MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED MARCH 7, 2025

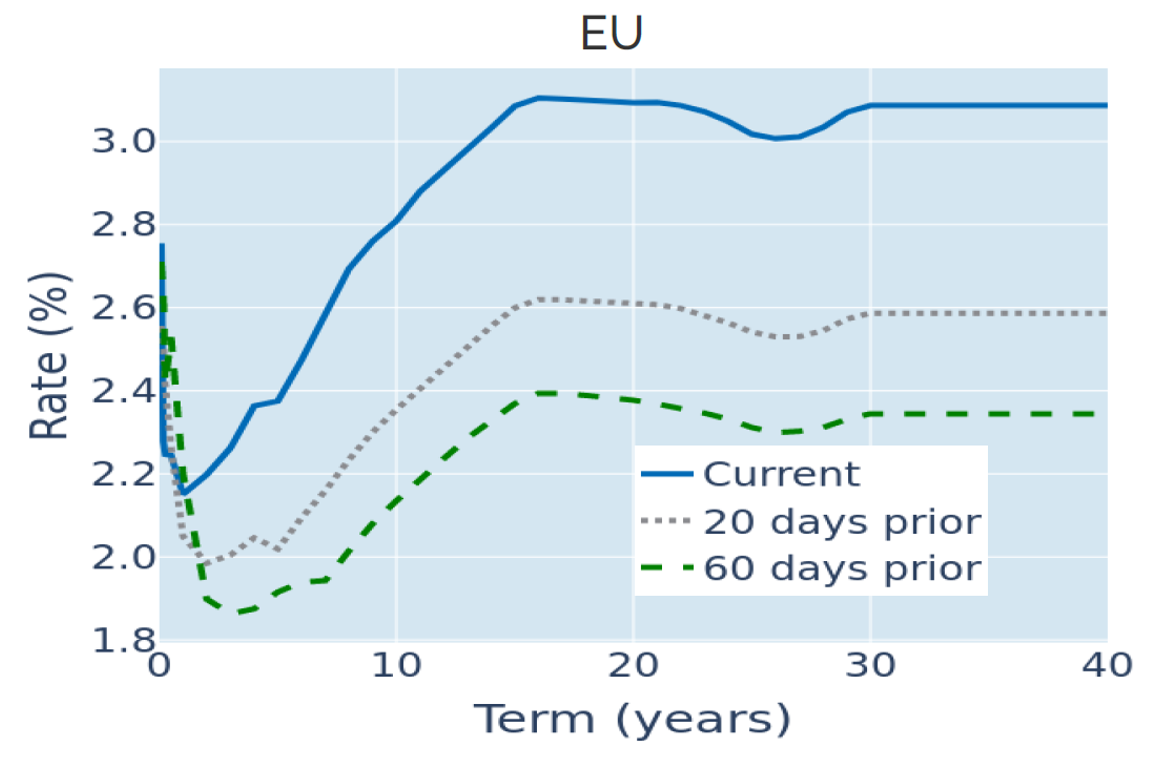

German debt brake exemptions boost Bund yields…

German Bund yields soared to their highest level in more than 16 months in the week ending March 7, 2025, as the incoming German government relaxed fiscal rules by exempting military and infrastructure spending from its notorious “debt break.” The announcement on Wednesday boosted the 10-year benchmark rate by 30 basis points in its biggest daily move in two decades.

Another 0.1% was added to long-term borrowing costs after the European Central Bank meeting on Thursday, even though the governing council lowered its policy rates by a quarter point in line with market expectations. But when asked about how the changes in German fiscal policy might affect the bank’s economic outlook and monetary policy, President Christine Lagarde replied that the governing council would remain “attentive” and “vigilant” toward political and market developments.

Short-term interest-rate futures markets reacted to last week’s news by revising monetary policy expectations from a full percentage point of easing by the end of the year to only 75 basis points. The 2-year Bund yield climbed by 0.22% accordingly.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated March 7, 2025) for further details.

