MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED AUGUST 2, 2024

Weak US labor market fuels rate-cut expectations

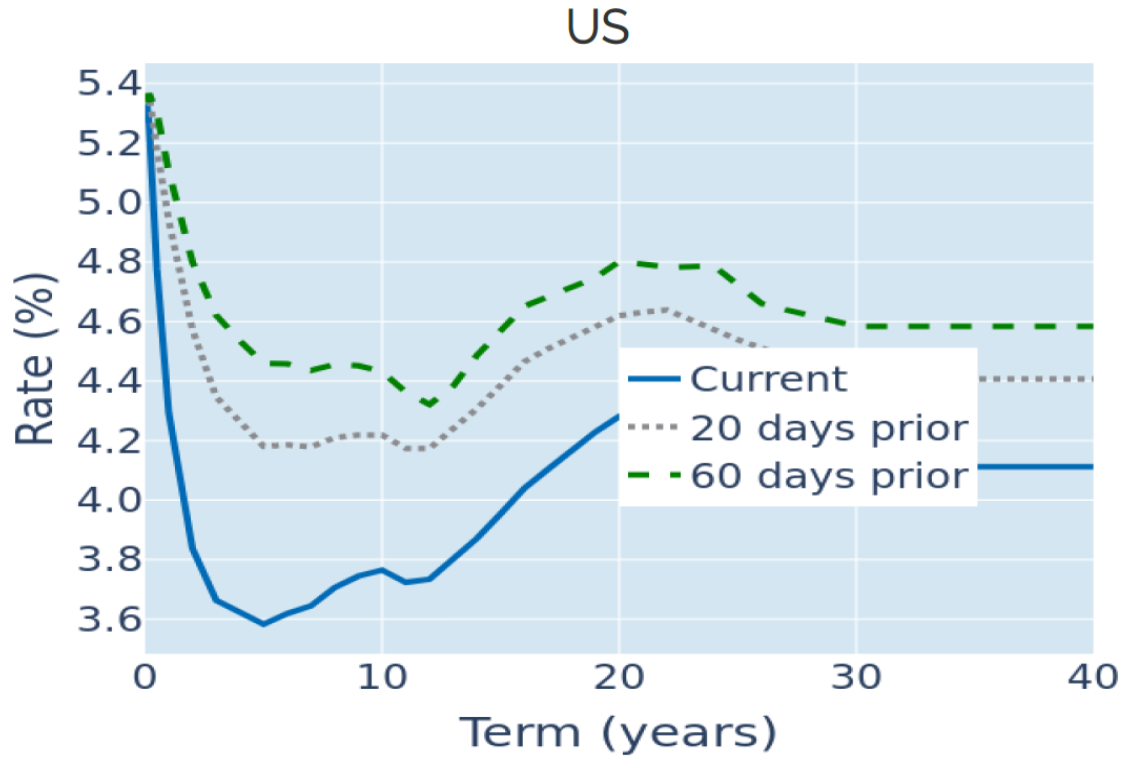

US Treasury yields recorded their biggest weekly drop since the onset of the COVID pandemic in the week ending August 2, 2024, following a weaker-than-expected employment report. The Bureau of Labor Statistics announced on Friday that the American economy added 114,000 jobs in July, which was well below the consensus projection of 179,000. The previous month’s number was also revised downward from 206,000 to 179,000, while the published unemployment rate of 4.3% exceeded analyst predictions of 4.1%.

The monetary policy-sensitive 2-year rate plummeted over 50 basis points to its lowest level since May 2023, as traders raised their rate cut expectations for the remainder of the year by a similar amount. According to the CME FedWatch tool, market participants now firmly anticipate a 0.5% cut at the September 18 FOMC meeting, possibly followed by a similar-size step in November. There is even a probability of around 70% that the Fed may have eased by at least 125 basis points by the year end.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated August 2, 2024) for further details.

