MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED AUGUST 16, 2024

US market focus shifts from inflation to economic growth

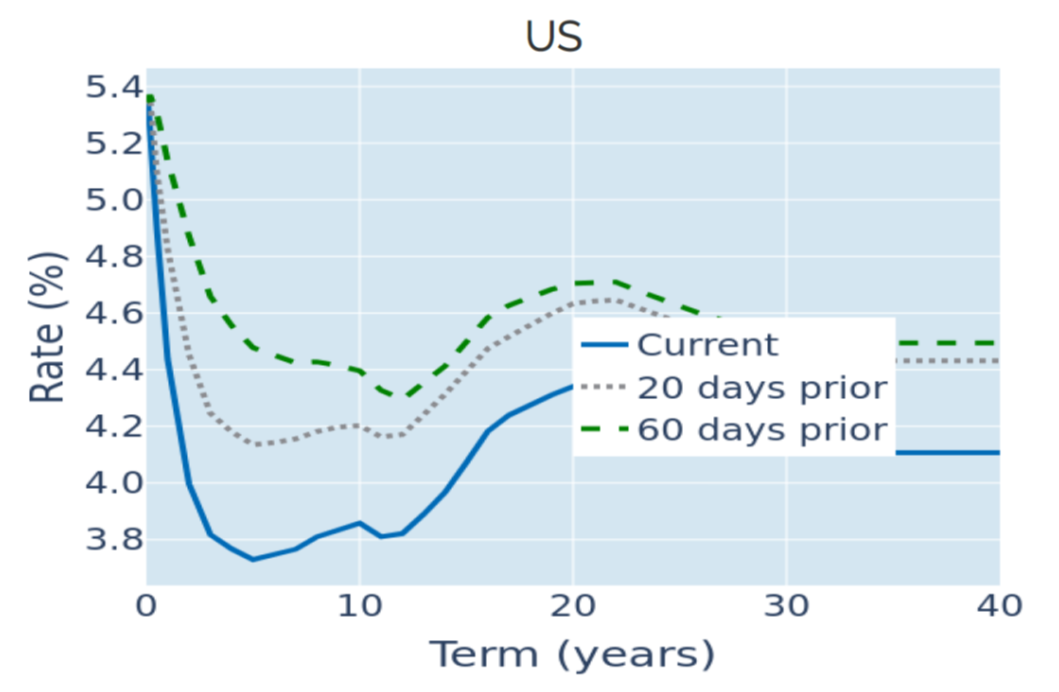

The US Treasury curve flattened in the week ending August 16, 2024, as traders shifted their focus away from inflation toward economic growth. The term spread between the 10-year and 2-year benchmark rates reverted to its most negative in two weeks, with long yields falling slightly, while the short end remained fixed. Inflation numbers for July came in marginally below expectations (2.9% versus 3%) on Wednesday, but instead of pricing in more monetary easing, short-term interest-rate futures markets lowered the probability of a 50-basis point rate cut in September from an even chance to 36%. Odds shifted even more in favor of the smaller rate move on Thursday, when the 1% growth in retail sales over the month of July eclipsed analyst predictions of 0.3%. Only one in four market participants now expects the Fed to ease by 50 basis points next month, while the projected year-end federal funds rate rose from 4.49% to 4.58%.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated August 16, 2024) for further details.

