MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED JULY 25, 2025

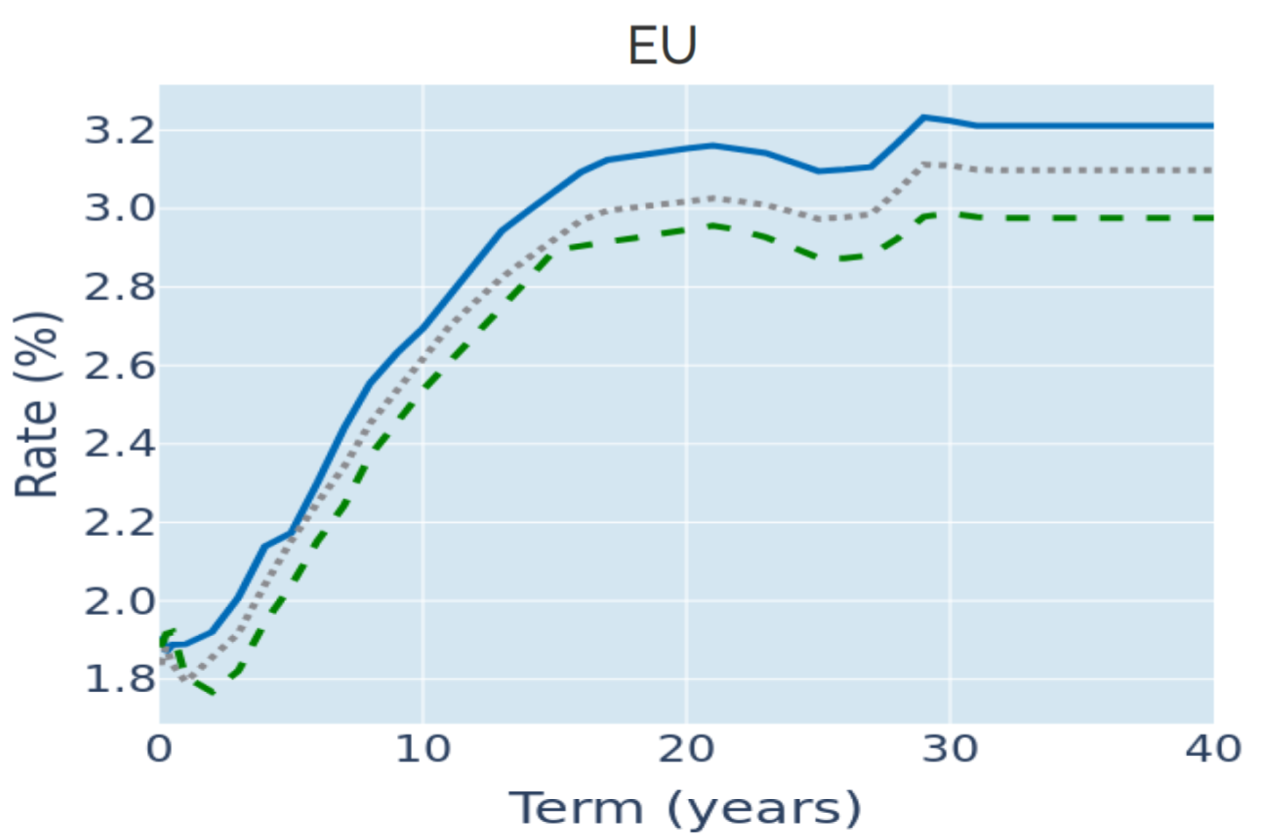

Bund yields rise as traders discount further ECB cuts

Short-term German sovereign yields climbed to their highest level since early April in the week ending July 25, 2025, amid increasing speculation that monetary easing in the Eurozone may have come to an end. The European Central Bank held its policy rates steady for the first time this year, following eight rate cuts over the previous 13 months. Even though the decision had been widely anticipated, there was still an expectation before the meeting that the governing council would ease monetary conditions one more time before the end of the year.

But ECB President Christine Lagarde noted in the subsequent press conference that “the economy grew more strongly than expected” in the first quarter. This was partly due to “frontloaded exports ahead of expected tariff hikes” but “also bolstered by stronger private consumption and investment.” Short-term interest expectations rose by nearly 10 basis points in response, while the monetary policy-sensitive 2-year Bund yield also ended the week 0.07% in the black. The reaction at the long end was more muted, though, with the 10-year rate marginally higher and the 30-year yield slightly lower than the week before.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated July 25, 2025) for further details.

