Stress tests: Candidates remain poles (but not polls) apart

Author:

Olivier d’Assier, Investment Decision Research

Trump vs Harris: Which portfolio is currently outperforming?

It's been three weeks since we shared the results of our US election stress test and the portfolios we created to track investor preferences for three possible outcomes: a “Blue Wave”, a “Red Wave”, and a “Divided” government. Since then, much has transpired, prompting us to update our findings. We've witnessed two debates—one for the presidential candidates and one for the vice-presidential candidates—the Fed's first interest rate cut after a series of hikes to multi-decade highs, and a rebound in employment numbers, alleviating fears of an economic recession.

Performance update since debate night (September 10)

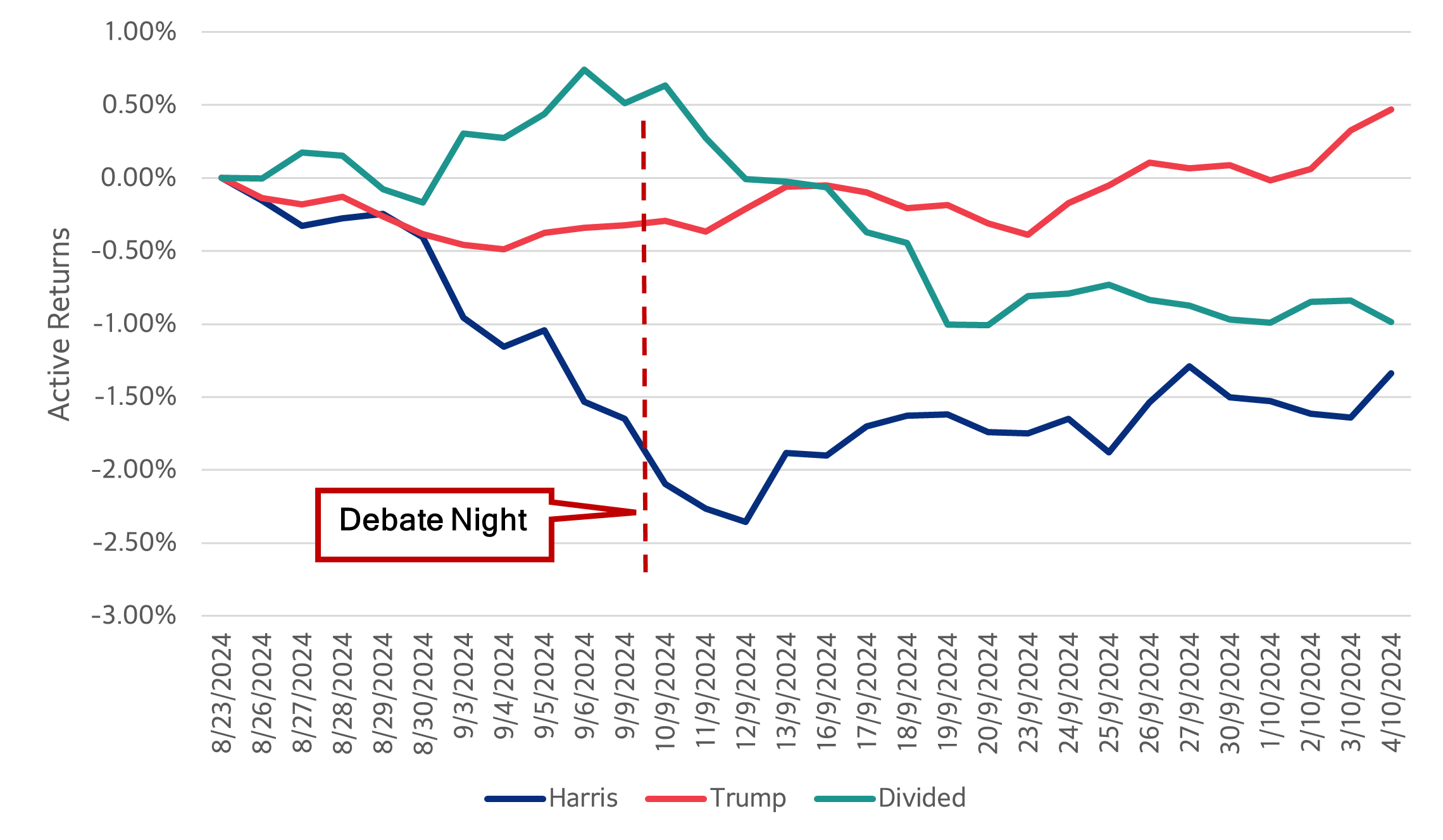

As of the night before the first presidential debate on September 9, the "Divided" portfolio was the only one showing a positive return since its creation on August 23, reflecting its status as the most favored among investors. However, following the debate, this portfolio experienced negative returns, ending with a loss of 162 basis points as of October 4, and has since become the least favored scenario.

