MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED AUGUST 23, 2024

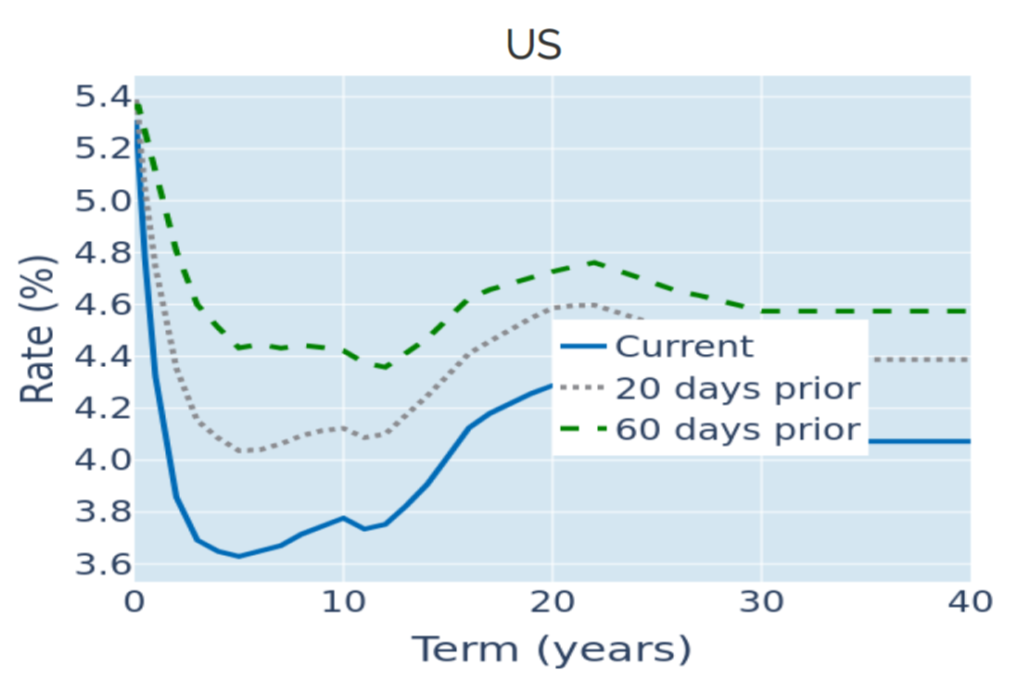

Yields plummet as Powell confirms shift from inflation to labor market

US Treasury yields plummeted across all maturities in the week ending August 23, 2024, after comments from Jerome Powell that the “time has come for policy to adjust.” The Federal Reserve chair noted in his speech at the Jackson Hole symposium on Friday that “upside risks to inflation have diminished” while also stressing that “downside risks to employment have increased.” Powell’s assessment underpins the market’s perception that the Fed has moved on from reigning in consumer prices to supporting the flagging labor market and ensuring a soft landing for the American economy. Near-term monetary-policy expectations were largely unaffected, but traders penciled in a lower terminal rate which led to a 14-basis point drop in the 2-year government benchmark. Yield changes were less pronounced but still substantial for longer tenors, with the 10-year point ending the week 0.08% in the red.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated August 23, 2024) for further details.

Strong UK business activity propels the pound to 29-month high

The pound sterling climbed to its highest level against the US dollar since March 2022 in the week ending August 23, 2024, as UK private sector activity grew at its fastest pace in four months. The S&P Global UK Composite PMI rose to 53.4 in August from 52.8 in July, comfortably beating analyst predictions of a more modest increase to 52.9. Survey respondents also reported that input costs advanced at their slowest pace since early 2021. But Bank of England Governor Andrew Bailey noted in his Jackson Hole speech that although he was now “cautiously optimistic” about inflation expectations, it was still “too early to declare victory.” Short-term interest-rate markets maintained their projections of no change in monetary policy at the September MPC meeting, with the next 25-basis point rate cut priced in for November instead.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated August 23, 2024) for further details.

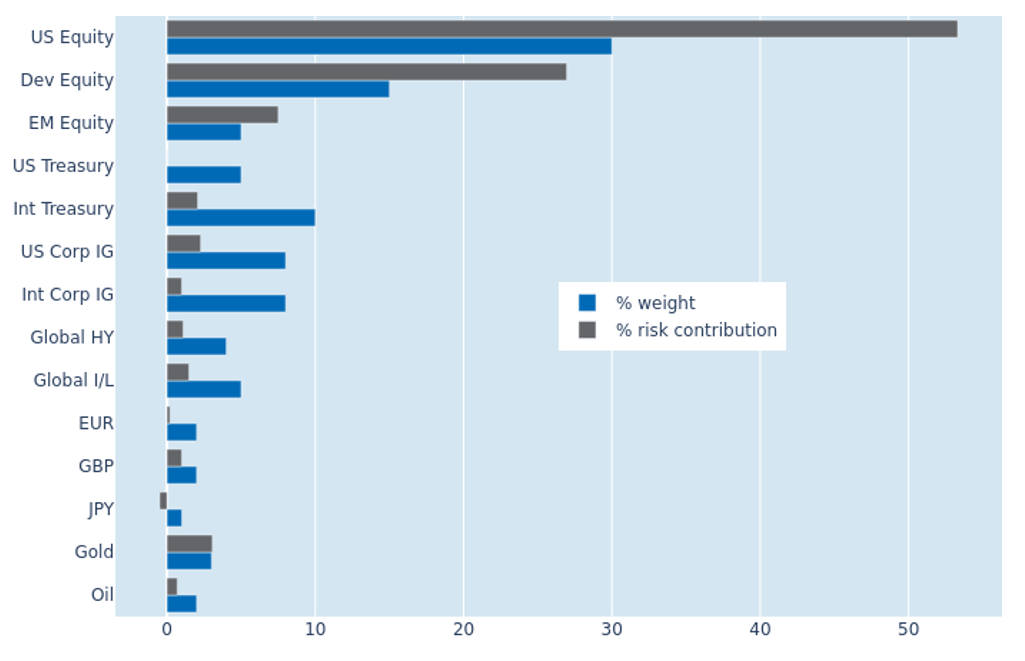

Ongoing equity recovery lowers portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio eased from 10.6% to 10.1% as of Friday, August 23, 2024, as global stock markets recovered for a third consecutive week. But the benefits of lower equity volatility were partly offset by a stronger co-movement of FX rates and share prices, as all major currencies strengthened against a weakening US dollar. This meant that the percentage risk contributions of non-US developed and emerging-market equities remained almost unchanged, whereas the contribution from US stocks dropped from 56.6% to 53.3%. US Treasury securities, meanwhile, neither added to nor subtracted from total portfolio volatility, as the correlation between stock and bond prices remained slightly negative. Their international counterparts, on the other hand, saw their share of total portfolio risk triple from 0.7% to 2.1%, due to the positive interaction of FX and equity returns.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated August 23, 2024) for further details.