MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED SEPTEMBER 13, 2024

We are going on a break! The author of our weekly MAC highlights, Christoph Schon, will go on an extended holiday with his family. He—and the highlights—will be back in early November.

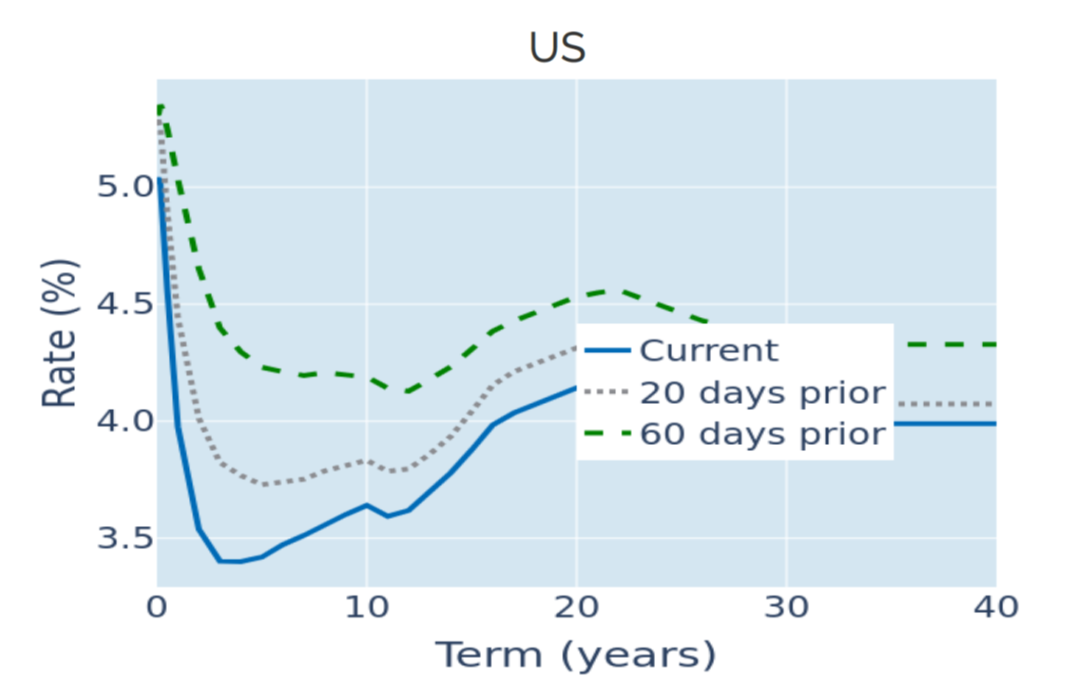

Yield curve normalization continues as traders up rate-cut expectations

The US Treasury curve continued to steepen in the week ending September 13, 2024, as traders upped their predictions on how much the Federal Reserve will ease monetary conditions this week and over the remainder of the year. According to the CME FedWatch tool, the chances of a bigger 50-basis point cut in September have now more than doubled to 67%, compared with only 30% the week before. The implied probability of the Fed having eased by at least 1.25% by year end also rose from 55% to around 63%.

The term spread between the 10-year and 2-year tenor points ventured further into positive territory, as short rates fell more than long yields, following a weaker-than-expected inflation report. The Bureau of Labor Statistics reported on Wednesday that US headline inflation fell for a fifth consecutive month to 2.5% in August, falling short of analyst predictions of 2.6%. Core CPI growth, on the other hand, remained stable at 3.2% in line with the consensus forecast. Even though monthly changes in core prices since April have been in line with an annual rate of just over 2%, reported year-over-year inflation is likely to remain above 3% for the remainder of 2024 and will only start descending toward the central bank target once the three big surges from Q1 this year fall out of the calculation.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated September 13, 2024) for further details.