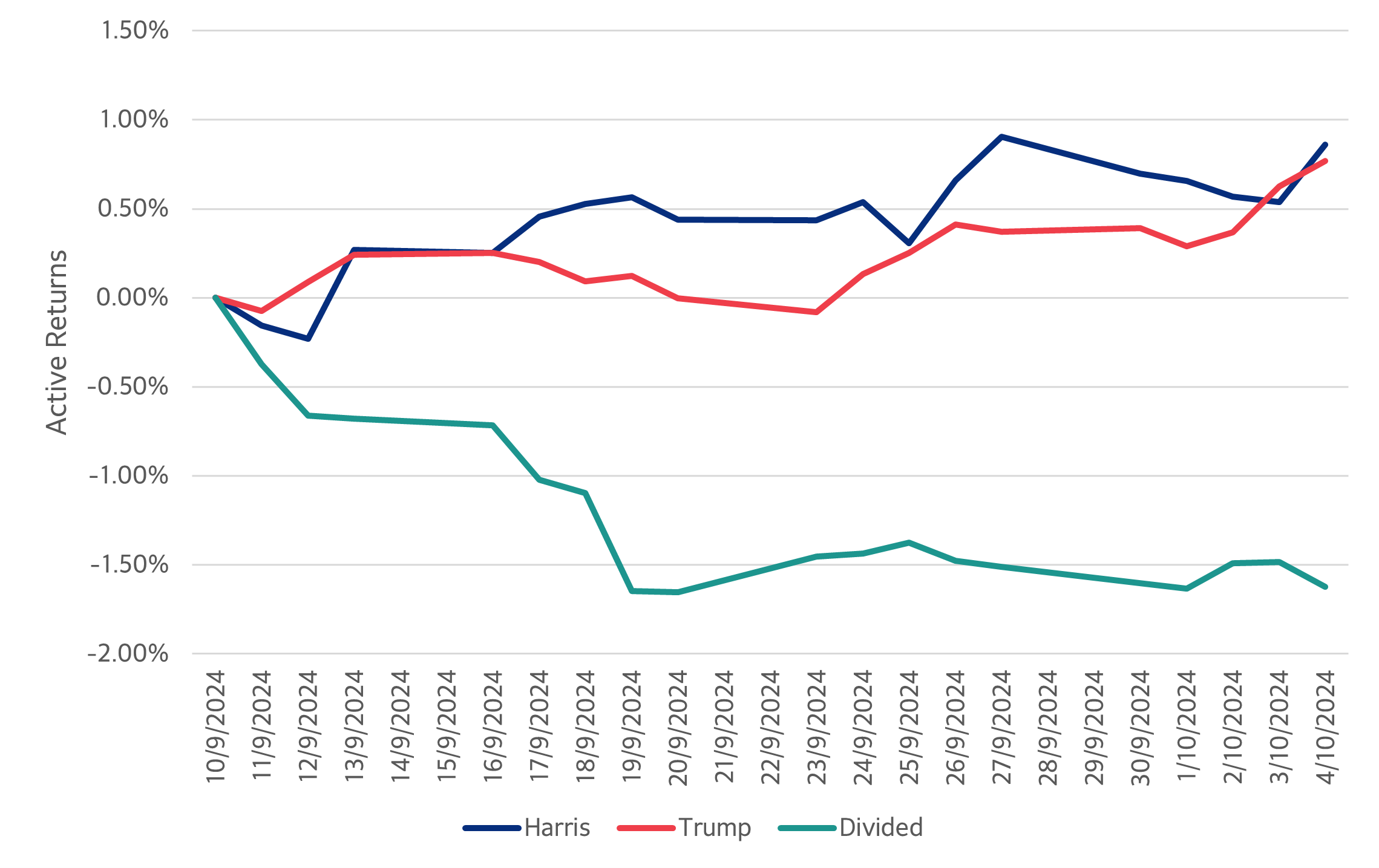

In contrast, both the Harris and Trump portfolios have shown similar gains since the debate on October 10, with Harris up by 86 basis points and Trump by 77 basis points, remaining closely aligned (see Figure 1 below).

Figure 1: Cumulative returns for optimal portfolios from September 10 through to October 4

Source: Axioma Portfolio Optimizer

Figure 2 shows the cumulative performance of the three portfolios since August 23. The Trump portfolio continues to lead, although its advantage has narrowed slightly since the debate on September 10.

Figure 2: Cumulative returns for optimal portfolios from August 23 through to October 4

