MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED JUNE 4, 2024

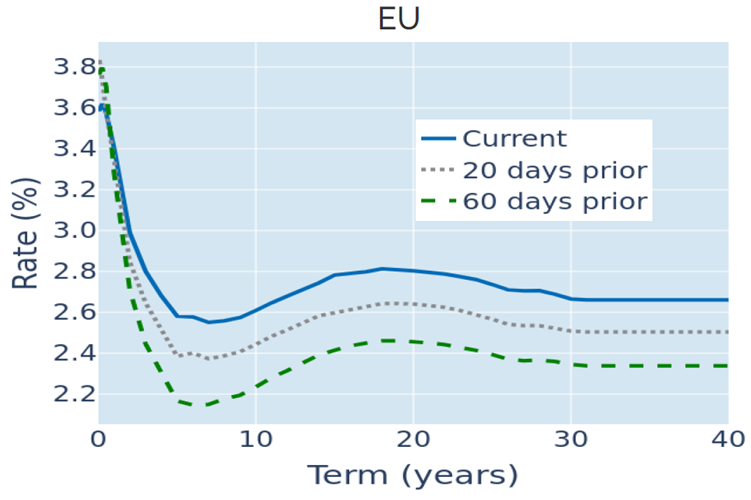

Accelerating Eurozone inflation boosts Bund yields to 6-month highs

Eurozone sovereign yields climbed to their highest levels in six months in the week ending May 31, 2024, as inflation for the region appeared to have accelerated more than market participants had anticipated. Eurostat estimated on Wednesday that consumer prices in the common-currency area rose by 2.6% in the twelve months to the end of May, up from 2.4% the previous month and beating analyst predictions of 2.5%. Core CPI growth at 2.9% also came in higher than the consensus forecast of 2.8%, ending the previous 9-month streak of slowing year-over-year rates and steering inflation away from the European Central Bank’s 2% target. That being said, long-term inflation expectations remained anchored just above 2%, which meant that 10-year real rate expanded to over 0.5%—its widest since the peak in Bund yields at the end of October last year.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated May 31, 2024) for further details.

