MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED APRIL 26, 2024

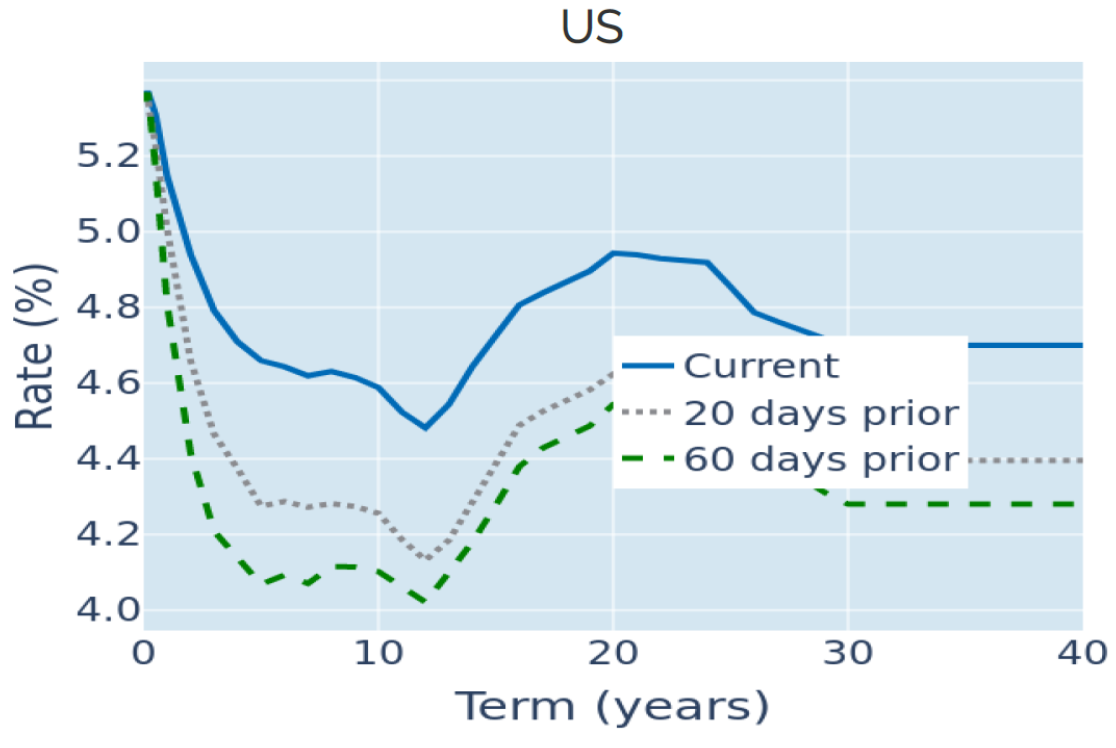

Yet another inflation surprise pushes Treasury yields to 5-month high

Long-term US Treasury yields climbed to their highest levels since November last year in the week ending April 26, 2024, following yet another upward surprise in consumer-price inflation. The reported 2.8% growth in core personal consumption expenditure—the Federal Reserve’s preferred measure of underlying price pressures—once again beat analyst predictions of 2.6% for the twelve months ending in March, even though market participants had already been caught off guard by the strong CPI readings for the same period two weeks earlier. Short-term interest-rate futures markets now predict an average federal funds rate of 5.05% for the month of December, which is only 28 basis points lower than the current effective rate of 5.33%. The first FOMC meeting with a slightly better than even chance (~57%) of a rate cut is September 18, and a probability of just under 70% is predicted for the subsequent one in early November.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated April 26, 2024) for further details.