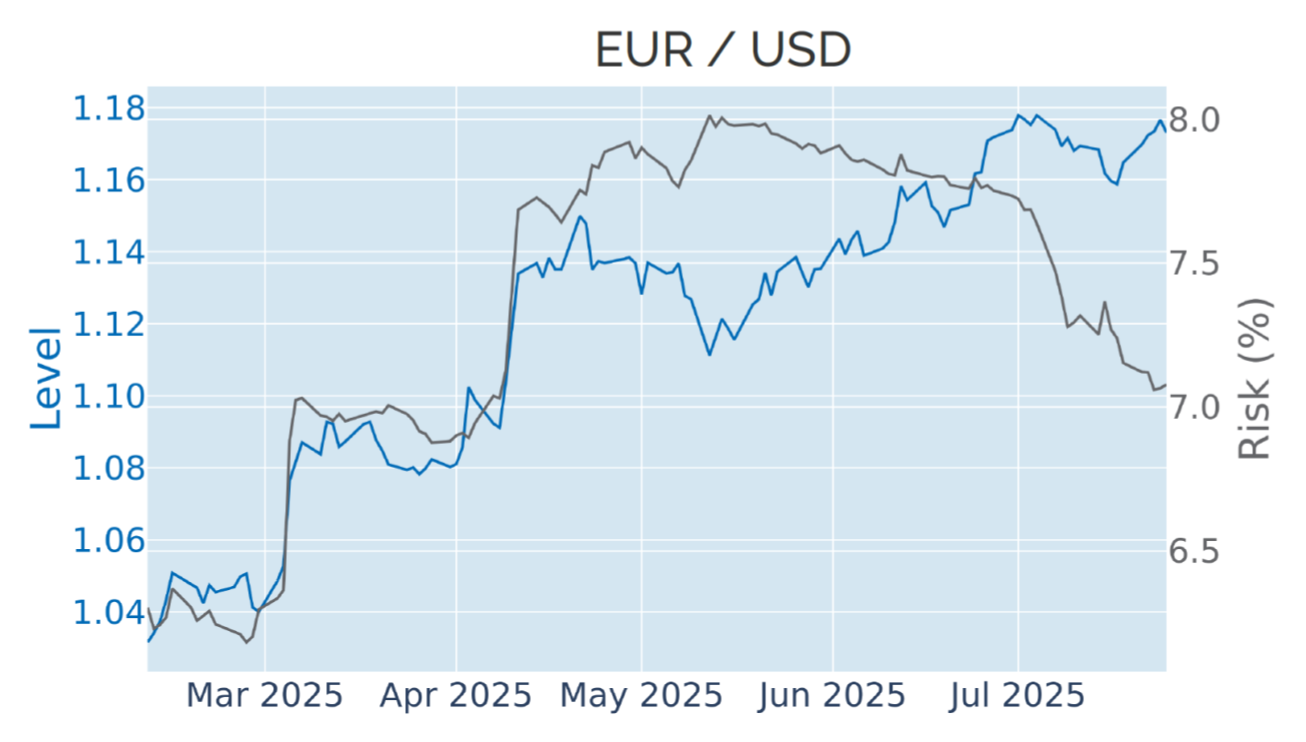

Euro strengthens alongside higher interest rates

The euro strengthened 0.7% against the US dollar in the week ending July 25, 2025, alongside rising interest rates in the single-currency area. The move may have made intuitive sense, as higher yields should make a local market more attractive to foreign investors. However, the relationship between the EUR/USD exchange rate and German Bund yields has been mostly negative since the Federal Reserve and the ECB began tightening monetary conditions aggressively in the summer of 2022.

Over the past three years, the interaction between FX and interest rates has been predominantly driven by the stateside leg of the relationship, with the focus almost exclusively on Fed policy. The only major exception were the weeks following the first tariff announcements in late February, which triggered a major capital flight from the United States into Europe. At the same time, German borrowing costs were boosted by the government’s announcement to relax its notorious ‘debt brake’ for defense and infrastructure spending.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated July 25, 2025) for further details.

