EQUITY RISK MONITOR HIGHLIGHTS

WEEK ENDED AUGUST 8, 2025

- With little change in market risk, factor returns and volatilities are in the spotlight.

- Volatility-related factors once again point to investor risk-seeking behavior in the US

- Global model results still largely favor lower risk and larger Size, as well as some unexpected factor results

Just a week ago, investors were still smarting from a sharp downturn in stock prices triggered by disappointing economic news. That all changed over the course of the week ending August 8, with global markets staging a strong recovery. The STOXX® US, STOXX® Europe 600, STOXX® Japan, STOXX® Asia ex-Japan, STOXX® International Developed Markets and STOXX® Developed World Indices all posted gains of more than 2% for the week ending August 8, 2025. The STOXX® US Small Cap Index was also up, albeit “just” 1.3%, and the STOXX® China A 900 rose 1.7%. The concerns about slowing global economies were replaced by hopes of lower interest rates and stocks were propelled by “buying the dip.”

Volatility-related factors once again point to investor risk-seeking behavior in the US

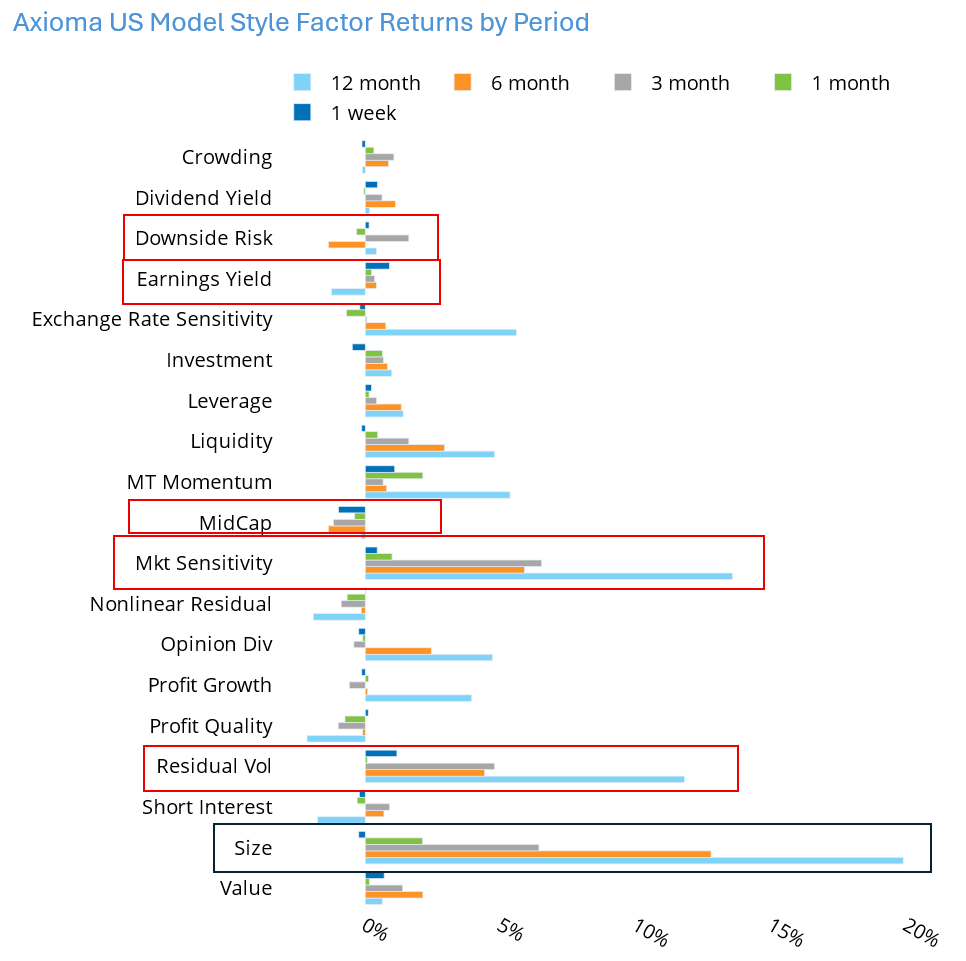

At the same time, after a brief turn toward a preference for low volatility in the US, investors once again sought higher Downside Risk, Market Sensitivity and Residual Volatility last week, according to the Axioma US5.1 fundamental medium-horizon model. At 1.4 standard deviations based on the risk model volatility forecast at the beginning of the week, the weekly return of 1.17% to Residual Volatility was particularly high in magnitude. The others, while positive, were not unusually high.

While investors were back to seeking higher risk, they were also favoring high Earnings Yield, after avoiding the cheaper names for a long time. Earnings Yield’s return of 0.89% was more than two standard deviations above expectations. They also shunned high Investment (as expected based on the long-term average return), with a -2.3 standard deviation weekly return of -0.48%. And while investors turned back to favoring smaller Size after highly positive returns to that factor (meaning larger stocks were far outpacing their small counterparts and a 12-month return reaching about +20%), it was mid-cap stocks that were hurt the most, with a return to the MidCap factor of nearly -1% that was almost three standard deviations below expectations.

