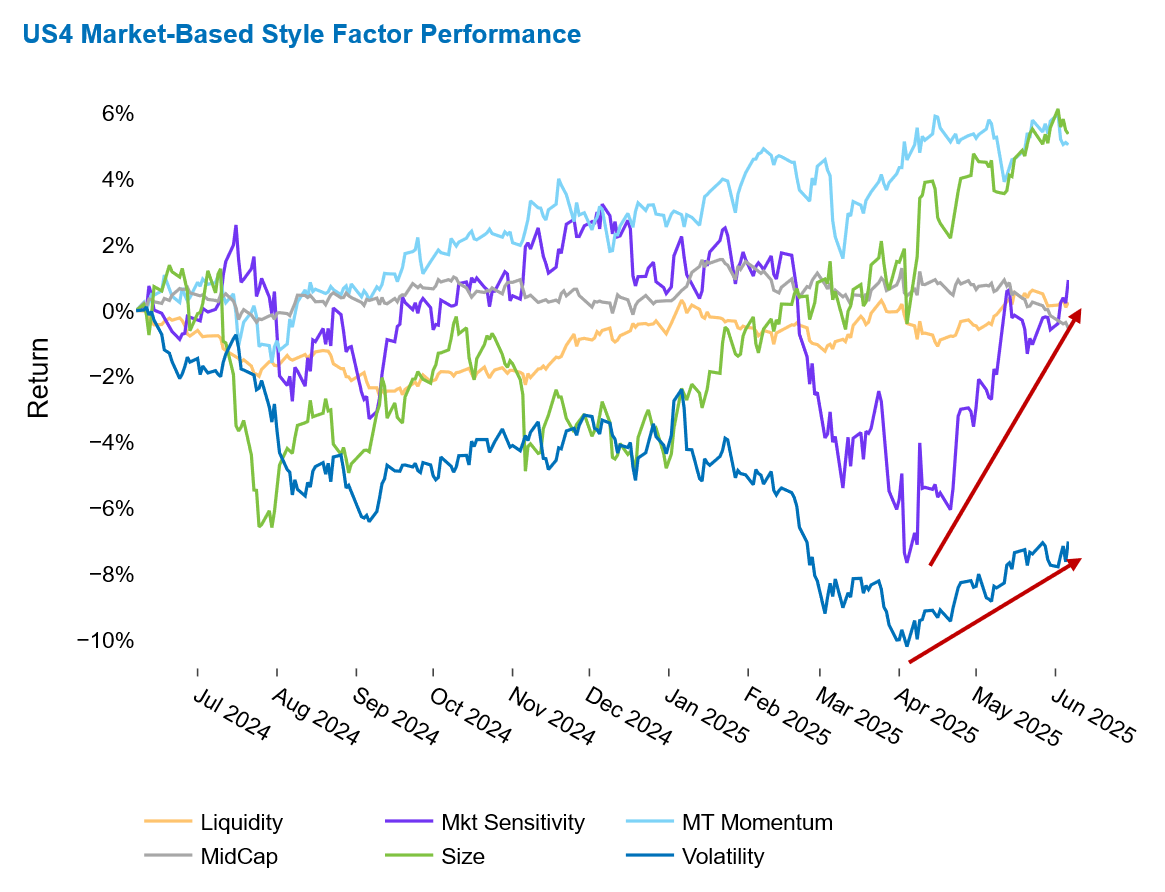

The shift toward a more risk-tolerant investment stance was also evident in style factor performance. After declining during the first quarter, Market Sensitivity and Volatility have been trending upward since early April. This suggests investors are favoring high-beta, high-volatility stocks over their lower-beta, more stable counterparts—a common pattern when markets rebound from a drawdown, though it doesn’t guarantee the rally will continue.

Notably, this growing optimism in financial markets contrasts with consumer sentiment. While investor sentiment has improved, American consumers remain cautious. The University of Michigan Consumer Sentiment Index for May 2025 remained low, unchanged from April, but marking a pause after four consecutive months of steep declines.

See graphs from the STOXX US Equity Risk Monitor as of June 6, 2025:

2025’s tariff turmoil isn’t a replay of 2018—even with similar returns

In 2018, the market contended with escalating trade tensions as well, particularly between the US and China, as the Trump administration rolled out successive rounds of tariffs. Despite these geopolitical headwinds, the macroeconomic backdrop remained relatively supportive: GDP growth was robust, unemployment was low, and inflation was contained. The Federal Reserve, responding to this strength, raised interest rates four times that year. Yet even in this favorable environment, tightening monetary policy and late-cycle concerns ultimately led to a 5% market decline by year-end.

Fast forward to 2025, and the context has changed dramatically. Today’s market is navigating a more fragile economic foundation—characterized by slower growth, higher inflation, elevated unemployment, and subdued consumer spending. Interest rates are now twice as high as they were in 2018, and while the Fed is expected to hold steady or even begin easing later this year, the policy stance remains restrictive by recent historical standards.

Interestingly, despite these starkly different macro and policy conditions, market returns in 2018 and 2025 have shown surprising similarities. As of June 6, 2018, the STOXX US Index had a year-to-date return slightly above 3%, nearly identical to its return in 2025 so far.

However, the contrast becomes more apparent when examining market volatility. Even the lowest volatility levels in 2025 have surpassed the highest points recorded during the onset of the tariff wars in Spring 2018, based on Axioma’s short-horizon fundamental risk model. The peak risk levels in 2018 are significantly lower than the highs observed so far this year.

The takeaway for investors is clear: similar returns do not imply similar conditions. The 2025 market is operating under a distinctly different set of pressures and dynamics. Understanding this divergence is essential for interpreting performance, managing risk, and positioning portfolios in a structurally different environment.

The following charts are not in the Equity Risk Monitors but are available on request: