MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED JUNE 14, 2024

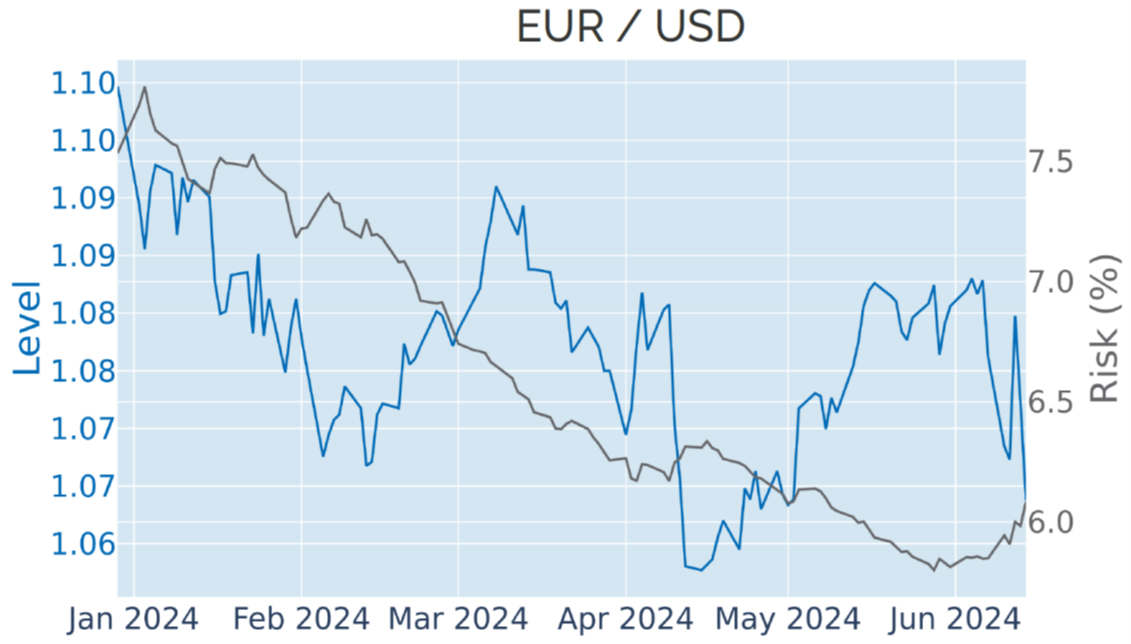

French stocks, bonds, and euro tumble after election announcement

The euro suffered its worst weekly return in two months in the week ending June 14, 2024, after French President Emmanuel Macron called a surprise parliamentary election, following the defeat of his party by the right-wing populist National Rally in the European elections on June 6. The drop in the common currency was accompanied by a surge in the yield premia of French government bonds over their German counterparts. The OAT-Bund spreads soared from under 0.5% to almost 80 basis points—its highest level since February 2017, when Marine Le Pen extended her lead over Macron in the opinion polls for the impending presidential election.

The French stock market also recorded its worst weekly drawdown since early March 2022, which happened to be a runup for a presidential election as well but was also the time when markets came to terms with the Russian invasion of Ukraine the month before. Banks have been bearing the brunt of the losses—both in the historic periods of widening sovereign risk premia but also in the current environment—as they tend to hold substantial amounts of (domestic) government debt.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated June 14, 2024) for further details.

