MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED JULY 12, 2024

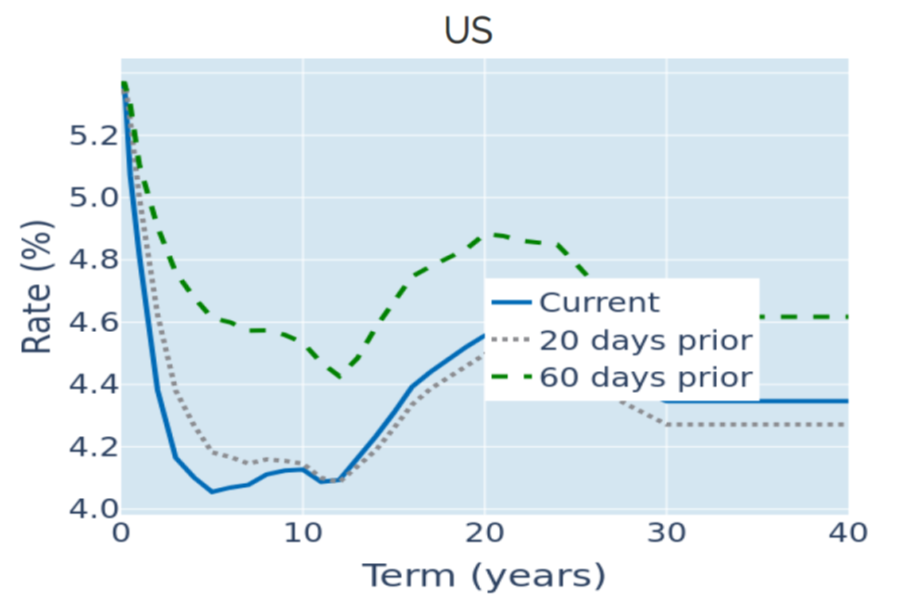

Tame US inflation pushes yields to 5-month low

Short-term borrowing costs for the US government fell to their lowest levels in five months in the week ending July 12, 2024, as consumer prices grew less than anticipated by most economists. Headline inflation fell to 3% for the first time since June 2023—beating analyst predictions of 3.1%—while core price growth continued to decelerate to 3.3%. More importantly, the average month-over-month change in the second quarter was only 0.2% (which equates to an annualized inflation rate of 2.4%), compared with over 0.5% in each of the first three months of this year (6.8% p.a.). Yet, the 1.7% core price increase in Q1 2024 also means that year-over-year inflation is unlikely to fall below 3% before early next year, even if monthly changes remain as modest as they have been over the past three months.

Nevertheless, short-term interest-rate traders raised the probability of a Fed rate cut in September to 96%, up from a three in four chance the week before. The projected average effective federal funds rate for December also fell from 4.93% to 4.83%, which is 50 basis points lower than the current level.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated July 12, 2024) for further details.

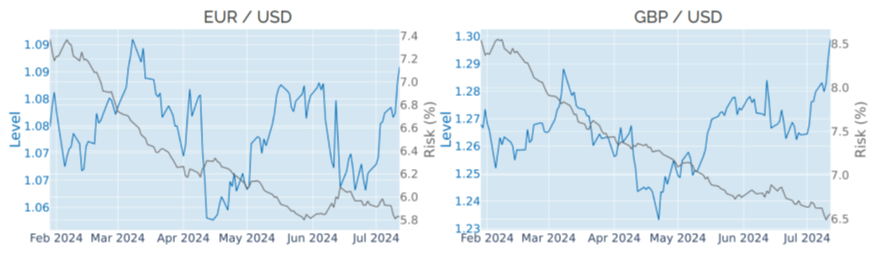

European currencies recover from pre-election lows

The euro and the pound both recovered from their recent pre-election lows at the end of June, each recording two weeks of strong gains against the US dollar. The EUR/USD exchange rate rose 1% in the week following the first round of the French legislative election on June 30—mimicking the concurrent recoveries of the country’s stock and bond markets—before adding another 0.8% the week after. The appreciation was even more pronounced for GBP/USD, which soared by a total of 2.8% over the same period. That said, large parts of both moves were likely due to a general weakness in the dollar, fueled by the recent downward revision in US monetary policy expectations.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated July 12, 2024) for further details.

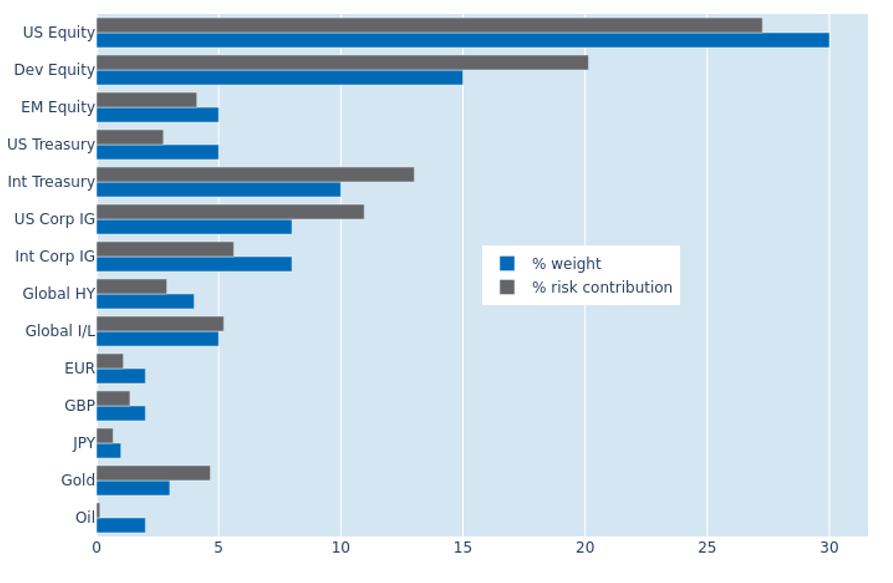

Renewed focus on inflation and rates raises portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio resurged to 7.3% as of July 12, 2024, up almost two percentage points compared to the end of June. The increase was primarily due to stronger cross-asset correlations, driven by the drop in inflation and monetary-policy expectations, which benefitted stocks, bonds and foreign currencies against the US dollar alike. At the same time, credit-spread returns also became more closely related to most other asset classes, adding further to total portfolio volatility. USD-denominated investment grade corporate bonds experienced the biggest increase in their percentage risk contribution from 7.3% to 11%, followed by a 1.7% surge for non-US sovereign debt. US equities, on the other hand, saw their share of overall volatility plummet from 38.4% to 27.3%, which means that they now contribute less than their monetary weight of 30%.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated July 12, 2024) for further details.