From Formula One to SimCorp One

Author

Ashish Aryal

Senior Market Strategist, SimCorp

How we are enhancing the portfolio manager experience

The job of a portfolio manager is a little bit like Max Verstappen’s or Lewis Hamilton’s in a Formula One car. You need technical brilliance, cutting-edge technology and a stellar supporting cast to squeeze every margin on the track.

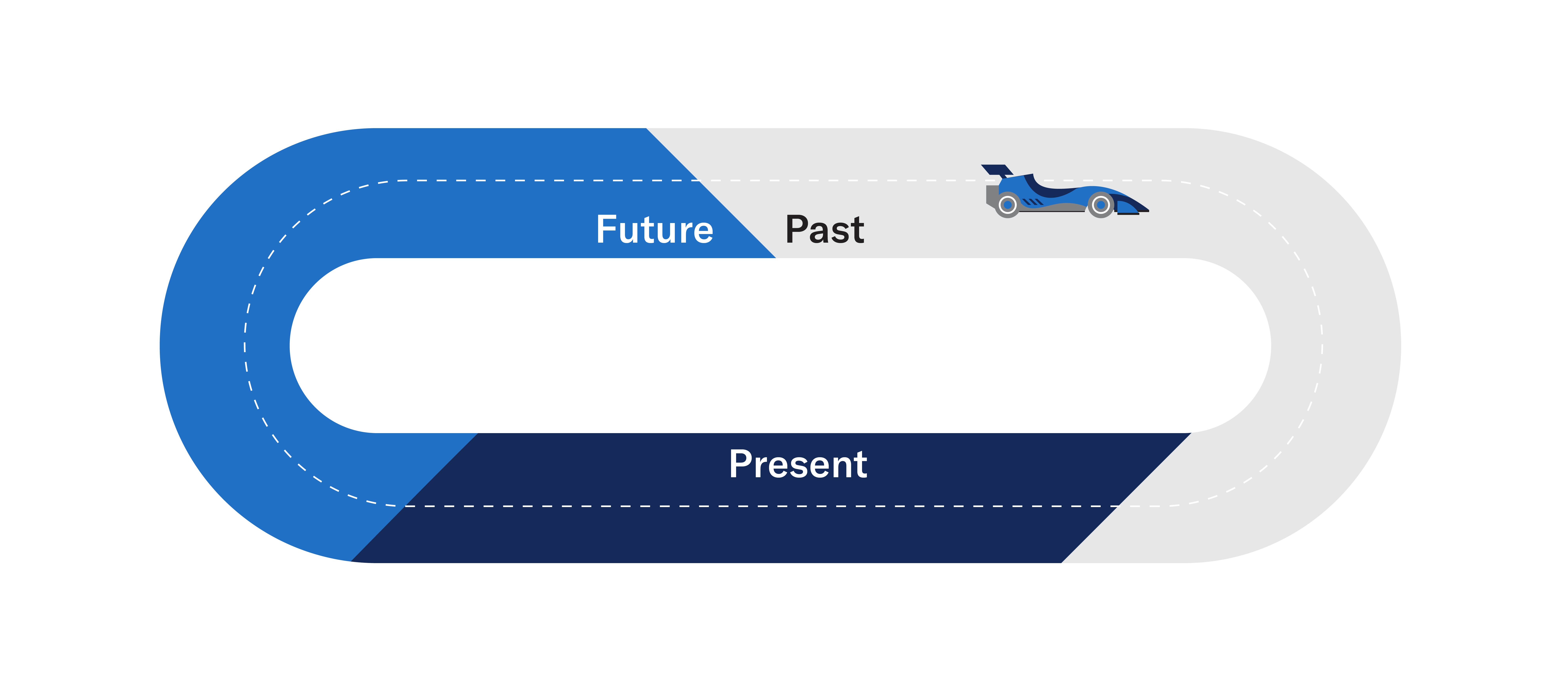

Formula One teams rely on real-time data about tire wear and fuel levels. They run risk models to predict race outcomes. They’re also constantly adapting to track conditions with their tire strategies. At all times, they’re learning from the past, present, and future.

SimCorp also uses the lens of the past, present and future time dimensions to enhance the portfolio manager experience.

The past is about reflecting on your investment decisions and pin-pointing sources of alpha through performance attribution and performing transaction cost analysis for greater efficiency in execution.

The present is about achieving best-execution and decision-making in the moment enabled through a comprehensive front office, spanning portfolio management and optimization, order management, compliance and risk.

The future is about forecasting and making predictions.

The challenge is to achieve a workflow that allows portfolio managers to seamlessly switch back and forth between these time dimensions. However, in many cases either the data for such analysis is not in one place, or the functionality is spread across many best-of-breed systems. Either it takes too long to prepare the data, or the data is already stale!