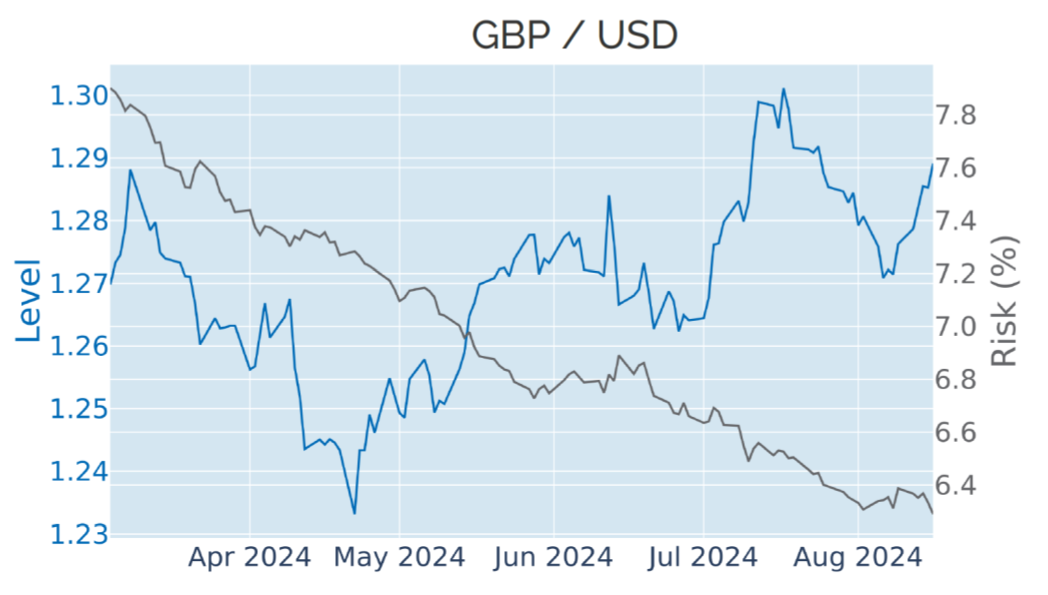

Pound rises over UK inflation bounce back

The pound gained 1% against the US dollar in the week ending August 16, 2024, after UK headline inflation bounced back up from the Bank of England’s 2% target. The increase from 2% per annum in June to 2.2% in July was marginally lower than the 2.3% predicted by economists, but still marked the first acceleration in price growth this year. Core inflation, on the other hand, resumed its downward trend, falling from 3.5% to 3.3%, largely due to a deceleration in services inflation from 5.7% to 5.2%. However, the latter remains a key driver of domestic price pressures, and its stickiness continues to represent a major area of concern for the rate setters on Threadneedle Street. Therefore, monetary policy expectations remained unchanged, with the next move still projected for early November rather than the next MPC meeting on September 19.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated August 16, 2024) for further details.

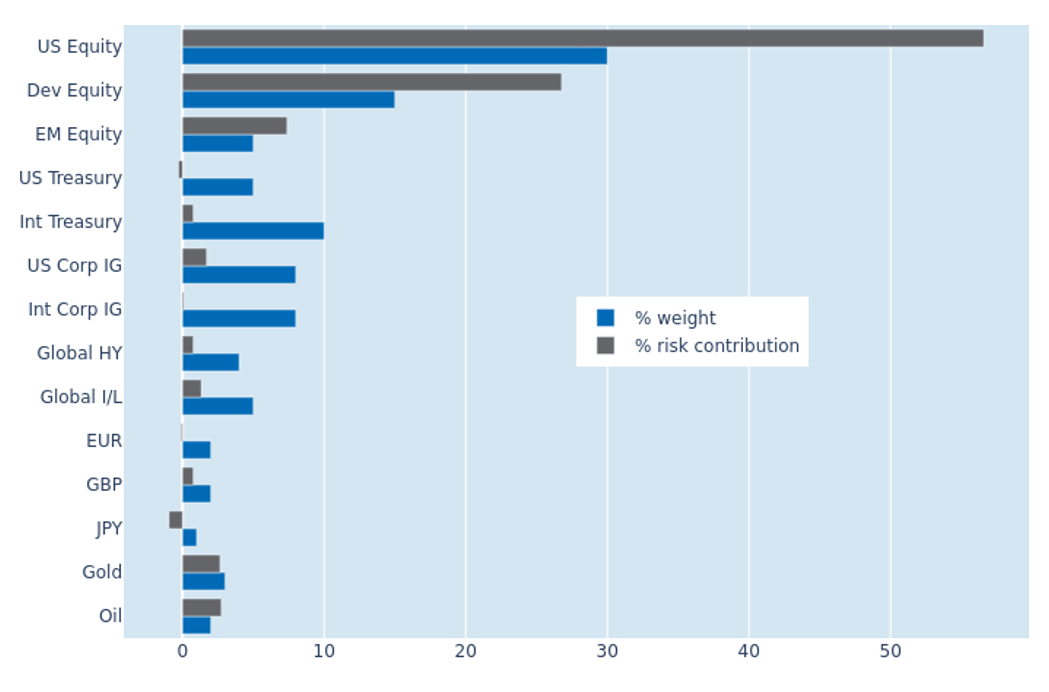

Cross-asset recovery raises portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio expanded by another percentage point to 10.6% as of Friday, August 16, 2024, as stocks and bonds recovered together while most major currencies rose against the US dollar. Holding non-USD government bonds once more increased total portfolio volatility, with their percentage risk contribution flipping from -1.6% to +0.7%. US Treasury securities also saw their share of overall risk increase by 0.6%, but just about continued to offer some relief. Investing in JPY cash provided the greatest diversification benefit, with the yen being the only other big currency apart from the Swiss franc that depreciated against the dollar, as some hedge appeared to be rebuilding carry trade positions—albeit with a much shorter target horizon.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated August 16, 2024) for further details.