Multi-Asset Class Risk Monitor Highlights

WEEK ENDED MARCH 22, 2024

- Downward inflation surprise sways BoE further toward cutting rates

- BoJ raises rates for first time in 17 years…and the yen plummets

- Joint stock and bond rally boosts portfolio risk

Downward inflation surprise sways BoE further toward cutting rates

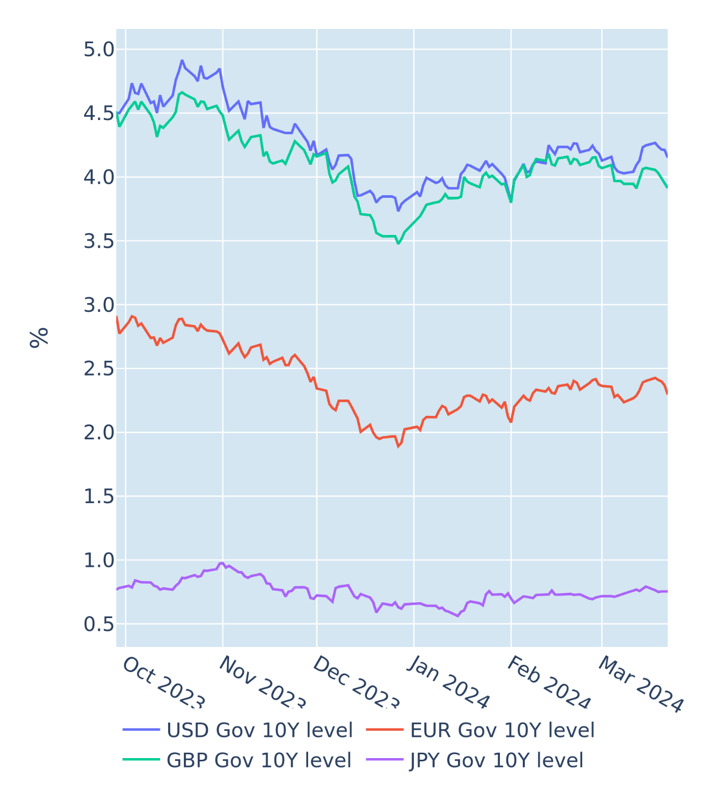

The Bank of England edged closer to easing monetary conditions in the week ending March 22, 2024, as consumer prices in the United Kingdom grew at the slowest pace since 2021. The Office for National Statistics announced on Wednesday that annual headline inflation dropped from 4% in January to 3.4% in February, while core-price growth decelerated from 5% to 4.5%. Analysts had predicted slightly higher rates of 3.5% and 4.6%, respectively. The BoE still kept rates on hold at its meeting on Thursday, but Governor Andrew Bailey acknowledged that “things are moving in the right direction.” Voting records also showed that no MPC member proposed to raise rates this time, compared to two rate setters who had still been in favor of tighter monetary conditions at the previous meeting in February. But it was still only one out of nine who voted for a rate cut, in spite of the fact that the Bank now expects headline inflation to temporarily drop below its 2% in the second quarter, once the lower energy price cap takes effect in April. Gilt yields reacted by dropping across all maturities to their lowest levels since the beginning of February, strongly outperforming US Treasury bonds and German Bunds.

Please refer to Figures 3 & 4 of the current Multi-Asset Class Risk Monitor (dated March 22, 2024) for further details.

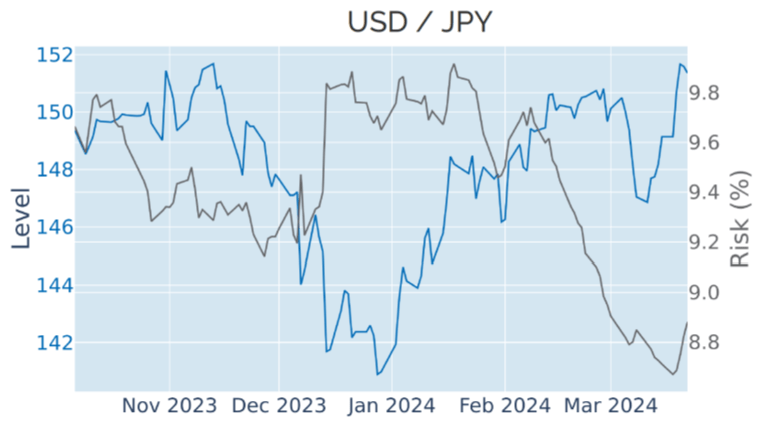

BoJ raises rates for first time in 17 years…and the yen plummets

The Bank of Japan raised interest rates for the first time since 2007 on March 19, 2024, ending more than a decade of ultra-loose monetary policy. Conventional wisdom has it that higher rates should support the value of currency, as they make investing in the region more attractive to foreign investors. Yet, the yen plummeted 1.5% against the US dollar over the following days, as the focus remained on the stateside leg of the exchange rate.

The Federal Reserve, which announced its latest monetary-policy decision a day later on March 20, left rates unchanged in line with market expectations, but FOMC members noticeably upped their ‘dot-plot’ projections for economic growth, inflation, and interest rates. Even though the median year-end prediction for the latter still stands at 450-475 basis points, there is now only one rate setter who expects a lower level, compared to five at the previous update in December.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated March 22, 2024) for further details.

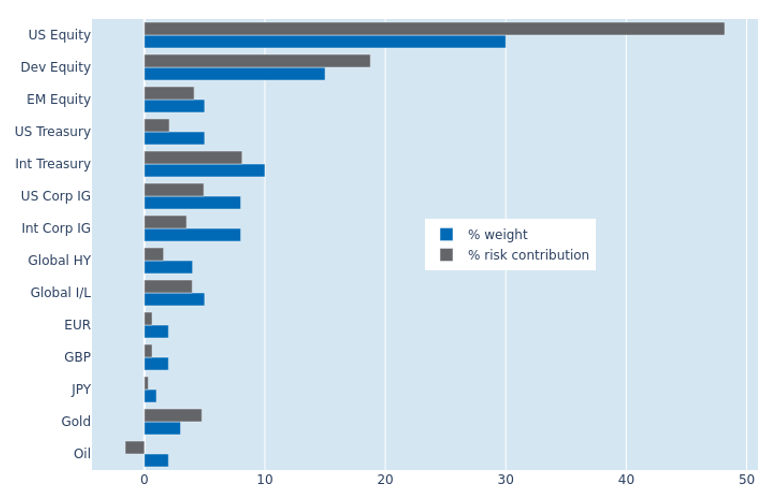

Joint stock and bond rally boosts portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio rebounded 0.4% to 6.3% as of Friday, March 22, 2024, on the back of higher equity volatility and a renewed co-movement of stock and bond prices. Both asset classes rallied as traders focused on the fact that a majority of FOMC rate setters still sees rates 75 basis points lower at the end of the year. US equities recorded the bulk of the risk increase, with their share of total volatility ballooning from 38.5% to 48.1%. Non-US developed stocks and sovereign bonds, on the other hand, saw their percentage risk contributions shrink by 0.9% and 2.4%, respectively, as local gains were dampened by opposing exchange-rate losses against the strengthening USD.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated March 22, 2024) for further details.