To invest like a hedge fund, think Opinion Divergence

Sentiment factors in risk models

Author

Bob Stock, PhD, Principal Analytics Researcher

Research has shown that stocks with high Opinion Divergence tend to outperform in the long run.

Alpha capture strategies have been utilized by start-up hedge funds for decades and this strategy is ramping up once again1. Blending fundamental and quantitative techniques, alpha capture aims to systematically find alpha. However, relying on market data, research and other inputs can be a cost-intensive exercise. So, what if you – as a hedge fund or asset manager – could lean on some of these inputs without the initial outlay?

In a recent report, we looked at how our latest risk model could help you do just that.

By using Crowding and Short Interest factors, you could look at some of the best ideas from hedge funds and build a long/short strategy we called a Budget Hedge Fund Index. In this article, we add on Opinion Divergence.

But first, what is Opinion Divergence?

Opinion Divergence is the strength of the disagreement among traders about whether a security is mispriced. A good observable proxy for Opinion Divergence is unusual trading volume.

Why do stocks that exhibit high Opinion Divergence perform well?

Put simply, it is because they are more susceptible to react positively to news. The economic intuition is that uncertainty depresses prices2, and when the uncertainty is removed (one way or another), the negative uncertainty premium evaporates as traders “buy the news.”

Opinion Divergence is a factor in the latest version of the Axioma suite of risk models (US5.1) for the Short and Trading horizons. It is a “Sentiment” factor based on measuring the activity of informed traders, like Crowding and Short Interest.

