MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED AUGUST 1, 2025

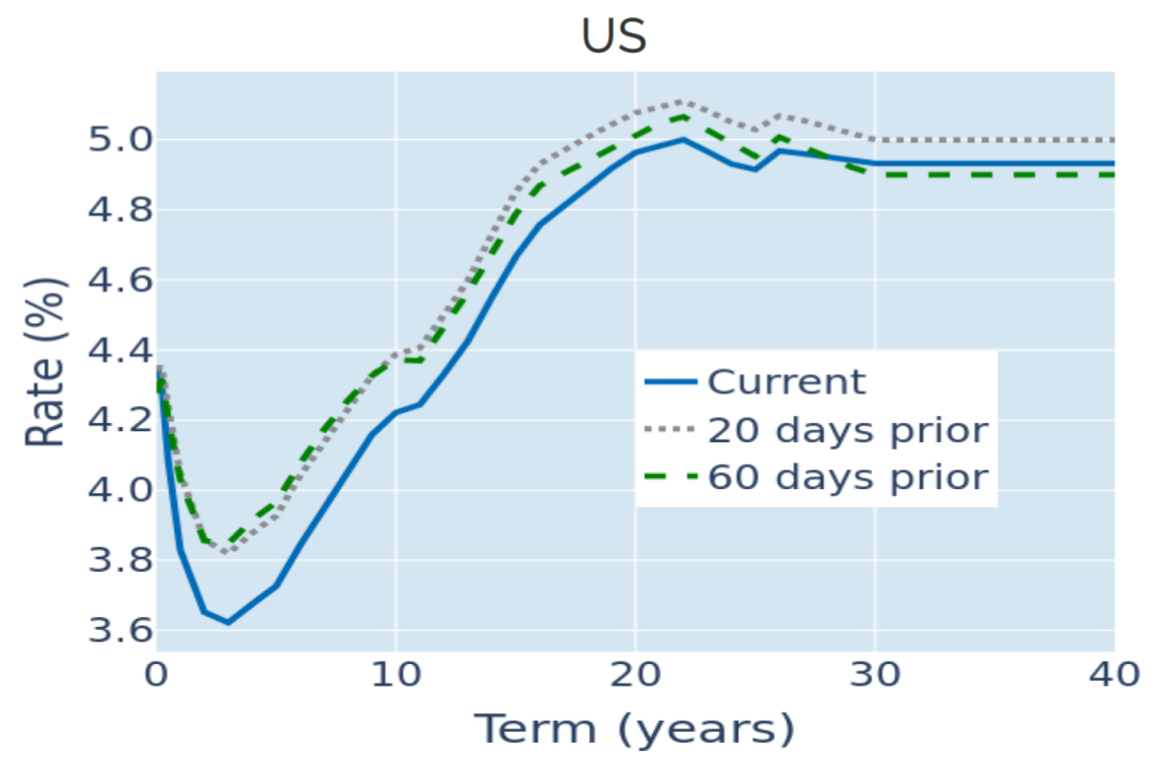

Weak labor market sends Treasury yields into a tailspin

US Treasury yields plunged to their lowest levels in three months in the week ending August 1, 2025, following a sharp, unexpected slowdown in US jobs growth. The latest non-farm payroll (NFP) report released on Friday showed an increase of 73,000 new positions in July, undershooting analyst predictions of 110,000. In addition, the 147,000 gain reported in June was revised downward to a mere 14,000, while the figure for May was cut by 125,000, indicating that the American labor market was cooling off more rapidly than previously anticipated.

Friday’s numbers seemingly contradicted the Federal Reserve’s assessment from only two days earlier, in which the central bank noted that the unemployment rate remained low and that labor market conditions were solid. This notion was further underpinned by the latest GDP numbers, which were also released on Wednesday and which showed that the American economy grew by an annualized rate of 3% in the second quarter, more than offsetting the 0.5% contraction in the first three months of the year.

The ambiguous data sent short-term interest-rate futures on a rollercoaster ride. The September federal funds contract started the week with a roughly two in three chance of a rate cut at the upcoming FOMC meeting next month, which was then inverted to 37% on Thursday, only to be flipped again to more than 80% after the NFP report on Friday. A full 50 basis points worth of monetary easing is now priced in for the remainder of the year, up from 0.4% at the end of start of the week.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated August 1, 2025) for further details.

