MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED NOVEMBER 8, 2024

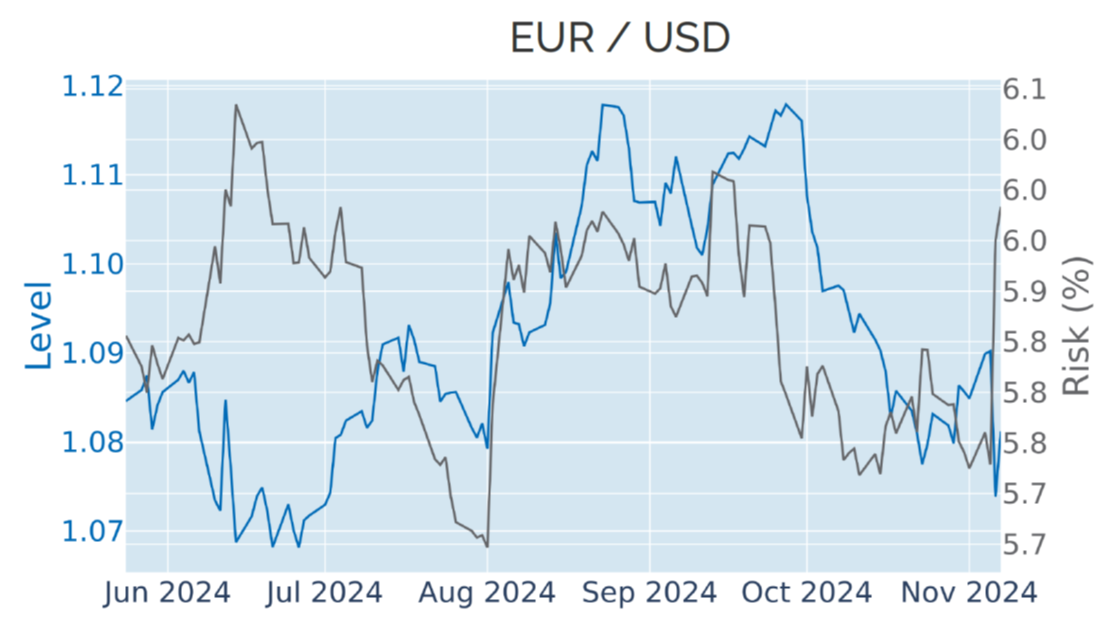

Trump victory boosts US dollar, stocks, and Treasury yields

The US dollar soared to a 4-month high against a basket of major trading partners in the week ending November 8, 2024, following Donald Trump’s decisive victory in the presidential election. The Dollar Index jumped 1.6% on Wednesday, booking its biggest daily gain since the Federal Reserve’s third consecutive ‘jumbo’ rate hike in September 2022. The move was accompanied by a 16-basis point surge in the 10-year Treasury yield, while the American stock market recorded both its biggest daily and weekly gains in twelve months. The positive correlation of currency, share prices, and bond yields is consistent with market movements during the first four months following the 2016 election when the dollar, the STOXX® US 900 index, and long Treasury rates rose by 3.5%, 12%, and 75 basis points, respectively.

That being said, long-term borrowing rates still finished the week slightly in the red, after falling 10 basis points in the wake of the Federal Reserve’s decision to lower its policy rate by 0.25%.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated November 8, 2024) for further details.

