MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED MAY 3, 2024

Cooling US jobs market boosts stocks and bonds alike

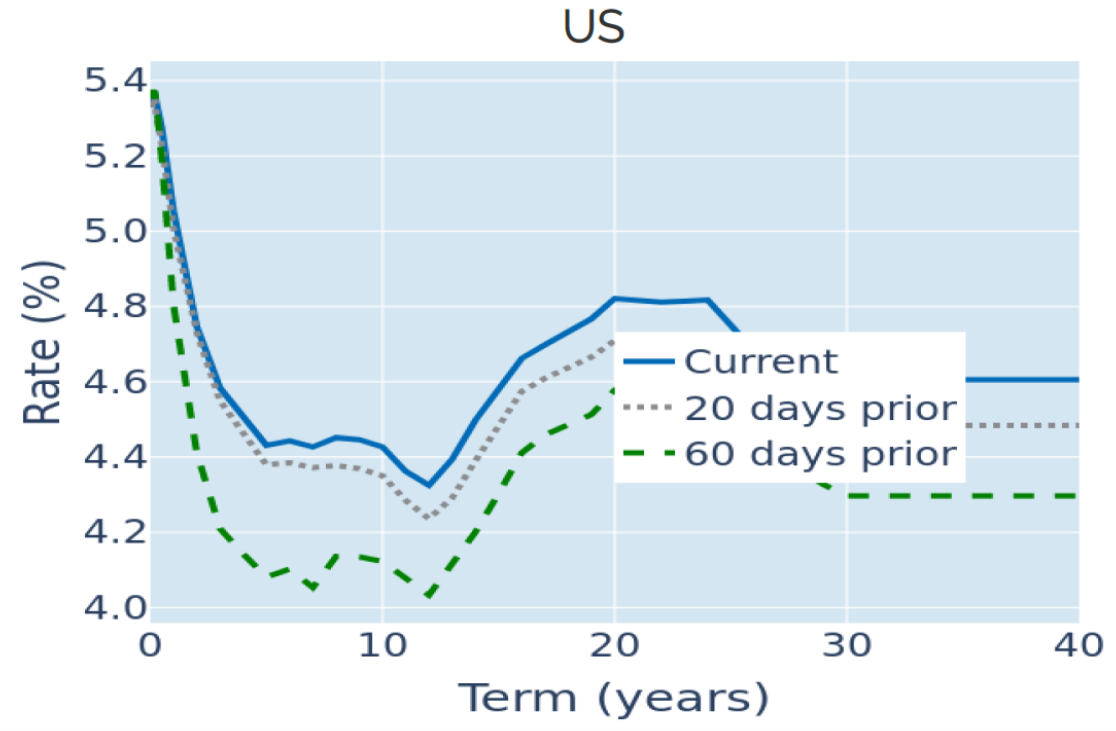

US stock and bond markets rallied together in the week ending May 3, 2024, on the back of weaker-than-anticipated jobs figures, which were expected to increase the probability that the Federal Reserve could ease monetary conditions sooner rather than later. The non-farm payroll report released on Friday showed that the American economy created 175,000 new positions in April, down from an upwardly revised 315,000 jobs added the month before and significantly undershooting the consensus forecast of 243,000. In response, short-term interest-rate futures markets raised their implied probability for a Fed rate cut in September by 10 percentage points to 67%, while the projected average effective fed funds rate for December fell 0.1% to 4.95%. Yield decreases were even more pronounced further down the Treasury curve, with the 2-year and 10-year rates falling by 19 and 16 basis points, respectively.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated May 3, 2024) for further details.