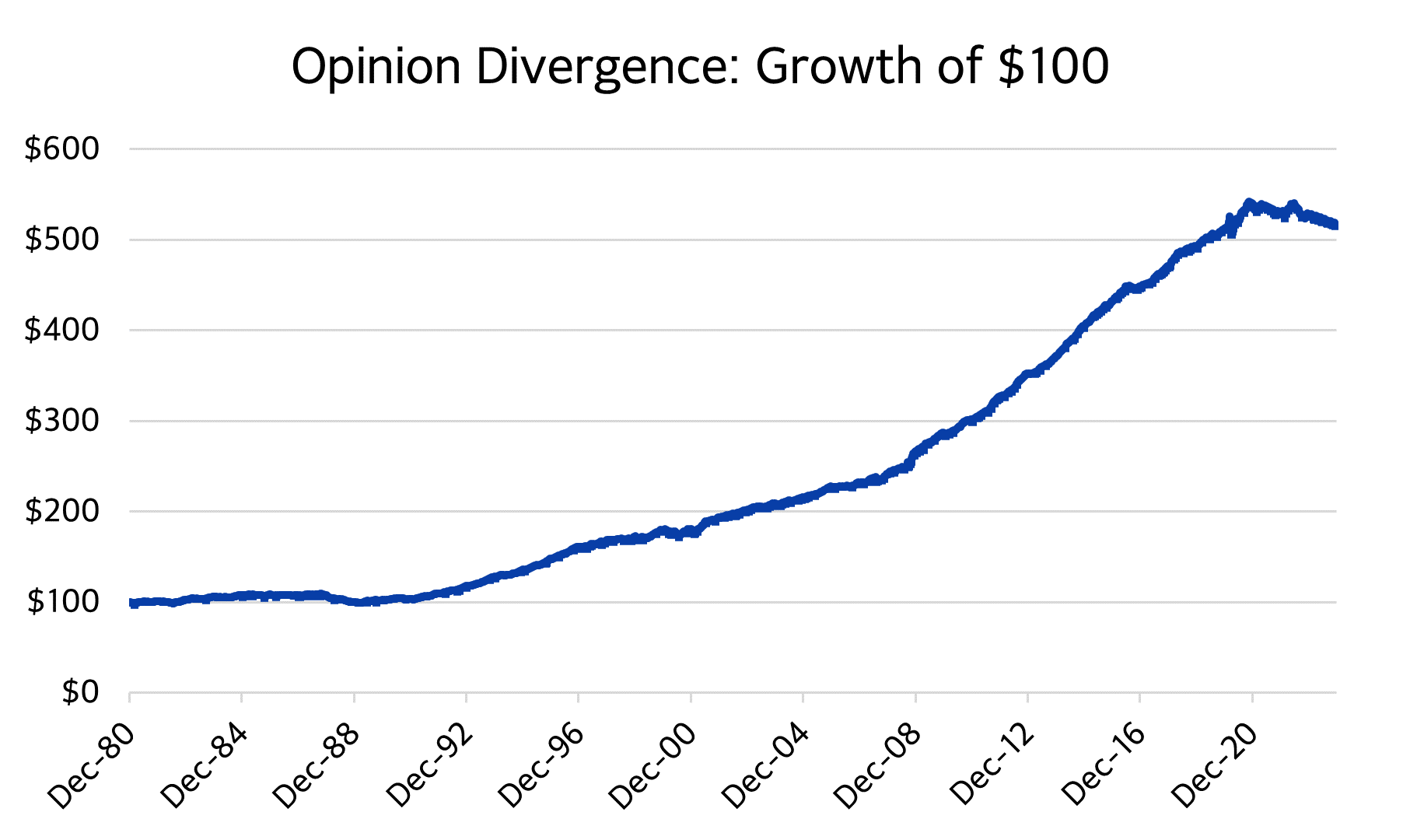

Figure 1: Factor returns for Opinion Divergence

Source: Axioma US Equity Factor Risk Model (US5.1) – Short Horizon

Hedge funds’ best ideas: The methodology

How can we utilize this additional Sentiment information in our Budget Hedge Fund Index? In the previous article, we took a 0.2% long position in the top-500 Crowding stocks and a 1% short position in the top-100 Short Interest stocks to mimic the best ideas of hedge fund managers, rebalancing monthly. And if a name were on both lists, we simply dropped that exposure and held cash (earning 0%). Finally, we restricted our pool of equities to the risk model’s estimation universe of about 3,000 stocks, and applied an additional modest screen for market cap and average daily volume.

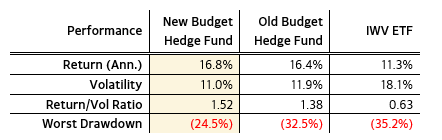

Since stocks with high Opinion Divergence are at high risk of outperforming to the upside, we add an additional screen to drop from our short portfolio any stock with an Opinion Divergence exposure greater than 1.0 at the monthly rebalance, and replace it with cash. For a 10-year backtest through 2023, comparing to the previous study and the Russell 3000 ETF (IWV), the results speak for themselves (Figure 2 and Figure 3).

New vs Old Budget Hedge Fund Index performance

Figure 2: Summary performance statistics from 12/31/2013 through 12/31/2023

Source: Axioma US Equity Factor Risk Model (US5.1), Russell 3000 ETF

Figure 3: Comparison of average portfolio characteristics from 12/31/2013 through 12/31/2023

.png)

Source: Axioma US Equity Factor Risk Model (US5.1)

By removing on average just nine stocks, the return is somewhat boosted and the volatility is reduced by nearly a full point, significantly improving the risk-adjusted return. The worst drawdown is also greatly improved. This at first glance appears surprising, because presumably by removing short positions on high-upside stocks, we might expect to mainly be improving our returns, but instead we mostly improve our risk. These high Opinion Divergence stocks, however, are also jointly high Short Interest stocks, so apparently when news arrives, a battle between these respective upward and downward tendencies occurs, resulting in higher unexpected volatility. Therefore, removing them also reduces overall portfolio volatility (and reduces turnover as well).