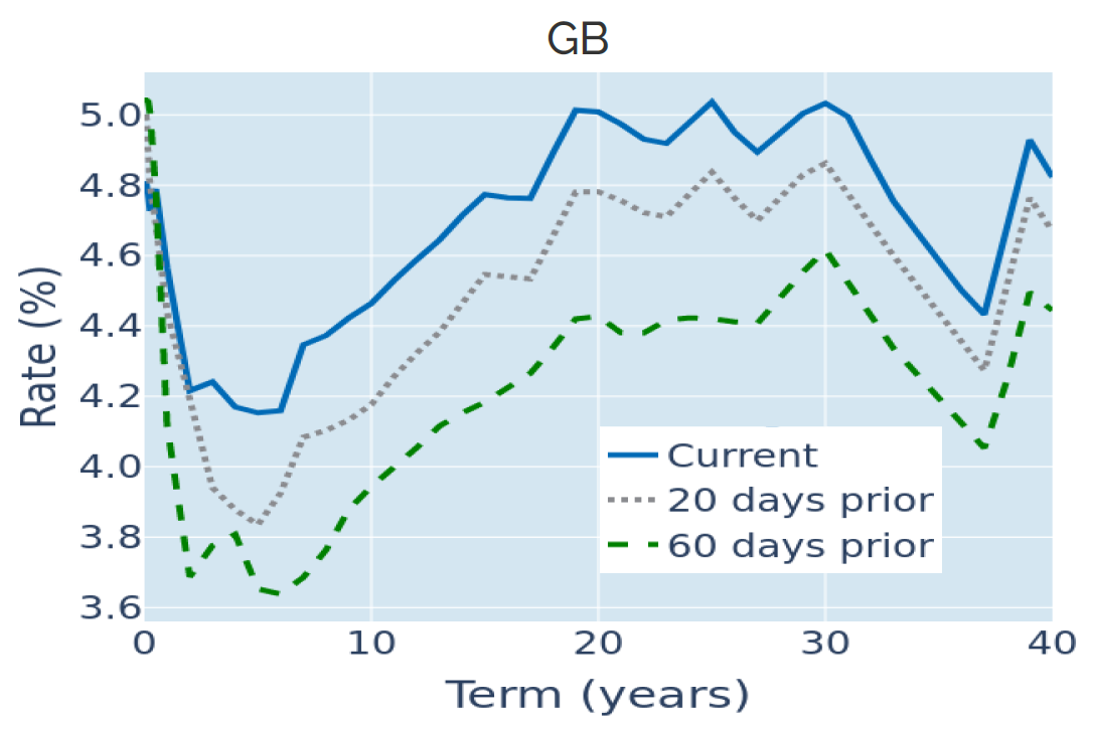

But BoE rate cut leaves markets unimpressed

The Bank of England cut its base rate by 25 basis points to 4.75% in line with market expectations last week, despite raising its inflation projections for the next two years in response to the previous week’s government budget. In its quarterly report, the Monetary Policy Committee upped its forecast for CPI growth in the fourth quarter of 2025 from 2.2% to 2.7% and from 1.6% to 2.2% for Q4 2026. But fixed income markets had already anticipated the upward revision right after the budget announcement, which meant that Gilt yields and short-term interest-rate derivatives ended the week almost unchanged. The pound rose 0.8% against the dollar after the rate decision, exactly offsetting the previous day’s losses, so that it was flat against its American rival overall.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated November 8, 2024) for further details.

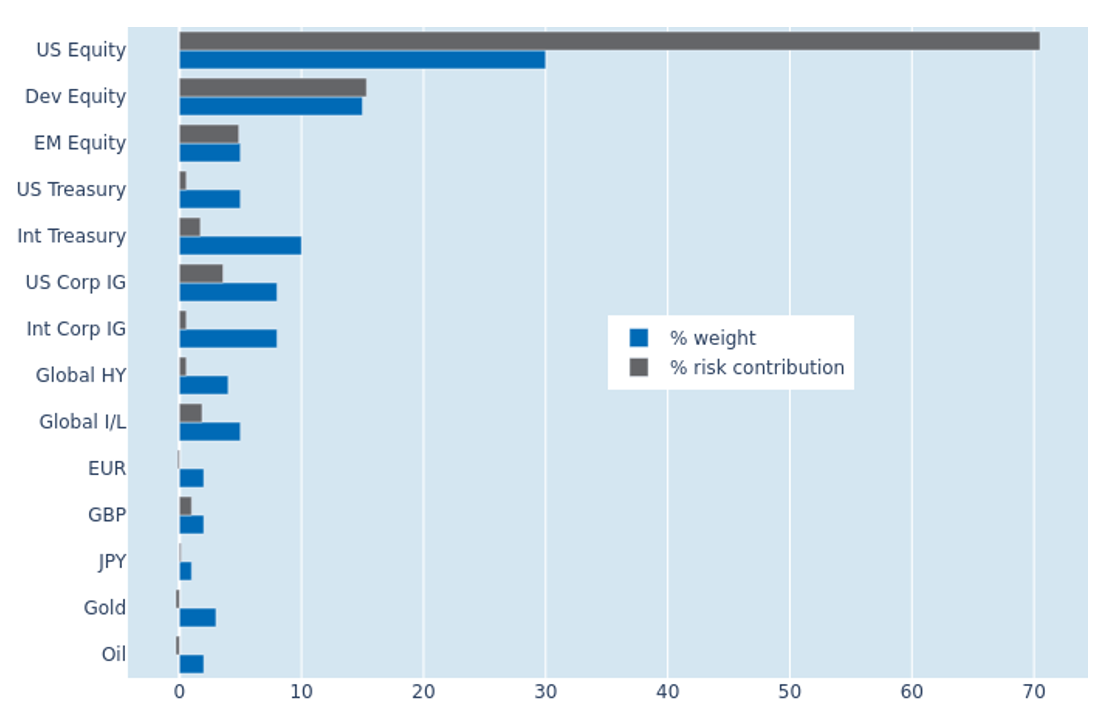

Equity rally pushes up portfolio risk

A surge in equity volatility pushed the predicted short-term risk of the Axioma global multi-asset class model portfolio to 7% as of Friday, November 8, 2024, compared with 6.2% the week before. However, the stock-market gains outside of the United States were dampened by weaker exchange rates against the dollar, compressing the percentage risk contribution of non-US developed equities from 23.8% to 15.5%. Non-USD government securities also saw their share of overall portfolio volatility shrink from 6.7% to 2.1%, as their correlation with share prices turned negative. US stocks took the brunt of the risk increase and now account for more than two thirds of total volatility—up from about half the week before—despite making up only 30% of the portfolio’s market capitalization.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated November 8, 2024) for further details.

You may also like