MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED AUGUST 9, 2024

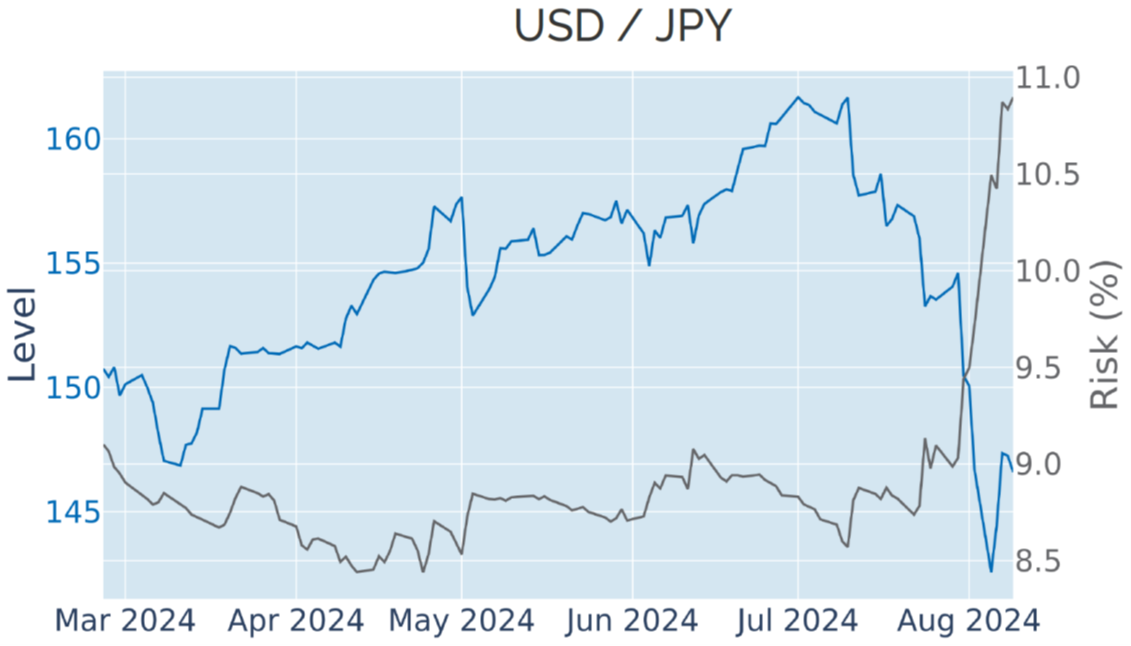

Carry trade unwind boosts yen volatility

The unwinding of carry trades and the accompanying surge of the yen in the week ending August 9, 2024, boosted predicted short-term volatility for JPY/USD to its highest level since May 2023, making the yen the riskiest G10 currency. The popular cross-currency strategy, in which investors borrow cheaply in JPY to invest in markets with higher yields, had been gaining momentum over the past two years, as central banks around the world aggressively tightened monetary conditions, while the Bank of Japan (BoJ) kept interest rates near zero. With the BoJ now finally raising rates and markets pricing in more forceful easing from the Fed, the narrowing of the interest rate differential makes this trade less attractive. Meanwhile, the strengthening yen—partly as an effect of higher rates—further eats into the shrinking return margin, as borrowers will need to put down more foreign currency to repay their Japanese debts.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated August 9, 2024) for further details.

