MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED APRIL 19, 2024

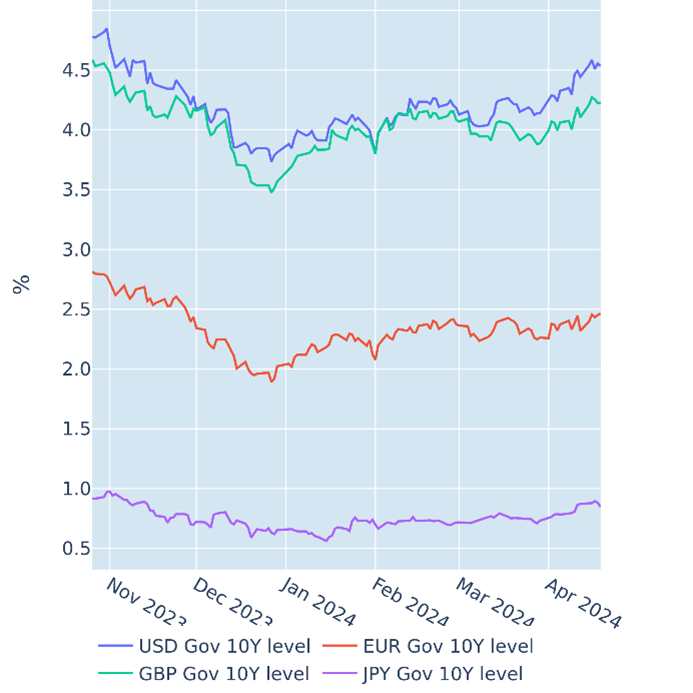

Strong retail sales and inflation boost yields and USD to 5-month highs

A third consecutive upward surprise in US inflation in the week ending April 12, 2024, led US interest-rates and bond traders to bury their last hopes of a June rate cut from the Federal Reserve. The Bureau of Labor Statistics reported on Wednesday that headline consumer prices grew by 3.5% in the twelve months ending in March, up from 3.4% the previous month and once more beating the consensus forecast of 3.4%. Core inflation also rose for the first time after eleven consecutive drops, as prices grew stronger this March than in the same month last year. The CME FedWatch Tool now only indicates a probability of less than 30% for a rate cut in June, down from an almost equal chance at the start of last week. The projected average fed funds rate for December also climbed from 4.76% to nearly 5% on the day the inflation numbers were released. The move was once again replicated along the entire US Treasury curve, lifting long-term yields to their highest levels since mid-November.

Please refer to Figure 5 of the current Multi-Asset Class Risk Monitor (dated April 19, 2024) for further details.

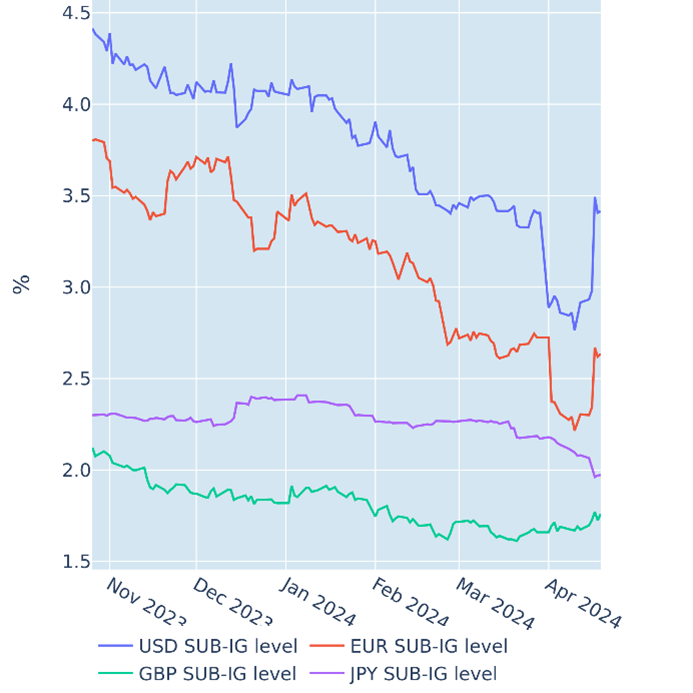

Ongoing stock-market losses blow up credit spreads

Three weekly stock-market losses in a row in the US and continental European pushed risk premia on USD-denominated high yield bonds to their widest margins in more than five weeks. Initially, equity and credit investors appeared remarkably insensitive to the revisions in monetary-policy expectations following the first two upward surprises in US inflation released in February and March. However, after the most recent consumer-price data published two weeks ago, the realization that the Federal Reserve may not be in a hurry to ease monetary conditions anytime soon seems to finally have sunk in. If inflation keeps surprising on the upside, even a rate hike is, in our opinion, no longer completely off the cards.

Please refer to Figure 5 of the current

Multi-Asset Class Risk Monitor (dated April 19, 2024) for further details.

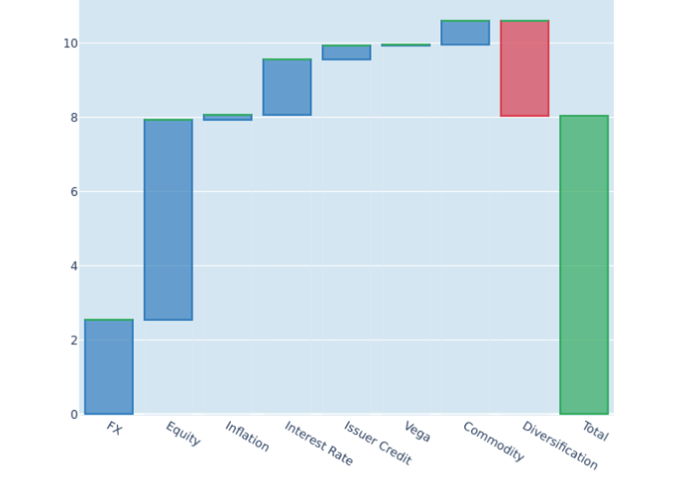

Continued cross-asset sell-off squeezes portfolio diversification

The predicted short-term risk of the Axioma global multi-asset class model portfolio skyrocketed from 5.9% to 8% as of Friday, April 19, 2024, fueled by a third consecutive combined weekly sell-off in stocks and bonds, which was once again aggravated by a strengthening dollar. Most of the risk expansion occurred in the three equity buckets, which saw their combined share of total portfolio volatility expand from 60.7% to 72.1%. Holding commodities offered the best chances of reaping whatever diversification opportunities were left, as both oil and gold continued to buck the trend and increased in value. Investing in gold even actively reduced total risk, with the price of the precious metal ascending to all-time highs.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated April 19, 2024) for further details.