Impact on Volatility

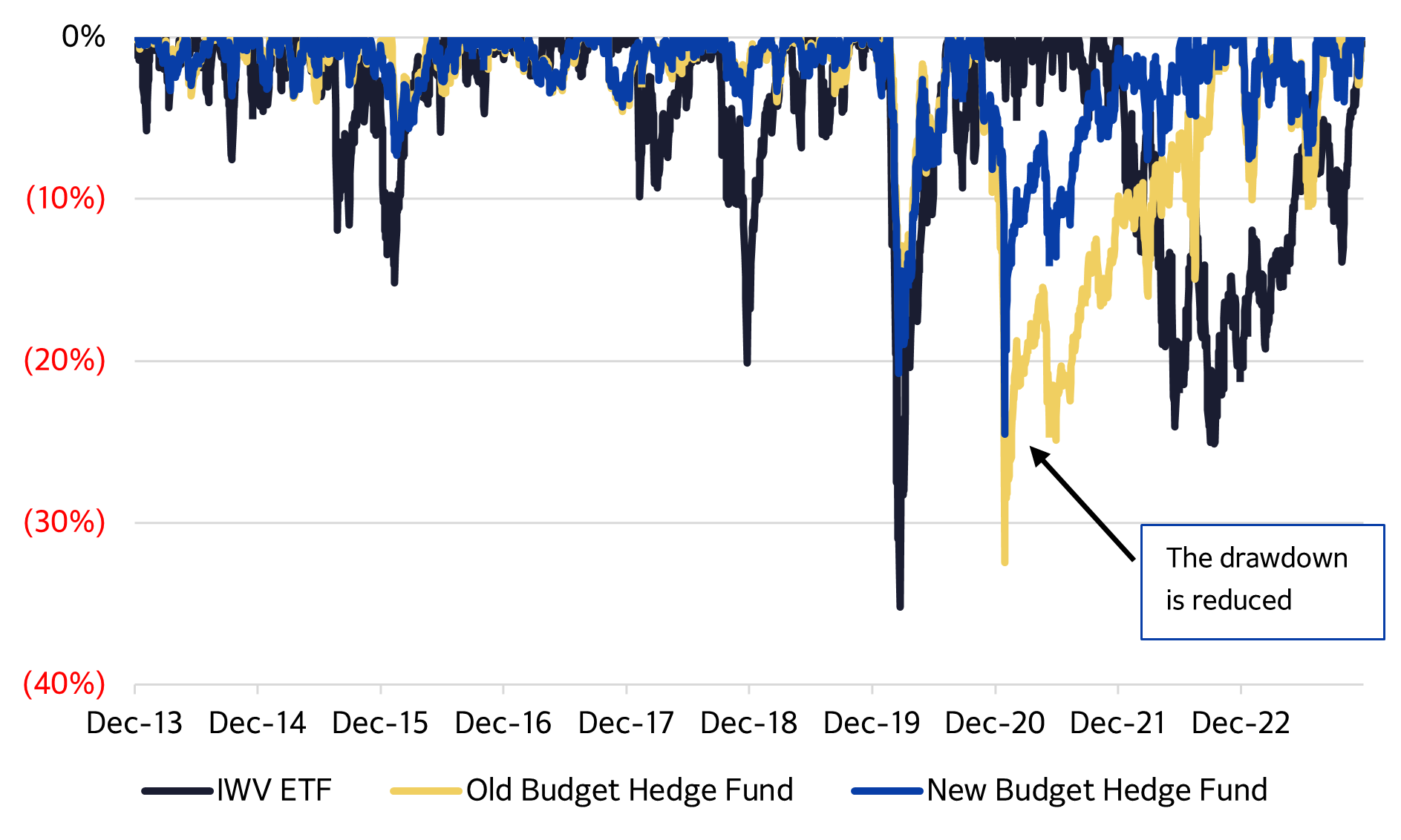

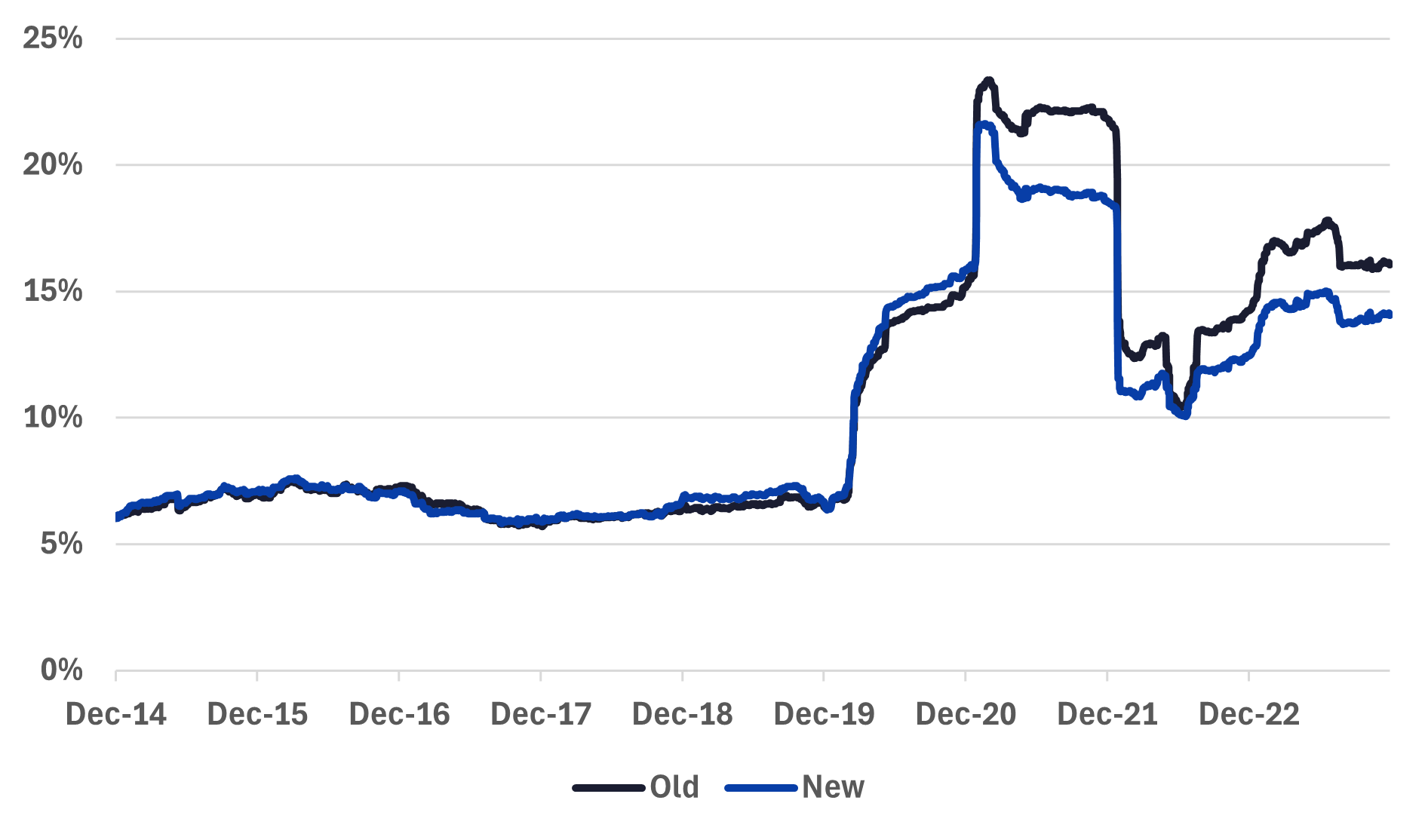

This stock-specific volatility-reduction effect is all the more apparent as the portfolio’s net long position actually increases from 15% to 24%, yet its volatility falls. Indeed, the hypothesis that stocks that are jointly high in Opinion Divergence and high in Short Interest are exposed to a hidden “unexpected volatility” risk is supported by the observation that their average exposure to our standard Residual Volatility factor at the time of removal (1.09) is not especially different from that of the short portfolio as a whole (1.07). In fact, precisely where this screening helped the most was where the Old Budget Hedge Fund’s short portfolio rebounded strongly after COVID, outperforming the long portfolio and causing a drawdown at the end of 2020 that was not shared by the overall market. This drawdown was driven by the high Opinion Divergence effect winning out on the short side; the removal of those stocks reduced the drawdown’s depth and duration as can be seen in Figure 4, and has reduced volatility since then, as per Figure 6.

Figure 4: Drawdown comparison

Source: Axioma US Equity Factor Risk Model (US5.1)