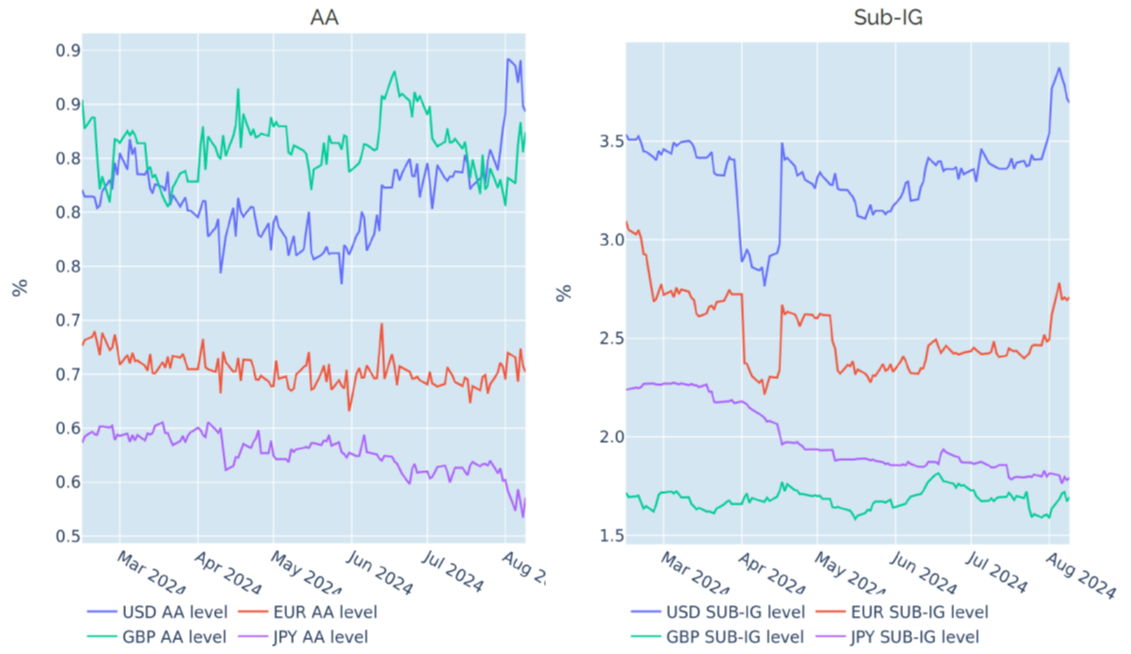

Market turmoil propels credit spreads to 6-month highs

Last week’s stock-market turmoil propelled the risk premia of USD-denominated corporate bonds to their widest levels in over six months. Euro high yield spreads also rose significantly, but only briefly surpassed the highs from March and April when equities were rocked by a series of upward inflation surprises. That being said, the fluctuations in credit spreads were offset by lower risk-free rates, as flight-to-safety flows depressed sovereign yields to their lowest levels since the start of the year. This meant that lower-rated USD securities are only marginally down so far this month, while investment grade debt recorded small positive returns. Year to date, high yield bonds are still firmly in the black with only slightly higher volatility, thus delivering superior risk-adjusted return.

Please refer to Figure 5 of the current Multi-Asset Class Risk Monitor (dated August 9, 2024) for further details.

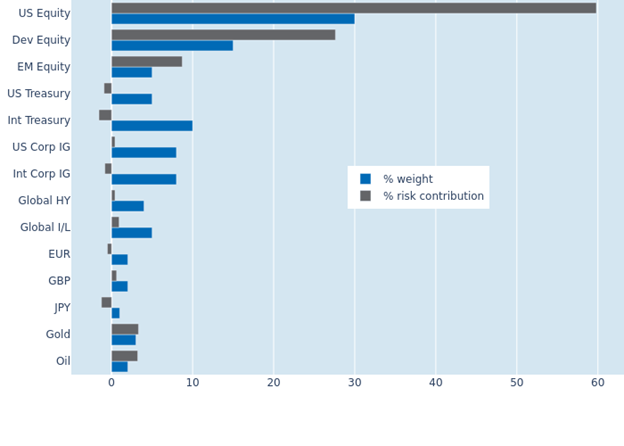

Portfolio risk soars as equity volatility doubles

The predicted short-term risk of the Axioma global multi-asset class model portfolio soared by three percentage points to 9.6% as of Friday, August 9, 2024, as standalone equity volatility more than doubled from just under 9% to almost 21%. The risk increase was most severe for US equities, which saw their share of total portfolio volatility swell from 42% to 60%. For their counterparts from other parts of the world, the effect was dampened by offsetting currency effects, as the correlation between share prices and FX rates flipped signs from mildly positive to strongly negative, with the strengthening yen providing significant diversification benefits. There was also a sizeable risk reduction from the renewed inverse interaction of stock and bond returns, although some of the benefits were curtailed by the deepening relationship of credit spreads and share prices.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated August 9, 2024) for further details.