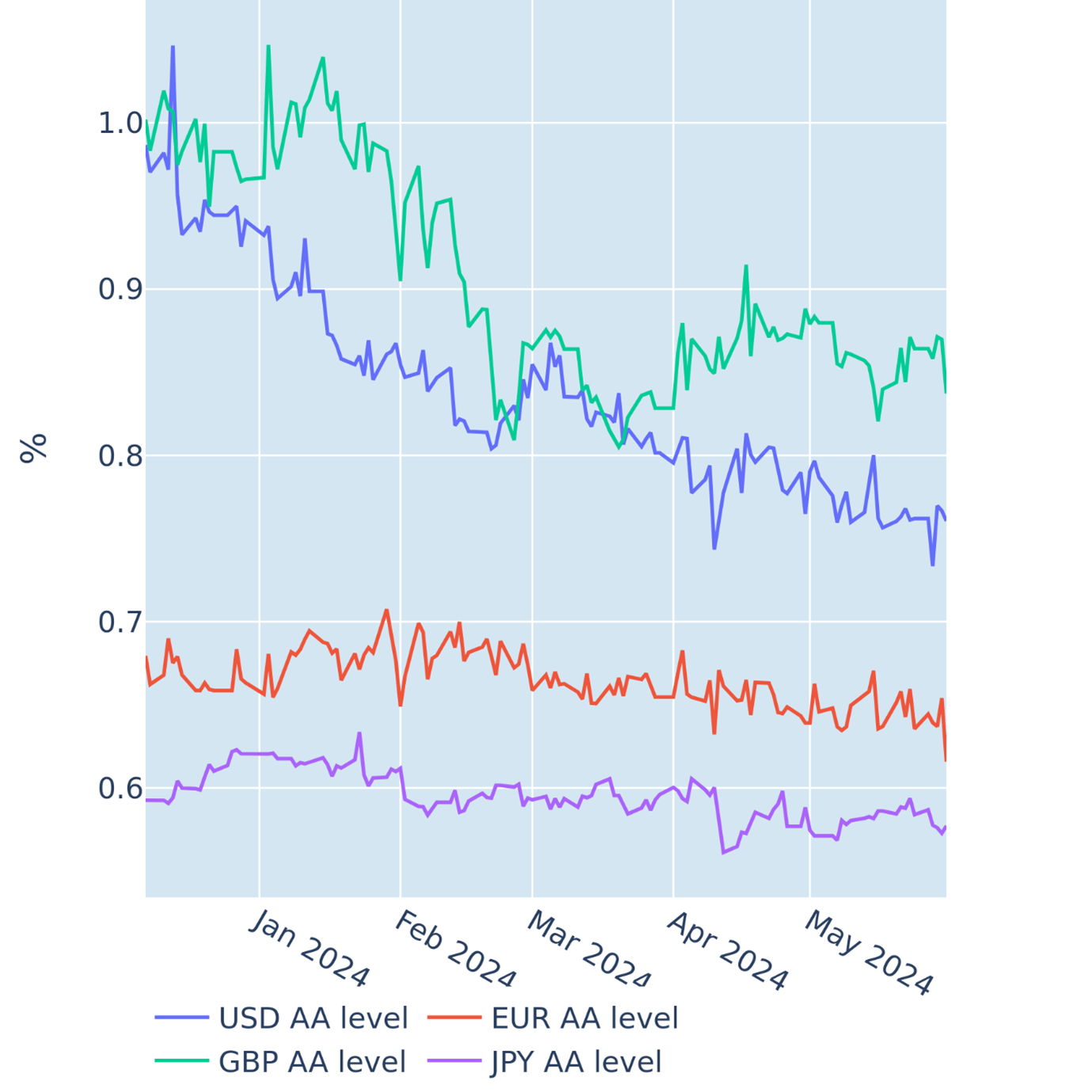

Euro corporates buck stock selloff as risk premia continue to fall

Risk premia on high-quality EUR-denominated corporate over sovereign bonds fell to their tightest levels since mid-October in the week ending May 31, 2024, despite the latest resurgence in inflation. They also bucked the ongoing selloff in the stock market, where the EURO STOXX 50 index booked a third consecutive weekly loss. Credit spreads have been on a steady downward trend since the start of the year, softening the blow from higher risk-free rates. High yield bonds overall are even up year-to-date—compared with a negative return for government bonds—as the tightening in yield premia for lower-rated debt more than offset the increase in sovereign yields.

Please refer to Figure 5 of the current Multi-Asset Class Risk Monitor (dated May 31, 2024) for further details.

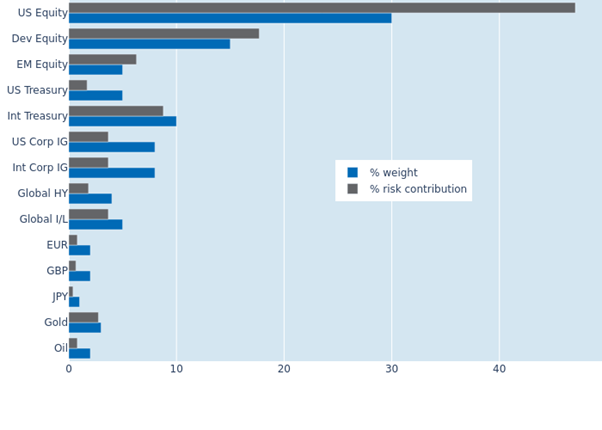

Lower FX volatility and tighter credit spreads reduce portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio fell another 0.4% to 7.6% as of Friday, May 31, 2024, as the benefits of lower exchange-rate volatility and tighter credit spreads outweighed the adverse effects of stronger share-price fluctuations. USD-denominated investment grade corporates experienced the biggest decline in their percentage risk contributions from 5.2% to 3.7%, while the effect was somewhat muted for their international counterparts, due to the still significant positive correlation of exchange rates against the dollar and local stock-market returns. The three equity buckets, on the other hand, saw their combined share of total portfolio volatility expand from 67.6% to 71.2%, with US stocks being by far the riskiest asset class relative to its market-value weight.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated May 31, 2024) for further details.