MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED FEBRUARY 28, 2025

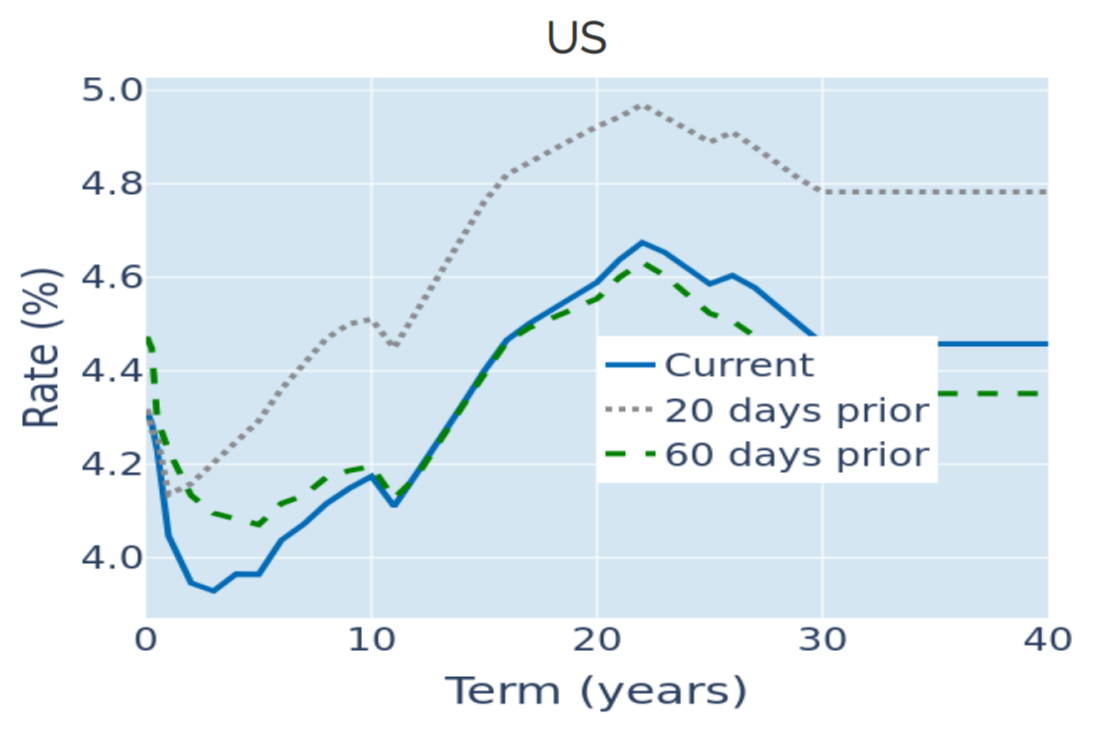

Recession fears push long Treasury yields below fed funds

US Treasury yields recorded their biggest weekly decline in three months in the week ending February 28, 2025, amid rising concerns over the state of the American economy. The 10-year borrowing rate plummeted to an 11-week low on Tuesday, after the Conference Board reported the steepest monthly decline in consumer confidence since August 2021. The expectations index also dropped below 80 for the first time in eight months, signaling that consumers are bracing for an impending recession.

The bleak economic outlook was seconded by the Federal Reserve Bank of Atlanta, whose GDPNow model lowered its growth prediction for the US economy in the first quarter of 2025 from +2.3% to -1.5% on Friday. This triggered a further decline in long Treasury yields, pushing the 10-year benchmark below the federal funds rate for the first time since the Fed last eased monetary conditions on December 18. Meanwhile, the monetary policy-sensitive 2-year rate also dipped below 4%—a level not seen since mid-October—as traders almost doubled the implied probability of three rate cuts this year from around 30% at the start of the week to 58% by the end of it.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated February 28, 2025) for further details.

But the dollar still strengthens despite lower rates

The dollar strengthened against a basket of major trading partners in the week ending February 28, 2025, despite a big drop in bond yields and interest rate expectations. This marks a significant break in the predominantly positive relationship between the greenback’s value and monetary policy projections over the past three years. The increased demand for USD cash is yet another manifestation of safe-haven flows amid the increasingly uncertain geopolitical and economic environment.

