Total Portfolio Approach: Integrating Private Assets

Author

Thomas Meyer

Director, SimCorp

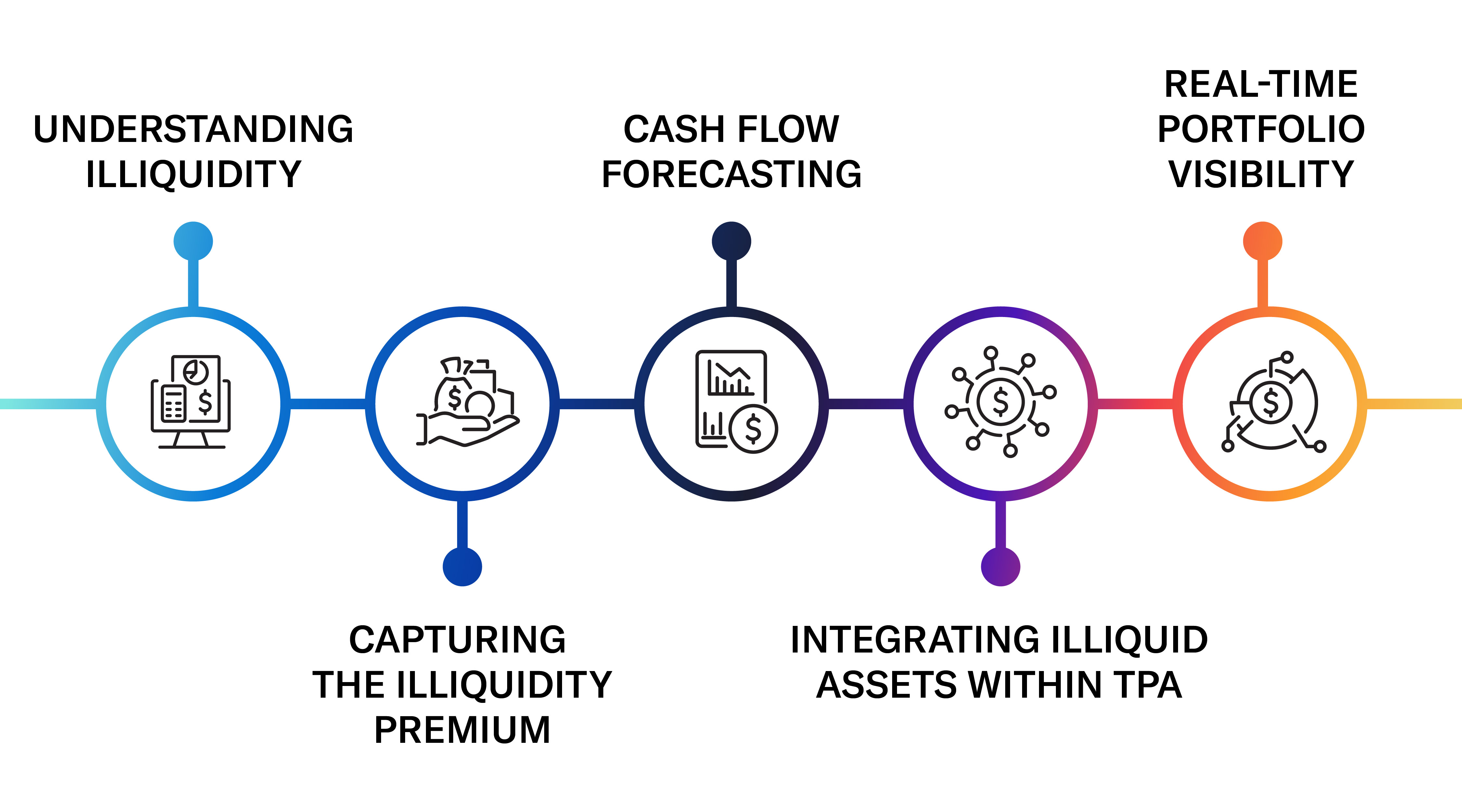

Five strategic steps to maximize private assets with Total Portfolio Approach

Why the total portfolio approach matters?

As private markets are projected to reach $23 trillion by 2026 1, buy-side firms have a significant opportunity and challenge: enhancing long-term performance by incorporating illiquid assets which offer greater return potential and diversification into portfolio strategies while exercising rigorous risk management. Traditional frameworks for portfolio construction and risk management are increasingly inadequate in meeting these demands. As a result, firms are exploring alternative frameworks that can better accommodate the unique characteristics of both liquid and illiquid investments.

The Total Portfolio Approach (TPA) represents a fundamental shift in capital deployment strategies. Rather than allocating investments by asset class buckets, TPA focuses on diversification across risk factors, breaking down the silos of liquid and illiquid assets that characterize traditional Strategic Asset Allocation (SAA) frameworks.

This transformation fundamentally reorients investment-making throughout the organization. Unlike SAA, which restricts capital deployment to predetermined percentage allocations regardless of market conditions, TPA empowers Chief Investment Officers to pursue opportunities across the investment landscape wherever they emerge. The resulting strategic flexibility elevates liquidity to a critical operational function that influences investment outcomes.

This paradigm shift is not merely theoretical; it has practical implications. The Thinking Ahead Institute estimated TPA could enhance annual returns by 50 to 100 basis points over SAA 2. Furthermore, their 2024 survey revealed that asset owners implementing TPA have shown to outperform their SAA counterparts by as much as 1.8% annually 3.

The path forward: A new operating reality

By treating private assets on an equal footing with liquid investments, forward-thinking firms can construct portfolios that achieve higher risk-adjusted returns sustainably. The combination of advanced risk factor models with on-demand cash flow forecasting creates the unified framework that makes this possible. Success lies in navigating the trade-offs between expected total portfolio returns, market risk, and the likelihood of adverse liquidity events. This requires a technology stack that integrates:

- Risk factor models tailored for illiquid private assets

- Optimization tools for asset allocation that consider both asset class risks and liquidity risks

- Commitment pacing and cash flow forecasting solutions

- Additional optimization capabilities to enhance the utility of treasury assets based on portfolio-specific cash flow characteristics

As markets evolve, organizations that provide a true total portfolio view in real time will make better-informed decisions, seize opportunities in illiquid markets when appropriate, and capitalize on prospects across both public and private investment landscapes.

Footnotes

1 Source: Preqin’s 2022 Global Alternatives Reports

2 Source: Thinking Ahead Institute study as of 2019. Past performance is not a reliable indicator of future returns.

3 Source: Thinking Ahead Institute survey as of 2024

Get in touch to learn how you can effectively move towards the Total Portfolio Approach