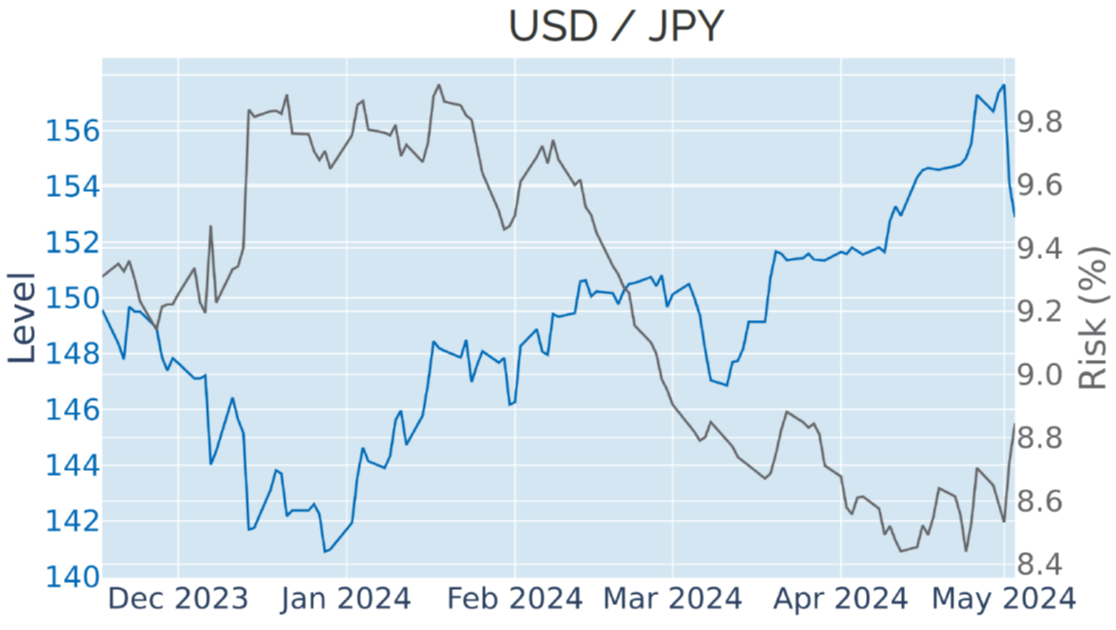

Yen rebounds as intervention rumors substantiate

The yen regained 3% against the US dollar in the week ending May 3, 2024, amid growing evidence that Japanese authorities had indeed intervened in foreign-exchange markets to prop up the ailing currency from its recent 34-year lows. The Bank of Japan all but confirmed the action by the ministry of finance when it published a daily current account balance for Tuesday that diverged by roughly $35bn from brokers’ forecasts. The fact that all other G10 currencies hardly moved against the greenback on that day could be seen as further proof that the underlying driver was specific to the yen.

That being said, the dollar did weaken overall as well last week—by 1% on average against its major trading partners—on the back of the lower interest-rate expectations.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated May 3, 2024) for further details.

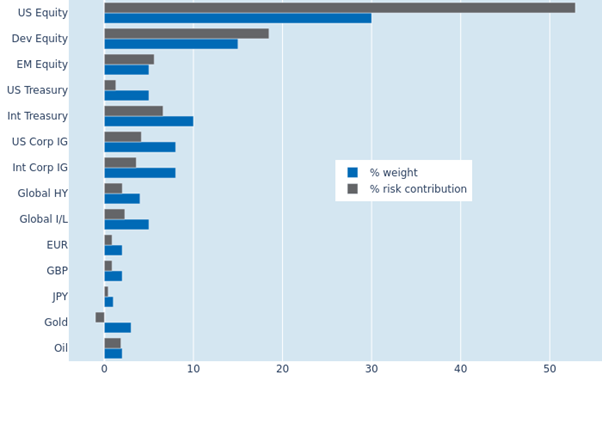

Cross-market recovery further reduces portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio eased by another 0.6% to 7% as of Friday, May 3, 2024, as most asset classes in the portfolio recovered on the back of lower monetary-policy expectations. Share prices in the US and the UK rose for a second consecutive week, while sovereign yields declined in all regions. The weakening dollar also led to gains across all major currencies, with predicted volatilities for the euro and the pound falling to their lowest levels since before the Silicon Valley Bank default in March 2022. Non-US developed equities were the biggest beneficiaries of this combination of lower exchange-rate and share-price volatilities, seeing their share of total portfolio risk shrink from 20.1% to 18.5%. Holding gold still provided some notable diversification benefits, though to a lesser extent than before, as the precious metal eased off its recent record highs.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated May 3, 2024) for further details.