MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED JULY 19, 2024

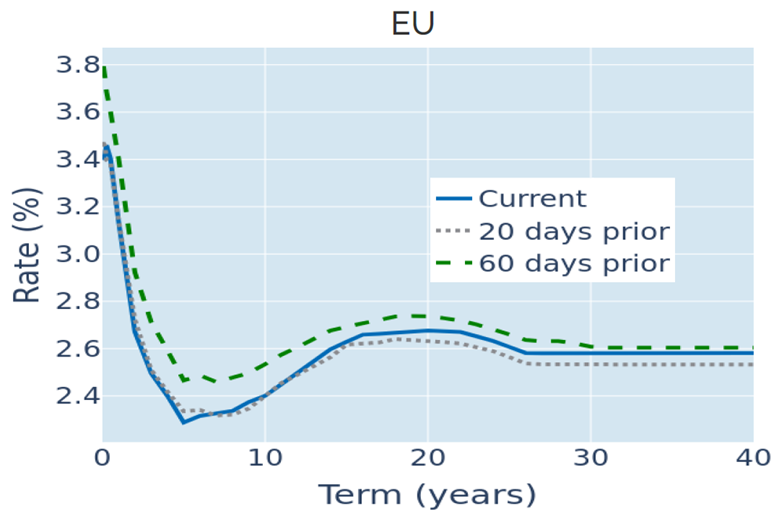

Euro STIR traders remain unfazed by cautious ECB

Eurozone short-term borrowing rates fell to their lowest levels since February in the week ending July 19, 2024, as markets continued to bet on further rate cuts despite the European Central Bank keeping its deposit facility rate (DFR) unchanged at 3.75% on Thursday and leaving its options for its next meeting “wide open.” The bank’s latest survey of monetary analysts showed that respondents still assigned a 75% probability to a rate cut in September and that they expected the DFR to have been lowered to 3.25% by year end. The German Bund curve steepened slightly, with the 2-year rate falling 0.08%, while longer yields eased between 2 and 3 basis points.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated July 19, 2024) for further details.

Higher inflation and rate expectations support the pound

The pound sterling climbed above $1.30 for the first time in 12 months last Wednesday, as stickier-than-expected inflation dented hopes that the Bank of England will cut interest rates at its upcoming meeting on August 1. Data from the Office of National Statistics showed that headline consumer prices grew by 2% in the 12 months to June, in line with BoE’s target, but slightly higher than the consensus prediction of 1.9%. Services inflation remained a major upward force at 5.7% but was partly offset by falling petrol prices and easing food price growth. This meant that core prices grew at a much faster pace of 3.5% per annum.

Short Gilt yields still fell by 5-8 basis points, emulating their continental European peers, but longer maturities ended the week marginally in the black.

Please refer to Figures 3 & 6 of the current Multi-Asset Class Risk Monitor (dated July 19, 2024) for further details.

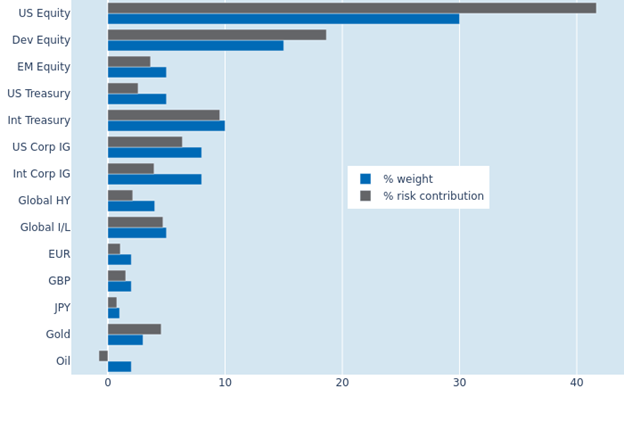

Credit spreads decouple from other factors, reducing portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio eased from 7.3% to 6.6% as of Friday, July 19, 2024, as a weaker co-movement of credit returns with FX rates, share prices, and government bonds offset the adverse effect of stronger equity volatility. The impact of the former was most notable for USD-denominated investment grade corporates, which saw their share of total portfolio risk plummet from 11% to 6.3%. Non-US sovereigns also benefitted from a lower correlation with both credit instruments and stocks, as their percentage risk contribution shrank by 3.5% to 9.5%. US equities, meanwhile, became riskier once more, as their standalone volatility soared from 8% to 11%, boosting their contribution to total risk from 27.3% to 41.6%.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated July 19, 2024) for further details.