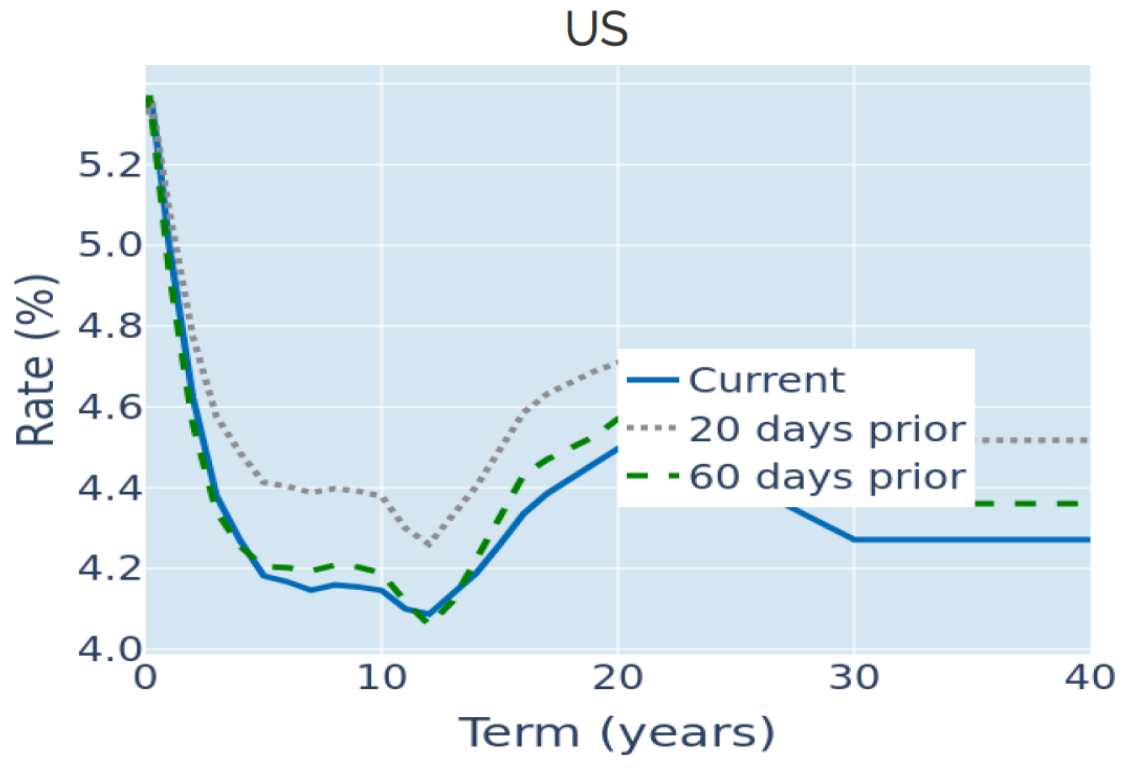

Easing US inflation raises Fed rate cut hopes

US inflation decelerated to 3.3% in May, raising hopes that the Federal Reserve may ease monetary conditions by more than one rate cut before the end of the year. The month-over-month growth in headline consumer prices fell to 0.17%, which is exactly the average monthly rate that is required for an annual inflation of 2%. Core price growth was only marginally stronger at 0.2% last month. In response, short-term interest-rate traders raised the implied probability of rates being 50 basis points lower at the end of December from 66% at the start of the week to 83% on Friday.

The updated dot plot, which was released later on Wednesday, showed that FOMC members were also equally split between one and two rate cuts, with seven participants expecting the former and eight the latter. The remaining four rate setters on the 19-member committee anticipated no change. However, Fed officials would not have been aware of the latest inflation numbers when submitting their forecasts, which were based on the expectation that core PCE inflation for the whole year would be 2.8% (revised upward from 2.6% three months earlier).

Treasury yields plummeted across all maturities, falling between 20 and 25 basis points to their lowest levels since early April.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated June 14, 2024) for further details.

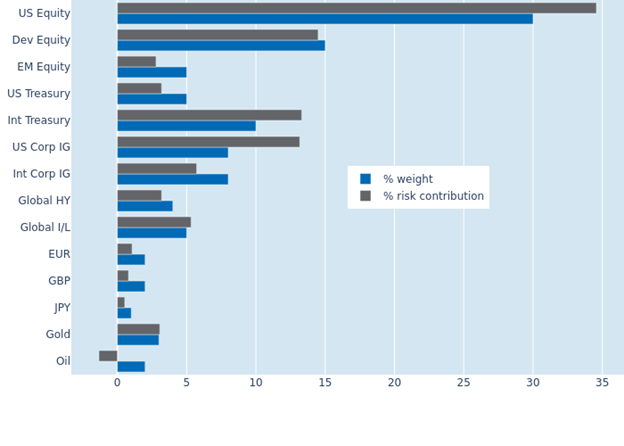

Stronger FX and rate fluctuations outweigh lower equity volatility

The predicted short-term risk of the Axioma global multi-asset class model portfolio was marginally higher at 7.5% on Friday, June 14, 2024, as the benefit of lower stock-market volatility was outweighed by stronger fluctuations in FX and interest rates. As a result of the latter, non-USD sovereign and investment grade corporate bonds saw their percentage risk contributions rise by 3.2% and 1.6%, respectively. US corporates also expanded their share of total portfolio volatility from 9.4% to 13.2%, due to the strong co-movement of credit spreads and risk-free rates. The volatility contribution from US equities, on the other hand, plummeted from 41.6% to 34.6%. Oil, meanwhile, continued to actively reduce overall risk, as its price remained inversely correlated with exchange rates against the US dollar and the returns of sovereign bonds.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated June 14, 2024) for further details.