MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED MAY 24, 2024

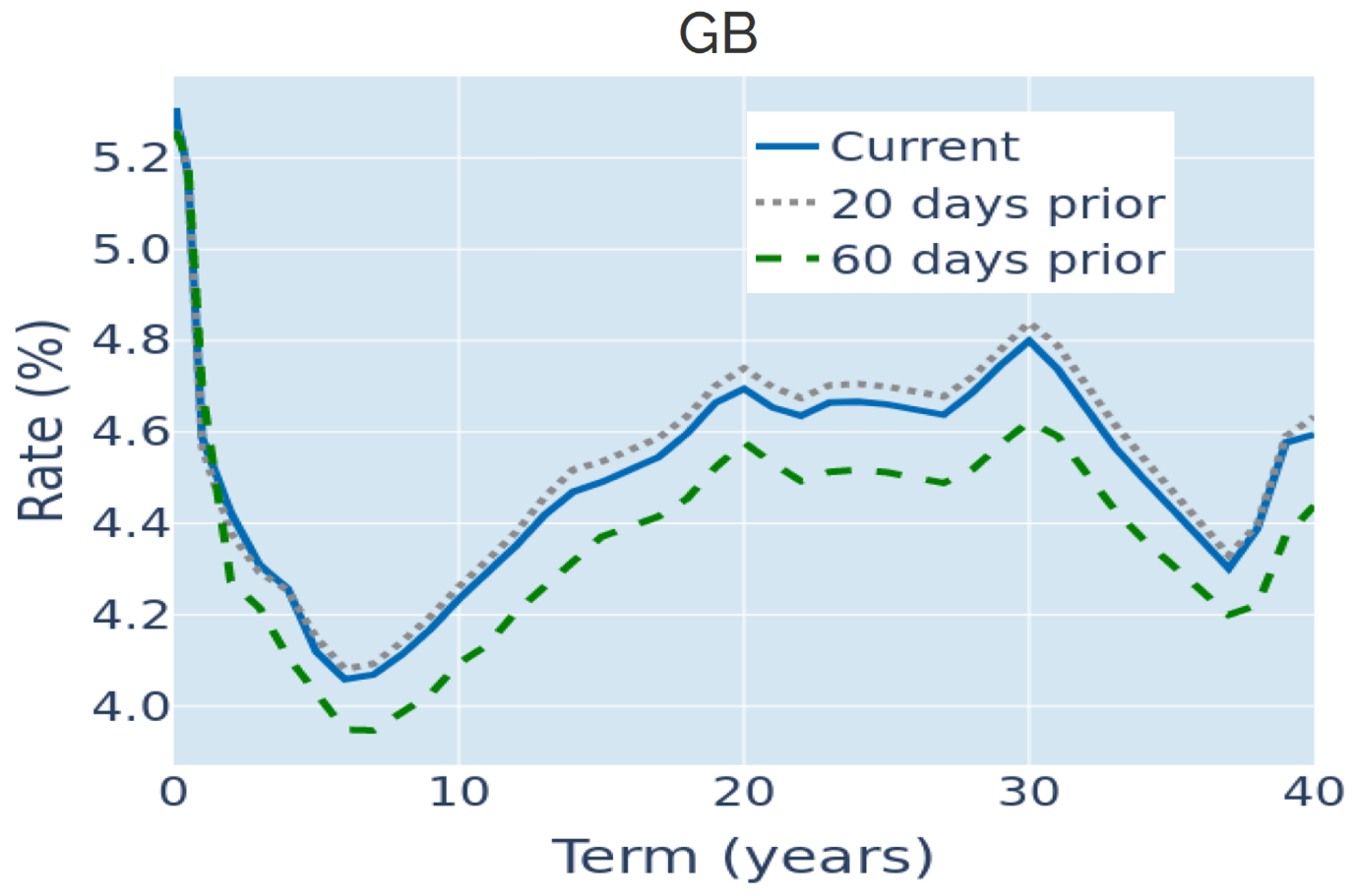

Higher-than-expected UK inflation quashes June BoE cut hopes

Investors all but abandoned hopes of a June rate cut from the Bank of England (BoE) in the week ending May 24, 2024, following yet another upward surprise in inflation numbers. The Office of National Statistics reported on Wednesday that annual headline consumer-price growth had fallen from 3.2% to 2.3% in April, bringing it within reach of the Bank’s 2% target for the first time since 2021. However, market participants had expected a much bigger drop to 2.1%. Core inflation, which excluded the beneficial effect from the lower household energy cap, also outstripped analyst predictions of 3.6%, coming in at 3.9% instead. More importantly, the monthly core price change of 0.9% is more than five times higher than the average month-over-month growth rate of 0.17% that would be consistent with annual inflation of 2%. BoE Governor Andrew Bailey had also predicted a much bigger drop in inflation in a lecture at the London School of Economics on Monday, seemingly substantiating speculation about a potential rate cut in June, to which short-term interest-rate (STIR) traders assigned about a 50% probability at the time. But this was quickly reduced to a one in six chance following Wednesday's inflation release. The monetary policy-sensitive 2-year Gilt yield soared by nearly 20 basis points as a result, while longer rates climbed by 10-12 basis points.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated May 24, 2024) for further details.