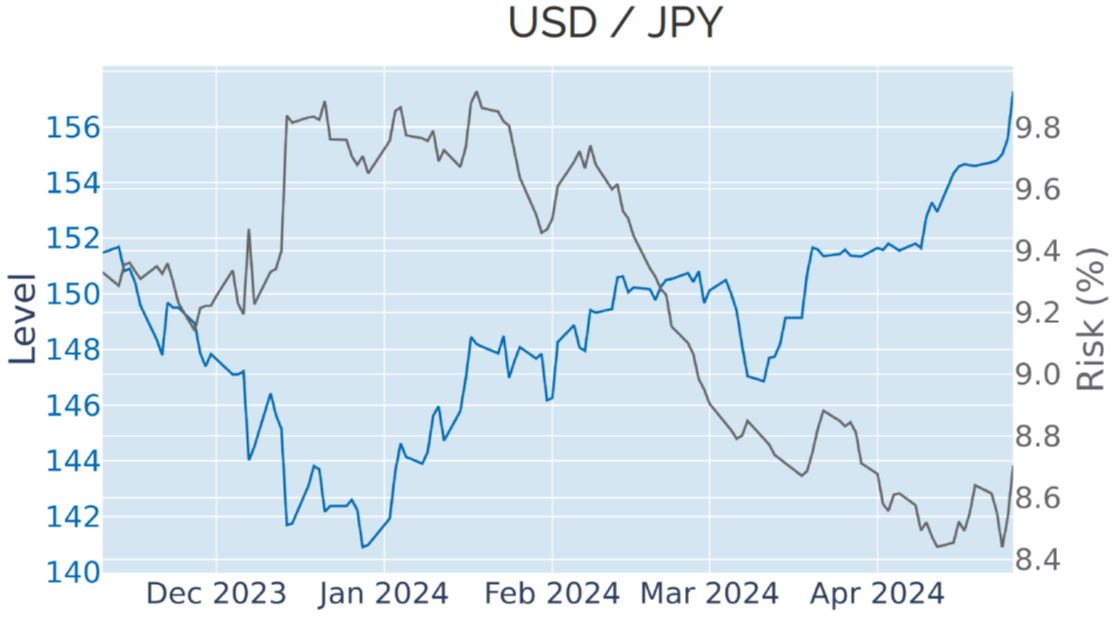

Unconcerned Bank of Japan lets yen tumble to 34-year low

The Japanese yen plummeted to a 34-year low against the US dollar on April 26, 2024, as the Bank of Japan defied market expectations of a further tightening in monetary conditions and left its benchmark interest rates unchanged. In the accompanying press conference, Governor Kazuo Ueda noted that the bank saw no immediate need to act , as weaker exchange rates have so far had “no major impact” on inflation. However, ongoing upward revisions in US monetary-policy expectations are likely to support the greenback even further to the point that the Japan’s finance ministry could eventually intervene. In fact, the yen’s rebound at the start of this week triggered speculation that this might already be happening.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated April 26, 2024) for further details.

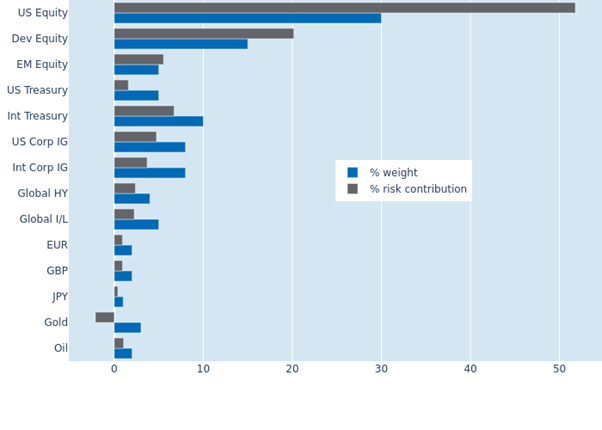

Weaker stock-bond correlation reduces portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio eased to 7.6% as of Friday, April 26, 2024, down from 8% the week before. Last week’s recovery in global stock markets while bond yields continued to rise meant that the two asset classes appeared less—though still positively—correlated. That being said, the risk reduction was mostly limited to the fixed income portion of the portfolio, whereas the three equity buckets saw their combined share of total portfolio volatility expand even further from 72.1% to 77.4%, due to the stronger fluctuations in share prices. Gold, on the other hand, enhanced its risk-diversifying properties, more than doubling its percentage risk reduction from -1% to -2.1%, thanks to a yet more inverse relationship with equities.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated April 26, 2024) for further details.