Multi-Asset Class Monitor Highlights

WEEK ENDED APRIL 5, 2024

- Strong manufacturing and jobs data lift Treasury yields to 4-month high

- Dollar breaks positive correlation with monetary-policy expectations

- Inverse FX/equity relationship reduces portfolio risk

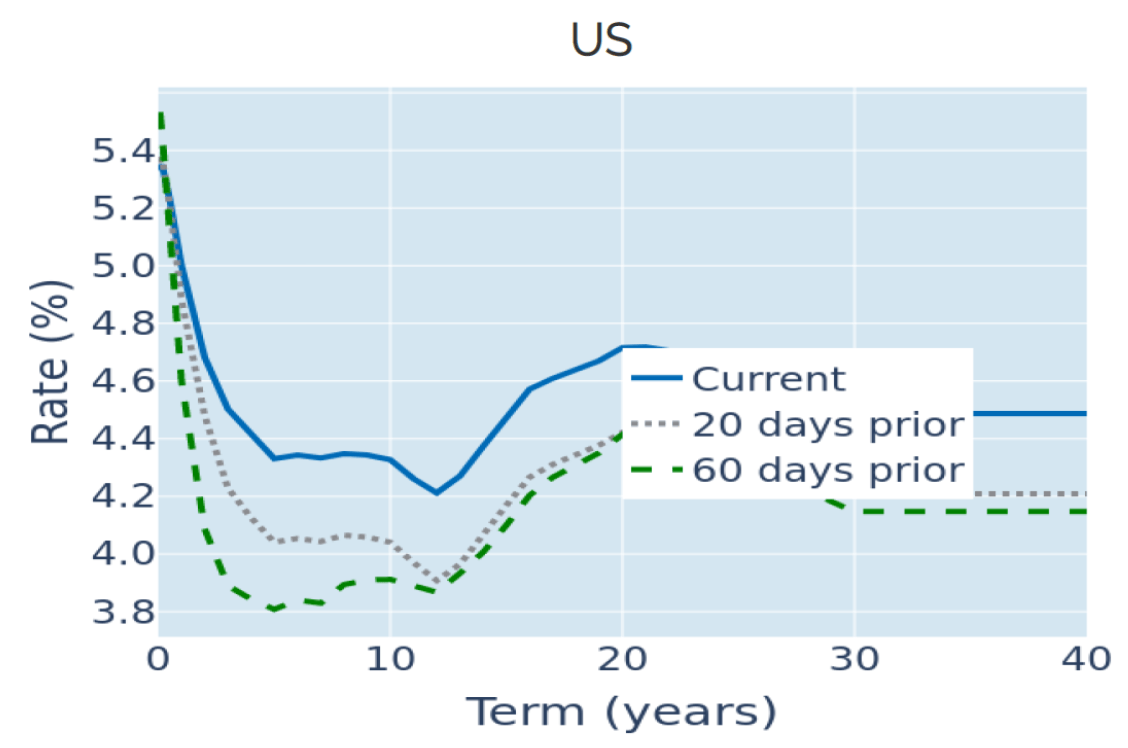

Strong manufacturing and jobs data lift Treasury yields to 4-month high

US Treasury yields soared to their highest levels since late November in the week ending April 5, 2024, on the back of stronger-than-expected manufacturing and jobs data. The Institute for Supply Management’s purchasing manager index for the manufacturing sector, released on Monday, rose to 50.3 in March, climbing into expansionary territory for the first time since 2022 and beating the consensus forecast of 48.4. Non-farm payrolls also dwarfed analyst predictions, showing that employers added 303,000 last month, compared to 200,000 anticipated job gains. Traders lowered the chances of a June Fed rate cut to almost equal odds, down from an implied probability of 75% only a fortnight earlier. The projected average federal funds rate for December also climbed to 4.76%, compared to around 4.6% two weeks prior. The change in rates once again propagated along the entire curve, with longer Treasury yields rising by similar amounts.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated April 5, 2024) for further details.

