MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED SEPTEMBER 06, 2024

Traders raise rate-cut expectations over soft labor market

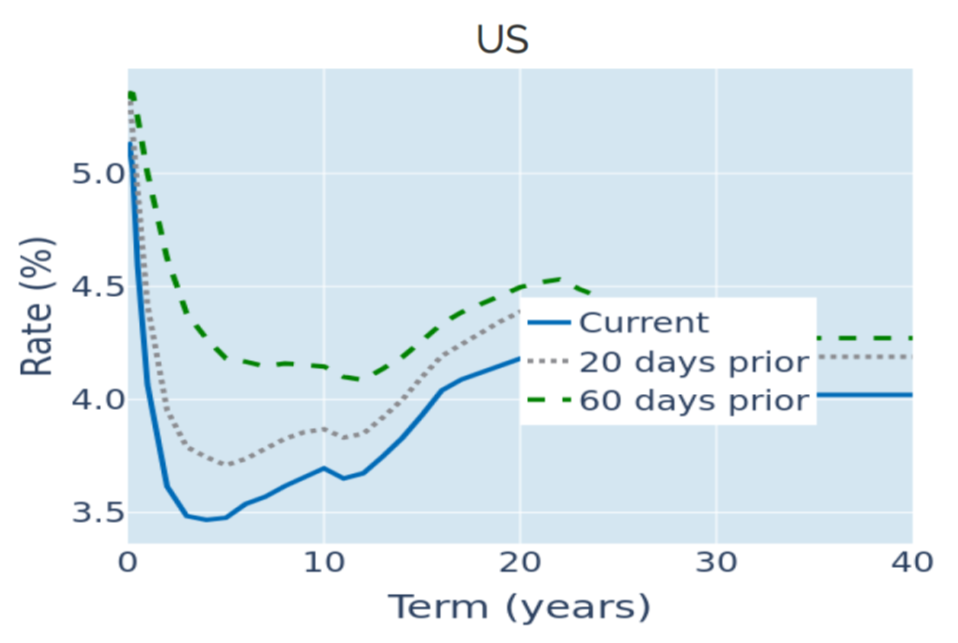

Short-term US Treasury yields plummeted to their lowest levels in two years in the week ending September 6, 2024, following another soft employment report. The Bureau of Labor Statistics reported on Friday that the American economy added 142,000 jobs in August, up from a downward revised 89,000 (from 114,000) in July, but once again undershooting analyst predictions of 160,000. However, the discrepancy was not deemed significant enough to alter monetary policy expectations for the upcoming FOMC meeting on September 18, with seven in ten traders still anticipating a smaller cut of 25 basis points. But the implied probability that the Fed will have lowered its rate target by at least a percentage point by year end soared from 70% to over 90%. Yield increases were most pronounced at the 2-year point, which rose almost 30 basis points, compared with 0.2% for the 10-year benchmark. This meant that the term premium between the two maturities ventured even further into positive territory.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated September 6, 2024) for further details.