Source: Axioma Portfolio Optimizer

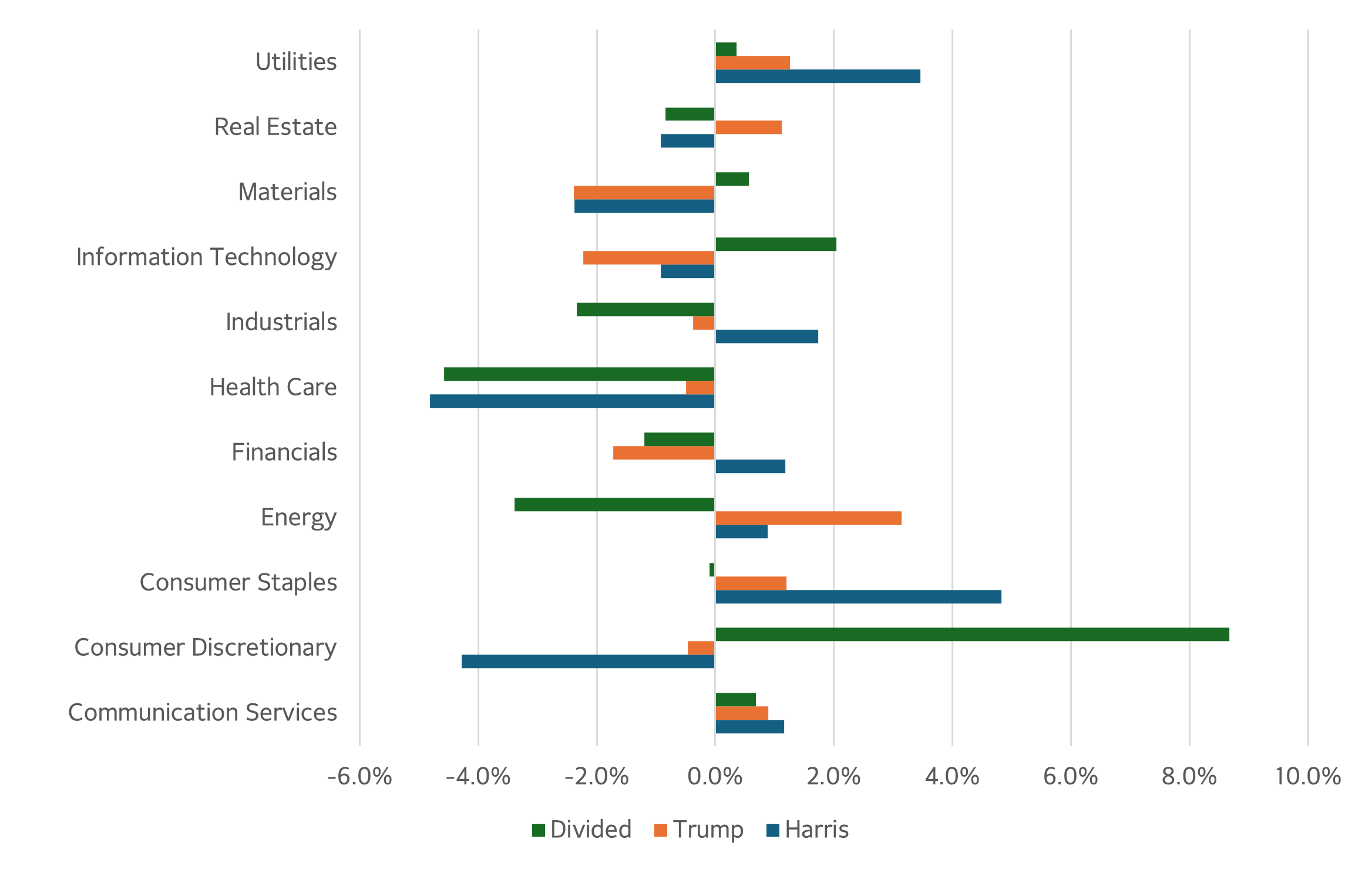

Figure 3 illustrates the active sector weights of each portfolio compared to the S&P 500 index. There are notable differences in sector preferences across these portfolios, especially in Consumer Discretionary, Health Care, Energy, Real Estate, and Utilities. Considering that the alphas used to construct these portfolios were derived from a stress test on the direction of interest rates, these variations are not unexpected.

Figure 3: Active sector allocation for optimal portfolios

Source: Axioma Risk, Axioma Portfolio Optimizer, S&P 500

As we noted in our original post, the Trump win scenario is initially more bullish for markets due to promises of tax cuts and deregulation—both pro-business moves. The recent interest rate cut by the Fed and the better-than-expected September jobs report have further boosted investor sentiment. Consequently, we expect the more risk-tolerant segments of the market to start outperforming the more risk-averse segments.

Examining the three portfolios through the lens of the ROOF Scores, our sentiment indicator, we see that the Trump portfolio has style factor tilts that give it a more risk-tolerant score of 0.73, compared to the Harris portfolio's score of 0.53. The Divided portfolio is the most risk-averse, with a ROOF Score of 0.25. This suggests that the Trump portfolio will benefit more from an increasingly bullish investor mood. If the upcoming Q3 earnings season reflects positive guidance from CEOs, we would expect the Trump portfolio to continue performing well. Conversely, any event that reduces investors' willingness to speculate should benefit the Harris portfolio more.

Stress test construction

These candidate portfolios were created using Axioma solutions:

- Axioma Risk for stress test configuration based on each candidate’s fiscal policy impact on the US yield curve

- Axioma Portfolio Optimizer to create Harris, Trump and Divided active portfolios

- Axioma Portfolio Analytics to compare the portfolios and track their daily performance

In this article, we also analyzed the three portfolios using risk on, risk off sentiment scores to evaluate which portfolios would benefit from an increasing bullish or bearish mood.

"Investors have had a change of heart after the first debate and no longer think a divided government is the most likely outcome, preferring instead a Red or Blue wave."

Related content