MULTI-ASSET CLASS MONITOR HIGHLIGHTS

WEEK ENDED AUGUST 8, 2025

Knife-edge BoE vote sends Gilt yields soaring

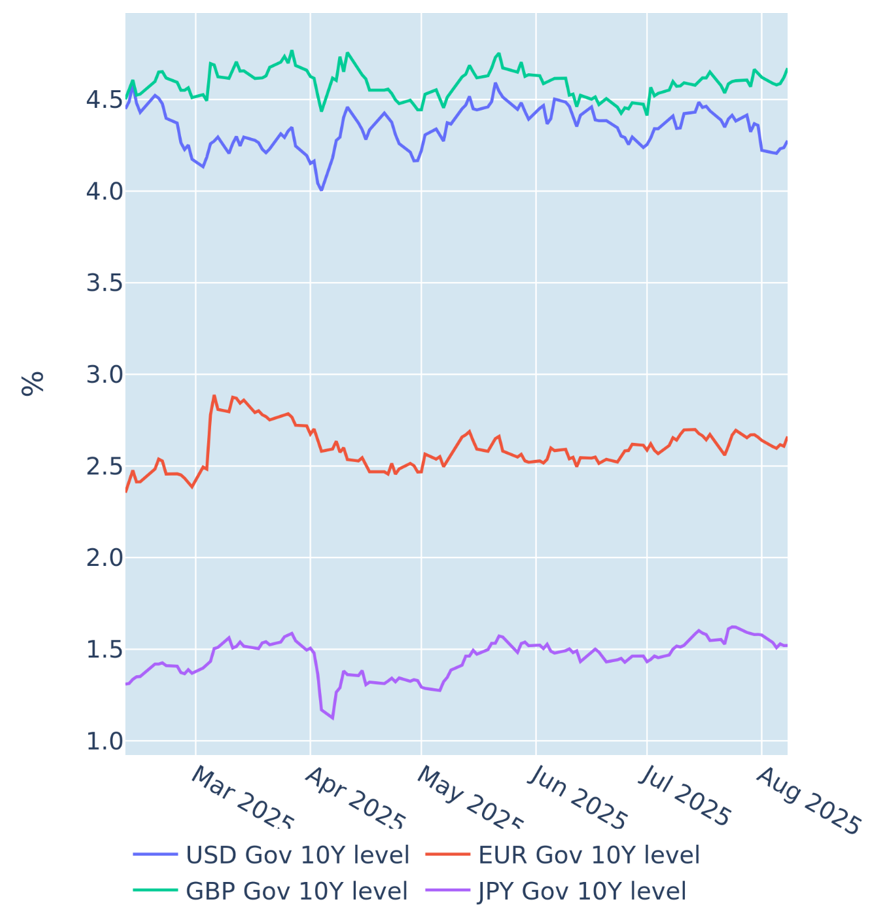

British Gilt yields rose across all maturities in the week ending August 8, 2025, following a close decision from the Bank of England (BoE) on Thursday. The bank’s Monetary Policy Committee (MPC) lowered interest rates by 25 basis points in line with market expectations at its monthly meeting. But the split vote of five MPC members in favour of the cut and four against it mirrored the twin challenges of persistent inflation and subdued growth that the UK economy is facing. BoE Governor Andrew Bailey noted in the press conference following the MPC meeting that the path of interest rates “continues to be downward” but that there was now greater uncertainty about the exact course of further rate cuts.

Short-term interest-rate markets reacted by significantly reducing the implied probability of further monetary easing this year, with potentially no more rate cut before February next year. The monetary policy-sensitive 2-year Gilt yield rose by 8 basis points in response, while longer rates ended the week 0.05% higher.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated August 8, 2025) for further details.