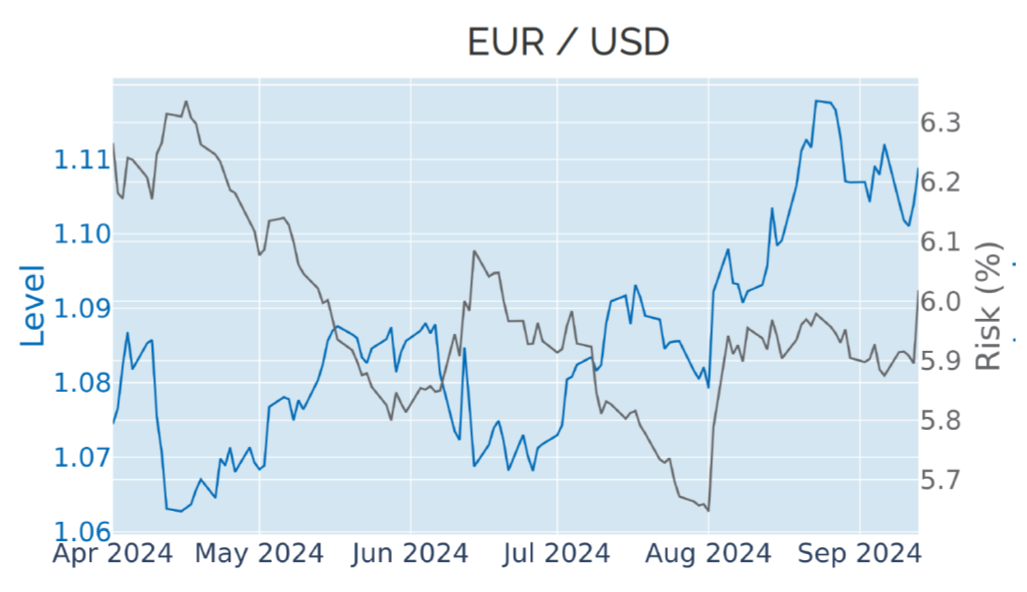

Euro strengthens after ECB rate decision

The European Central Bank cut interest rates for a second time in line with market expectations in the week ending September 13, 2024, citing growing confidence that inflation is heading toward its 2% target. The euro strengthened by 0.3% against the US dollar after the decision on Thursday, seemingly contradicting conventional wisdom that lower rates make a currency less attractive for foreign investors. However, the movement was more driven by the stateside leg of the relationship—in continuation of the pattern observed in the past three years—as the greenback weakened over the downward revision in US monetary policy projections.

The Japanese yen was the only notable exception among the world’s biggest currencies, gaining 1.3% against its American rival on Friday over speculation about the narrowing interest rate differential between the two economies. This means that the yen is once more strongly inversely related with share prices in the United States.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated September 13, 2024) for further details.

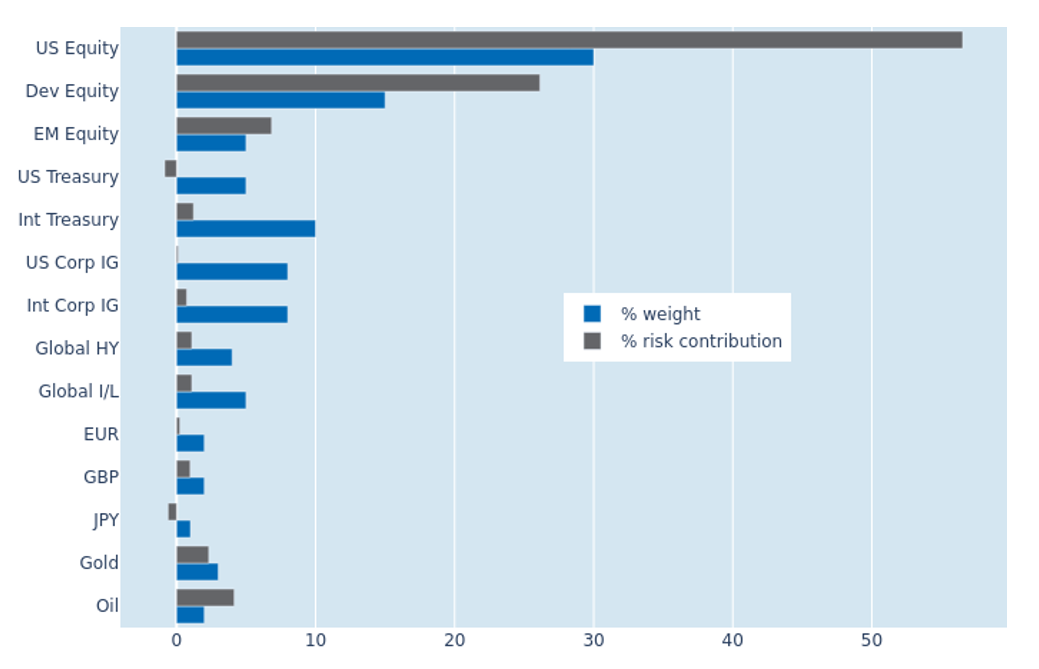

Lower equity volatility and cross-asset correlations reduce portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio eased by another 0.3% to 8.3% as of Friday, September 13, 2024, caused by a combination of lower stock-market volatility and a decoupling of interest-rate and FX returns. Non-US developed equities were the biggest beneficiaries, as they saw their share of total portfolio risk shrink by one percentage point to 25.3%. All fixed income assets also experienced a reduction in their risk contributions, due to a weaker interaction of bond prices and exchange rates against the US dollar, with US Treasury securities and the yen actively lowering total volatility. Gold and oil, on the other hand, increased their co-movement with share prices, leading to bigger risk contributions for both commodities.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated September 13, 2024) for further details.

You may also like