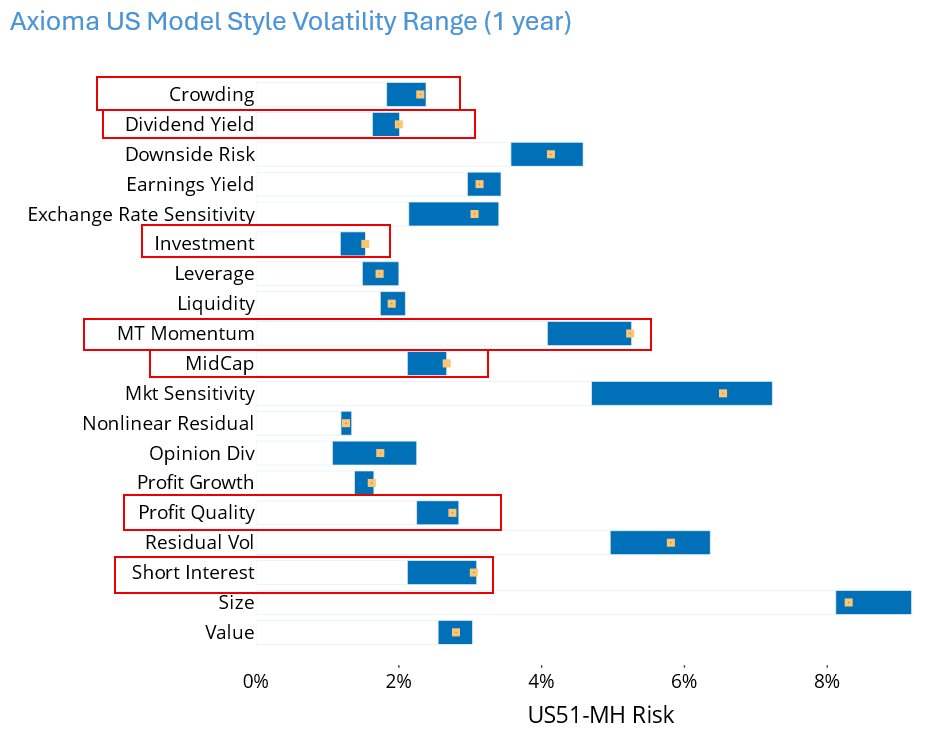

Although these risk-related factors have flip-flopped, their volatility, while above average, remains below the high of the last 12 months. At the same time Crowding, Dividend Yield, Earnings Yield, Investment, Medium-Term Momentum, MidCap, Profit Quality and Short Interest are all at the high end of their one-year volatility ranges. Investors focusing on these factors may want to take note.

See charts from the Russell 1000 AXUS5.1 Equity Risk Monitor of August 8, 2025

Global model results still largely favor lower risk and larger Size, as well as some unexpected factor results