Stock-market sell-off boosts credit spreads

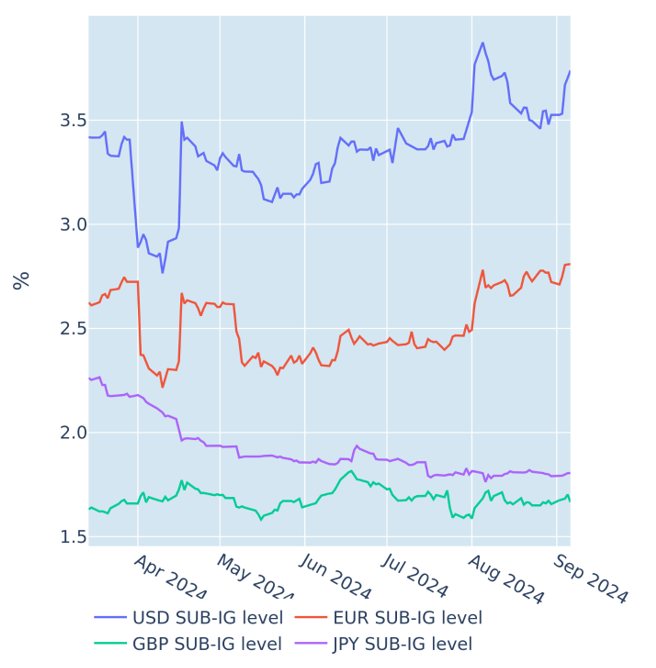

Risk premia on lower-rated corporate bonds surged in the week ending September 6, 2024, as equity markets recorded their worst weekly sell-off in 18 months. The widening credit spreads offset much of the benefit from lower risk-free rates, which meant that sub-investment grade securities barely broke even last week, whereas European and US government bonds rose between 1% and 1.5%. That said, EUR and USD-denominated high yield benchmark indices are still ahead of their sovereign counterparts, with year-to-date returns of around 6%, compared with less than 1% for German Bunds and 4% for US Treasury bonds.

Please refer to Figure 5 of the current Multi-Asset Class Risk Monitor (dated September 6, 2024) for further details.

Portfolio risk falls despite surge in equity volatility

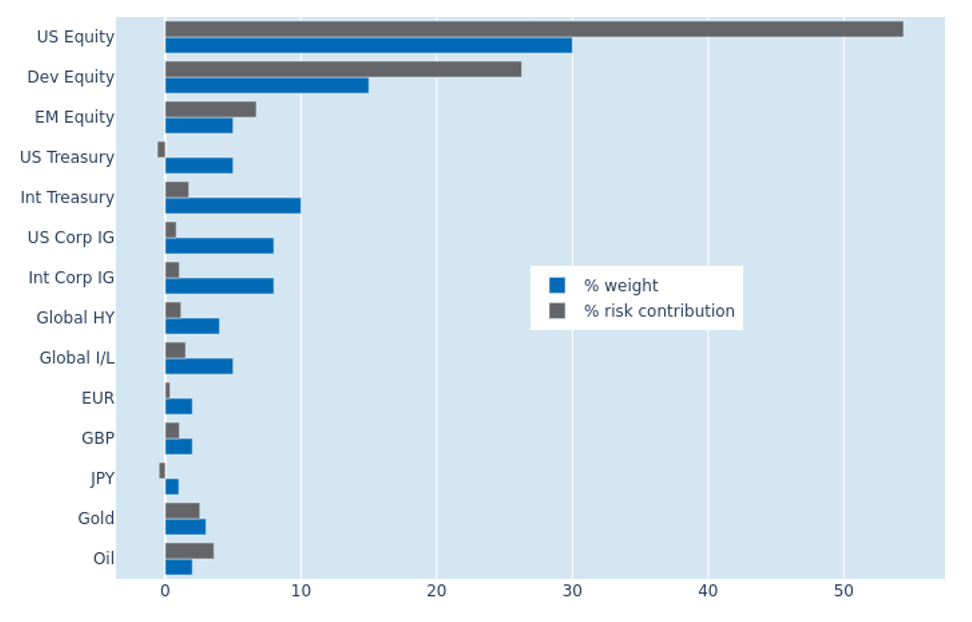

The predicted short-term risk of the Axioma global multi-asset class model portfolio fell from 9.1% to 8.6% as of Friday, September 6, 2024, as the adverse effects of higher share-price volatility were more than offset by opposing movements in the FX and bond markets. US equities and oil were the only two asset classes which saw their percentage risk contributions expand by 3% and 2%, respectively, with crude prices dropping to a year-to-date low alongside falling stock markets. Investing in US Treasury securities once more actively reduced total portfolio risk, as did holding the Japanese yen, which appreciated 2.3% against a weakening US dollar to its highest level since the start of the year.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated September 6, 2024) for further details.