Melissa Brown, Managing Director of Investment Decision Research, SimCorp

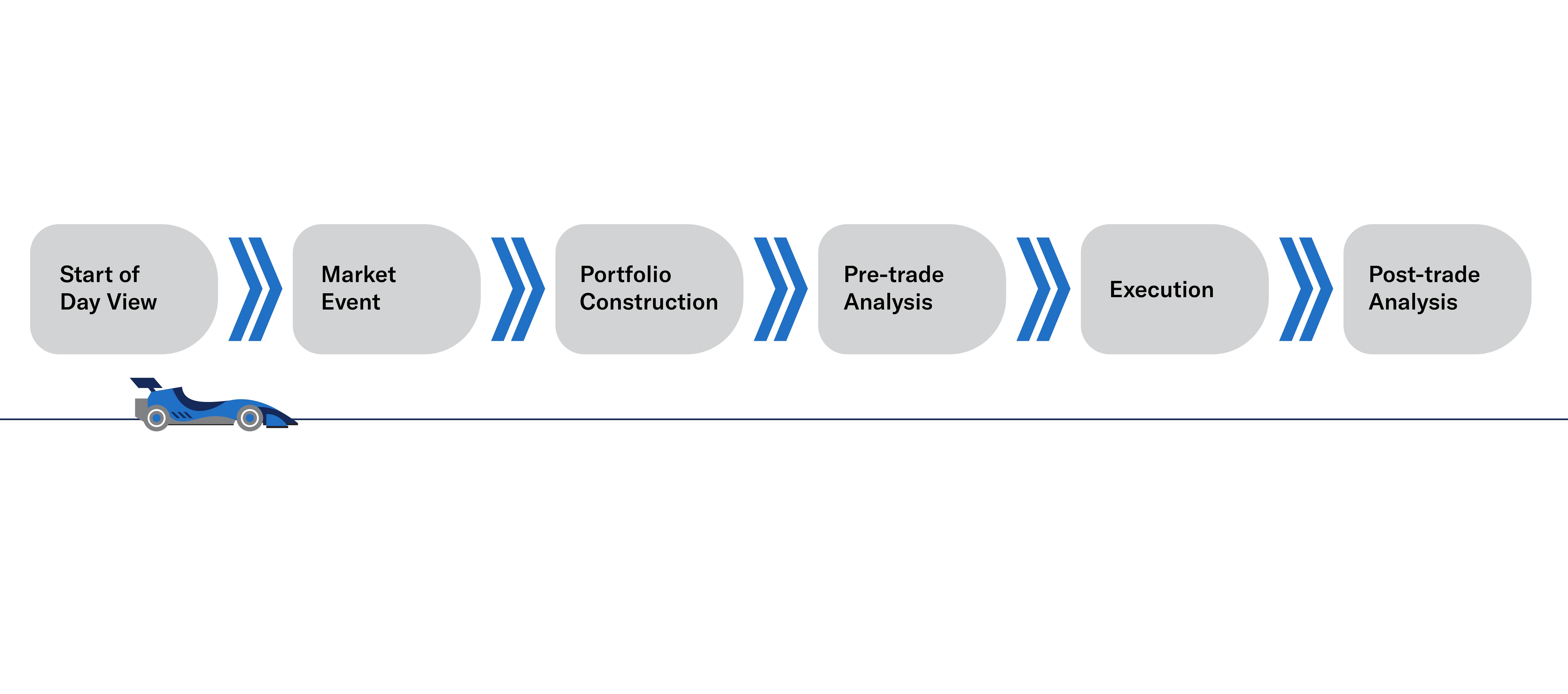

The traditional view of a day in the life of a portfolio manager

Let’s put a little more context around why these time dimensions are useful. We will start with the traditional approach first to highlight where the challenges are.

The traditional view of a day in the life of a portfolio manager can be split into the follow key workflows:

The key questions the portfolio manager will be looking to solve are based on putting the fundamental law of active management into practice:

Start of day

Are my portfolios ready, that is, positions reconciled, prices validated, benchmarks calculated? Do they accurately represent my existing investment thesis?

Market analysis and investment strategy review

What is the impact of new market information (macro data, earnings, geopolitical events) on my existing forecasts and investment thesis? Do I need to adjust my forecasts and rebalance my portfolio based on the new information?

Portfolio construction

How should I optimize my portfolio to best capture my forecast? How should I align alpha signals and market risks to reduce active risk or enhance returns?

Pre-trade analysis

Have I introduced any bias in my trade ideas? Am I in compliance with my investment thresholds?

Execution

How do I best minimize market impact and optimize the sequence of my trades? How do I minimize execution shortfall and ensure I get the intended price?