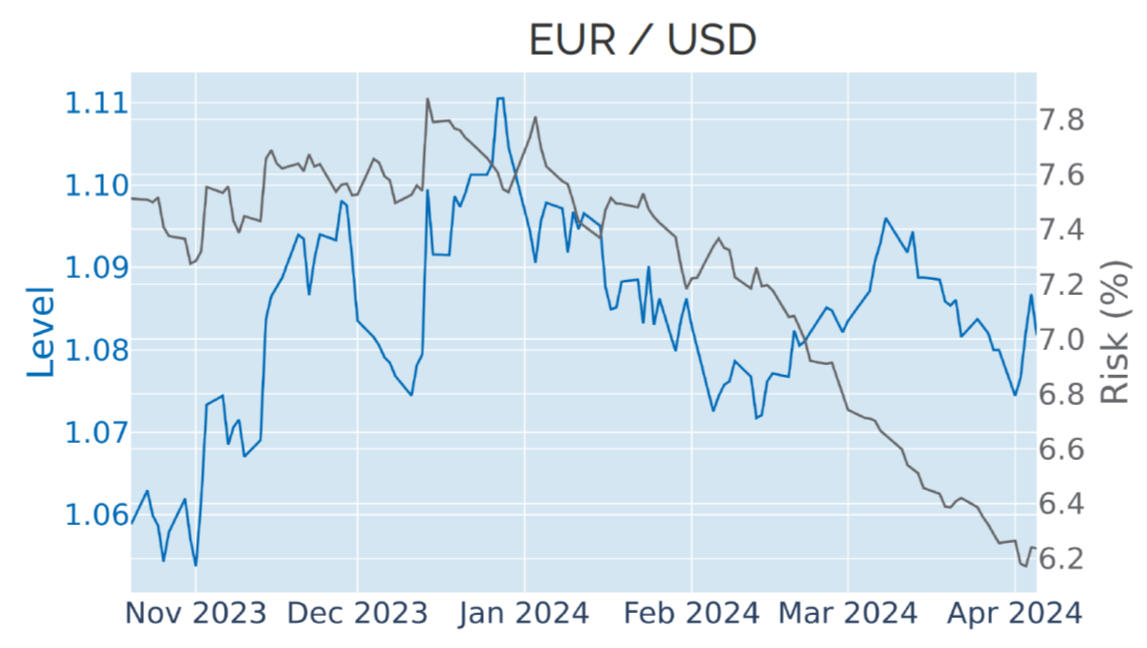

Dollar breaks positive correlation with monetary-policy expectations

The US dollar weakened slightly against a basket of major trading partners in the week ending April 5, 2024, despite a significant increase in interest rates and bond yields, seemingly breaking its hitherto close relationship with monetary policy expectations. Since the start of the year, the Dollar Index had appreciated nearly 4% to its most recent high on April 1, as short-term interest-rate traders priced out over 90 basis points worth of monetary easing by year end. Most of these gains were driven by the dollar leg of each underlying currency pair, as investors focused solely on the Federal Reserve, almost ignoring the actions of the other central banks. The most recent move was more mixed, however, with the euro rising 0.2%, while the pound, yen and Swiss franc all weakened. The single currency got a boost on Wednesday, as inflation for the Eurozone continued its downward trend, which should in turn enable the European Central Bank to start easing monetary conditions in June. Traders also stuck with their expectation that rate setters in Frankfurt would cut policy rates by up to 100 basis points by the end of the year, nearly twice as much as what is now priced in for the Fed.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated April 5, 2024) for further details.

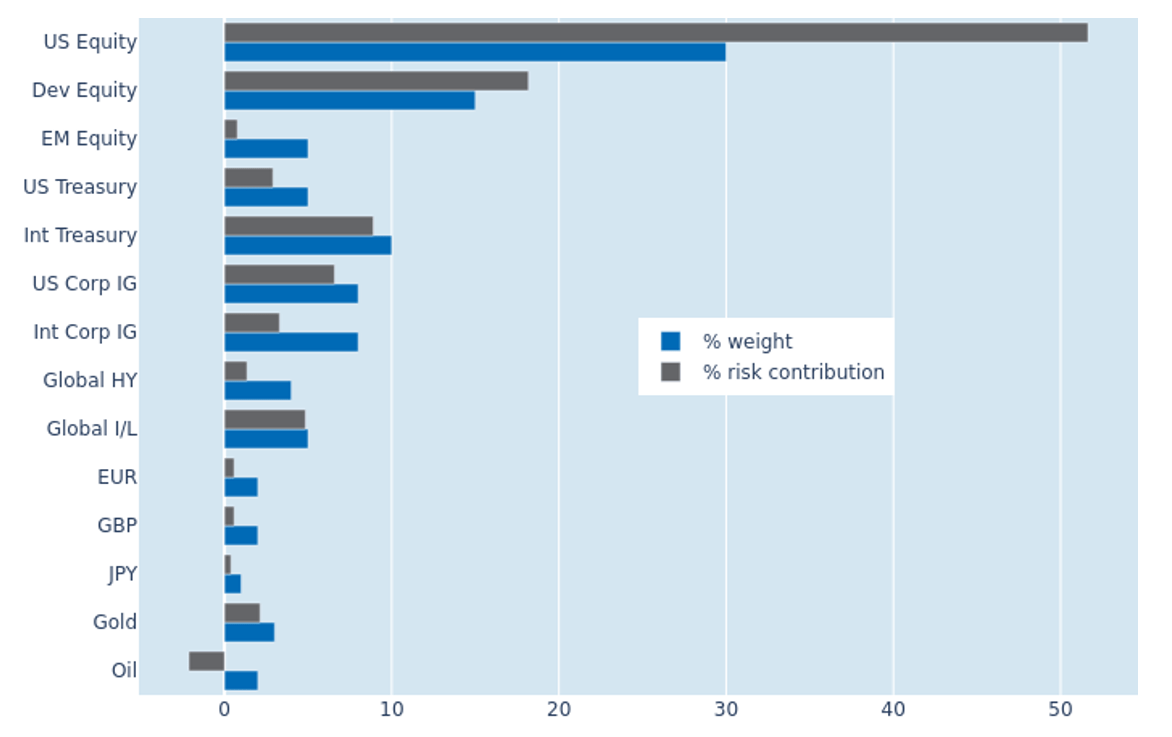

Inverse FX/equity relationship reduces portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio eased to 5.2% as of Friday, April 5, 2024, due to an increasingly inverse relationship between share prices and FX rates against the US dollar. The successive upward revisions in interest-rate expectations since the start of the year had supported the greenback, but left stock markets largely unaffected. This meant that local share-price gains were dampened by exchange-rate losses, making foreign investments appear less volatile for US-based investors. Most of the risk reduction was, therefore, recorded in the non-US developed and emerging-market equity buckets. The recent sharp rises in gold and oil prices also significantly shrunk the percentage risk contributions of the two commodities, with crude now actively reducing total portfolio volatility.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated April 5, 2024) for further details.