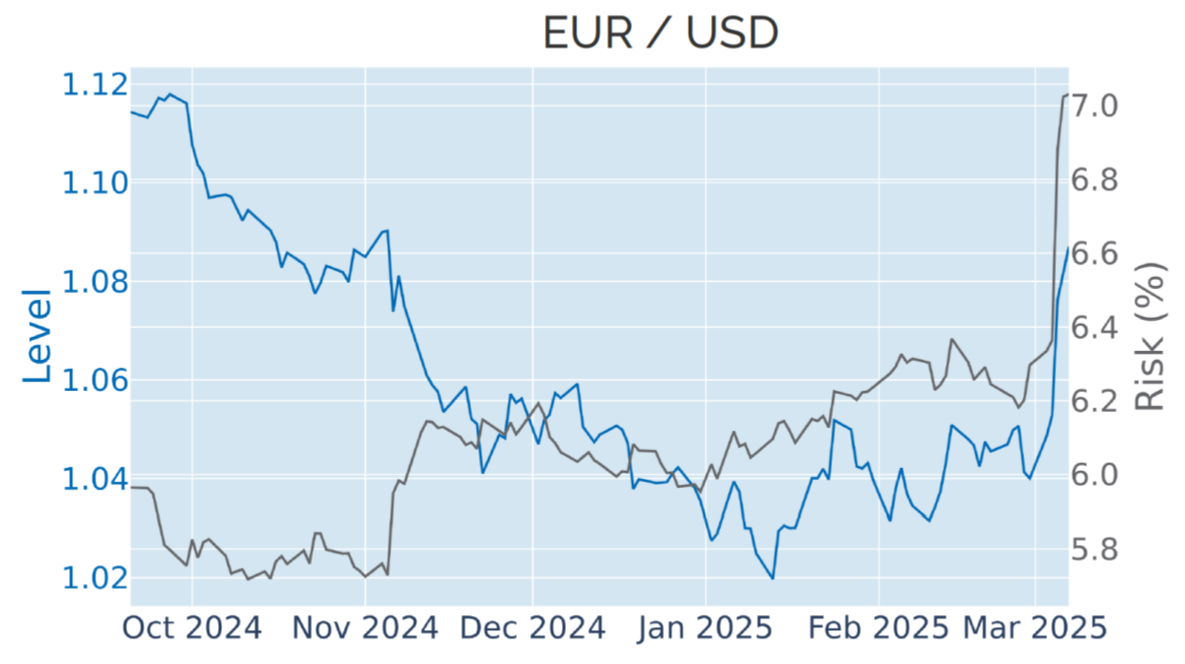

…and support the euro

Last week’s rise in interest rate expectations and Bund yields and the expected benefits of increased defense and infrastructure spending in Europe lifted the euro to a 4-month high against the US dollar. The common currency gained 4.5% against its American rival in its biggest weekly upward move since the Federal Reserve announced that it would spend an extra $1tn on quantitative easing in March 2009.

The euro’s ascent was part of a wider dollar weakness against all other G10 currencies amid growing concerns of the impact of Donald Trump’s wide-ranging tariffs on the already shaky US economy. The Bureau of Labor Statistics reported on Friday that the non-farm sector added 151,000 jobs in February, missing analyst predictions of 160,000 for the second month in a row. At the same time, January’s number was revised downward from 143,000 to 125,000, while the unemployment rate resurged from 4% to 4.1%.

The Dollar Index—an indicator of the USD’s value against a basket of major trading partners—recorded its biggest weekly drop of 3.5% since November 2022, when weaker-than-expected inflation numbers prompted a sharp drop in Treasury yields and monetary policy projections. Both the US dollar and stock market have now fallen back below the levels seen right before the presidential election last November.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated March 7, 2025) for further details.

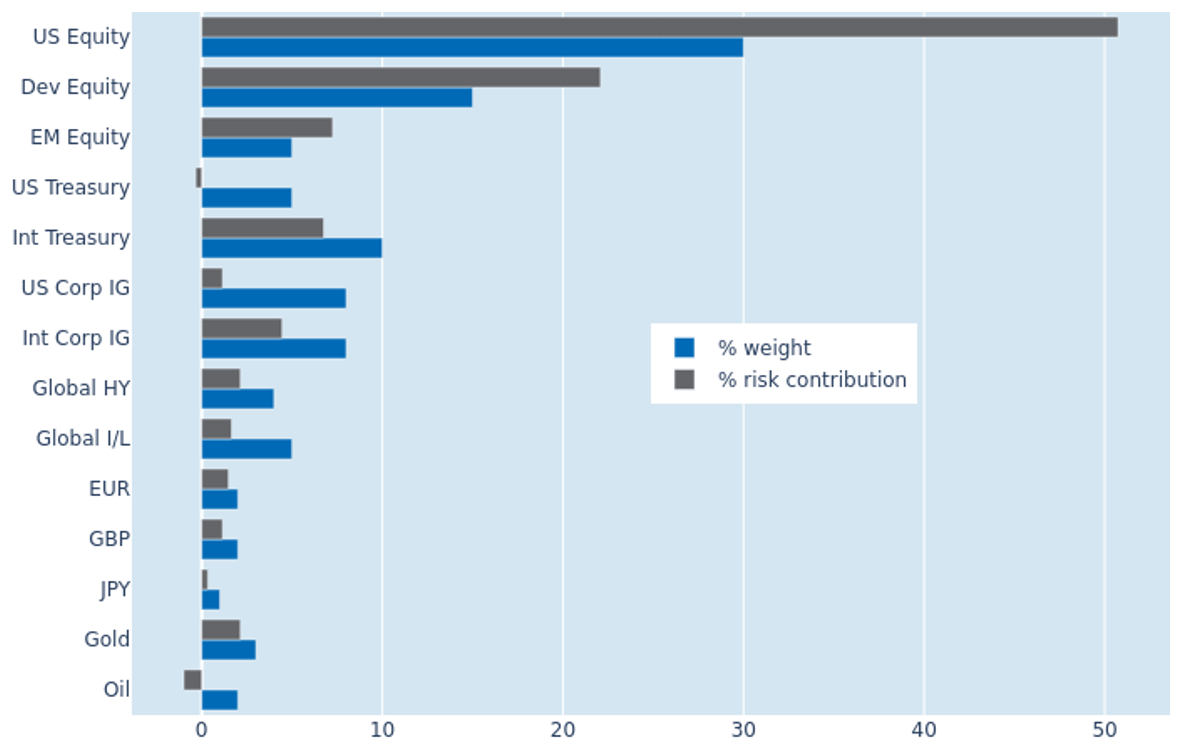

Portfolio risk falls as FX gains offset stock and bond losses

The predicted short-term risk of the Axioma global multi-asset class model portfolio continued its downward trend for a sixth consecutive week, falling 0.8% to 6.1% as of Friday, March 7, 2025, as the adverse effects falling share prices and higher bond yields were more than offset by currency gains against the weakening US dollar. The dominance of FX rate fluctuations over local returns even made non-US stocks appear negatively correlated with their American counterparts, with the latter seeing their share of total portfolio risk shrink from 52.3% to 50.7% despite a significant uptick in their standalone volatility. But it had the reverse effect on foreign developed and emerging market equities, as their percentage risk contribution expanded by 1.7% and 2.1%, respectively.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated March 7, 2025) for further details.

You may also like