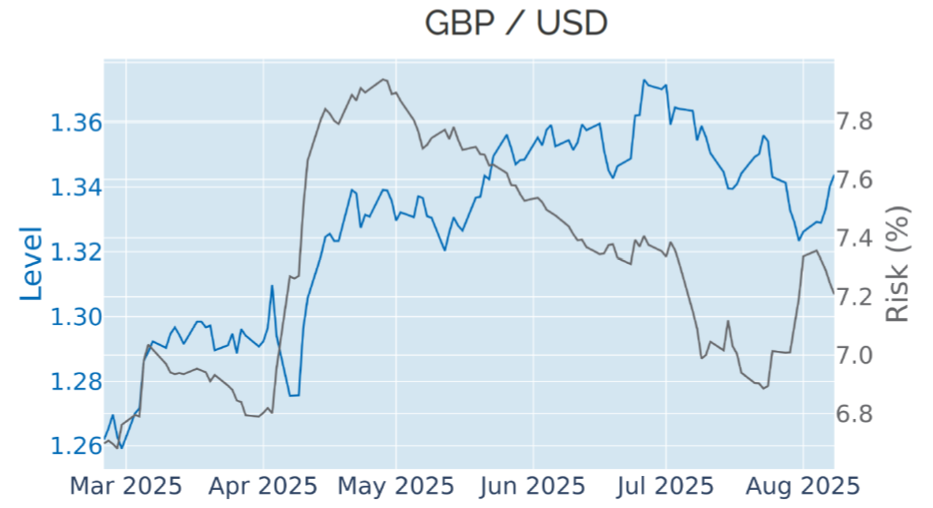

Higher rates support the pound

Last week’s rise in UK borrowing costs boosted the value of the pound against all other G10 currencies, erasing its steep loss against the US dollar from the week before. This co-movement of FX and interest rates, even though it makes intuitive sense, actually marks a reversal of the previously inverse relationship between the GBP/USD exchange rate and Gilt yields.

When both the Fed and the BoE raised rates in 2022 and 2023, the higher yields predominantly benefitted the greenback. It even made the pound appear to be inversely correlated with UK interest rates, while in reality the exchange rate was driven entirely by the stateside leg of the relationship. Now, with the Fed expected to ease its policy target by another 50 basis points this year, all the way down to just above 3% next year, and no more cuts expected from the BoE in 2025 while the base rate is projected to conclude around the 3.5% mark, the growing rate differential could lend further support to the pound going forward.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated August 8, 2025) for further details.

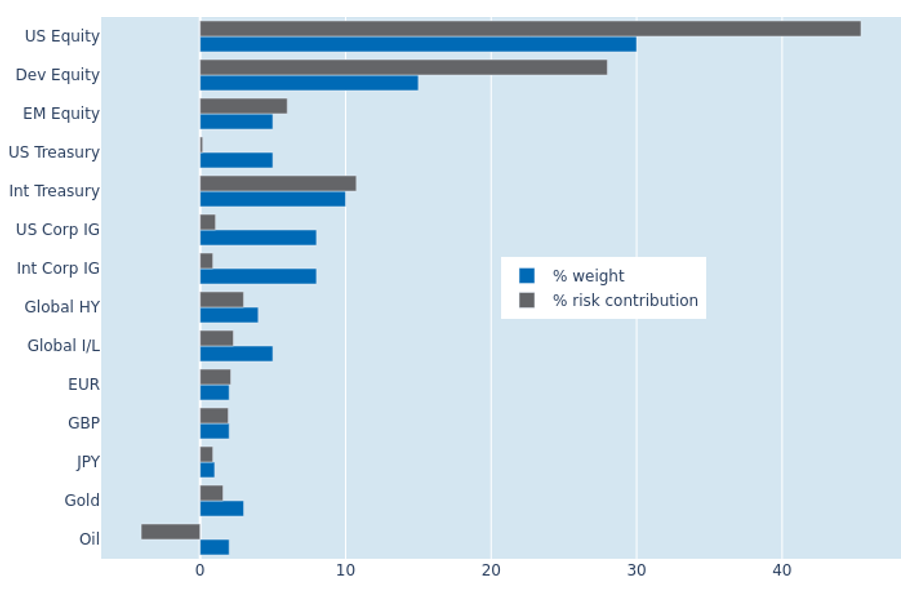

Lower FX volatility reduces portfolio risk

The predicted short-term risk of the Axioma global multi-asset class model portfolio eased back to 5.7% as of Friday, August 8, 2025, down from 6.1% the week before. The decline was mostly due to lower FX volatility and a more negative correlation between stock and bond prices. As a result, non-USD government bonds recorded the biggest reduction in their percentage risk contribution from 11.7% to 10.8%. US Treasury securities also benefited from their renewed inverse relationship with equities, no longer adding to overall volatility. But oil remained the greatest diversifier in the portfolio, even expanding its risk-reducing capacity from -3.4% to 4.1%.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated August 8, 2025) for further details.

You may also like