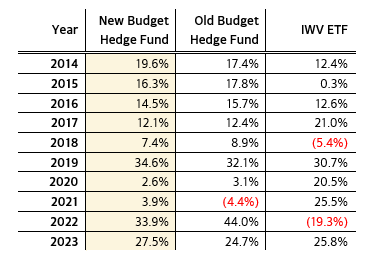

Figure 5: Comparison of annual returns

Source: Axioma US Equity Factor Risk Model (US5.1), Russell 3000 ETF

Figure 6: Comparison of rolling annual volatility

Source: Axioma US Equity Factor Risk Model (US5.1)

Piggyback on hedge funds’ best ideas

Using the Opinion Divergence factor, alongside the other two Sentiment factors in the Axioma Equity Factor Risk Model, significantly improves the performance of our sample hedge fund strategy. By turning to the observable behavior of informed traders, we have demonstrated how institutional investors can leverage hedge funds’ best ideas.

Request a demo of the Axioma US5.1 Equity Factor Risk Model

"These high Opinion Divergence stocks, however, are also jointly high Short Interest stocks, so apparently when news arrives, a battle between these respective upward and downward tendencies occurs, resulting in higher unexpected volatility."

1 Saacks, B. “Here’s why alpha capture is hot in the hedge fund world.” Business Insider, March 7, 2024, (https://www.businessinsider.com/alpha-capture-hedge-funds-quantamental-2024-3)

2 Varian, H. “Divergence of Opinion in Complete Markets: A Note.” Journal of Finance 40 (1985): 309–17.