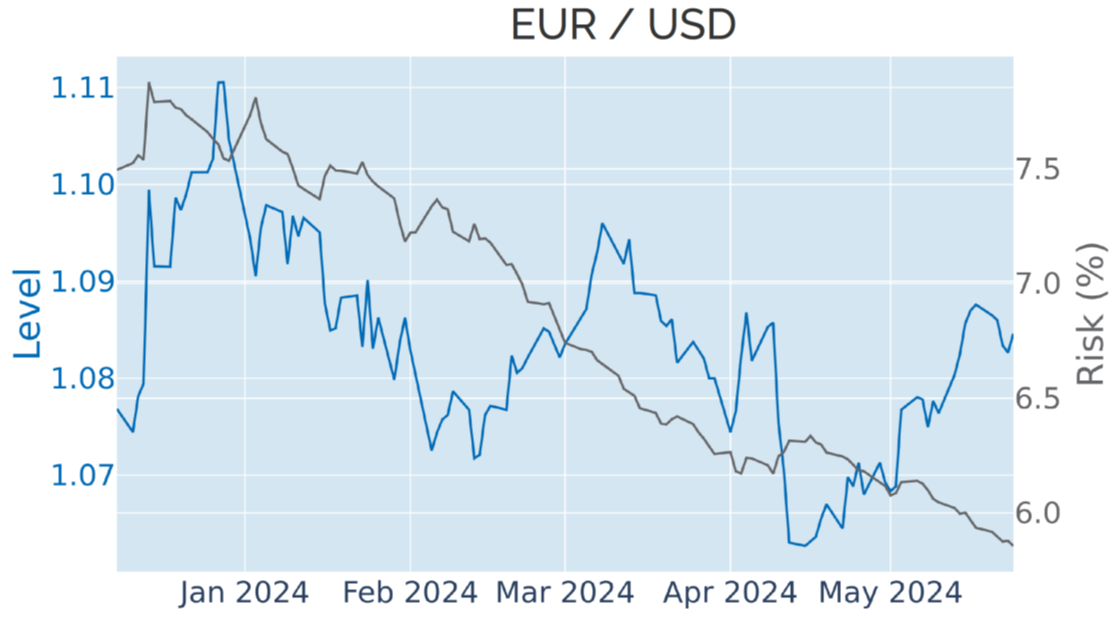

Possible Fed hike supports the dollar

The dollar recovered some of its recent losses against a basket of major trading partners in the week ending May 24, 2024, as the latest Federal Open Market Committee meeting minutes revealed that participants had “mentioned a willingness to tighten policy further should risks to inflation materialize in a way that such an action became appropriate.” In response, the futures-implied average federal funds rate predicted for December rose to 5.08%, which is only 25 basis points below the current effective rate.

That being said, the greenback’s performance was not homogenous against all its biggest rivals. For example, the pound actually strengthened by 0.3% on the back of the latest upward revision in UK inflation and monetary-policy projections. The European Central Bank, on the other hand, is still expected to ease borrowing conditions at its upcoming meeting on June 6, depressing the euro by 0.3%.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated May 24, 2024) for further details.

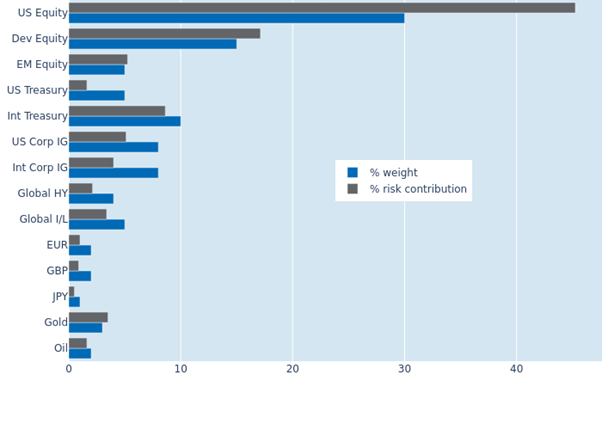

Lower equity volatility reduces portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio eased from 8.3% to 8% as of Friday, May 24, 2024, mostly on the back of lower equity volatility. It was therefore predominantly the stock holdings in the portfolio that saw their combined share of total portfolio risk tighten from 70.8% to 67.7%. The percentage risk contribution of gold, on the other hand, almost tripled from 1.2% to 3.5%, as higher interest rates made non-yielding assets, such as precious metal, less attractive. Oil experienced a similar increase in its volatility contribution from 0.5% to 1.6%, but this was due to a stronger co-movement with share prices, while its own standalone volatility remained relatively stable.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated May 24, 2024) for further details.