Market and Geopolitical Risks: Mid-year review and H2 outlook for investors

Mid-year review of the following risks and events that defined the first half of 2025, with insights on what investors should watch out for the rest of the year:

- Investor Sentiment

- Bond Market Reaction

- Global Trade and Tariffs

- Geopolitical Tensions

- Contrarian Strategies Outperform

- US Dollar Weakness

- Capital Flight

- US and China Relationship

- Federal Reserve Concerns

- Peace Dividend Hopes

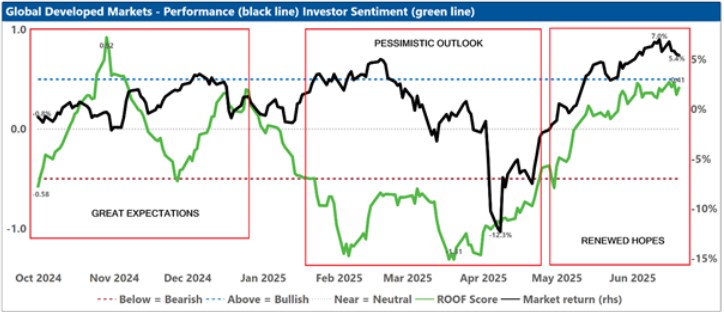

Great expectations from November 2024 to January 2025 turned into a pessimistic outlook in February to April, then into renewed hopes in May to June.

The first half of the year was marked by pro-business hopes initially, which then shifted to an unprecedented market volatility, USD weakness and capital flight from US markets among many other pivotal events that have occurred so far.

Watch the following video as Olivier d'Assier, Head of Investment Decision Research, APAC, discuss these risks and events and what APAC investors can expect for the rest of the 2025.

Found this helpful? Sign up to receive the latest on the complex world of market risks, index and portfolio exposures, and investment implications across a broad range of geographies and asset classes.

You may also like