Especially the threat of impending tariffs of 25% across all goods against Canada and Mexico has been weighing on the CAD and MXN, which were down by 1.4% and 0.9%, respectively, last week. The pound, on the other hand, suffered a milder weekly loss of 0.4%, even closing the month in the black for the first time since September last year, after Donald Trump expressed optimism about a potential trade deal with the United Kingdom. Due to its trade surplus with the United States and its strategic importance as a security partner, the UK is more likely to escape tariffs and secure a trade deal than other countries.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated February 28, 2025) for further details.

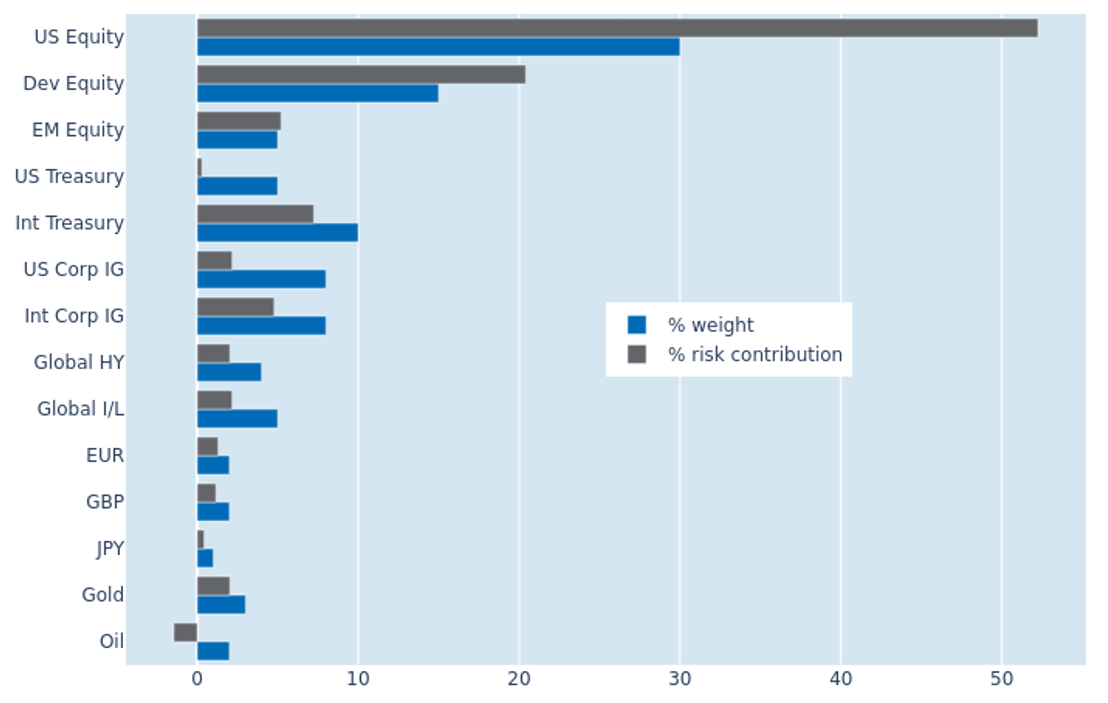

Flight to safety eases portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio fell for the fifth week in a row to 6.9% as of Friday, February 28, 2025, as the adverse effects of stronger equity and interest rate volatilities were more than offset by a renewed counter-movement of stock and bond prices. The flight to safety benefited all fixed income assets, which saw their combined share of total portfolio risk shrink by seven percentage points. USD-denominated investment grade corporates experienced the biggest individual decline of 2.1% in their percentage risk contribution, as credit spreads also once again moved in the opposite direction of risk-free rates. But it was US Treasury bonds which provided the greatest diversification benefit relative to their monetary portfolio weight, while oil continued to actively reduce overall volatility as it maintained its negative correlation with FX and interest rate returns.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated February 28, 2025) for further details.

You may also like