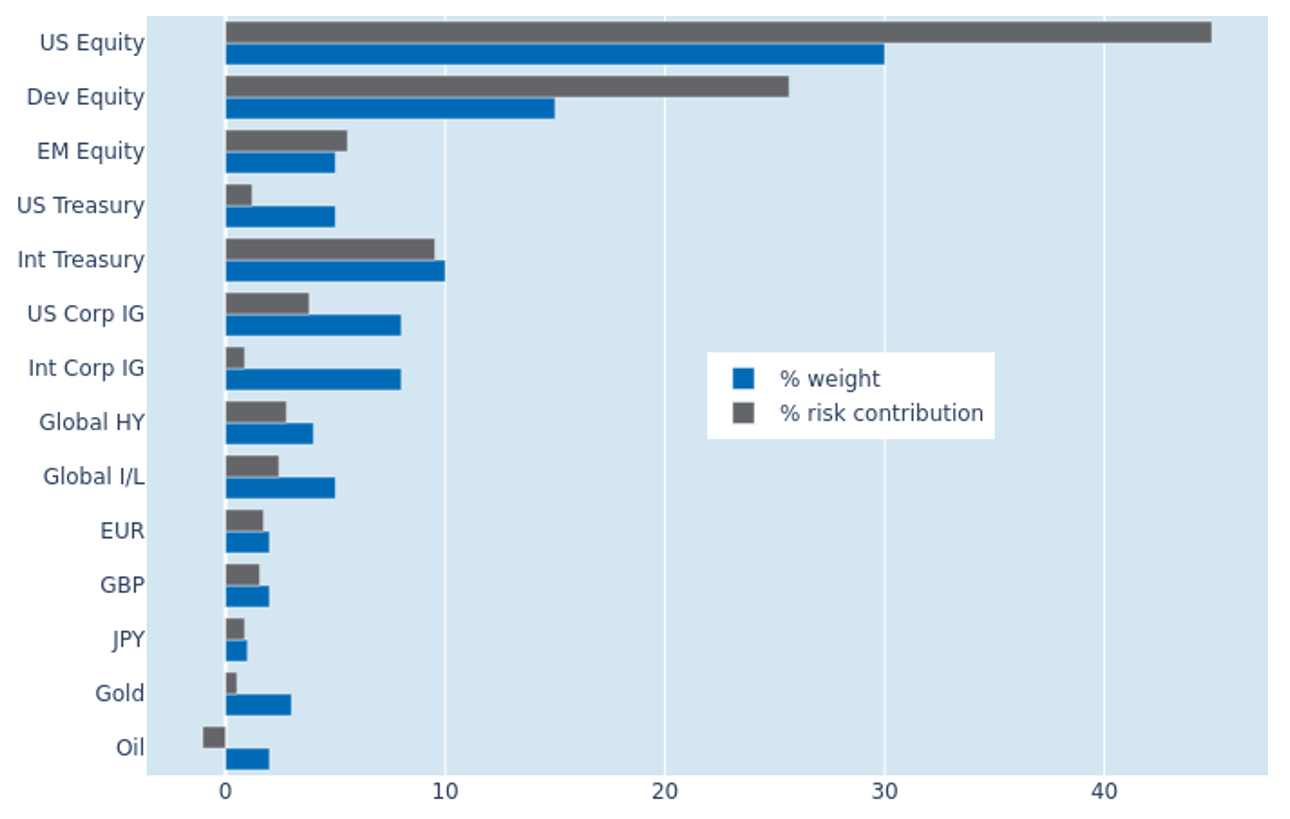

Portfolio risk rebounds as currencies and stocks rise together

The predicted short-term risk of the Axioma global multi-asset class model portfolio rebounded from 5.4% to 5.8% as of Friday, July 25, 2025, as local stock-market gains were boosted by stronger exchange rates against the US dollar. The effect was most notable for non-US developed equities, which saw their share of total portfolio risk expand from 20.3% to 25.6%. The stronger co-movement of share prices and FX rates also made non-USD-denominated sovereign bonds appear more correlated with their corresponding stock markets, boosting their percentage risk contribution by nearly two points to 9.5%. This was in contrast to US equities, which were unaffected by currency effects and instead recorded a 10% reduction in their contribution to overall volatility to 25.6%, as American share prices climbed to another record high.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated July 25, 2025) for further details.

You may also like