Post-trade analysis

Did I achieve best execution? What factors contributed to my returns?

The challenge with the traditional workflow described above is that it is often disjointed, with various tools and datasets of differing frequencies being used. More time is spent on data preparation rather than analysis. Additionally, existing technology limitations means that the steps can’t always be done in sequence, so you may have ideated trades only to find out later that they are incompatible with your investment guidelines.

The time view—the life of a portfolio manager, reimagined

Now let’s pivot to the time view. The idea here is to move from portfolios that are optimized periodically to portfolios that are optimized continuously with respect to the portfolio manager’s risk and return objectives. It's about making investment decisions at speed and scale.

The time view relies on centralized, normalized, real-time data available across the organization. You’re no longer constrained by inconsistent or point-in-time intelligence, and portfolios that were previously optimized only periodically can now be optimized continuously with respect to your risk and return objectives.

Instead of disparate tasks, you can look at the workflow more holistically across the trade lifecycle and work seamlessly with risk managers, traders and compliance, whether you are thinking about past performance, decision making in the present or optimizing for future returns

Here are the key questions that a portfolio manager can solve for in this new context:

- The past: what did I buy/sell yesterday, last week, last month, last year? Were my decisions profitable, and if not, why not? How quickly can I get access to the data to perform this analysis on a regular basis?

- The present: only once I have a clear and accurate picture of my positions and cash, I can start to plan next steps. What shall I invest in to take advantage of market volatility? Has the outlook for any of my holdings changed substantially? Are my trade ideas compliant with my investment thresholds? How do we ensure best execution on the trades?

- The future: what is the range of possible future paths for my portfolio? How will my portfolio react to potential market shocks? How much is the potential maximum loss I will incur in any given day? How should I construct and optimize my portfolio to navigate these changes in the market?

Axioma is a leading provider of risk and portfolio management solutions. The integration of Axioma to SimCorp earlier this year enhances our ability to deliver a front-to-back solution for investment managers. A robust centralized data strategy on SimCorp One combined with the the Axioma’s risk and optimization capabilities, makes for a compelling proposition for portfolio managers.

How SimCorp One delivers a superior experience for portfolio managers

The benefits of SimCorp and Axioma being one company go beyond just embedding Axioma capabilities into SimCorp. We emphasize on having a centralized data strategy: your data on one platform, available in real-time and on top of a unified and consistent data layer. This is fundamental to the continuous workflow described above.

Having your data and functionality in one place, first and foremost, frees up time for the portfolio manager and improves productivity. They can redirect their focus to what they do best: working more collaboratively with research analysts, risk managers, compliance officers and traders in one fluid portfolio management workflow. Everyone is working from the same data, and the same data that is being used to do stress tests and forecasting, is also the same data that is powering historic performance analysis. Portfolio managers can create and back test strategies directly from start-of-day view, while compliance rules can be directly embedded into the optimization process. This means less time spent on repetitive tasks and data preparation, and more time spent on driving decisions.

We have built SimCorp One with fundamental, quantitative and index managers in mind. SimCorp and Axioma’s combined offering allows you to perform all the same analysis you previously did but with greater precision and timeliness. So whether you are adding a couple of names or rebalancing the whole portfolio, this is all possible within SimCorp’s native portfolio management solution

The reality on the ground—what portfolio managers can achieve

Here are some concrete examples of how portfolio managers can switch seamlessly between the time dimensions in SimCorp One:

Pushing the boundaries to enhance the portfolio manager’s experience

To further enhance the portfolio manager's experience, we have integrated advanced features that enable them to prioritize strategic decision-making over administrative tasks:

- Bringing compliance checks further up the workflow chain: compliance rules on portfolios typically get taken into consideration after portfolio construction. We are changing that by allowing Compliance rules written on SimCorp One to be incorporated directly into the Axioma Optimizer simultaneously. What that means is that any trade recommendations that the Optimizer sends back are already verified and compliance checked. That saves substantial time for portfolio managers who find great trade ideas only to realize they have hit a compliance threshold after they are ready to trade

- Using Artificial intelligence (AI Copilot) to support rebalancing as a passive manager, you will have a number of different portfolios, likely tracking different indices. Our AI Copilot alerts you when a specific portfolio has an upcoming rebalance. On top of that, it'll run a series of frontier optimizations to tell you the best way to trade into the rebalance, showing you the trade-off between tracking error and trading-cost.

- Simplifying the job of the multi-manager: our open-ecosystem architecture translates to a significantly improved experience for multi-managers. We’ve established connections to data feeds from the top service providers and custodians. The network effect means that if we are already connected to your custodian, setting up the connection is quick and straightforward.

For more information and any questions, get in touch with us today.

Related content