Debunking the high credit beta myth

Author

Christoph Schon,

EMEA Applied Research, SimCorp

Investors beware: There is a misconception in credit investing that high spreads equal high beta.

The notion that higher-yielding bonds are more sensitive to changes in overall spread levels is based merely on the empirical observation that their risk premia tend to fluctuate more than those of better-quality issues. But low-rated securities often exhibit very weak correlations with the general credit market, resulting in betas significantly below one. A bullish investor looking to increase market sensitivity by buying higher-yielding bonds may thus inadvertently end up with a portfolio that is more volatile than the broad market but may still not outperform when spreads tighten.

Therefore, it is important for investors to have a tool that allows them to analyze and verify that their portfolios’ exposures are as intended and that there are no hidden and unwanted risks or vulnerabilities.

In our recent whitepaper How smart is your credit beta? we analyzed three fixed income smart beta exchange traded funds through the lens of the Axioma Credit Spread Factor Model (CSFM). Unlike other fixed income risk models that often use timeseries of sector/rating spread averages, this Axioma model applies cross-sectional regression techniques — used mostly in equity risk modeling — to issuer spread curves to estimate a parsimonious set of credit factors, such as Market Sensitivity (a.k.a. “Beta”), Size, Momentum, and Value.

High yield equals high volatility, but not high beta

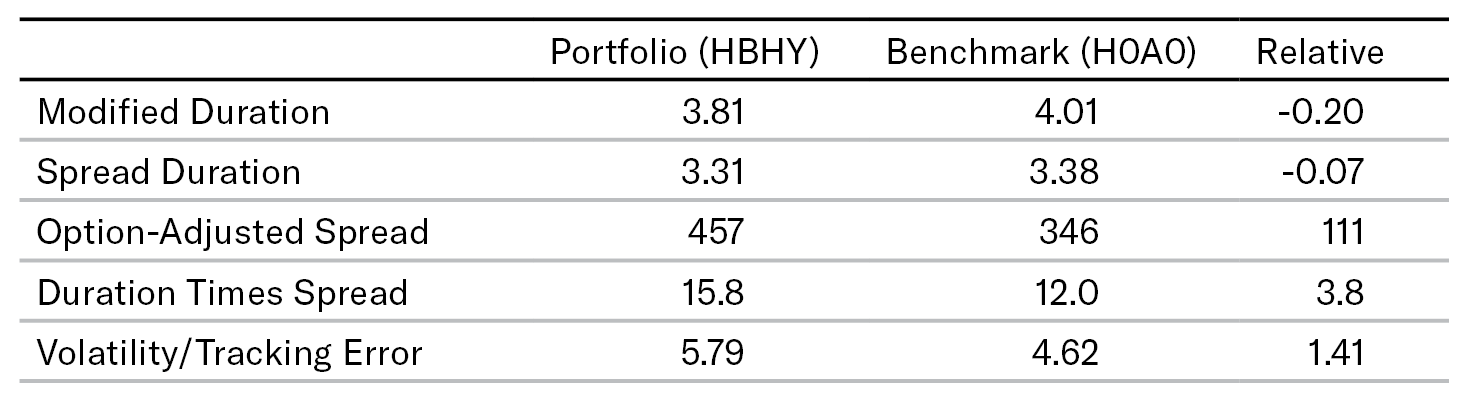

One of the funds analyzed was a High Beta High Yield ETF (HBHY), which invests in US dollar-denominated high yield corporate bonds that potentially have higher beta to the overall high yield corporate bond market. The ETF prospectus defines beta as a measure of price sensitivity relative to overall market movements, but then explains that the actual selection criterion for inclusion of a specific security in the fund is its yield. Figure 1 shows a comparison of some key portfolio metrics against the ICE BofA US High Yield Index (H0A0).

Figure 1. Fund and benchmark characteristics

Source: Axioma Risk

The fund’s modified duration is very close to that of the benchmark, meaning that it has almost no exposure to the general direction of interest rates. Its spread duration is even closer, but its option-adjusted spread (OAS) is more than 100 basis points wider, giving it a relative duration-times-spread (DTS) exposure of 3.8. As the Axioma CSFM uses proportional changes in spreads (log returns), the portfolio shows a much higher predicted volatility than the benchmark and a substantial tracking error (TE) of 1.41%. Figure 2 shows a more detailed breakdown of this active risk.

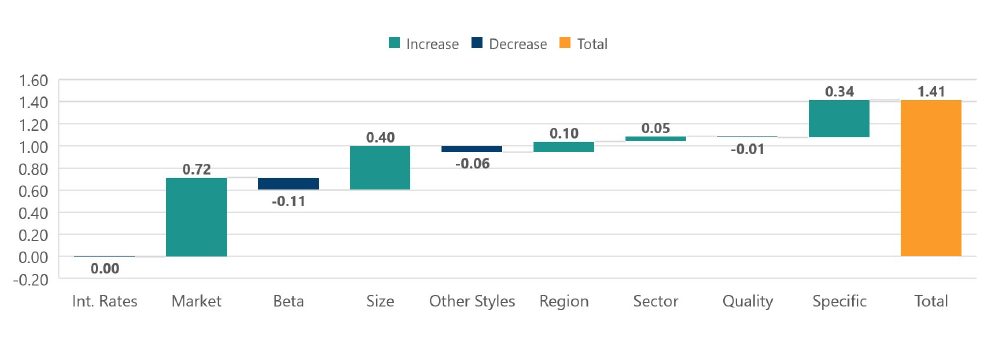

Figure 2. Predicted tracking error by major risk factor type

Source: Axioma Risk

About half of the total tracking error seems to come from general credit “market” risk, which is not surprising given the fund’s DTS overweight. What may seem counterintuitive however, given the prospectus states the objective as being “high beta”, is the apparent risk reduction stemming from the associated factor. The USD High Yield Beta factor in the Axioma CFSM is very highly correlated with the corresponding Market Intercept. As the fund is net “long” the credit market, the negative TE contribution from Beta implies that it is mostly invested in low-beta securities. A more detailed analysis reveals that it is the combination of being overweight CCC and underweight BB-rated debt relative to the benchmark that is responsible for this.

Robust credit spread factor models – a must-have

The fund is promoted as a “high beta” strategy, but our analysis concluded that it is simply an investment in higher yielding, low quality securities with greater expected volatility than the overall market. Due to the low correlation of the lowest-rated issuers with general spread levels, there is no guarantee that the fund would outperform its benchmark if risk premia were to tighten. End investors would, therefore, be well advised to use a risk model that enables them to verify the claims made by fund providers with regards to target exposures to systematic risk factors, before buying those products.

With its foundation of robust issuer curves, the Axioma CSFM is the first commercially available credit risk model that has been able to successfully apply cross-sectional regression techniques to extract meaningful, significant signals and discernible risk premia from credit spreads.

Contact us to learn more about our range of Axioma Risk Models, which are available on the SimCorp One platform.

Related content