Currencies deviate over diverging monetary policies

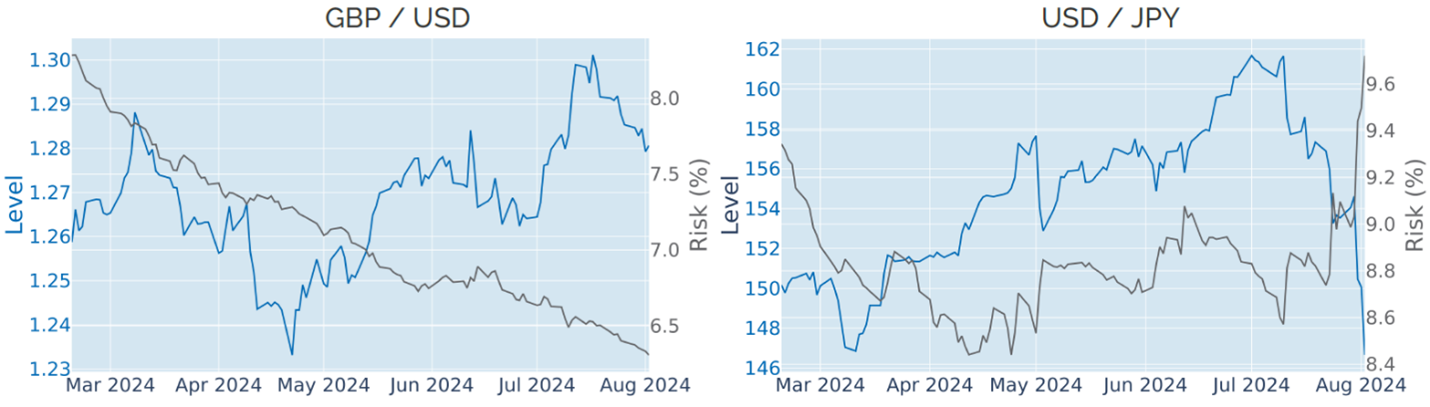

The pound sterling depreciated almost half a percent against the US dollar following the Bank of England’s rate cut last week. In a “finely balanced” decision, five of the nine Monetary Policy Committee members voted to reduce restrictiveness, citing “some progress in moderating risks of persistence in inflation.” The remaining rate setters’ preference to maintain a contractionary stance reflected concerns about the persistent strength of services inflation alongside elevated wage growth.

Meanwhile, the yen soared to a six-month high after the Bank of Japan raised its short-term policy rate from 0-0.1% to 0.25%, bucking the trend of easing monetary conditions in the rest of the developed world. BoJ Governor Kazuo Ueda remarked that the decision was mostly driven by economic considerations but acknowledged that the recent weakening of the yen to four-decade lows—though a boon for exporters—posed a major upside risk factor to consumer price growth.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated August 2, 2024) for further details.

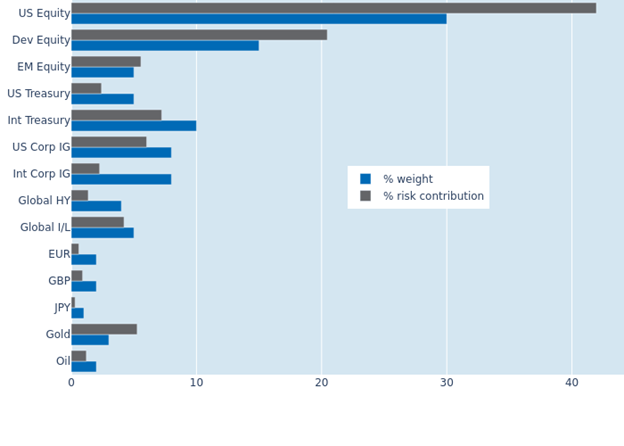

Decoupling FX rates offset stronger equity volatility

The predicted short-term risk of the Axioma global multi-asset class model portfolio remained stable at 6.7% as of Friday, August 2, 2024, as the adverse effect of stronger equity volatility was offset by a decoupling of exchange rates against the US dollar. Non-USD-denominated sovereign and corporate bonds were the biggest beneficiaries, seeing their percentage risk contributions drop by 2.3% and 1.6%, respectively. Oil, on the other hand, once more added to total portfolio risk, as its correlation with share prices showed signs of turning positive again.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated August 2, 2024) for further details.