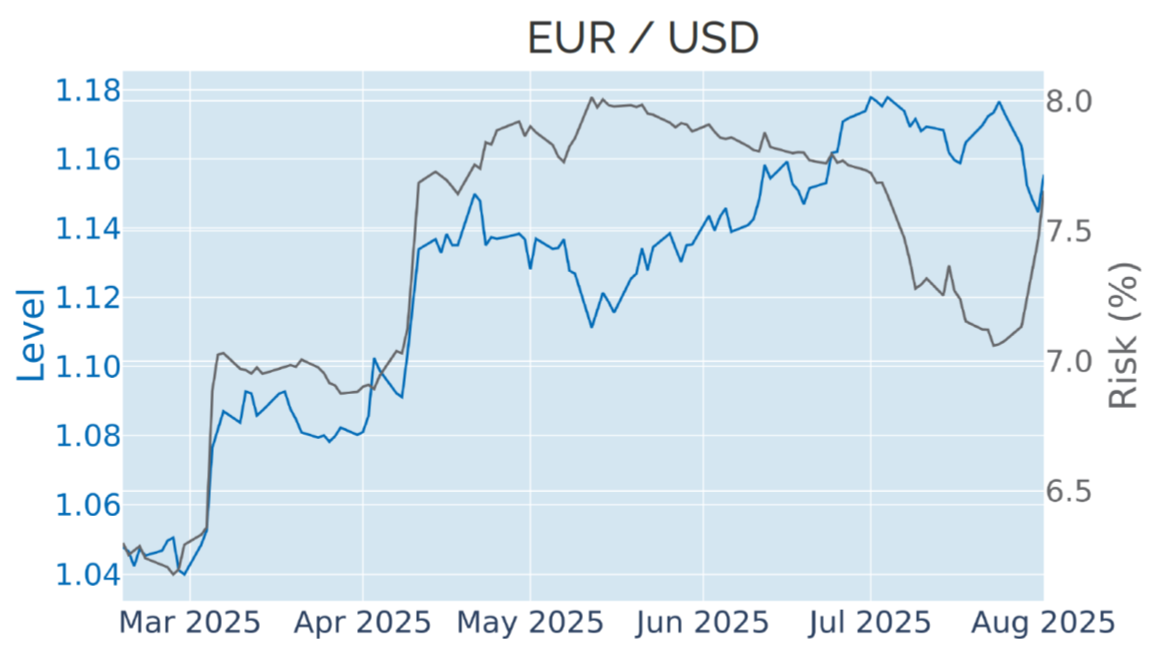

Dollar edges higher despite lower interest rates

The US dollar recorded its greatest weekly gain since the aftermath of November’s presidential election, strengthening 1.5% against a basket of major trading partners despite last week’s sharp drop in Treasury yields. The Dollar Index was bound for an even steeper ascent of almost 2.4% by Thursday—which would have been the strongest weekly uptick since September 2022—had it not been for the weak labor market report the following day. Friday’s 0.9% selloff marked the biggest daily drop since the fallout from the two tariff announcements at the end of February and in early April, reflecting renewed concerns over the adverse effects of trade barriers on the labor market and the American economy as a whole.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated August 1, 2025) for further details.

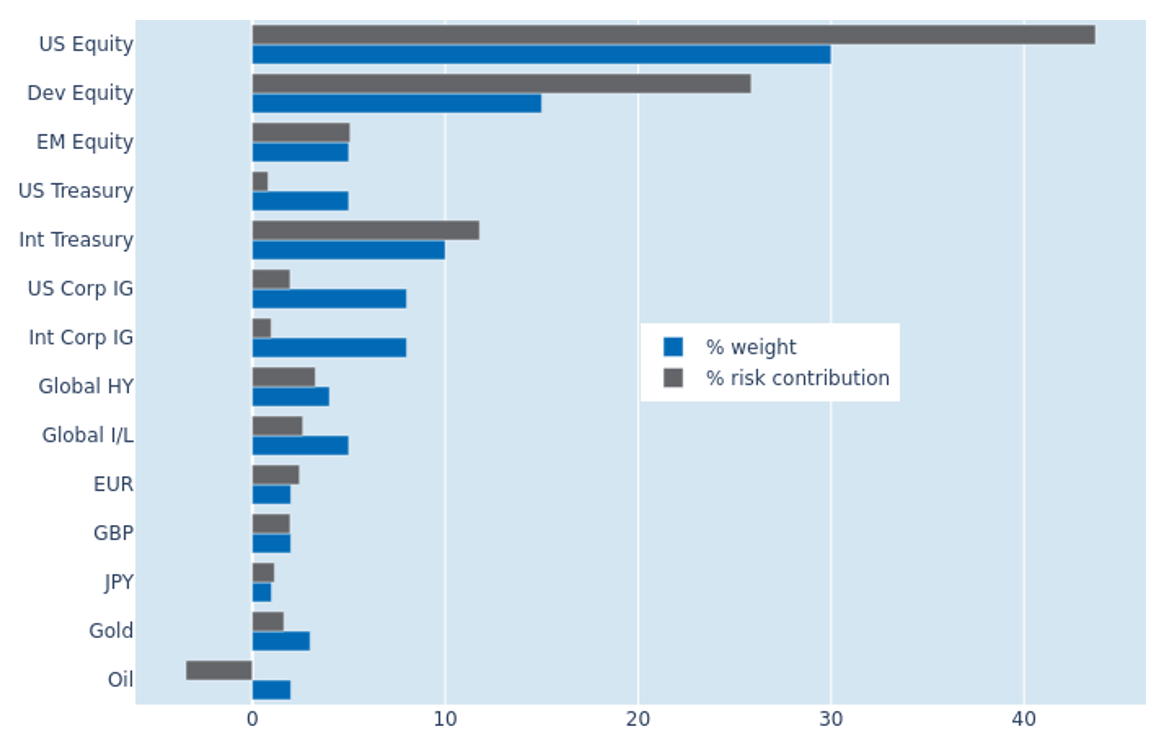

Greater FX rate volatility raises portfolio risk

A surge in exchange rate fluctuations lifted the predicted short-term risk of the Axioma global multi-asset class model portfolio from 5.8% to 6.1% as of Friday, August 1, 2025, more than offsetting a slight reduction in share price volatility. Non-USD sovereign bonds took the brunt of the risk increase, as their share of total portfolio volatility expanded from 9.5% to 11.7%. US equities, on the other hand, experienced a 1.1% reduction in their percentage risk contribution to 43.7%. Oil more than tripled its active risk reduction from -1.1% to -3.4%, due to a more negative correlation with most foreign currencies.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated August 1, 2025) for further details.

You may also like