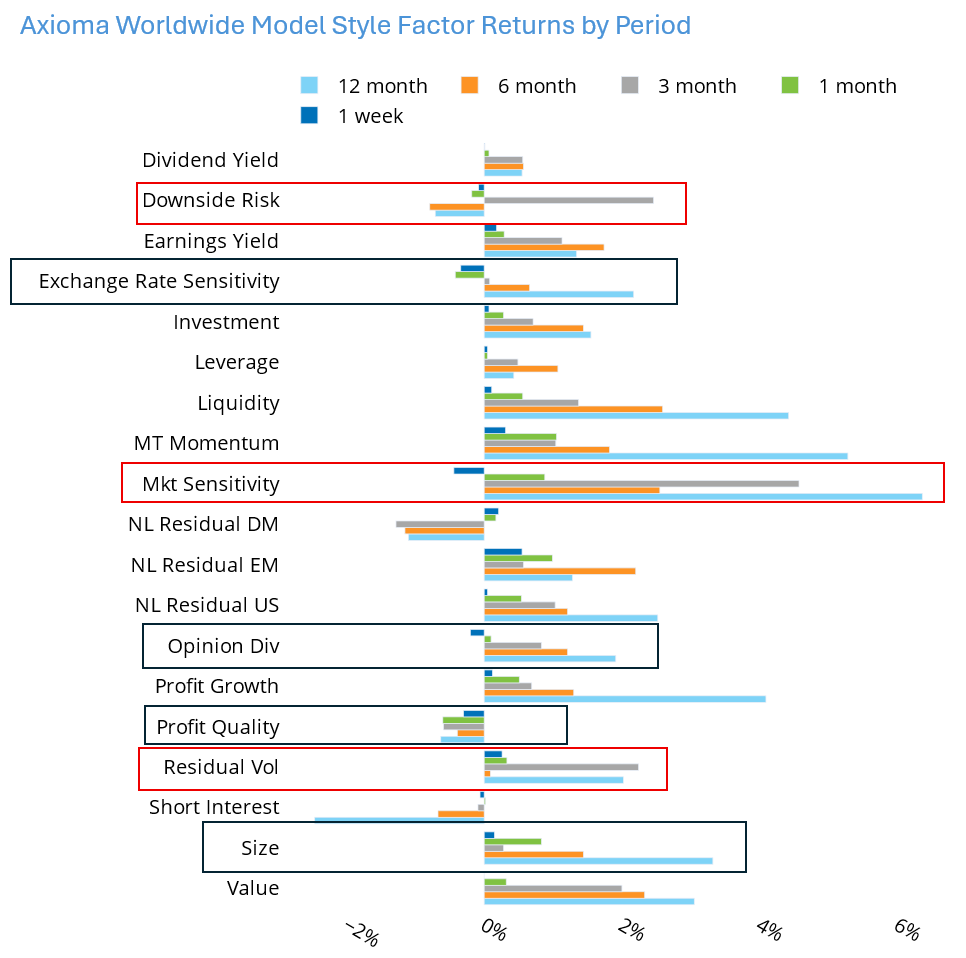

When we consider the rest of the world, as we do in the Axioma Worldwide (WW5.1) model, we see fewer “outsized” returns (more than two standard deviations above or below from expectations). In fact, none of the model’s factors exceeded those bounds in the last week or month. In addition, weekly returns to Downside Risk and Market Sensitivity of -0.08% and -0.44%, respectively, showed a small preference for lower risk names, in contrast to the results from the US5.1 model. As in the US, however, Residual Volatility showed a small positive return last week. Large Size remained the favored strategy, and Earnings Yield’s 0.18% weekly return was a bit higher than expected.

The factors that deviated the most from expectations, according to the Worldwide model were Exchange Rate Sensitivity (-0.34%, -1.6 standard deviations), Opinion Divergence (-0.2, -1.6 s.d.) and Profit Quality (-0.3%, -1.69 s.d.). As compared with results from the US model, these factors may have been more surprising to model users, as Exchange Rate Sensitivity’s return is often expected to be close to zero (at least in times when trade and tariffs are stable and currencies are not as volatile), whereas the other two factors are expected to produce positive returns (according to their long-term average returns).

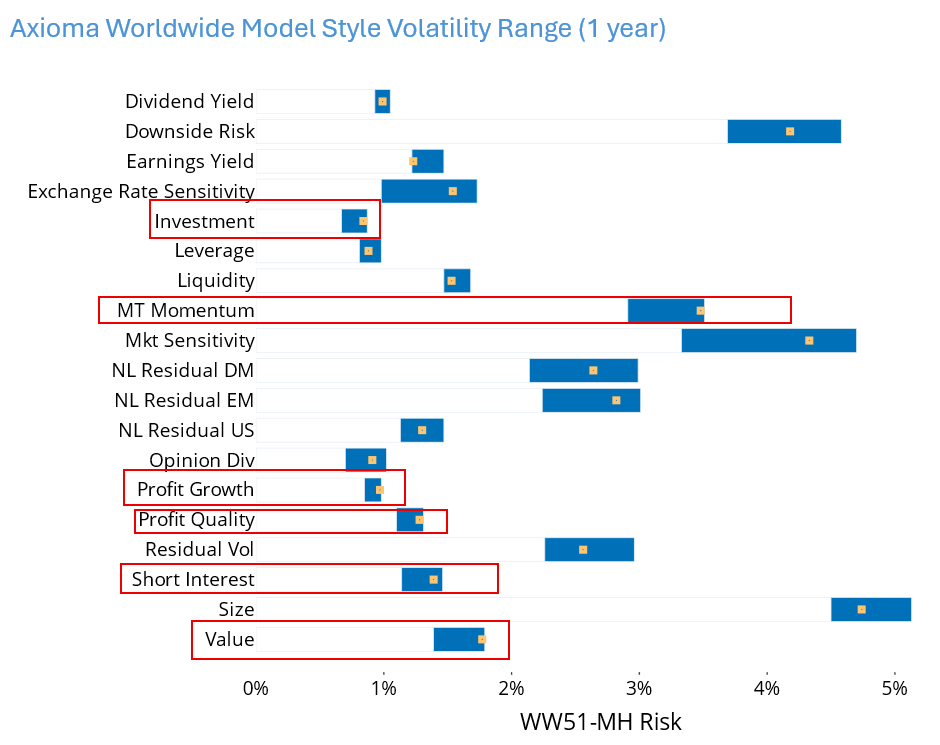

As we saw for the US model, several style factors in the Worldwide model saw predicted volatility at or near the high end of their respective12-month ranges. The factors with the highest predicted risk relative to their recent history are somewhat different from what we observed in the US, but quite a few currently still exhibit high risk. They include Investment, Medium-Term Momentum, Profit Growth, Profit Quality, Short Interest and Value. Only Earnings Yield’s risk ended last week at the low end of its range.

Again, investors may want to be aware of these relatively high levels of volatility. If one is concerned about whether they will continue to increase – and therefore trigger the need to rebalance to maintain active risk limits, one possibility is to look at what their short-horizon model counterparts say about predicted volatility. If short-horizon risk is higher, there is a good chance medium-horizon risk will follow.

See charts from the STOXX Developed World AXWW5.1 Equity Risk Monitor of August 8, 2025

You may also like